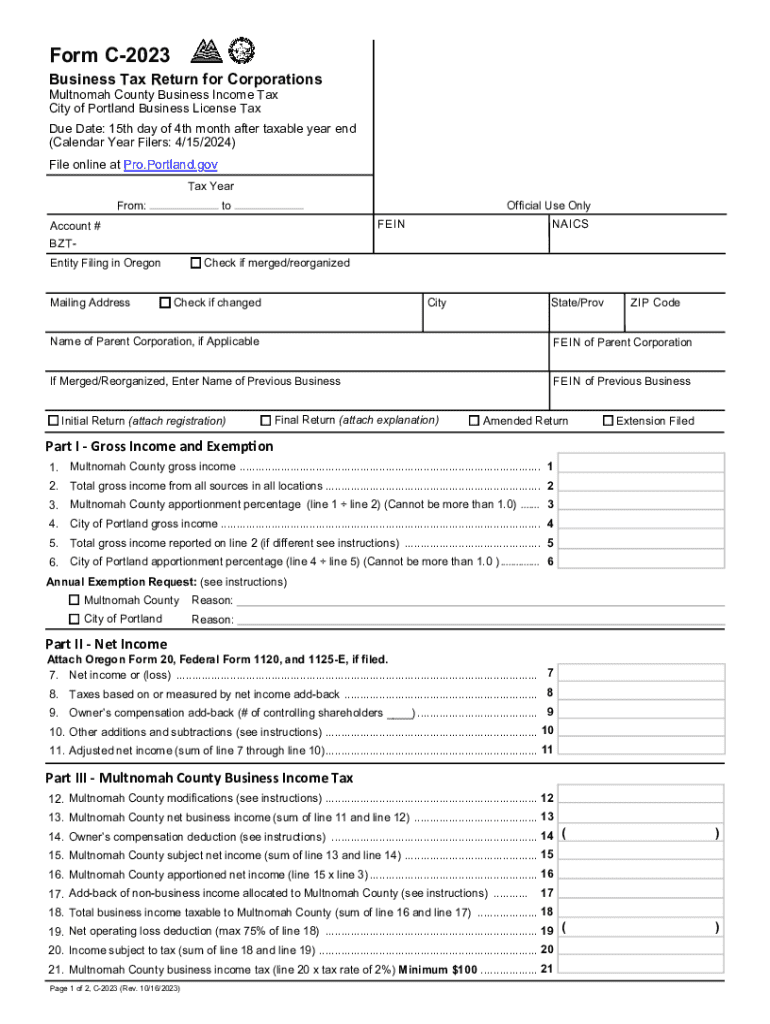

Get the free Form C-2023

Get, Create, Make and Sign form c-2023

How to edit form c-2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form c-2023

How to fill out form c-2023

Who needs form c-2023?

Form -2023 Form: A Comprehensive How-to Guide

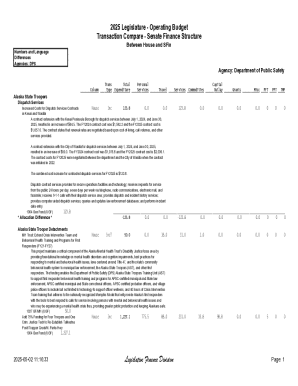

Overview of Form -2023

The Form C-2023 is a critical document designed for individuals and teams to comply with current tax regulations. Its primary purpose revolves around facilitating accurate income reporting and ensuring proper deduction and credit applications, thereby impacting the overall tax liability. With various stakeholders relying on precision in these submissions, understanding the Form C-2023 is essential for accurate fiscal representation.

In today's regulatory landscape, the importance of Form C-2023 cannot be overstated. It serves as a standardized method of reporting income and claims, contributing to transparency and compliance across various financial sectors. The 2023 update introduced key revisions aimed at simplifying the process, aligning it with contemporary tax practices, and enhancing user experience.

Understanding the components of Form -2023

Breaking down Form C-2023 into its core components reveals the importance of detailed reporting. Understanding each section not only eases the filling process but also prevents common errors that could lead to delays or complications during tax reviews.

Section 1 focuses on identification information. This section requires precise details such as name, social security number, and address to establish the taxpayer's identity. Section 2 delves into income reporting, where individuals report various sources of income including wages and business earnings. Sections 3 and 4 handle deductions, credits, and tax calculations respectively, while Section 5 is dedicated to signatures and acknowledgments, confirming the accuracy of reported information.

Step-by-step instructions for filling out Form -2023

Filling out Form C-2023 requires careful preparation. Begin by gathering necessary documents such as W-2s, 1099s, and receipts pertaining to deductions. Familiarizing yourself with key terminology will also aid in accurate reporting.

When filling out the form, each section should be approached methodically. For instance, ensure that the income reported in Section 2 matches the amounts listed in your supporting documents. Avoid common pitfalls such as miscalculating deductions or leaving blank fields, as these can trigger audits or rejections. Utilize dynamic fields within pdfFiller’s platform to streamline the completion process and ensure that you have incorporated all required elements.

Editing and customizing your Form -2023

With pdfFiller, users can easily edit their Form C-2023 to enhance clarity and functionality. Annotations such as comments or notes can be added directly to the document, ensuring that all team members involved in the completion are aligned on certain aspects of the form.

Customization options also allow for adjustments to the document's appearance. These practices not only improve the visual aspect of the forms but also help with organization and readability. Best practices for editing include keeping annotations clear and concise, and regularly saving changes to avoid data loss.

Signatures and eSigning using pdfFiller

eSignatures have become a legal standard, allowing users to sign documents electronically without the need for physical paperwork. The process of adding an eSignature to Form C-2023 through pdfFiller is straightforward and ensures legal validity.

To add your eSignature, simply navigate to the designated section, select 'Add Signature,' and follow the prompts to create your digital signature. Additionally, pdfFiller supports multi-signature options, enabling teams to collaborate efficiently on submissions where multiple confirmations are required.

Managing your Form -2023 after submission

Once Form C-2023 is submitted, tracking its status becomes essential. Utilizing pdfFiller's capabilities enables you to monitor submission updates and understand your document's current standing within the tax organization.

Should you find the need to make amendments post-submission, pdfFiller outlines a clear process for adjustments, ensuring that your document remains compliant and accurate. Effective storage practices within pdfFiller's platform also help organize your forms for easy retrieval in future audits or reviews.

Troubleshooting common issues

Errors on Form C-2023 can lead to significant delays or complications. It's crucial to know how to address these issues effectively. Common errors may include discrepancies in reported income, missing signatures, or incorrect deductions, all of which can be rectified following the right procedures.

If you encounter challenges, obtaining accurate support is vital. pdfFiller offers robust customer support channels, including FAQs that can guide users through common troubleshooting scenarios, ensuring that users remain equipped to handle any issues swiftly.

Case studies: Real-life applications of Form -2023

Examining real-life scenarios where Form C-2023 is employed reveals diverse strategies for compliance in tax situations. For instance, individual taxpayers have succeeded in maximizing deductions through meticulous income reporting and utilizing credits effectively.

On a team level, groups have successfully collaborated using pdfFiller to manage submissions efficiently, ensuring each member's contributions are reflected accurately. Collaboration reduces errors and fosters a comprehensive understanding of financial reporting among team members.

Further insights and guidelines

As we look toward the future, understanding changes anticipated for Form C-2024 is crucial for proactive compliance. Tax regulations are ever-evolving, making it essential to stay informed about upcoming changes that could affect filing processes and requirements.

Subscribing to updates and notifications from reliable sources ensures that you remain ahead in your document management and filing processes. This proactive approach mitigates the risk of missing critical information related to tax filings.

Conclusion: Enhancing document management with pdfFiller

Form C-2023 represents an essential tool for fulfilling tax obligations accurately. By leveraging pdfFiller's solutions, users can navigate the complexities of document management, ensuring compliance and enhancing overall efficiency in form submissions.

Whether you are an individual filing independently or part of a team, embracing pdfFiller’s capabilities empowers you to manage your documents from anywhere, enhancing accessibility while reducing errors in your submissions. As tax regulations continue to evolve, staying informed and equipped with the right tools makes all the difference.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form c-2023 directly from Gmail?

How do I edit form c-2023 online?

Can I edit form c-2023 on an Android device?

What is form c?

Who is required to file form c?

How to fill out form c?

What is the purpose of form c?

What information must be reported on form c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.