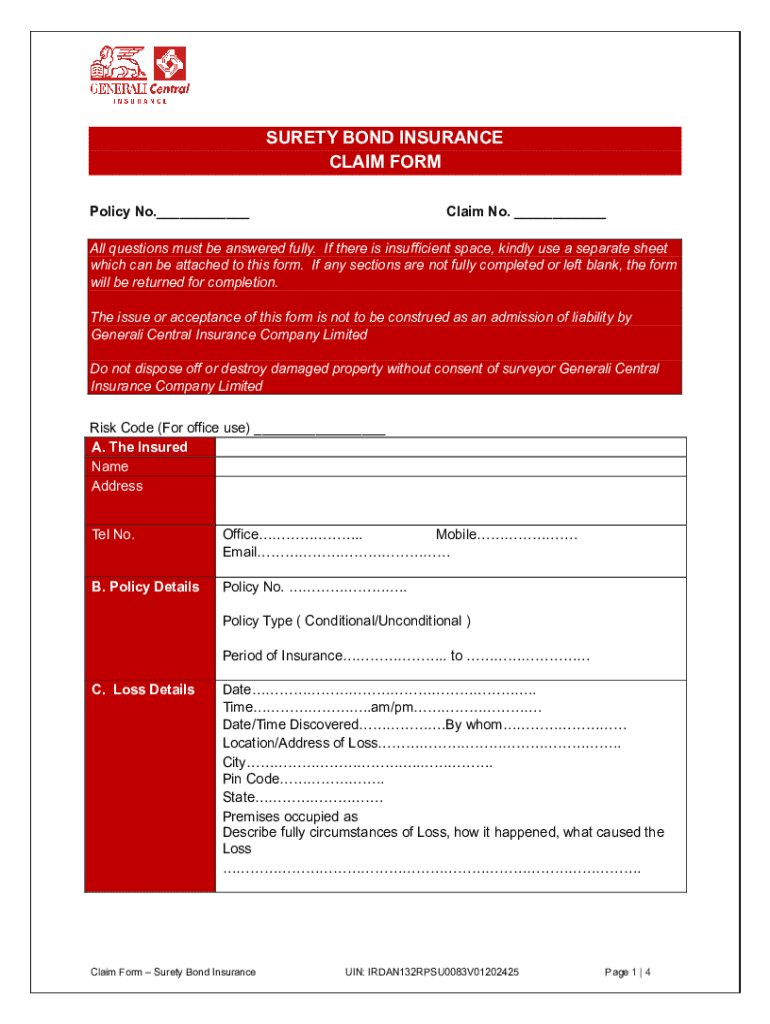

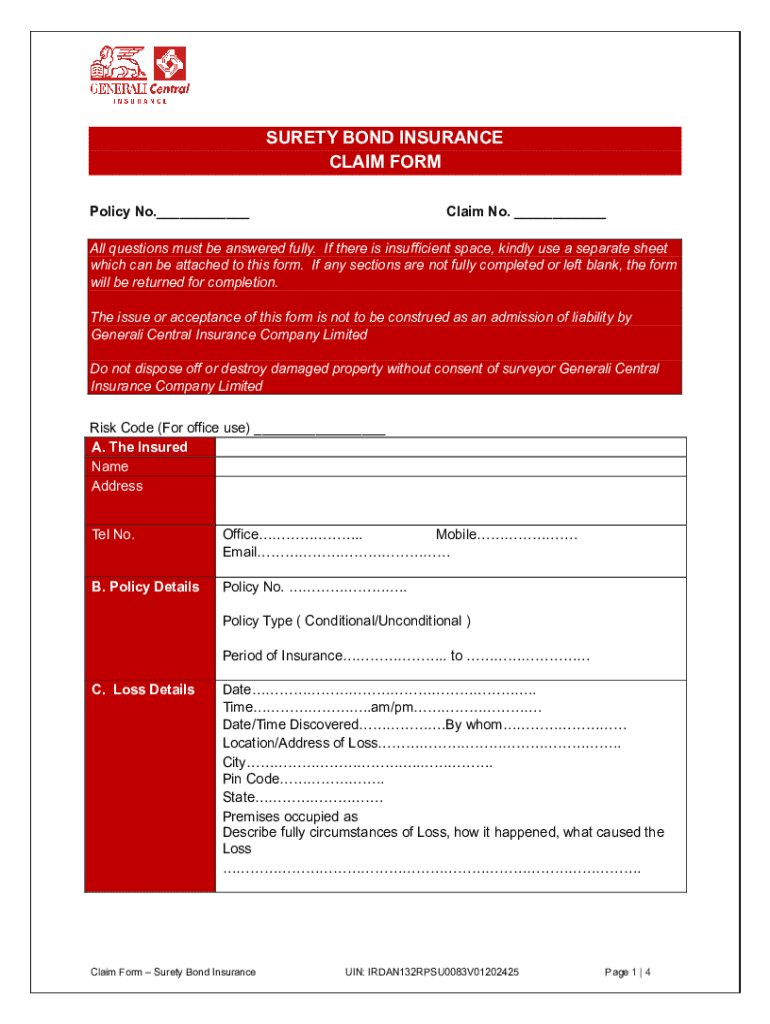

Get the free Surety Bond Insurance Claim Form

Get, Create, Make and Sign surety bond insurance claim

How to edit surety bond insurance claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out surety bond insurance claim

How to fill out surety bond insurance claim

Who needs surety bond insurance claim?

Surety bond insurance claim form - a comprehensive how-to guide

Understanding surety bonds

Surety bonds are financial instruments used to guarantee that a party will fulfill a contractual obligation. The bond is a tripartite agreement involving three parties: the obligee, who is the entity that requires the bond; the principal, who is the party that carries out the contractual obligation; and the surety, usually an insurance company that backs the bond. This agreement serves as a form of insurance for the obligee, ensuring that they can seek compensation if the principal fails to uphold their responsibilities.

There are several types of surety bonds, each serving different purposes. The most common categories include performance bonds, which guarantee the completion of a project; payment bonds, which ensure that subcontractors and suppliers are paid; and bid bonds, which provide financial assurance that a contractor will accept a job if awarded. In various industries, such as construction, real estate, and service provision, these bonds play a critical role in mitigating risk and providing security.

What is a surety bond insurance claim?

A surety bond insurance claim is a formal request for compensation made by the obligee when the principal fails to fulfill their obligations. By filing a claim, the obligee seeks to recover financial losses incurred due to the principal's default. Common reasons for filing such claims include non-performance—where the contractor does not complete the work as agreed—and payment delays—where subcontractors or suppliers are not compensated in a timely manner.

Timely filing of a claim is crucial as it can affect the overall resolution process. If the claimant waits too long after a breach of contract to file their claim, they may jeopardize their right to recover losses. Therefore, understanding the correct timeline and documentation required is essential for successful claims.

Preparing to file a claim

Before filling out the surety bond insurance claim form, preparing the necessary documentation is a vital step. Essential documents include contractual agreements that outline the responsibilities of the principal, correspondence that reflects communications with the principal about the issue, and proof of damages incurred, such as invoices or payment reports. Having this information readily available allows for a smoother claims process.

Additionally, understanding the specific clauses within the surety bond is crucial. Each bond may have different stipulations regarding the conditions for filing a claim, time limits, and required documentation. Familiarity with these details can significantly impact the outcome of the claim.

Step-by-step guide to filling out the surety bond insurance claim form

To initiate a claim, you will need to access the surety bond insurance claim form, which can be found on pdfFiller. Once you have the form, you can fill it out by completing each section accurately. Begin with your contact information, including your name, address, and phone number. Then, provide the bond details, which typically include the bond number and the name of the principal.

Next, in the description of the claim section, clearly outline the reasons for the claim, detailing any non-performance or payment issues. Finally, state the amount of the claim clearly, supported by documentation. It’s vital to ensure that all information is complete and accurate before submission, as errors can delay the claims process.

Editing, signing, and managing your claim form

After filling out the claim form, you can leverage pdfFiller’s editing tools to refine your document. The platform allows users to make real-time edits, attach relevant documentation such as invoices or contracts, and enhance the clarity of the submission. This flexibility can be invaluable in presenting a well-organized claim.

Once the claim form is complete, signing it securely is essential. With pdfFiller, you can sign electronically, ensuring that your submission is both valid and legally binding. Additionally, saving and storing your claim form in the cloud eases management and accessibility, enabling you to retrieve it when needed.

Submitting the claim

Claim submission can be executed through various methods—each with its own considerations. Online submissions are often the fastest, allowing immediate confirmation of receipt. Alternatively, you may choose to submit via mail or fax; however, this requires additional steps such as physical documentation and, possibly, longer processing times. Whichever route you choose, ensuring that all required attachments are included is critical.

A checklist can serve as a helpful guide to streamline the submission process. Before completing your submission, verify that you have included all necessary documentation and that the information on the form is accurate. Missing documents or incorrect details could lead to delays in processing your claim.

After submission: what to expect

Once submitted, your claim will enter a processing timeline determined by the surety. The duration can vary considerably based on several factors, including the complexity of the claim and the responsiveness of the involved parties. Tracking the status of your claim is essential, and pdfFiller provides users with tracking features to monitor progress effectively.

During the processing stage, it’s common to face challenges such as requests for additional information or lengthy response times. Being prepared to address these inquiries can facilitate smoother communications with the surety, positively impacting the resolution of your claim.

Frequently asked questions (FAQs) about surety bond claims

Navigating the world of surety bond claims raises many questions, especially regarding potential claim denials or appeals. If your claim is denied, the first step is understanding the reasons for the denial, as these can often be addressed through additional documentation or clarifying communications with the surety. Equally important to understand is the timeline associated with surety bonds, as they typically have expiration dates that affect your eligibility to file claims.

Furthermore, be aware of any fees associated with filing claims, which may vary by surety provider or bond type. Knowing these details beforehand can help you prepare financially for the process.

Case studies: successful claim resolutions

To underscore the importance of having a well-prepared surety bond insurance claim form, consider various case studies showcasing successful resolutions of claims. For example, in a construction scenario, a claimant successfully recovered costs due to non-performance by a contractor by presenting clear documentation and timely submission of the claim. Such success stories emphasize the value of following the appropriate claims process and leveraging systematic tools like pdfFiller to enhance the claims experience.

Lessons derived from these real-world cases often highlight the importance of skillful documentation preparation, adherence to timelines, and clear communication with the surety. They illustrate how utilizing structured tools and platforms can lead to smoother claims processing and favorable outcomes for the claimant.

Connecting with experts and legal assistance

In certain situations, pursuing a claim may require the expertise of a surety bond attorney, particularly if the claim becomes disputed or complex. Understanding when to seek legal help is essential; for instance, if there are significant complications in negotiations with the surety or if liability issues arise. Leveraging resources available through pdfFiller can also provide valuable insights and connections to legal expertise, improving your chances of navigating the process effectively.

Ensuring access to expert guidance can empower you to tackle any potential obstacles in your claims process, making the experience less stressful and more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my surety bond insurance claim directly from Gmail?

How do I edit surety bond insurance claim online?

How do I edit surety bond insurance claim in Chrome?

What is surety bond insurance claim?

Who is required to file surety bond insurance claim?

How to fill out surety bond insurance claim?

What is the purpose of surety bond insurance claim?

What information must be reported on surety bond insurance claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.