Get the free Residential Property Purchase Application

Get, Create, Make and Sign residential property purchase application

Editing residential property purchase application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out residential property purchase application

How to fill out residential property purchase application

Who needs residential property purchase application?

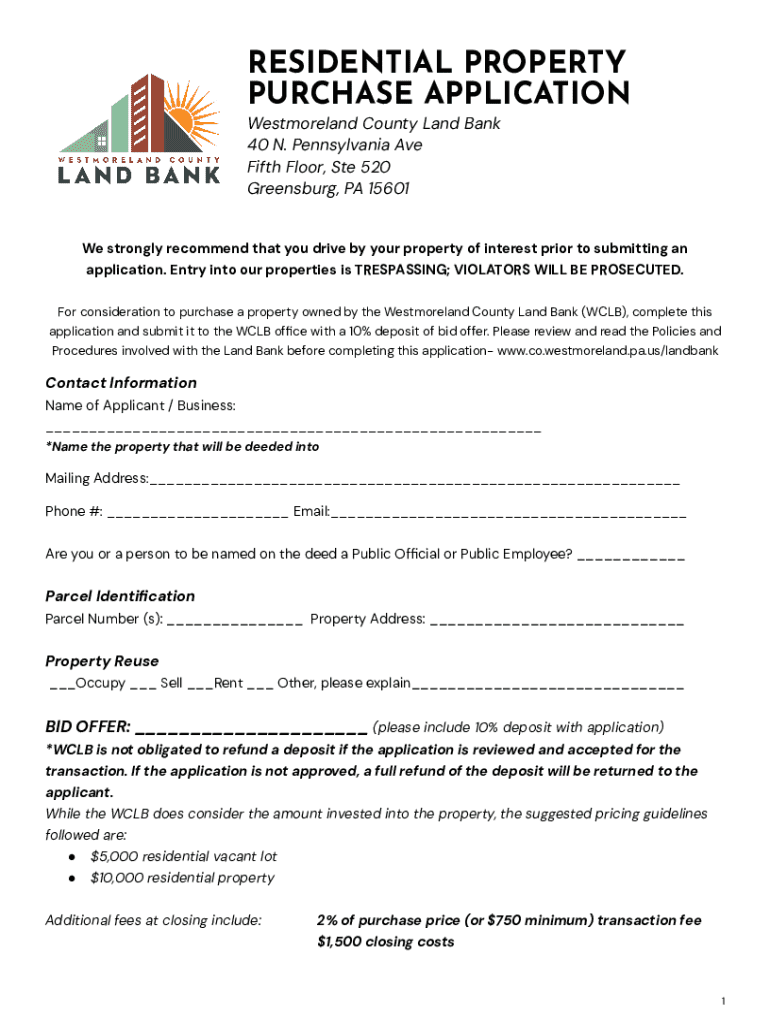

Residential Property Purchase Application Form - A Comprehensive Guide

Navigating the Residential Property Purchase Application Form

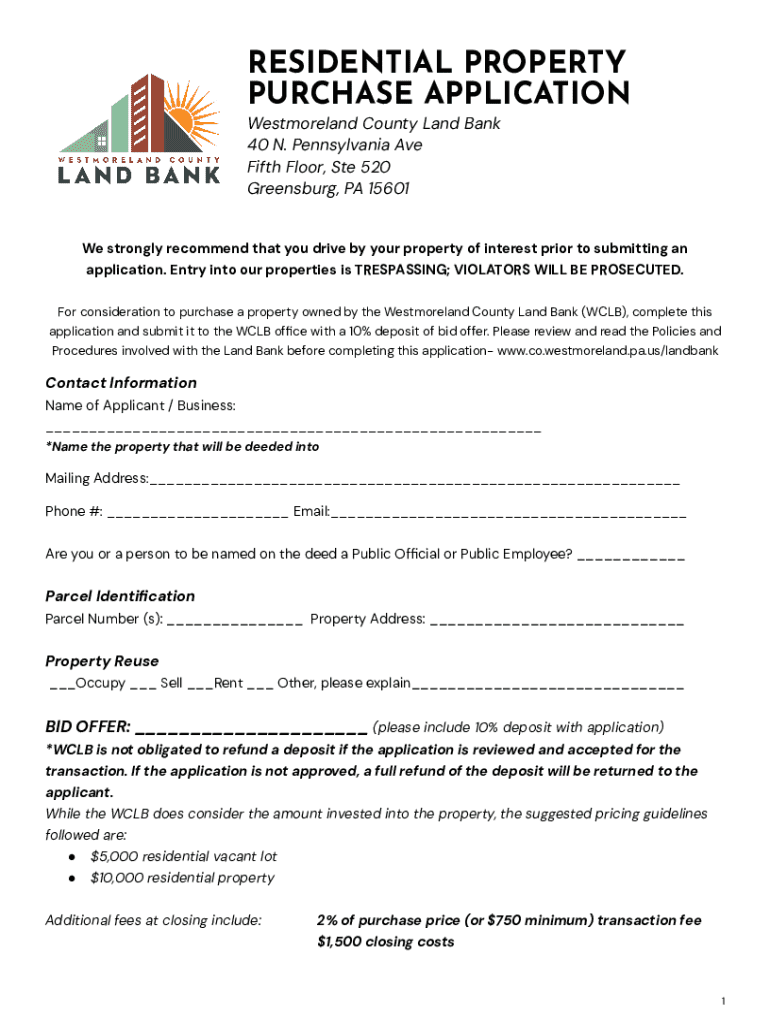

The residential property purchase application form is not merely a document; it is a crucial part of the property buying process. It serves as the first official step in securing your dream home by providing lenders with vital information to assess your suitability for a mortgage. The information requested typically includes personal details, financial background, and specifics about the property you wish to purchase.

Understanding the purpose of the application form allows buyers to prepare adequately. The key information typically requested includes personal identification, proof of income, credit history, and details about the property itself. Misunderstanding this document can lead to delays and complications further down the line.

Types of property purchase applications

There are various types of property purchase applications. It’s essential to distinguish between residential and commercial applications, as they follow different processes and requirements. Additionally, applications for new builds may differ from those for existing properties, reflecting the unique factors involved in each type of purchase.

Before you begin, it's crucial to gather all necessary documents, including proof of income such as pay stubs or tax returns, credit reports, and identification to verify your address. Many first-time buyers may feel overwhelmed by these requirements, particularly regarding credit scores and financial disclosures.

Step-by-step guide to completing the application form

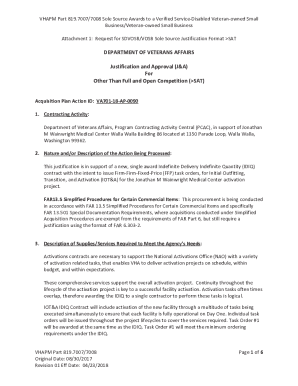

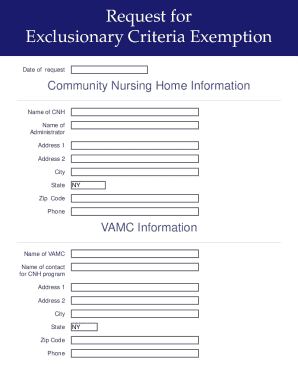

Completing the residential property purchase application form may seem daunting, but breaking it down section by section makes it manageable. The form typically has three crucial sections: personal information, property details, and financial overview.

Section breakdown of the residential property purchase application form

In the personal information section, you will provide your name, current address, contact details, and identification to verify your identity. It is essential to check for accuracy here, as mistakes can cause delays.

Next, the property details section requires information about the home you plan to purchase, including its address, proposed purchase price, and the type of financing you're considering. Accurately describing the property is vital as it affects the lender’s evaluation.

Lastly, the financial overview requires a thorough disclosure of income sources and any existing debts. Be prepared to outline your down payment plans and any other financial obligations. Providing accurate information ensures a smoother process and minimizes potential delays in approvals.

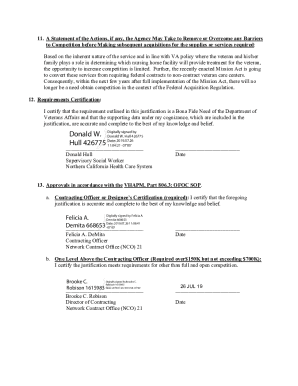

Signatures and authorizations

Once filled out, you must sign the application form in designated areas. Understanding the need for authorizations, such as permission for lenders to run credit checks, is crucial. Missing signatures can delay your application process, so take special care in this final step.

Editing and customizing your application form

To enhance your residential property purchase application form, using a tool like pdfFiller can simplify the editing process. You can upload your application, make necessary adjustments, and even share it for additional feedback. This level of customization enables you to present your information most effectively.

Tools for document editing on pdfFiller

pdfFiller's unique features allow you to enhance your application with digital signatures and text boxes for additional notes. This ensures you can provide all necessary details without cluttering the main sections of the application, which might confuse lenders.

Collaboration is another strong point; you can share your form with others for their insights and utilize tracking tools to manage comments and suggestions efficiently. This streamlines the editing phase, making it easier to finalize your application.

Submitting the residential property purchase application

Completing your application is just the first step; knowing how to submit it efficiently is equally crucial. Before hitting send, ensure your application is complete by following a checklist of all required documents and information. Common pitfalls include missing signatures, incomplete financial disclosures, or lacking essential supporting documents.

Methods of submission

Applications can often be submitted online directly through lenders and agencies, promoting instant confirmations of receipt which is beneficial. However, if you prefer to mail your application, follow best practices such as using certified mail and maintaining a copy for your records.

After submission, it's essential to follow up. You can check the status of your application by reaching out to the lender’s contact person or accessing their online portal if available. This proactive approach shows your interest and helps you stay on top of any requirements or requests.

Managing your residential property purchase after submission

After submitting the application, maintaining organization and tracking your application's status becomes crucial. Utilizing cloud-based tools can assist in managing documents easily, and setting reminders for critical dates will ensure that you don’t miss any follow-ups or deadlines.

Responding to requests for additional information

Be prepared for possible follow-up requests from the lender for additional information or clarification. Understanding common follow-up requests helps you quickly provide the necessary documentation, which can speed up the approval process. Leveraging pdfFiller enables fast re-uploading of documents, making this process more manageable.

Moving to closing: What’s next?

The transition from application to closing involves several more steps, such as finalizing your mortgage, performing inspections, and negotiating contingencies. Being prepared for this phase by understanding what to expect will ease your transition to homeownership.

FAQs about the residential property purchase process

As with any purchase process, questions often arise regarding the timeline and possible outcomes. Frequently asked questions include: How long does the application process typically take? Generally, it can take anywhere from a few days to several weeks, depending on the lender and the complexity of your financial situation.

Another common question is, what happens if my application is denied? If your application is denied, lenders typically provide a reason, allowing you to address the issues and potentially reapply either with improved financials or additional guidance.

Advice for first-time homebuyers

For first-time homebuyers, simplifying the application and buying process can significantly reduce stress. Tips include thoroughly researching lenders and their specific requirements, maintaining an organized file of all essential documents, and seeking out financial assistance or grants available in your area.

Utilizing pdfFiller for a seamless document management experience

pdfFiller empowers users to manage their documents from a single, cloud-based platform, which is highly beneficial for individuals navigating complex processes such as purchasing property. Features like mobile access allow users to manage their applications and related documents on-the-go, enhancing convenience.

Features that enhance the property purchase experience

Security and compliance are also critical aspects of using pdfFiller. It ensures that your personal and financial data remains protected during the entire application process. By choosing pdfFiller, you can streamline the document management process while ensuring that your data is kept safe.

Advantages of pdfFiller over traditional methods

The advantages of pdfFiller over traditional document management methods are significant. The time saved through ease of editing and collaborating online is incomparable to the cumbersome nature of paper forms. This efficiency is complemented by the cost-effectiveness of managing documents digitally, resulting in reduced printing and mailing expenses.

In this section

For those who need additional forms or templates to complement their residential property purchase application, pdfFiller offers various related real estate documents. Access to these forms can significantly ease the overall process, allowing for a comprehensive view of what is needed beyond the application.

Interactivity: Engage with our tools and resources

Interactive tools and guides specific to different property types are also available, along with community forums for sharing experiences and advice. Engaging with these resources provides valuable insights that can help streamline your property purchase journey.

Contact support

Lastly, if you require further assistance while using pdfFiller, reaching out to their dedicated support team is straightforward. You can find direct contact information through their website, and online chat options make obtaining immediate help convenient for users navigating the application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my residential property purchase application directly from Gmail?

How can I get residential property purchase application?

Can I create an electronic signature for signing my residential property purchase application in Gmail?

What is residential property purchase application?

Who is required to file residential property purchase application?

How to fill out residential property purchase application?

What is the purpose of residential property purchase application?

What information must be reported on residential property purchase application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.