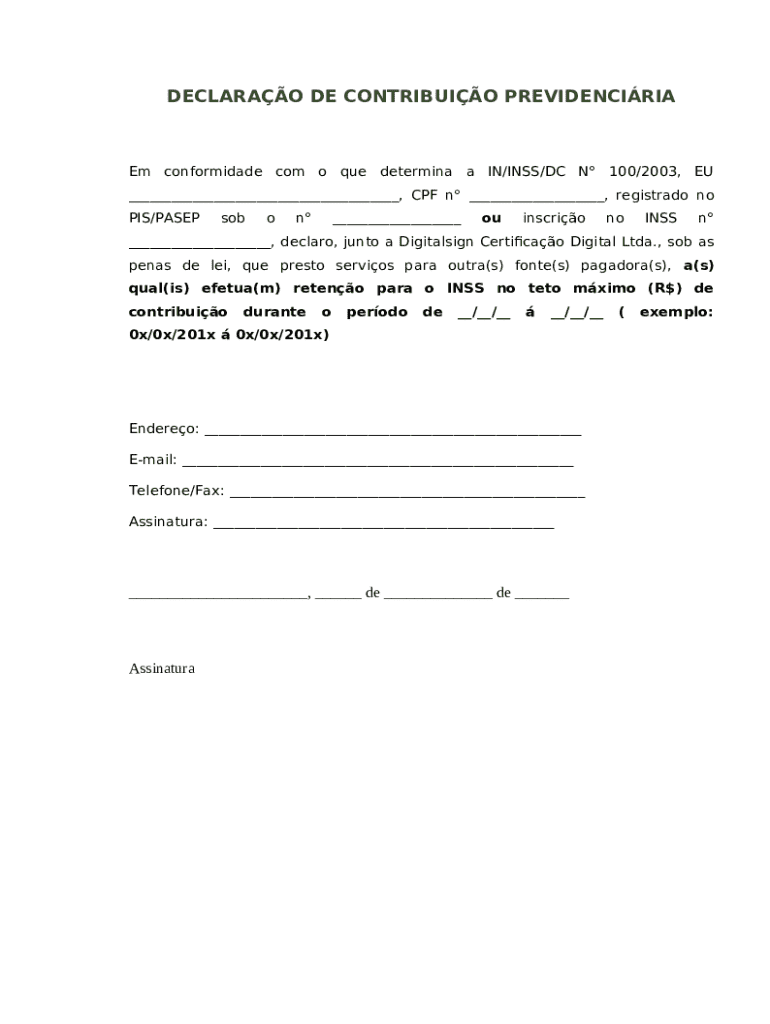

Comprehensive Guide to the Declaração de Contribuição Previdenciária Form

Understanding the Declaração de Contribuição Previdenciária

The Declaração de Contribuição Previdenciária (DCP) is a pivotal form in Brazil's social security framework. This declaration outlines the contributions made by individuals towards their previdência social, ensuring they are eligible for essential benefits like retirement, disability, or health assistance. The form serves as a formal record of contributions made, helping to accurately compute future entitlements.

Filling out this declaration is not just a bureaucratic formality; it is crucial for safeguarding one’s rights within the social security system. Individuals such as self-employed workers, freelancers, and employees may be required to submit the DCP to maintain their contribution accounts, affecting their future entitlement to benefits.

Definition of the form and its importance.

Eligibility criteria for filling out the declaration.

Consequences of failing to submit the DCP on time.

Key components of the Declaração de Contribuição Previdenciária form

Understanding the various components of the DCP is vital for accurate completion. The form includes a series of fields that require detailed input from the contributor. The first major component involves identification details like 'Nome' and 'CPF' (Cadastro de Pessoas Físicas), essential for linking contributions to the individual.

Next, the contribution details section outlines the monthly contributions and the type of activity being carried out, whether self-employed or as a salaried employee. Additionally, accurate salary details must be included to ensure that the calculations around the 'cálculo de GPS' (Guia da Previdência Social) reflect the contributor's actual earnings without discrepancies, especially relating to minimum wage regulations.

Identification details (Name, CPF, etc.) needed for verification.

Contribuição details indicating the type of work and monthly contributions.

Salary details to enable accurate calculations for social security.

Additional fields that may include previous contributions or additional personal information.

Step-by-step guide to filling out the form

Before actually filling out the form, it is essential to gather all necessary documents. This includes proof of income, previous contribution records, and any other relevant financial statements. Having these documents at hand streamlines the process and minimizes the likelihood of errors.

As you begin filling out your information on the DCP, pay close attention to each section. Start with basic identification and follow through to more detailed contribution information. Each segment has specific requirements and should be completed accurately to avoid unnecessary complications. It's advisable to refer to any available guidelines or FAQs provided by the 'agência da previdência social' for additional clarity.

Collect required documents like proof of income and past contribution records.

Fill in identification details accurately to ensure proper processing.

Provide detailed information regarding contributions and relevant salary.

Double-check for any common errors before final submission.

Submitting the Declaração de Contribuição Previdenciária

Once the form is completed, you must submit it. There are two primary methods for submission: online and offline. The online option is usually more convenient and quicker. You can access the online portal of the INSS (Instituto Nacional do Seguro Social) to submit your DCP. Follow the prompts to upload your filled form and any attached documents.

For offline submission, you will need to print the form and deliver it to the nearest INSS agency. It's important to keep track of your reference number once submitted, as this will allow you to monitor the processing status. Typically, submissions are processed within a few days to a couple of weeks, depending on the volume of applications.

Access the INSS online portal for submission or print the form for offline delivery.

Follow all steps as indicated online for a smooth submission process.

Track your submission status using the reference number received after submission.

Regularizing your contribution previdenciária

Failing to submit the Declaração de Contribuição Previdenciária on time can lead to delayed benefits or complications in securing your right to social security services. It's essential to be vigilant about deadlines and submission protocols. In cases where you’ve missed the deadline, prompt action is necessary to rectify your contribution status.

To regularize your situation, you should promptly submit the DCP along with supporting documentation reflecting your contributions up to the deadline. If you have a backlog due to missing submissions, you may need to adjust your contributions retroactively. Utilizing resources such as the 'Decreto nº 10.410' provides clarity on procedures for regularization and adjustments due to discrepancies or late payments.

Know the consequences of late submissions to avoid penalties.

Submit your form as soon as possible to correct missed deadlines.

Check for provisions for retroactive contributions according to your situation.

Managing your contribution records

Keeping an accurate record of your contributions is vital, not just for compliance but also for personal financial planning. To effectively manage your records, consider employing tools and resources provided by platforms like pdfFiller. Utilizing digital document management systems allows you to store your forms safely, access them easily, and make edits as needed.

Best practices for organizing documentation include regularly updating your records following each submission or payment cycle. Ensure you maintain copies of all submissions and documents related to your contributions, as they will be crucial in case of any disputes or inquiries by the INSS. Regularly review your contribution statement to ensure all figures are accurate, especially if you anticipate changes due to salary adjustments or new employment.

Use cloud-based solutions to store and manage your contribution documents.

Regularly update your contribution records after each submission.

Keep copies of all relevant submission documents for future reference.

Interactive tools for easily filling out your form

Platforms like pdfFiller provide a comprehensive suite of interactive tools to simplify the process of filling out the Declaração de Contribuição Previdenciária. The cloud-based platform allows users to access forms from anywhere, eliminating the hassle of physical paperwork. Features include real-time editing, eSigning capabilities, and collaborative tools that can facilitate team efforts in managing contributions.

The ability to edit documents in real-time prevents errors and ensures that all entries are correct before submission. Moreover, these platforms enable users to save application progress and return to it later, ensuring that information is not lost in case of interruptions. Utilizing such digital tools can significantly enhance efficiency and accuracy in managing important forms.

Access forms seamlessly from any device using pdfFiller.

Collaborate with team members easily using shared access features.

Take advantage of real-time editing and error prevention tools.

Common questions and troubleshooting tips

As with any bureaucratic process, questions frequently arise. Common queries include inquiries about how to update previously submitted DCP forms, manage contributions if irregularities are found, or what exact documents to submit along with the declaration. It’s advisable to consult the FAQs section of the INSS website for a comprehensive list of answers to typical questions.

In cases of technical difficulties while filling out the DCP online, contacting support or utilizing help resources available on the pdfFiller platform can mitigate challenges. Staying informed about common issues helps streamline the process, allowing for a smoother submission experience.

Familiarize yourself with frequently asked questions for quick answers.

Access technical support resources on platforms like pdfFiller.

Seek guidance on common mistakes to avoid complications during submission.

Navigating related areas of tax and contribution

Understanding the interrelationship between the Declaração de Contribuição Previdenciária and broader tax obligations is vital for all contributors. The DCP directly impacts the 'contribuição previdenciária e salário de contribuição' and failure to comply with these aspects can lead to substantial issues down the road, including penalties or a lower benefit calculation compared to your contributions made.

It's imperative for contributors to stay informed about any legislative changes that may affect tax obligations and contributions, such as information stemming from 'portaria pres/inss no 1.382' or relevant ‘alteraçoes’ in the law. Additional forms or declarations may be required depending on specific circumstances, emphasizing the need for thorough knowledge of all related documentation.

Understand the implications of your contributions on overall tax obligations.

Stay updated on any relevant changes in laws affecting contributions and tax.

Identify additional forms needed for specific scenarios or employment statuses.

Video tutorial: accessing your contribution statement

To help navigate the often complex world of contribution management, a video tutorial can provide step-by-step guidance on how to access, interpret, and track your contribution statement. Such resources can demystify the process of understanding your contribution history, detailing how to read the statements effectively and what figures are significant for future reference.

Keeping an updated record, as emphasized throughout this guide, is crucial for ensuring seamless management of your social security contributions. Learning how to interpret your statements can aid in foreseeing potential issues and facilitate the necessary adjustments in your contribution strategies based on your changing income or employment scenarios.

Watch a detailed video guide on accessing your contribution statement.

Learn to interpret your contributions to maintain accurate records.

Use insights from your statements to manage your contribution strategy effectively.