Limited Liability Company Organization Form How-to Guide

Understanding limited liability companies (LLCs)

A limited liability company (LLC) is a business structure designed to provide the benefits of both a corporation and a partnership. This structure combines the flexibility of a partnership's operational framework with the liability protection typically associated with a corporation. Essentially, LLC members are not personally liable for business debts and liabilities, safeguarding personal assets from business-related risks.

Choosing an LLC organization form offers numerous benefits. Among these are the capacity for pass-through taxation, which prevents double taxation at both the corporate and personal levels, and minimal requirements for management structure compared to corporations. Moreover, LLCs can have an unlimited number of members, including individuals, corporations, and foreign entities, which enhances their appeal.

When comparing LLCs with other business structures, such as sole proprietorships, partnerships, and traditional corporations, the differences become notably significant. Sole proprietorships lack liability protection, exposing personal assets to business risks, while corporations face stricter operational requirements and double taxation. Thus, LLCs strike a balance, making them an optimal choice for many entrepreneurs.

Why you need an organization form

Formalizing your LLC by submitting an organization form is essential for establishing your business on legal grounds. This process initializes your status as a recognized entity, which is crucial for various aspects, including opening bank accounts, entering contracts, and protecting personal assets against business liabilities.

Filing for an organization form grants various legal advantages. A registered LLC can sue or be sued, own property, and enter into agreements under its name. This separation between personal and business assets ensures that in the event of lawsuits or debts, personal liability is minimized, thereby offering a significant layer of protection.

Establishes a legal business entity.

Provides liability protection for personal assets.

Facilitates easier access to business financing.

Enhances credibility with customers and suppliers.

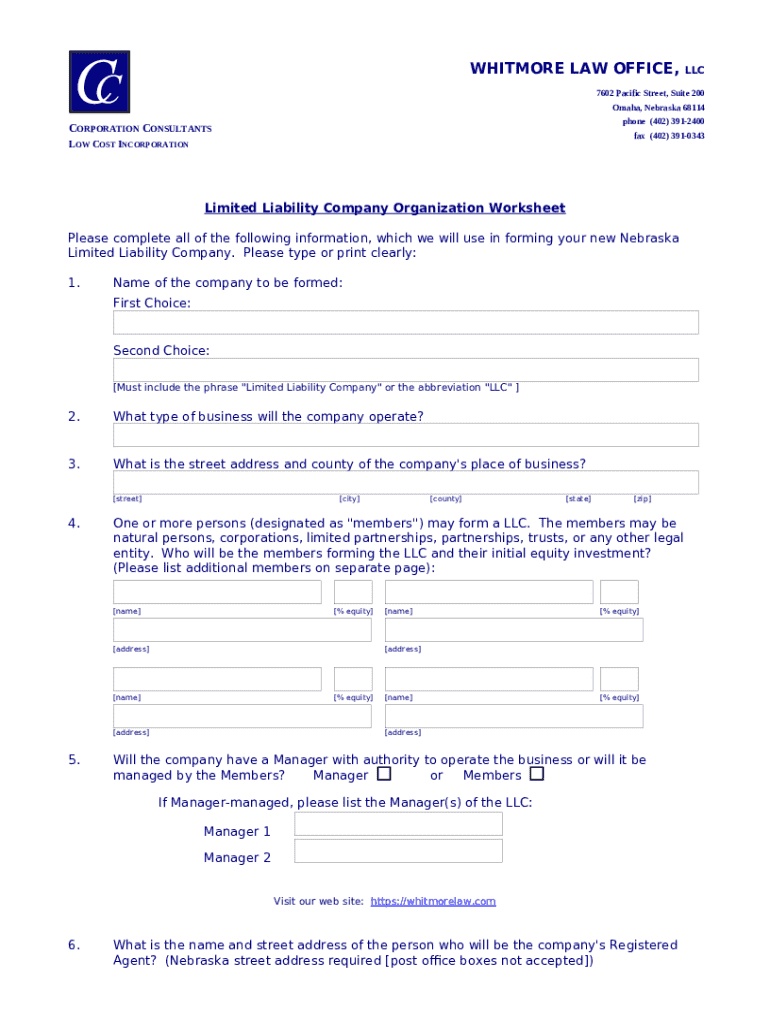

Overview of the limited liability company organization form

The organization form required for LLCs, often referred to as Articles of Organization or Certificate of Formation, typically includes several crucial sections. These include the LLC's name, purpose, principal office address, duration, registered agent, and member details. Each section serves a distinct purpose, ensuring that the LLC meets all state requirements for establishment.

The information presented in these sections must be accurate and meet state-specific guidelines. The form’s clarity and completeness are essential, as inaccuracies can lead to delays or even rejection of your filing. It's beneficial to review your state's requirements carefully before completing the organization form.

Registered agent information.

Business purpose statement.

Member or manager details.

Step-by-step instructions to complete the organization form

Step 1: Gather necessary information

Before starting the process of filling out the LLC organization form, gather the necessary documents and information. This includes your desired business name, contact information, registered agent details, and an overview of the members or managers. Being organized at this stage will simplify the actual form-filling process.

Step 2: Choose an appropriate name for your

Selecting the right name for your LLC is crucial since it represents your brand identity. Ensure your chosen name adheres to state laws, including the requirement to include 'Limited Liability Company' or its abbreviations. Use pdfFiller’s tools to search for name availability, preventing potential conflicts.

Step 3: Designate a registered agent

A registered agent acts as a liaison between your LLC and the state, receiving legal documents and correspondence. Choosing a reliable registered agent is vital. You can appoint an individual or a professional service provider who can ensure compliance with state requirements and timely communication of critical information.

Step 4: Fill out the organization form

When filling out the organization form, it’s essential to pay close attention to each section. For example, while detailing the business purpose, provide a clear and concise description that reflects your business activities. Avoid vague language and ensure that your information matches other documentation to minimize confusion during processing.

Be aware of common pitfalls, such as using incorrect abbreviations for your company name or entering inaccurate member information. Taking your time and ensuring thoroughness can spare you delays.

Step 5: Review your completed form

After completing the organization form, review it meticulously to ensure all details are accurate. Grammatical errors, typos, or omissions can cause serious delays in the processing time. Utilizing pdfFiller’s integrated tools can significantly help streamline this step, enabling effective edits and revisions until you are satisfied with the final version.

Filing the organization form

Once you’ve completed your organization form, the next step is filing it with your state. Filing options vary; you can submit your form online, via mail, or in person. Online filing is often faster and more convenient, while mailing can take more time due to processing.

For online filing, navigate to the relevant state portal, follow the provided instructions, and upload or enter your completed organization form. Keep in mind the specific requirements for your state, as they may vary significantly. Choosing the right submission method may depend on how soon you want to finalize your LLC status.

Fees associated with filing

Filing fees for LLC organization forms can differ substantially from state to state. Generally, these fees range between $50 and $500. Additionally, there may be costs for expedited processing services, name reservations, or obtaining certified copies of your documents.

It’s prudent to check your specific state's requirements for a detailed breakdown of the costs involved. Being prepared financially ensures you can complete your filing without unexpected hurdles.

Expedited processing options for formation

If you need to form your LLC quickly, many states offer expedited processing options for a higher fee. This can significantly reduce processing time, sometimes down to as little as 24 hours. To request expedited processing while using pdfFiller, simply select it during the submission process — be sure to check your state’s expedited options to determine the costs involved.

Utilizing these expedited services is particularly beneficial if you are ready to start business operations or fulfill contracts that require your LLC status to be active.

Post-filing steps for your

Once your organization form is filed and accepted, you can expect a few formalities to follow. One crucial step includes obtaining an Employer Identification Number (EIN) from the IRS, essential for tax purposes and hiring employees. The process is relatively straightforward and can often be completed online.

Another important consideration is creating an operating agreement. While not always required by law, this internal document outlines the management structure of your LLC, member obligations, and critical procedures. Having a solid operating agreement can provide clarity and prevent disputes among members.

Managing your documents with pdfFiller

pdfFiller offers a powerful cloud-based platform for managing your LLC documents efficiently. With features such as seamless editing, eSigning, and collaboration tools, you can streamline your operations from anywhere. Whether you need to update member information or draft the operating agreement, pdfFiller simplifies the process.

Additionally, the platform provides secure storage options to keep your LLC documentation safe and easily accessible. This capability allows you to manage your important documents without the hassle of physical paperwork.

Troubleshooting common issues with formation

As you navigate the formation process for your LLC, common challenges may arise. Some of the most frequently encountered issues include filling out the organization form incorrectly or inconsistently with state guidelines. Errors in member details or the business purpose can delay filing or affect your LLC status.

To address potential filing delays, ensure you double-check the form before submission and cross-reference with state requirements. If you encounter further complications, various resources are available, such as local business development centers, state websites, and even legal advisors who specialize in LLC formations.

Interactive tools to enhance your formation experience

pdfFiller offers an array of interactive tools designed to simplify the organization form management process. Utilizing these tools, users can easily fill out, save, and edit documents, making the overall experience much more user-friendly. The platform also enables collaboration, meaning multiple members can access and contribute to documents without needing paper copies.

These capabilities can significantly streamline the communication process among LLC members, ensuring everyone stays on the same page. By leveraging pdfFiller’s tools, you can enhance your organization and efficiency in managing your LLC, allowing you to focus on growing your business.