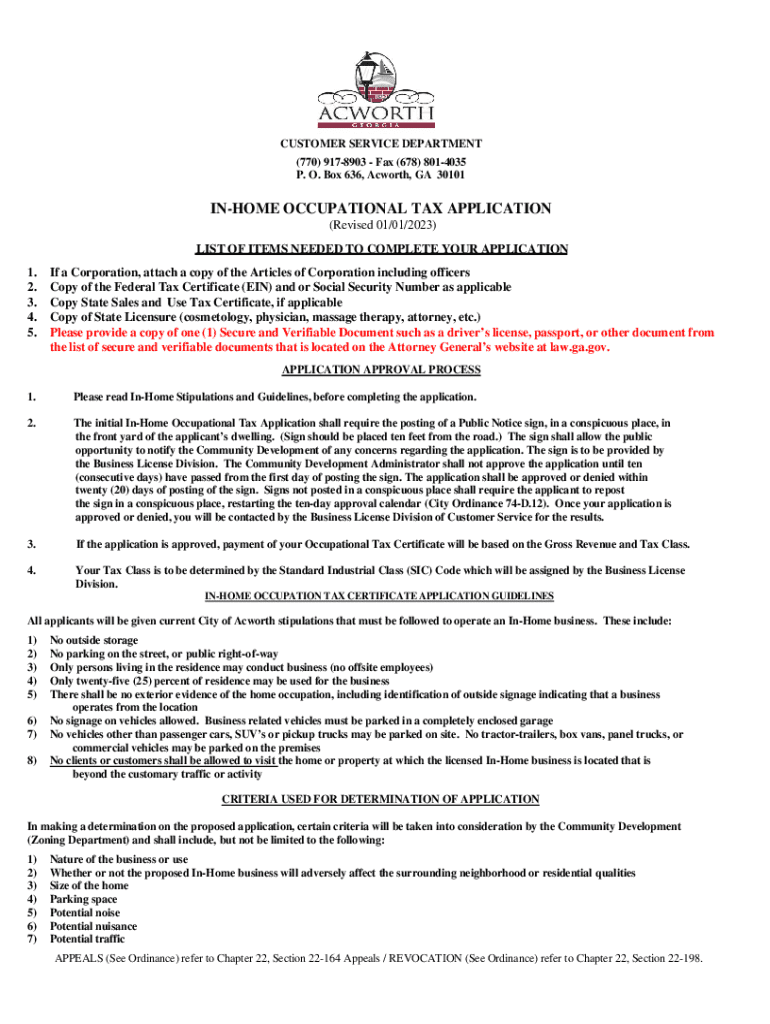

Get the free in-home Occupational Tax Application

Get, Create, Make and Sign in-home occupational tax application

Editing in-home occupational tax application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out in-home occupational tax application

How to fill out in-home occupational tax application

Who needs in-home occupational tax application?

In-Home Occupational Tax Application Form: A How-to Guide

Overview of in-home occupational taxes

In-home occupational taxes refer to the specific tax obligations imposed on individuals or businesses operating from their residences. This tax serves as a means for local governments to generate revenue from home-based businesses, ensuring that these entrepreneurs contribute to the public services they utilize. For home-based business owners, understanding these taxes is crucial not only for compliance but also for proper financial planning.

The importance of these taxes cannot be underestimated as they validate the presence of businesses operating within residential communities, contributing to local economic growth. Additionally, they often play a role in maintaining community infrastructure and services. Generally, eligibility for filing this tax is contingent upon the nature and revenue generated by the business, with specific requirements varying by locality.

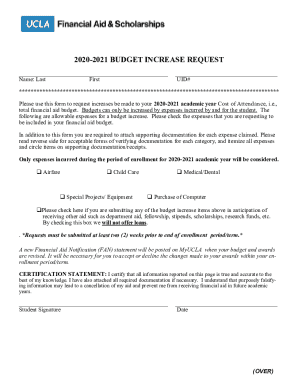

Understanding the in-home occupational tax application form

The in-home occupational tax application form is a structured document designed to collect pertinent information about home-based businesses. The essential components of the form include various sections that solicit specific information from the applicant, ensuring that all pertinent data is available for processing.

Key terms associated with the tax application process include 'occupational tax' — a fee assessed for the privilege to operate a business — and a distinction between 'business license' (permission to operate) and 'tax permit' (authorization to pay taxes).

Step-by-step instructions for filling out the form

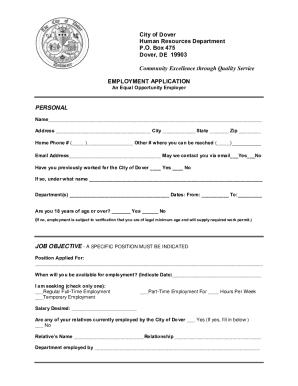

Filling out the in-home occupational tax application form can seem daunting, but following a systematic approach simplifies the process significantly. Begin by gathering necessary information to expedite the process.

Editing and signing the in-home occupational tax application form

Once you have filled out the form, it is vital to ensure that all information is correct. Using a tool like pdfFiller enhances this process, allowing seamless editing and adjustments to your application.

Submitting your application form

Submitting your in-home occupational tax application is straightforward, with a couple of options available to you depending on your preferences. The convenience of online submission via pdfFiller is a popular choice among applicants.

After submission, tracking the status of your application becomes important. You can anticipate receiving notifications regarding approval, and it's always advisable to maintain open lines with your local tax office to ensure everything is on track.

Supporting documents for your application

Along with your in-home occupational tax application, you'll likely need to provide supporting documents depending on your specific situation. These documents not only legitimize your claims but also assist in streamlining the processing of your application.

Frequently asked questions (FAQs)

Navigating the intricacies of the in-home occupational tax application can lead to several questions. Acknowledging these common queries helps prepare applicants for potential hurdles.

Contact information for further assistance

For personalized support regarding your in-home occupational tax application, directly reaching out to your local tax office is advisable. They can provide tailored insights based on your local regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit in-home occupational tax application from Google Drive?

How do I edit in-home occupational tax application in Chrome?

How do I complete in-home occupational tax application on an Android device?

What is in-home occupational tax application?

Who is required to file in-home occupational tax application?

How to fill out in-home occupational tax application?

What is the purpose of in-home occupational tax application?

What information must be reported on in-home occupational tax application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.