Get the free Wb-11

Get, Create, Make and Sign wb-11

How to edit wb-11 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wb-11

How to fill out wb-11

Who needs wb-11?

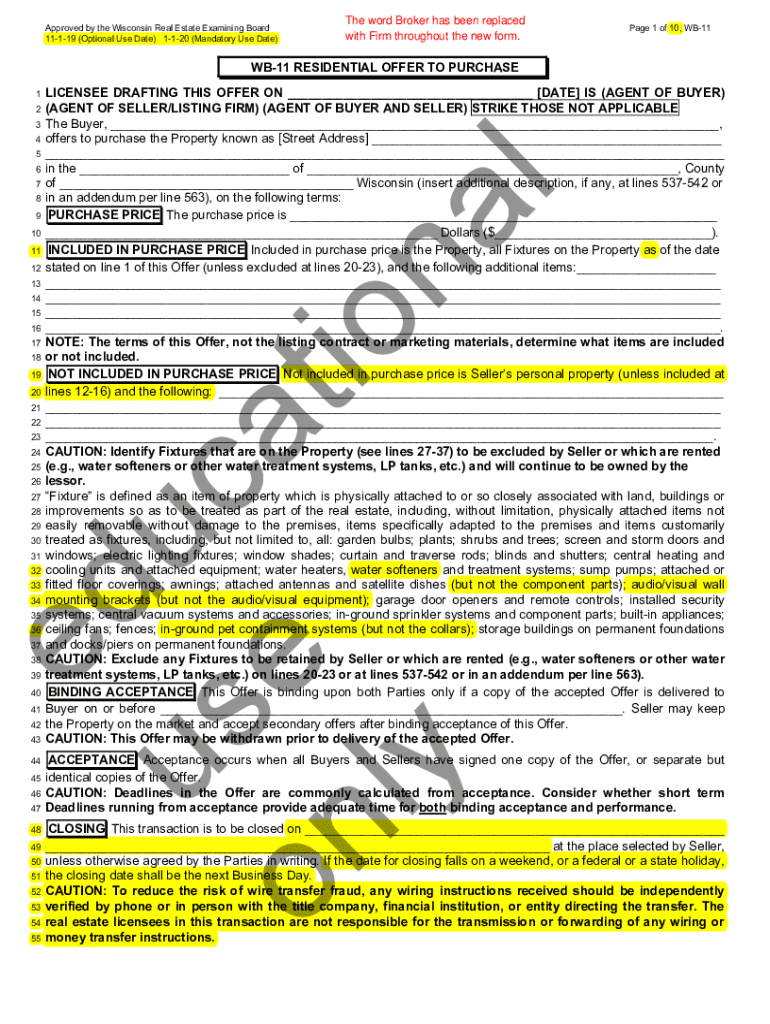

Comprehensive Guide to the wb-11 Form

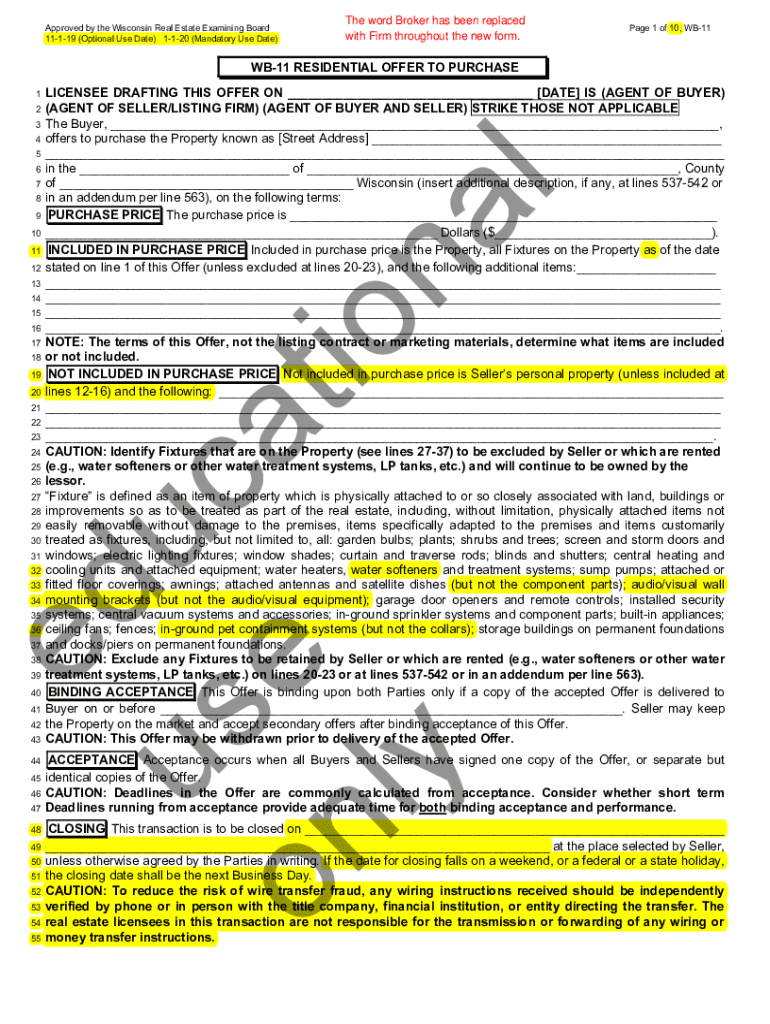

Overview of the wb-11 Form

The wb-11 Form serves as a vital tool for individuals and organizations navigating various financial and administrative processes. Its primary purpose is to gather critical information regarding a subject's financial status, which can inform decision-making in contexts such as loan applications, grant evaluations, or compliance assessments. Filling out the wb-11 Form accurately is crucial, as incomplete or incorrect submissions can lead to rejection or delays in the processing of requests.

Understanding the importance of the wb-11 Form cannot be overstated. For example, in monetary transactions where transparency is required, proper completion ensures credibility and accountability. Moreover, in competitive settings like grant applications, a well-prepared wb-11 can distinguish applicants from their peers.

Understanding the components of the wb-11 Form

The wb-11 Form consists of several key sections that users must navigate to provide a comprehensive picture of their financial status. Each section plays a crucial role in ensuring the document’s effectiveness in its designated purpose.

The primary divisions within the wb-11 Form include Personal Information, Financial Information, and Supporting Documentation. Each of these components requires careful attention to detail to ensure that the information provided is both accurate and relevant.

Understanding the terminology used is equally important. Familiar terms like 'assets,' 'liabilities,' and 'net worth' convey significant financial insights that can impact decisions made using the wb-11 Form.

Step-by-step instructions for filling out the wb-11 Form

Before diving into the details of each section, it is essential to prepare adequately. Gathering necessary documents and accessing the wb-11 Form through pdfFiller’s user-friendly platform will streamline the process.

Detailed Instructions by Section

1. Personal Information

Inputting your personal information accurately is vital for a successful submission. Ensure that names are correctly spelled, and that addresses include complete details such as street number, zip code, and contact numbers.

2. Financial Information

This section requires you to report all relevant income and expenses accurately. Discrepancies can lead to significant consequences, such as rejection or scrutiny during audits.

3. Supporting Documentation

A crucial aspect of the wb-11 Form, this section must include all relevant supporting documents. Proper formatting and clear labeling of documents are necessary to ensure they correlate with the financial information provided.

Editing and customizing the wb-11 Form

Utilizing the editing features on pdfFiller can enhance your wb-11 Form, making it clearer and more informative. Adding comments or notes can clarify points for reviewers or collaborators.

Clarity and readability should guide the customization process. Ensure that all text is legible and formatted in an easy-to-read manner.

eSigning the wb-11 Form

The electronic signing (eSigning) process for the wb-11 Form is designed to be intuitive and straightforward. It's important to understand the various methods available for eSigning to select one that meets your needs.

Collaboration tools for teams working on the wb-11 Form

If you're part of a team, pdfFiller offers robust collaboration tools that allow for efficient sharing and feedback. Teams can work on the wb-11 Form simultaneously, enhancing productivity.

Tracking changes and comments using pdfFiller can lead to more organized teamwork and helps avoid confusion during the completion process.

Managing and storing the wb-11 Form

Efficient document management is essential to keep track of your wb-11 Form and related documents. With pdfFiller, users can save and organize their wb-11 Form securely and access it whenever needed.

Troubleshooting common issues with the wb-11 Form

Despite thorough preparation, issues can arise when submitting the wb-11 Form. Understand common concerns and how to effectively address them if they occur.

For unresolved issues, contacting support can provide the necessary guidance. pdfFiller’s customer service is well-equipped to assist users through challenging scenarios.

Additional information about the wb-11 Form

As with any official documentation, staying informed about the wb-11 Form is crucial. Users should regularly check for updates or changes that might affect their completion process.

User experiences and testimonials

Hearing from users who have successfully completed their wb-11 Form can provide insight into best practices and common pitfalls. For instance, several users have reported that thorough preparation and attention to detail not only facilitated smooth submission but also expedited responses from relevant authorities.

Let us help: Customer support for the wb-11 Form

For users facing difficulties with the wb-11 Form or who seek further assistance, pdfFiller offers comprehensive support. Their dedicated team can guide you through any aspect of the form, ensuring you achieve successful completion.

Related forms and resources

Understanding the wb-11 Form may involve familiarity with similar documents. pdfFiller provides a variety of templates that may offer additional context or serve related needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify wb-11 without leaving Google Drive?

How can I send wb-11 to be eSigned by others?

How do I make edits in wb-11 without leaving Chrome?

What is wb-11?

Who is required to file wb-11?

How to fill out wb-11?

What is the purpose of wb-11?

What information must be reported on wb-11?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.