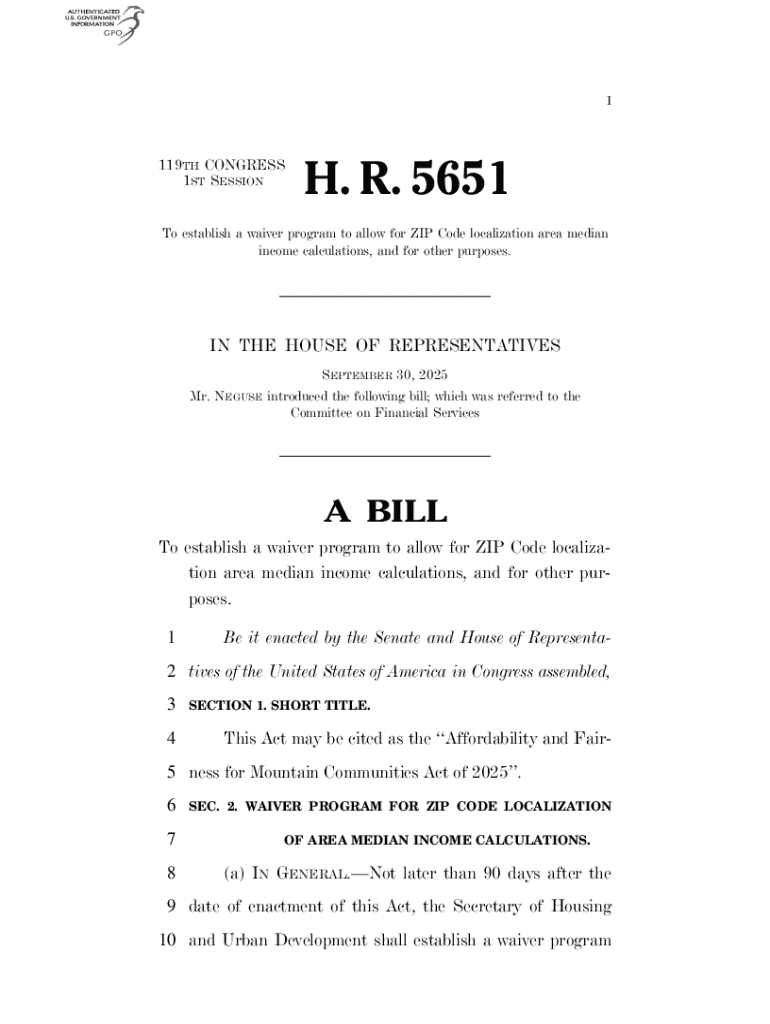

Get the free H. R. 5651

Get, Create, Make and Sign h r 5651

How to edit h r 5651 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out h r 5651

How to fill out h r 5651

Who needs h r 5651?

A Complete Guide to the H R 5651 Form

Understanding the H R 5651 form

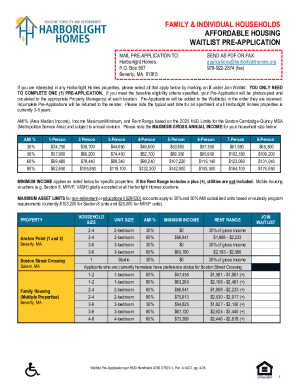

The H R 5651 Form is a crucial document primarily utilized within the scope of financial and legal compliance. This form serves to provide relevant information required by various entities, ensuring that all parties have access to necessary data concerning financial transactions or regulatory compliance.

Its importance cannot be understated; the H R 5651 form streamlines processes, mitigates risks, and enhances transparency in financial reporting and legal undertakings. Understanding the specifics of this form is essential for any individual or organization engaged in matters that require disclosure of financial data or adherence to regulatory standards.

Key features of the H R 5651 form

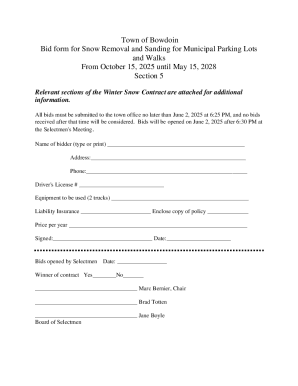

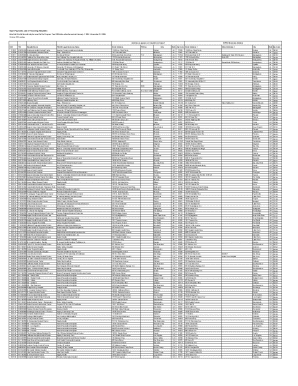

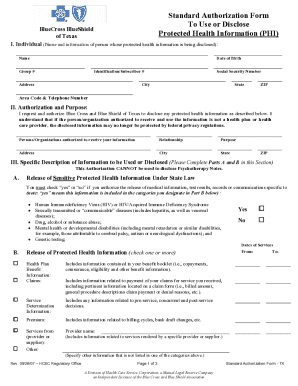

Essential components of the H R 5651 form include various fields designed to capture critical information. Each section demands precise details, ranging from personal identifiers to financial metrics, which together create a comprehensive overview of the individual or organization submitting the form.

Documents required for successful completion typically include identification records, financial statements, and any relevant legal documentation that might support the claims made within the H R 5651 form. Variations and versions may be present, particularly at the state level, which can lead to discrepancies; thus, it is vital to ensure you are using the correct version applicable to your jurisdiction.

Detailed instructions for filling out the H R 5651 form

Filling out the H R 5651 form may seem daunting, but following a systematic approach simplifies the process. Start by gathering all required information, which includes personal information such as your name, address, and Social Security number, along with necessary financial data.

Next, proceed with filling out the form section by section, ensuring every field is addressed accurately. Common pitfalls include misreporting financial data or forgetting to sign the form. After completing the form, review your submission carefully to catch any errors that may have slipped through, as accuracy is paramount in avoiding future complications.

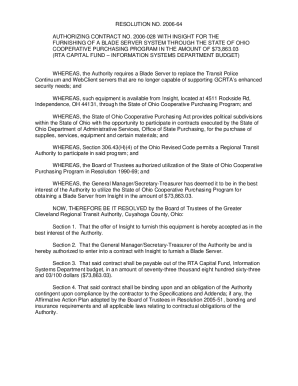

Editing and managing the H R 5651 form

Revising a completed H R 5651 form is straightforward when using pdfFiller's editing tools. Once you've filled out the form, if changes are necessary, simply upload your document to pdfFiller. Utilize the intuitive interface to modify text, adjust fields, or replace outdated information.

Best practices for document revision include saving different versions of your file to track changes and ensuring all corrections are made before the final submission. Regularly checking for updates on form requirements can prevent you from using outdated information.

Signing the H R 5651 form

The eSignature process for the H R 5651 form is a crucial step to ensure legal validity. Electronic signatures have gained widespread acceptance across various jurisdictions, providing a secure, efficient way to sign documents without the hassle of printing and scanning.

Using pdfFiller, you can follow a simple step-by-step guide to sign the document electronically. The process not only saves time but also ensures that your signatures are legally binding and stored securely within the cloud.

Collaborating on the H R 5651 form

Working effectively with team members or advisors when completing the H R 5651 form can enhance efficiency and ensure that all perspectives are considered. pdfFiller offers features that enable seamless collaboration, allowing multiple users to edit the document simultaneously, leave comments, and share insights.

Sharing options include sending a link for viewing or editing, with permissions that can be customized based on individual roles in the process. This collaborative approach not only improves accuracy but fosters a team-oriented environment, enhancing the overall quality of the submission.

Submitting the H R 5651 form

When it comes to submitting the H R 5651 form, users have a choice between e-filing or traditional paper submissions. E-filing is often preferred due to its convenience and speed, enabling immediate confirmation of submission.

For those opting for paper submissions, ensure you understand the mailing protocols, including correct addresses and necessary postage. After submission, tracking your submission status is recommended to ensure it has been received and accepted by the relevant authorities.

Troubleshooting common issues

As with any form, users frequently encounter questions or issues surrounding the H R 5651 form. Common mistakes include misrepresentation of financial data or neglecting to include necessary attachments. To mitigate these issues, refer to the completion guidelines and ensure that all aspects of the form are reviewed prior to submission.

For additional assistance, most official resources provide contact information for resolving specific issues related to the H R 5651 form. It’s crucial to act quickly if issues arise, ensuring all corrections can be swiftly addressed to avoid potential delays.

Leveraging pdfFiller for document management

Using pdfFiller for completing the H R 5651 form and managing other documents offers numerous advantages. The platform's cloud-based functionality allows users to access and edit their documents from anywhere, which is especially beneficial in a fast-paced, remote-work environment.

Additionally, document security is a top priority, ensuring that all information shared and stored is compliant with regulatory standards. With pdfFiller, users can confidently manage their documentation without worrying about security breaches, enabling a focus on completion and collaboration.

Conclusion and next steps

Familiarity with the H R 5651 form is crucial for individuals and teams navigating financial and legal responsibilities. Utilizing tools like pdfFiller not only simplifies the process of filling out and managing the form, but also ensures that submissions are accurate and timely.

Continued use of pdfFiller can streamline the completion of various forms and templates, enhancing overall productivity in document management endeavors. As you explore the platform further, you'll find an array of tools designed to optimize the way you handle paperwork, from drafting to submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete h r 5651 online?

How do I make changes in h r 5651?

How do I fill out the h r 5651 form on my smartphone?

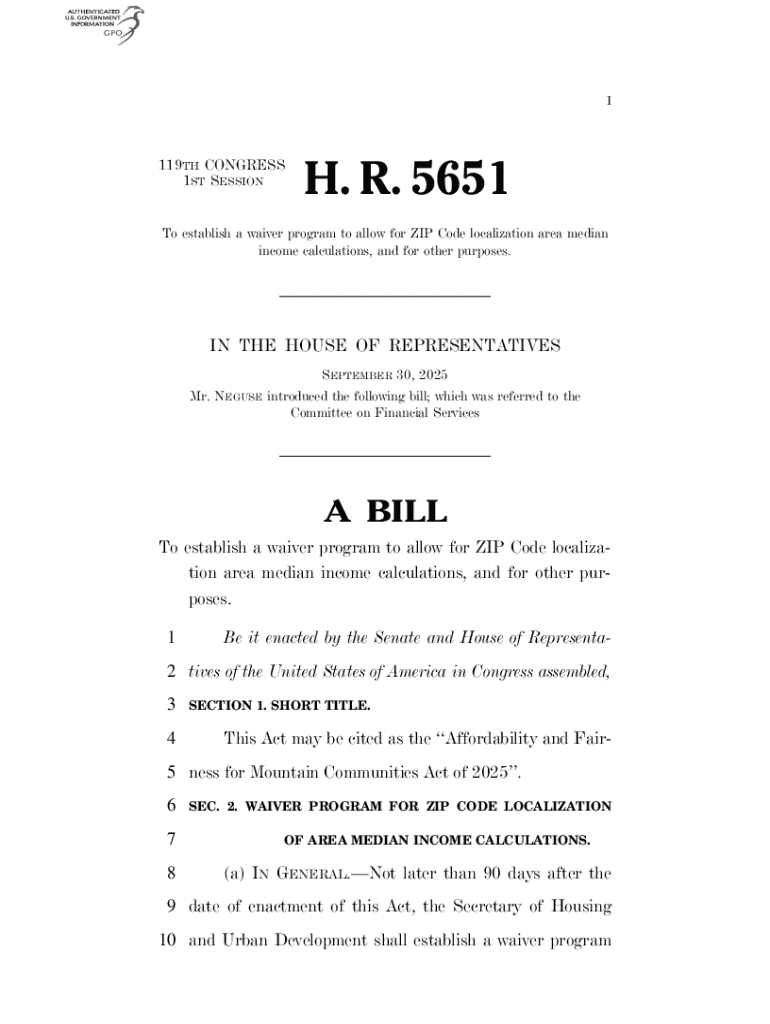

What is h r 5651?

Who is required to file h r 5651?

How to fill out h r 5651?

What is the purpose of h r 5651?

What information must be reported on h r 5651?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.