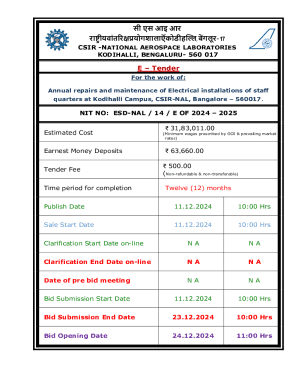

Get the free Loan Agreement

Get, Create, Make and Sign loan agreement

Editing loan agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan agreement

How to fill out loan agreement

Who needs loan agreement?

Comprehensive Guide to Using a Loan Agreement Form

Understanding the basics of a loan agreement

A loan agreement serves as a crucial document that formalizes the terms between a lender and a borrower, stipulating the conditions under which money will be lent and repaid. This legally binding instrument is essential for defining the relationship between both parties and safeguarding their interests. Without such an agreement, disputes may arise regarding repayment terms, and the rights of each party may remain ambiguous.

Having a loan agreement not only delineates obligations but also protects lenders from defaults, while borrowers have the assurance of knowing their repayment terms. Key components include the principal amount, interest rate, repayment terms, and any collateral involved, if applicable. Each of these components plays a vital role in the agreement's integrity and usability.

Types of loan agreements

Various loan agreements cater to different needs, ranging from personal loans for individual expenses to business loans aimed at venture funding. Understanding the distinction is crucial for both lenders and borrowers. A personal loan agreement typically addresses loans made to individuals for purposes such as medical emergencies, consolidating debt, or financing large purchases.

Conversely, business loan agreements are more complex due to the larger sums involved and the potential for higher risks. Furthermore, loans can be categorized based on security. Secured loans come with collateral, providing a safeguard for lenders, while unsecured loans rely solely on the borrower's creditworthiness. Lastly, the terms can also vary between fixed-rate and variable-rate agreements, influencing how payments are structured over time.

Preparing to use a loan agreement form

Before you delve into completing a loan agreement form, it's vital to identify your needs and evaluate your eligibility. This involves assessing the purpose of the loan and determining how much you require. Are you looking to fund a new initiative for your business, or do you need to cover unexpected medical bills? Each scenario demands a different approach and potentially different terms.

Once you've defined your needs, scrutinizing your personal or business credit is the next critical step. A strong credit score may provide you with favorable terms, while a weaker score could limit your options or lead to higher interest rates. Concurrently, gather necessary documentation like identification proof, income statements, and credit history reports. These documents reassure lenders of your credibility and help facilitate smoother negotiations.

Step-by-step guide to completing the loan agreement form

The first step toward completing a loan agreement form is accessing it on pdfFiller. The platform offers an array of customizable templates, ensuring you find the right one suitable for your needs. Once you've selected the correct form, begin by accurately filling in your personal or borrower information, then proceed to elaborate on the loan details, such as the amount you're requesting and the purpose for which it will be utilized.

A crucial part of the process is specifying the repayment schedule — outline how frequently you will make payments, whether weekly, bi-weekly, or monthly. Subsequently, it's essential to stipulate any terms and conditions related to the agreement. Be sure to cover aspects like late fees and penalties for missed payments, as well as default clauses that establish what happens in case of non-repayment. Conclude the process by signing the agreement using pdfFiller’s eSignature tool, and check whether any witness or notary requirements apply based on your jurisdiction.

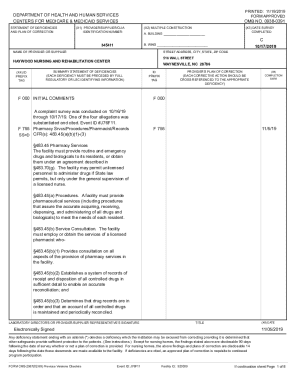

Editing your loan agreement

PDF documents are malleable when using pdfFiller’s editing tools, allowing you to modify the agreement to reflect changes in terms or parties involved. Should circumstances dictate that you need to add or remove sections from the agreement, the platform's collaborative features facilitate swift adjustments. You can work with colleagues or partners to finalize terms efficiently, ensuring that every party remains informed and content.

It's equally vital to ensure your loan agreement complies with all relevant laws. Familiarizing yourself with key legal considerations will bolster the agreement's enforceability. Furthermore, watch out for common mistakes, such as using outdated terminology or failing to capture essential elements of the agreement. With pdfFiller, you can troubleshoot potential issues before they elevate into significant discrepancies.

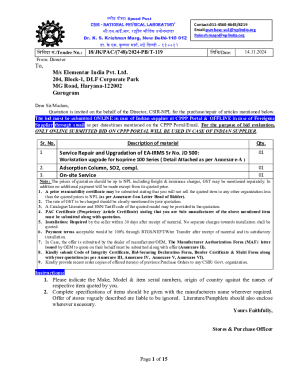

Managing the loan agreement

Having completed your loan agreement form, effectively managing it is vital. pdfFiller ensures that you can store and access your documents conveniently, contributing to smoother ongoing management. Keep meticulous track of repayment schedules to ensure you are not caught off guard by impending obligations. It's prudent to set reminders ahead of payment dates, which can mitigate issues related to missed payments.

Should the need arise to amend your agreement in the future—perhaps due to financial changes or adjustments to loan terms—knowing the appropriate process is essential. Typically, modifications can be integrated into the existing agreement, provided all parties consent and make the alterations visible in the document. PDF document management via pdfFiller supports this transition seamlessly.

Troubleshooting common issues

When managing a loan agreement, effective communication between all parties is essential. Ensure that everyone involved fully understands the terms laid out in the agreement, which can help prevent misunderstandings and disputes. A proactive approach here goes a long way in maintaining positive relations throughout the lifespan of the loan.

In case miscommunication arises, establishing a method for resolving disputes promptly can save both time and resources. Should disagreements persist, seeking legal assistance can be wise. Consulting with an attorney who specializes in finances or loans can provide clarity and legal guidance, helping navigate the intricacies of contractual obligations and rights.

Advanced tips for using loan agreements effectively

Navigating loan agreements with finesse involves reviewing the document thoroughly before signing. This simple act of due diligence can prevent future complications and assures you understand all obligations. Additionally, utilizing loan agreement templates can streamline the process—these templates often contain best practices and checked clauses that cover essential elements.

Moreover, collaborating with financial advisors can yield invaluable insights. They not only help evaluate your needs but also guide you through structuring terms effectively. Finally, practicing best practices for record-keeping ensures you maintain transparent financial management, which is beneficial for both personal and business purposes.

Success stories: How using a loan agreement form made a difference

User success stories highlight the significant benefits derived from employing loan agreement forms. Individuals have reported improved outcomes when they provided detailed loan terms upfront, which minimized confusion and fostered accountability. Businesses, too, have shared how signed loan agreements ensured clarity in cash flow management while facilitating optimized financial planning.

Many users of pdfFiller's loan agreement form have praised its user-friendly interface, emphasizing that the ability to collaborate digitally improved their efficiency. Testimonies indicate that having a clear, legally enforceable agreement offered peace of mind and reinforced trust between lenders and borrowers.

Interactive tools and resources on pdfFiller

pdfFiller offers a suite of interactive features designed to enhance your loan agreement document management. Users can access an array of templates tailored for various circumstances, streamlining the creation process. With built-in editing tools, you can modify agreements effortlessly while also benefiting from collaborative features that allow multiple parties to work on a document simultaneously.

In addition to customizable templates, pdfFiller also hosts a wealth of resources tailored for frequently asked questions regarding loan agreement forms. Whether you're seeking straightforward answers or looking for elaborate explanations, the user support section offers substantial information readily accessible for any queries or assistance you may need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute loan agreement online?

Can I sign the loan agreement electronically in Chrome?

Can I edit loan agreement on an Android device?

What is loan agreement?

Who is required to file loan agreement?

How to fill out loan agreement?

What is the purpose of loan agreement?

What information must be reported on loan agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.