Get the free Form S-8

Get, Create, Make and Sign form s-8

Editing form s-8 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form s-8

How to fill out form s-8

Who needs form s-8?

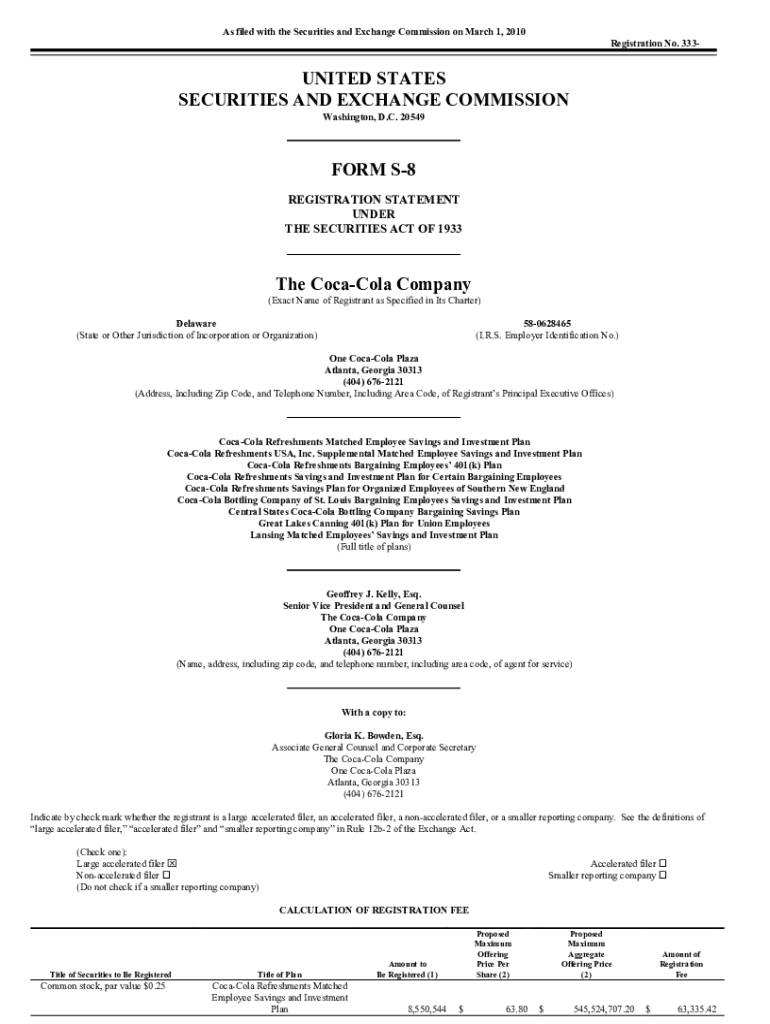

Understanding the Form S-8 Form: A Comprehensive Guide

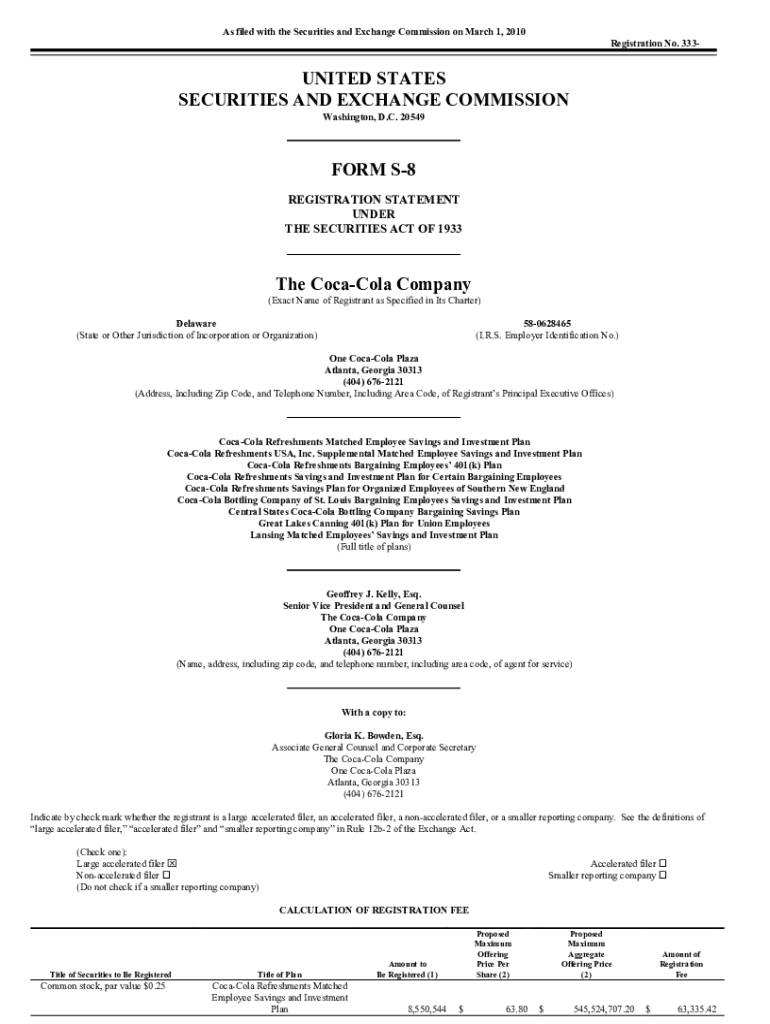

Understanding Form S-8

Form S-8 is a registration statement specifically designed for companies offering securities to their employees as part of a benefit package. This form enables businesses to register their securities under the Securities Act of 1933 for employee benefit plans, thus simplifying the process of offering stock options and other equity compensation. By using Form S-8, companies can enhance their ability to attract and retain talent, while also ensuring compliance with regulatory requirements.

Eligibility to file Form S-8 primarily depends on the company's need to register equity compensation plans. Companies must adhere to specific criteria established by the SEC, including maintaining current reporting obligations and being a registered entity under the Securities Exchange Act of 1934. The importance of this form cannot be overstated, as it not only facilitates seamless employee participation in stock programs but also assists companies in managing their regulatory compliance.

Who needs to file Form S-8?

Form S-8 should be filed by publicly traded companies that wish to offer securities to their employees. This includes both large corporations and smaller public companies looking to incentivize their staff through equity compensation. Specifically, businesses implementing employee stock ownership plans (ESOPs), retirement savings plans, or stock option plans must utilize Form S-8 to ensure their offerings comply with SEC regulations.

Moreover, companies need to file Form S-8 under various situations, such as when creating new employee benefit plans or when adding new securities to an existing plan. This requirement emphasizes the dynamic nature of employee offerings and the necessity for firms to stay compliant as they evolve their benefits packages.

The Form S-8 timeline: key dates to remember

Filing Form S-8 involves a crucial timeline that businesses must adhere to for effective compliance. Initially, companies should dedicate significant time to gathering necessary information and documentation, including details about the plan participants, eligibility criteria, and the company’s securities information. Establishing internal deadlines is key, as this preparation phase can be complex and time-consuming.

Once the preparation is complete, the submission process involves filing the form with the SEC. Following submission, important reporting deadlines need to be remembered, such as annual updates on the number of participants, changes in plan structure, or updates to the company’s financial status that affect the securities. Finally, organizations should monitor any communications from the SEC post-filing, as this can include inquiries or audits, necessitating further compliance.

Filling out Form S-8: step-by-step instructions

Filling out Form S-8 can appear daunting, but following a structured approach simplifies the process. The first step involves gathering all required information, including identifying eligible plan participants and collecting comprehensive company details, such as financial data and previous filings. Ensuring you have all data ready is essential for an accurate filing.

Next is completing the Form S-8. Companies should follow line-by-line instructions to ensure accuracy. Important sections include company details—such as legal name and SEC Central Index Key (CIK)—plan information including the terms and conditions of the employee benefit plans, and securities details including the type of securities being registered. Lastly, companies must conduct a thorough review of the form, checking for accuracy and completeness, thereby avoiding common errors during the submission.

Considerations when filing Form S-8

Regulatory compliance is paramount when filing Form S-8. Companies must fully understand SEC regulations and guidelines to avoid possible penalties. Regular updates about legal changes in securities and employee benefits are essential to ensure that the company remains compliant. Staying informed will also better prepare organizations for addressing inquiries or audits from the SEC.

Additionally, there are tax implications associated with Form S-8. Employees receiving stock options or equity compensation may face tax consequences, such as capital gains tax on the profits from selling the stock. It's crucial for both companies and employees to be aware of these implications and to manage reporting obligations correctly, ensuring that all required tax information is filed timely.

Common pitfalls with S-8 filings

Several common pitfalls can arise during the S-8 filing process. Incomplete sections, missing documentation, and misunderstanding eligibility requirements are frequent errors that can lead to complications down the line. Companies should ensure that all parts of the form are filled out accurately and that all necessary supporting documents are attached to avoid delays and maintain regulatory compliance.

The consequences of incorrect filings can have significant effects on both the company and its employees. Potential fines from the SEC can damage a company’s financial standing, while employees may face delays or complications in accessing their equity benefits. Thus, focusing on accuracy during the filing process is crucial to safeguard both the organization and its workforce.

SEC S-8 filing solutions: tools and resources

Utilizing technology can significantly enhance the S-8 filing experience. Various PDF editing and signing solutions are available to streamline this process. Tools like pdfFiller can facilitate the e-signing process, document collaboration, and editing, making it easier to manage Form S-8 filings from a centralized platform. This efficiency is critical for maintaining compliance and ensuring timely submissions.

Furthermore, consulting with legal or financial advisors can be beneficial for companies navigating the complexities of SEC regulations. By leveraging expert advice and ongoing document management tools, organizations can ensure effective compliance and avoid costly mistakes during the S-8 filing process.

Tips for effective management of Form S-8

Ongoing compliance strategies are essential for successful S-8 management. Establishing an internal filing calendar can help businesses track important deadlines and maintain organized records. Creating a dedicated team or assigning roles specifically for managing the filing process minimizes confusion and ensures that the company meets all regulatory requirements.

Leveraging PDF tools for better workflow is also beneficial in this aspect. Features such as editing capabilities, collaboration options, and cloud-based solutions facilitate smoother document management. By integrating a solution like pdfFiller, employees can access and manage their forms from anywhere, fostering greater efficiency and compliance.

Start the conversation: engaging your team

Building awareness around Form S-8 is crucial for organizations seeking to engage their employees effectively in equity compensation programs. Strategies such as workshops, informational sessions, and regular updates ensure that team members are well-informed about the benefit plans they are part of. Fostering a culture of transparency regarding stock options and their implications helps in building trust and encouraging participation.

Feedback mechanisms, including surveys or discussion forums, allow employees to voice their thoughts regarding participation in these plans. Regularly updating employees about changes in filing, benefits, or the status of their options can enhance engagement and organizational alignment around equity compensation strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form s-8 to be eSigned by others?

How do I execute form s-8 online?

How do I edit form s-8 straight from my smartphone?

What is form s-8?

Who is required to file form s-8?

How to fill out form s-8?

What is the purpose of form s-8?

What information must be reported on form s-8?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.