Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

How to Fill Out IRS Form 990: A Comprehensive Guide

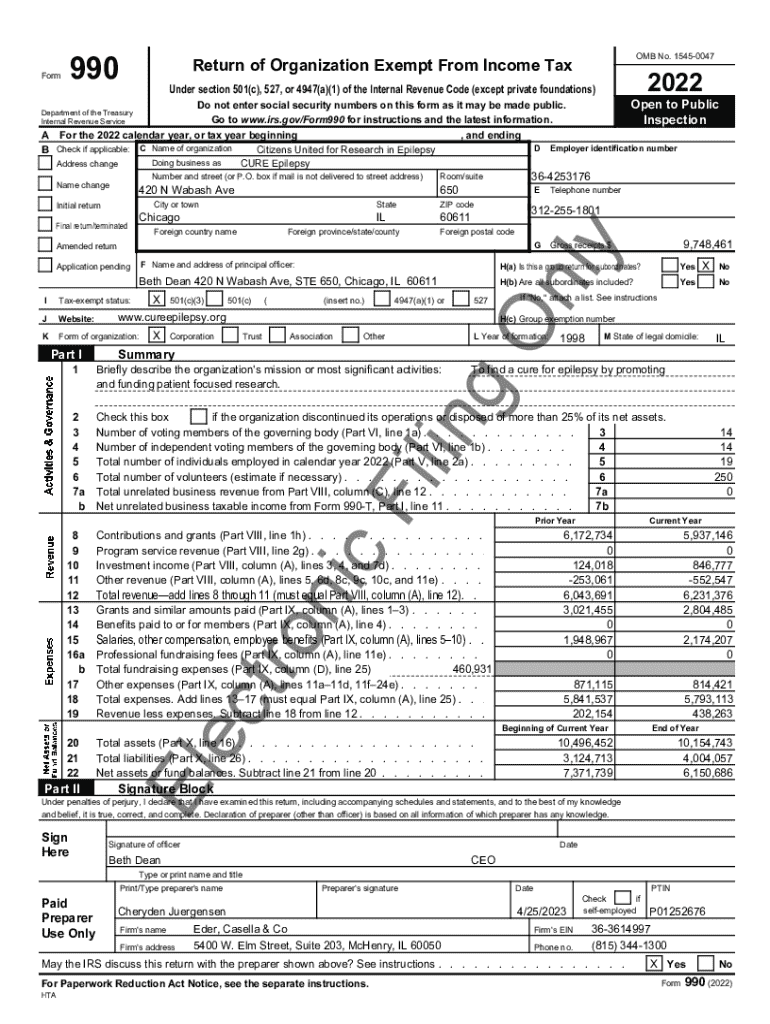

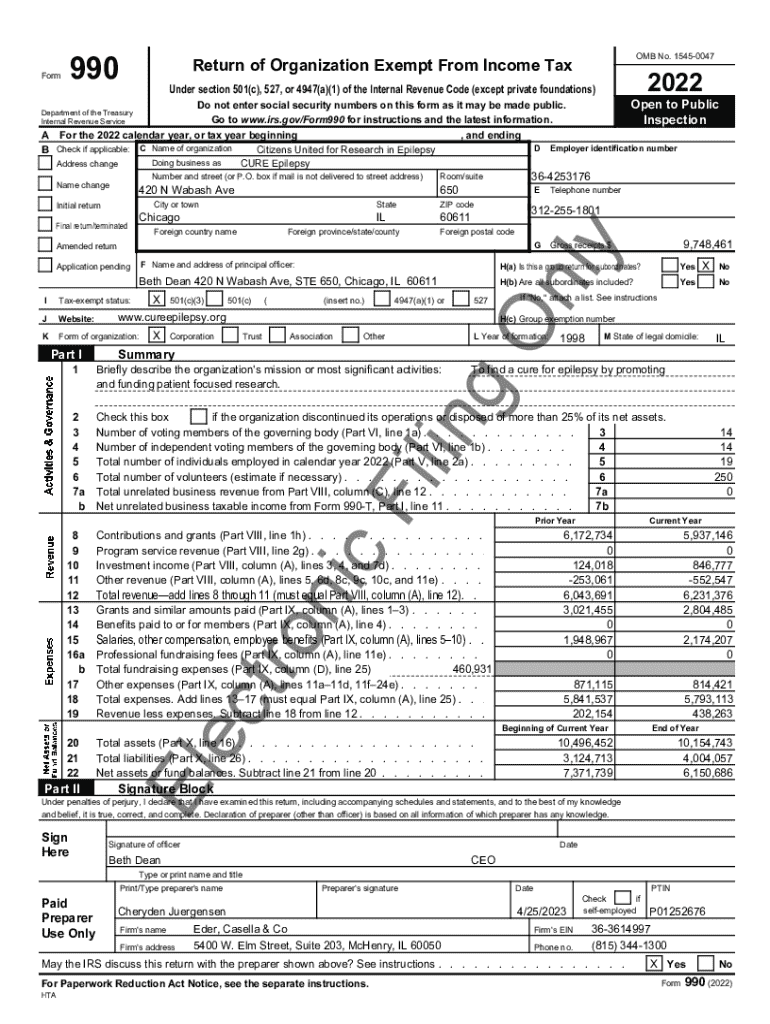

Understanding IRS Form 990

IRS Form 990 is a vital document that nonprofit organizations must file annually. Designed to provide the IRS and the public with a comprehensive overview of a nonprofit’s financial activities, it directly impacts both the organization’s transparency and its public image. This form not only reports income, expenses, and activities but also sheds light on the organization’s mission, making it crucial for sustaining grant eligibility and public trust.

For nonprofits, it signifies accountability and compliance with federal regulations. Organizations that fail to file can face penalties or even loss of tax-exempt status, underscoring the importance of understanding and accurately completing this form.

Types of organizations required to file

Organizations that are recognized as 501(c)(3) or other types of nonprofits are generally required to file Form 990. This encompasses charitable organizations, educational institutions, and advocacy groups among others. However, smaller nonprofits with gross receipts under $200,000 or total assets below $500,000 may be eligible to file a simpler version known as Form 990-EZ. Understanding which category your organization falls into is crucial for compliance.

Some specialized nonprofits, like churches or governmental entities, may be exempt from filing entirely. It’s key for organizations to determine their filing obligations based on size and type, as this will guide the entire completion process of the form correctly.

Key components of IRS Form 990

IRS Form 990 is structured into several key sections, each serving a specific purpose. The first part, Part I, provides a summary of the organization’s activities and finances. This is followed by Part II, which contains the signature block where authorized individuals must sign to certify the accuracy of the information provided. Part III highlights the organization’s program service accomplishments, conveying the impact and the mission fulfillment.

Additionally, Part IV is a checklist of required schedules, ensuring that all necessary supplementary forms are accounted for. Each section plays a critical role in presenting a complete picture of the organization's operations and financial health.

Filling out the form: step-by-step instructions

To effectively fill out IRS Form 990, preparatory steps are crucial. Start by gathering all necessary documentation, including financial records, bylaws, and prior Form 990s if available. Having these documents at hand ensures accurate data entry and minimizes errors.

Using templates, like those offered by pdfFiller, aids in accessing the form conveniently and streamlining the submission. Once prepared, follow these steps to fill out each section effectively.

Completing each section

When filling out Part I, focus on summarizing critical information succinctly. Avoid jargon and ensure clarity, as this section sets the tone for the rest of the form. In Part III, articulate your organization’s accomplishments effectively by including specific metrics or examples that demonstrate impact. Strong statements enhance credibility. For preparing financial information in Part VIII, ensure accuracy; consider employing pdfFiller for calculations to minimize human error.

Finally, appropriately complete the signature block, ensuring that authorized individuals review and sign the document. E-signature options via pdfFiller facilitate efficient submission.

Best practices for accurate completion

Completing Form 990 accurately requires diligence to avoid common errors that can lead to back-and-forth with the IRS or worse, penalties. Frequent mistakes include underreporting revenues, neglecting signatures, or misclassifying expenses. Double-checking each detail can prevent headaches down the line.

Additionally, staying current on IRS compliance standards is vital. Regularly review updates regarding regulations and reporting standards, as this landscape can shift, impacting how Form 990 should be filled out. Knowledge of these nuances significantly enhances organizational credibility.

Interactive tools and features of pdfFiller

pdfFiller stands out by offering interactive tools that simplify the filling process for IRS Form 990. With features tailored to enhance efficiency, users can easily upload, edit, and manage PDFs seamlessly on a cloud-based platform. Real-time collaboration features also allow teams to work together on the document, ensuring that all perspectives are included before final submission.

Utilizing pdfFiller's annotation tools further enriches the review process, enabling team members to input suggestions directly on the form. The ability to track changes and maintain a revision history ensures that all updates are documented, promoting transparency and accountability within the team.

Frequently asked questions (FAQs)

Understanding the nuances of IRS Form 990 can raise several questions. For instance, what happens if the filing deadline is missed? Generally, late filings incur penalties, so it is advisable to file even if late, rather than not at all. Organizations should also inquire about handling IRS audits, which can often occur if discrepancies are found during routine checks of Form 990 submissions.

Organizations also often wonder about amending submitted Forms 990. In cases where errors are identified post-submission, amendments can be made using Form 990-X. Lastly, seeking resources such as IRS guidelines or nonprofit accounting workshops can enhance understanding and compliance.

Case studies: successful Form 990 filings

Several organizations exemplify successful Form 990 filings, showcasing best practices. For example, the American Red Cross routinely receives an excellent rating for its transparency and detailed disclosures on Form 990. By including precise metrics and comprehensive program descriptions, they effectively communicate their impact to stakeholders and the public.

These exemplary filings can serve as educational case studies for other organizations. Learning from the strategies employed by such successful nonprofits can guide lesser-known organizations in refining their approach to completing the form accurately.

Further learning and support options

Nonprofits looking to gain deeper insights into Form 990 completion can explore various online courses and webinars tailored to nonprofit accounting. These resources offer updated knowledge on IRS requirements and enhance understanding of financial reporting. Platforms specializing in nonprofit training often have user-friendly content geared toward various audience skill levels.

Additionally, organizations may find it beneficial to consult with accountants or attorneys specializing in nonprofit law, particularly when navigating complex regulations. Knowing when to seek professional help can save organizations from potential pitfalls in financial management and compliance.

Utilizing pdfFiller for ongoing document management

The capabilities of pdfFiller extend beyond just Form 990. This platform houses an array of templates useful for various nonprofit compliance requirements, allowing organizations to manage their documents efficiently. Beyond filing forms, users can maintain a long-term document management strategy by storing essential records within the easy-to-use interface.

Effective organization of documents contributes to better management and retrieval of information when needed. By utilizing pdfFiller’s robust features, nonprofits can streamline their documentation processes, ensuring compliance and readiness for audits or reviews.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990 in Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

How do I fill out form 990 using my mobile device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.