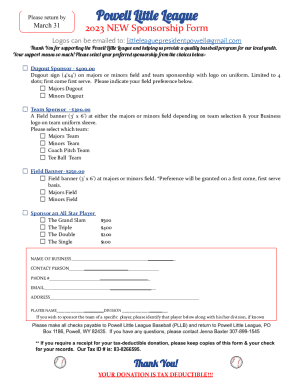

Get the free Quarterly Schedule Fr

Get, Create, Make and Sign quarterly schedule fr

Editing quarterly schedule fr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quarterly schedule fr

How to fill out quarterly schedule fr

Who needs quarterly schedule fr?

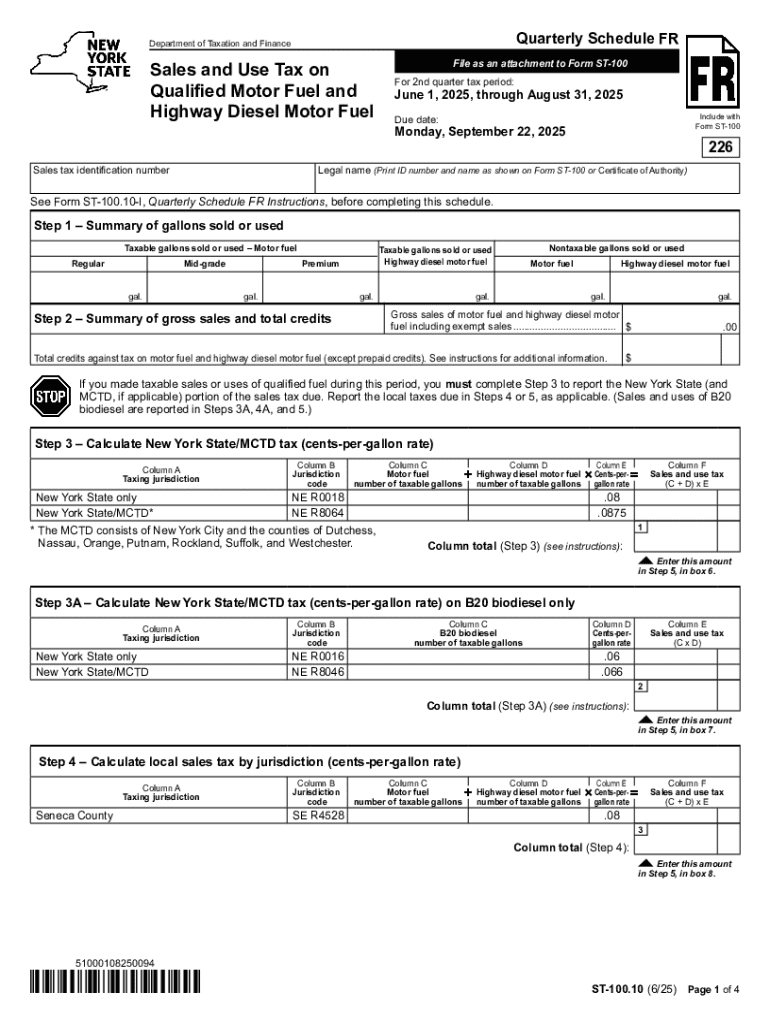

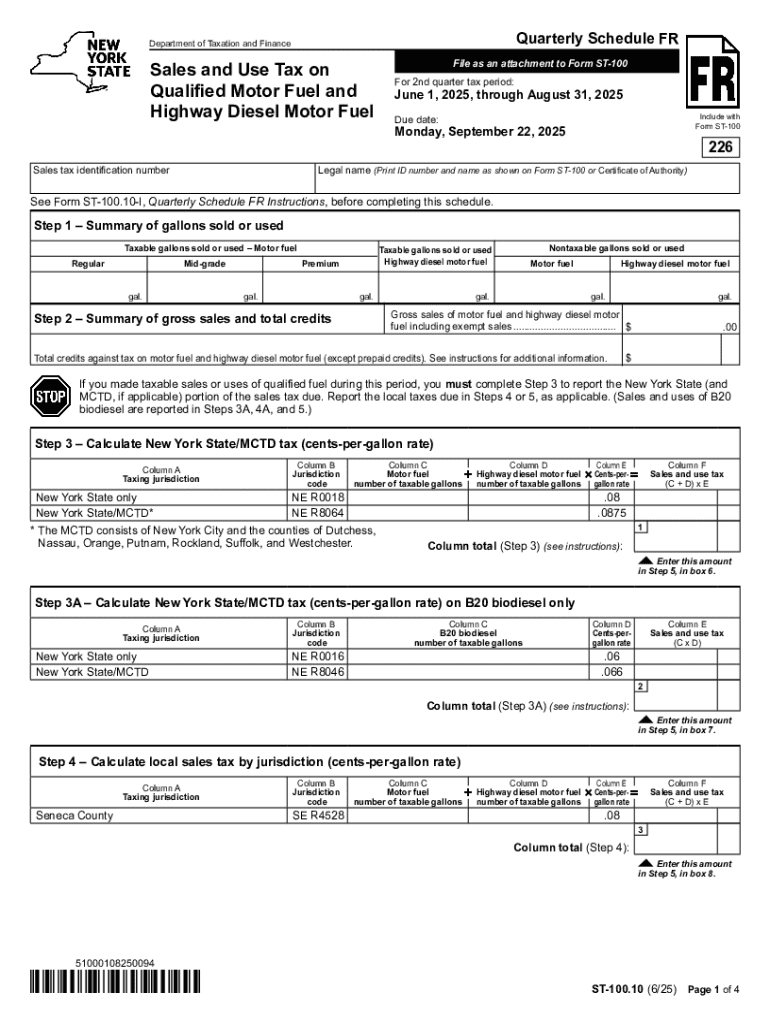

A Comprehensive Guide to the Quarterly Schedule FR Form

Understanding the Quarterly Schedule FR Form

The Quarterly Schedule FR Form is a critical document used in New York State for reporting sales tax collected over a specific quarter. Designed for businesses operating within the state, this form helps in maintaining compliance with the tax department’s requirements. Failing to file this form can lead to significant penalties and interest accruing on unpaid taxes, which is why understanding its intricacies is essential.

The importance of the Quarterly Schedule FR Form in tax compliance cannot be overstated. Accurate and timely submissions help ensure that taxpayers fulfill their obligations while avoiding unnecessary complications during audits. This form is significant not only for compliance but also for tax planning, as understanding one's sales tax liability can affect pricing strategies and cash flow management.

Who is required to use the Quarterly Schedule FR Form? Primarily, businesses that sell tangible personal property, operate as retail gas stations, or provide taxable services are mandated to file. Motor fuel distributors and those involved in the sale of highway diesel motor fuel also fall under this category. Ensuring you fall within the required group is crucial for avoiding penalties.

Key components of the Quarterly Schedule FR Form

The Quarterly Schedule FR Form comprises various crucial sections that collect essential information from taxpayers. An overview of these sections reveals how the form structures its requests for information.

Some of the key components include:

Additionally, special indicators and codes on the form signify particular types of transactions or exemptions that businesses may claim. Familiarizing yourself with these codes can simplify the process of filling out the form.

Step-by-step instructions for completing the Quarterly Schedule FR Form

Filling out the Quarterly Schedule FR Form requires a systematic approach to ensure accuracy and compliance. Following these steps will make the process more manageable.

First, prepare your information by gathering all necessary documents, including previous quarterly filings, sales records, and any receipts relevant to tax exemptions. It's essential to ensure the accuracy of your tax identification numbers for proper processing.

After completing each section, take time to review the form for accuracy before submission. Double-check numbers and ensure signatures are provided where necessary.

Common mistakes to avoid when submitting the Quarterly Schedule FR Form

Even the most diligent business owners can slip up when filing the Quarterly Schedule FR Form. Here are some frequently occurring errors to watch out for:

By following best practices, such as reviewing forms and using automated tools, you can significantly reduce the risk of making these mistakes. Ensuring ample time to file before the deadline can also alleviate last-minute errors.

Deadlines and filing requirements

Understanding the deadlines for submitting the Quarterly Schedule FR Form is crucial for effective tax management. Generally, this form is due one month following the end of the quarter. For example, if the quarter ends on March 31, the due date would be April 30.

Businesses should also be aware of extension options available for filing in certain circumstances. Extensions may allow taxpayers additional time to gather necessary documentation, although interest and penalties on late payments could still apply.

Managing your Quarterly Schedule FR submissions with pdfFiller

For those looking to streamline the process of filling out and submitting the Quarterly Schedule FR Form, pdfFiller offers an array of tools to make management simpler. Users can edit and manage their forms directly from the platform, ensuring clarity and accessibility.

Key features of pdfFiller include:

Utilizing pdfFiller not only enhances productivity but ensures that your filing process is both compliant and efficient.

Troubleshooting common issues related to the Quarterly Schedule FR Form

If your Quarterly Schedule FR Form submission is rejected, it can be frustrating. However, knowing how to address these issues can ease the process. First, review the stated reason for rejection, which is often due to data discrepancies or missing information.

Contacting support for guidance or accessing help resources can provide the clarity needed to resolve these issues effectively. The New York State Department of Taxation and Finance provides avenues for assistance that are worth utilizing should problems arise.

Additional considerations when filing the Quarterly Schedule FR Form

Filing the Quarterly Schedule FR Form involves considerations beyond merely completing the document. Variances in state-specific guidelines can impact how business owners approach taxes. As tax laws evolve, it's essential to stay informed about changes, especially those concerning categories such as sales tax exemptions or rates on fuels.

Businesses must remain adaptable, as alterations in tax law can directly affect your filing process. Keeping in contact with legal or tax professionals can help navigate these changes efficiently.

User experiences and testimonials

The efficiency and user-friendly interface of pdfFiller have garnered positive feedback from many users. Businesses report increased confidence in their filings due to the platform's comprehensive features, with testimonials highlighting successful filings and ease of collaboration.

Case studies reveal that teams leveraging pdfFiller for the Quarterly Schedule FR Form have reduced filing time significantly, highlighting its value as an indispensable tool for business tax compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify quarterly schedule fr without leaving Google Drive?

Where do I find quarterly schedule fr?

Can I edit quarterly schedule fr on an Android device?

What is quarterly schedule fr?

Who is required to file quarterly schedule fr?

How to fill out quarterly schedule fr?

What is the purpose of quarterly schedule fr?

What information must be reported on quarterly schedule fr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.