Get the free Non-employee Payment

Get, Create, Make and Sign non-employee payment

Editing non-employee payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-employee payment

How to fill out non-employee payment

Who needs non-employee payment?

Comprehensive Guide to Non-Employee Payment Forms

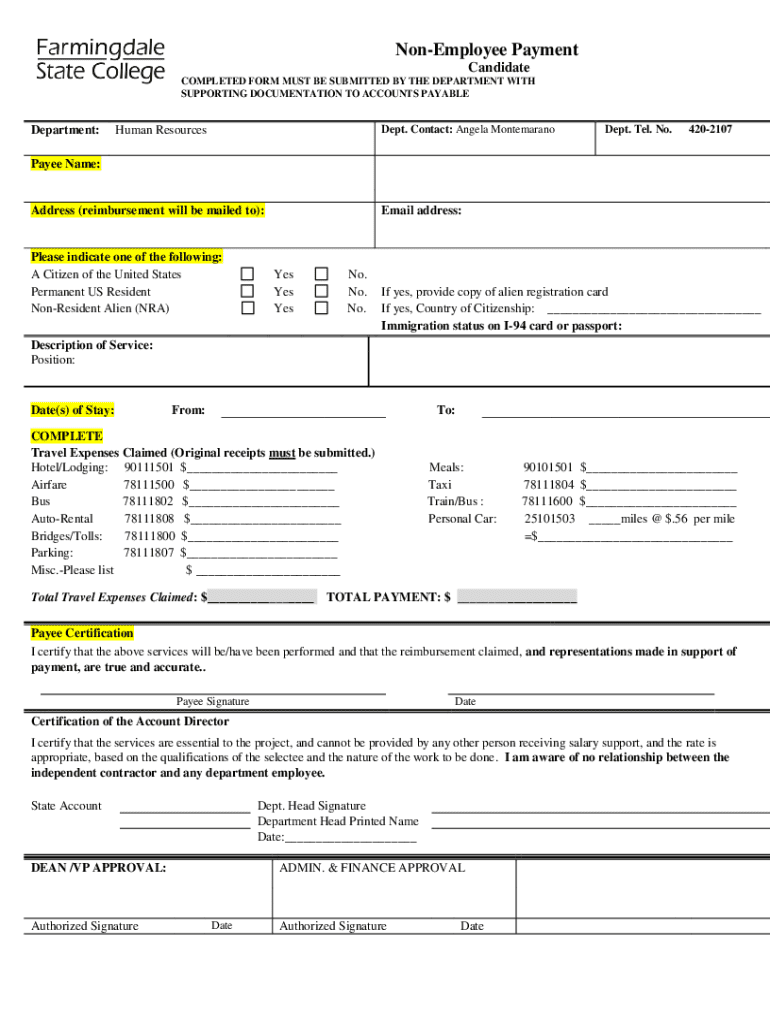

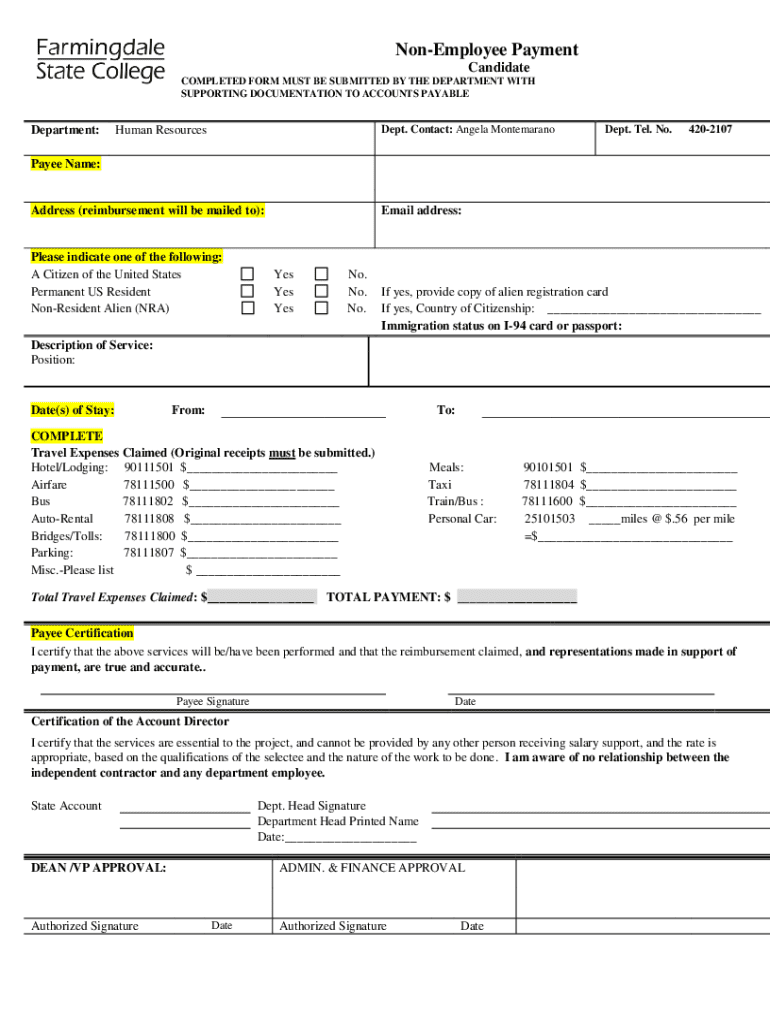

Overview of non-employee payment forms

Non-employee payment forms are essential documents used primarily by organizations to report payments made to individuals or entities that are not classified as employees. These forms serve to document transactions where services are rendered by freelancers, contractors, or other non-employee entities.

Typically used in situations involving project-based work, consulting services, or freelance roles, these forms help maintain transparent accounting practices. Their purpose extends beyond mere documentation; they ensure that both parties adhere to tax regulations and can safeguard against tax-related discrepancies.

Accurate completion of non-employee payment forms is crucial. Errors can significantly affect processing times, leading to potential delays in payment and complications during annual tax filings. Moreover, failing to properly fill out these forms can result in legal ramifications, including fines or legal challenges.

How to access the non-employee payment form on pdfFiller

To streamline your experience, accessing the non-employee payment form on pdfFiller is straightforward. Begin by navigating to the pdfFiller platform, where the user-friendly interface simplifies the process.

Once on the main dashboard, use the search bar located prominently at the top of the page. Typing in 'Non-Employee Payment Form' will present you with the relevant templates. For quicker access, include specific descriptors, such as 'IRS Form 1099', depending on the type of non-employee payment form you're looking for.

Detailed instructions for filling out the non-employee payment form

Filling out the non-employee payment form requires careful attention to detail. Starting with personal information, be prepared to input the name, address, and either the Social Security Number (SSN) or Employer Identification Number (EIN) of the individual or business receiving payment. Additionally, specific payment details must be recorded, including the amount paid, the nature of services provided, and payment dates.

pdfFiller makes this process interactive with various tools. By actively engaging with the interactive fields and checkboxes, you can enter data in a clear and structured manner. It's beneficial to add notes or comments where necessary—particularly if there are specific circumstances surrounding the payment—which can enhance the clarity of the document.

Tips for editing the non-employee payment form

Utilizing pdfFiller’s editing tools can transform the way you manage documentation. Changes such as modifying text, adjusting layouts, and even incorporating logos are made easy through the comprehensive editing features offered.

However, staying vigilant against common mistakes is crucial. For instance, ensure that all provided information is up to date and accurate. Incomplete fields can lead to delays in processing or incorrect submissions. Regularly reviewing your form before finalizing helps avert these common pitfalls.

Signing the non-employee payment form

One of the essential steps in finalizing your non-employee payment form is the signing process. pdfFiller offers various options for signing, including electronic signatures, which are legally binding and convenient. To use this feature, you can select the signature field in your document and follow the prompts to generate an electronic signature.

It’s imperative to validate your signature before submission. Check for typos in your name and ensure that all details within the form are accurate, as discrepancies could lead to complications later. Additionally, ensure that you comply with relevant signature standards to avoid rejection during processing.

Collaborating with team members

When managing non-employee payment forms, collaboration can enhance efficiency. Using pdfFiller, you can easily share your form with team members for approval. This allows for seamless communication and ensures that all relevant parties can review the document before it is finalized.

Roles and permissions are vital to this process. Clearly define who can edit, comment, or view the document to maintain the integrity of the information. Further, pdfFiller offers tracking features that allow you to monitor revisions and comments, ensuring that everyone’s input is considered and an audit trail is maintained for compliance.

Managing non-employee payment forms

Once your non-employee payment forms are created, proper management is crucial for record-keeping and compliance. Organizing your forms in pdfFiller's interface allows for easy retrieval. Utilize folders and tags to categorize your documents effectively, ensuring that everything is easily accessible when needed.

Best practices for record keeping include regularly updating files and ensuring data security. Establish a backup system to safeguard sensitive information and maintain compliance over time. Implementing these practices provides peace of mind and contributes to a more organized workflow.

Troubleshooting common issues

While utilizing pdfFiller, you may encounter technical issues or have questions regarding form requirements. Frequent software errors can often be resolved by refreshing the page, clearing your browser cache, or updating your browser.

If problems persist, reaching out to pdfFiller’s support team can provide quick resolutions. For questions regarding form requirements, consider consulting with industry best practices or reaching out to customer support for assistance. The pdfFiller community is also an excellent resource for finding answers to common queries.

Understanding legal and tax implications

Non-employee payment forms have significant legal and tax implications. It’s vital to understand the reporting requirements set forth by the IRS, which usually requires forms such as the 1099-MISC or 1099-NEC for reporting non-employee compensations. Staying compliant with these regulations will help avoid potential penalties.

In case of discrepancies or inquiries from the IRS, having complete and accurate records will enhance your position. For enhanced understanding, various external tools and guides on tax preparation can provide additional insights. Familiarize yourself with relevant terminologies and processes, ensuring that your organization remains compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit non-employee payment from Google Drive?

How can I send non-employee payment to be eSigned by others?

How do I fill out the non-employee payment form on my smartphone?

What is non-employee payment?

Who is required to file non-employee payment?

How to fill out non-employee payment?

What is the purpose of non-employee payment?

What information must be reported on non-employee payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.