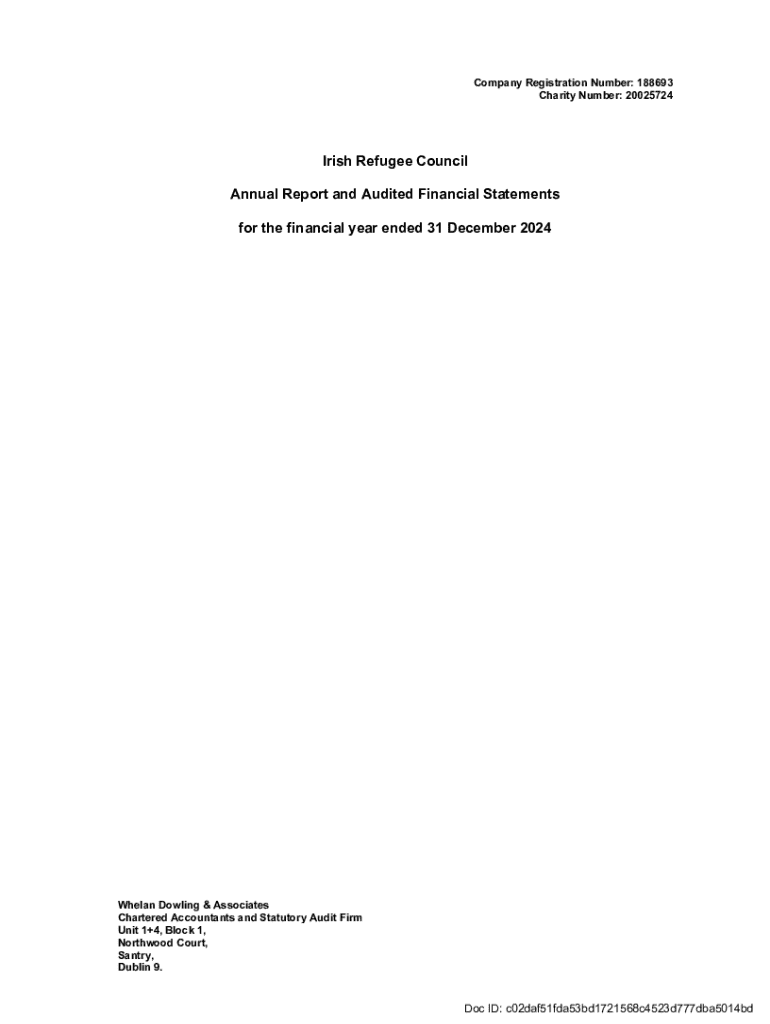

Get the free Annual Report and Audited Financial Statements

Get, Create, Make and Sign annual report and audited

Editing annual report and audited online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual report and audited

How to fill out annual report and audited

Who needs annual report and audited?

Annual report and audited form: A comprehensive guide

Understanding annual reports and their importance

An annual report is a comprehensive document that organizations produce once a year to present their financial performance and activities over the past year. This report is typically shared with stakeholders such as investors, employees, and regulatory bodies, outlining the company's financial position, operations, and strategic direction.

The key components of an annual report typically include the executive summary, financial statements, management discussion and analysis (MD&A), and acknowledgments. Each of these parts plays a crucial role in providing a holistic view of the company's performance, facilitating informed investment decisions and stakeholder engagement.

Audited forms refer to the verified financial statements within the annual report. These audits, conducted by independent third-party firms, ensure the accuracy and completeness of the financial information presented. The significance of audited forms lies in their ability to enhance transparency and credibility, assuring stakeholders that the reported data is reliable and can be trusted.

Key components of an annual report

The executive summary of an annual report compiles the essential highlights and achievements of the company in the past year. This brief yet powerful section is invaluable for setting the tone of the report and providing readers with a quick overview of the company's trajectory, performance metrics, and future goals.

Financial statements are arguably the most critical part of any annual report, including the balance sheet, income statement, and cash flow statement. These documents provide a snapshot of a company’s financial health, detailing assets and liabilities, income and expenses, and cash movements. Investors and stakeholders rely heavily on these figures to interpret financial data and make informed investment decisions.

Management Discussion and Analysis (MD&A) is where the company’s management shares insights on operational performance, market conditions, and risks affecting the business. This section allows readers to understand the narrative behind the numbers and provides context that financial figures alone cannot offer. The acknowledgments section recognizes contributions from teams or individuals, highlighting the collaborative nature of achieving the company's results.

The role of pdfFiller in creating annual reports

pdfFiller provides seamless editing capabilities for users looking to create or modify annual reports. With its user-friendly interface, pdfFiller allows users to edit PDF templates quickly. By accessing a range of pre-built templates or custom forms, users can efficiently generate comprehensive reports tailored to their specific needs.

In addition to editing, pdfFiller offers collaboration features that empower teams to work together on creating annual reports. Multiple users can review, suggest changes, and comment on drafts in real time, refining the report's content and ensuring it meets stakeholders' expectations. Effective teamwork enhances the final product's quality and relevance.

e-Signing functionalities help ensure the legal compliance of your annual reports. With pdfFiller, adding electronic signatures for approvals becomes effortless. The eSigning process is legally binding and prompts users through each step, eliminating the need for physical signatures and speeding up the finalization process.

Steps to fill out an annual report and audited form

Selecting the right template is a critical first step in creating an effective annual report. pdfFiller offers various templates designed specifically for annual reports, catering to different industries and company sizes. When choosing a template, consider factors such as the level of detail required, regulatory obligations, and personal branding needs.

Once the appropriate template is chosen, begin filling out the various sections methodically. Ensure that data input is accurate and relevant; mistakes can misrepresent the company’s situation. Include financial data, operational highlights, and insightful management discussions tailored to the intended audience, which may include investors, board members, and regulatory bodies.

Integrating audited financial information into the annual report is paramount for credibility. Ensure that the audited numbers are correctly represented and accompany necessary footnotes or explanations as required. Compliance with audit standards not only builds trust with stakeholders but also reflects the organization’s commitment to transparency.

Strategies for effective presentation of annual reports

The design and layout of an annual report are just as significant as its content. A polished, professional presentation enhances readability and engages stakeholders effectively. Employ colors, graphics, and charts that reflect your brand and make complex information more digestible. Best practices include using clear headings, bullet points for key information, and visually appealing graphs to present financial trends.

Tailoring content for different stakeholders is essential. Different audiences, such as investors, employees, and regulatory authorities, have varying interests and levels of expertise. For instance, while investors may prefer detailed financial analyses and forecasts, employees may appreciate insights into company culture and accomplishments. Adapting the depth and angle of the report’s narrative allows for better engagement and understanding across stakeholder groups.

Legal considerations for annual reports and audited forms

Compliance with regulatory requirements is critical when preparing annual reports. Each region and industry may have distinct legal obligations concerning reporting standards and deadlines. Companies must ensure that their reports meet the specific compliance guidelines issued by regulatory bodies to avoid penalties and maintain investor trust.

pdfFiller supports legal compliance by providing templates that adhere to industry standards and allowing for real-time updates based on regulatory changes. This tool ensures that users have access to up-to-date information and compliance-check features, fostering efficiency in report preparation.

Regular audits bolster compliance efforts and help organizations identify areas for improvement. Establishing robust internal controls and having a clear audit trail supports adherence to necessary regulations and assists in preparing accurate audited forms.

Interactive tools on pdfFiller to enhance understanding

pdfFiller offers an array of templates and customization options to create tailored annual reports. Users can select from various pre-designed templates created to meet specific needs while having the flexibility to modify them to reflect individual branding. This degree of customization ensures that the final report resonates with the intended audience.

Additionally, pdfFiller includes built-in educational resources that provide guidance on best practices for filling out forms. These resources can aid users in understanding required sections, nuances, and tasks to ensure thorough and accurate completion of annual reports. By leveraging these tools, teams can optimize their document management process.

Exploring case studies and examples

Successful annual reports can serve as effective benchmarks for companies striving for excellence. For example, renowned organizations like Apple or Amazon showcase well-structured reports that combine financial data with compelling narratives, illustrating how they navigate market challenges and opportunities. Their transparency and straightforwardness in presenting data to investors further solidify their credibility.

Learning from audit experiences is just as vital. Case studies reveal how companies that underwent meticulous audit processes managed to disclose crucial insights that contributed to operational improvements and risk mitigations. These examples highlight the value of prioritizing thorough audits, ensuring compliance while fostering annual reporting integrity.

Conclusion and next steps

As stakeholders in the business world, understanding the intricacies of annual reports and audited forms is vital. Leveraging the capabilities of pdfFiller can simplify the creation of these documents, streamlining your process from editing to eSigning. Adopting a structured approach to reporting allows companies to present their financial story effectively and transparently.

Explore additional templates and tools on pdfFiller to elevate your document management experience. The convenience of creating, editing, and signing documents in a single platform fosters greater efficiency, ultimately supporting your organization's objectives. As you navigate the complexities of the reporting landscape, pdfFiller stands ready to assist.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my annual report and audited in Gmail?

Can I create an eSignature for the annual report and audited in Gmail?

How do I fill out the annual report and audited form on my smartphone?

What is annual report and audited?

Who is required to file annual report and audited?

How to fill out annual report and audited?

What is the purpose of annual report and audited?

What information must be reported on annual report and audited?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.