Guide to the Continuing Disclosure Agreement Template Form

Understanding continuing disclosure agreements

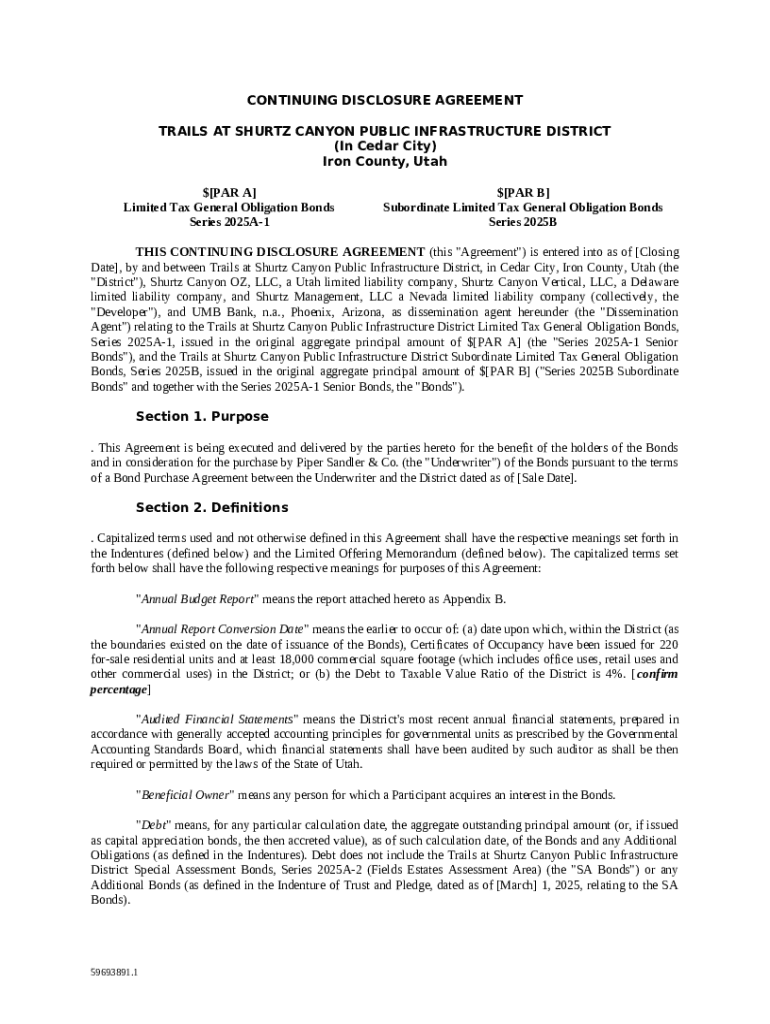

A continuing disclosure agreement (CDA) is a vital contract that ensures that issuers of municipal securities provide ongoing financial and operational information about themselves to investors. The primary purpose of such agreements is to promote transparency and uphold the integrity of financial markets. By mandating regular updates about financial condition and operational performance, a CDA serves as a safeguard for both investors and issuers.

The importance of continuing disclosure in financial reporting cannot be understated. It enables investors to make informed decisions, supporting market confidence while enabling issuers to maintain their credibility. Legal frameworks, primarily governed by the Securities and Exchange Commission (SEC) and the Municipal Securities Rulemaking Board (MSRB), outline the ongoing obligations that must be met. Failure to comply with these requirements can lead to penalties and reduced investor trust.

Key elements of a continuing disclosure agreement

A continuing disclosure agreement template form contains several key elements that define the responsibilities of each party. It typically includes:

Identifies the issuer and any obligated party responsible for the disclosure.

Detailing the types of information to be disclosed, including financial statements and material events.

Establishes the frequency and deadlines for disclosure, ensuring timely updates.

Additionally, the template will often highlight common terms and conditions, such as confidentiality clauses and regulatory compliance commitments. Integration with other documents, such as bond indentures or other legal agreements, can also be vital for ensuring comprehensive and cohesive compliance.

Navigating the continuing disclosure agreement template

pdfFiller offers an accessible platform for navigating continuing disclosure agreements with user-friendly templates. One standout feature is that it includes pre-filled sections, which significantly accelerates the completion process by automatically populating standard information. This is particularly useful for first-time users or teams looking to save on time without sacrificing detail.

Another pivotal feature of pdfFiller's template is the editable PDF elements, allowing users to tailor the document according to their unique needs. Step-by-step instructions for use provide additional clarity, simplifying what can be an otherwise intricate process. By leveraging these features, users can ensure that their disclosures meet regulatory requirements while maintaining operational efficiency.

Step-by-step guide to completing the template

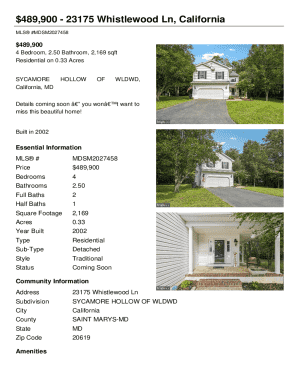

Completing a continuing disclosure agreement template begins with preparing your information. First, gather all necessary documents, such as financial statements, audit reports, and relevant agreements that outline disclosure obligations. Being organized will streamline the completion process.

Next, fill out the template methodically:

Fill in the names of all parties involved and the effective date of the agreement.

Provide comprehensive financial disclosures and material event descriptions as required.

Carefully verify all data for accuracy and completeness before finalizing.

Editing and customizing your agreement may also be beneficial. Users can add custom clauses to address specific requirements or regulatory changes and adjust language to reflect the unique aspects of the issuer's situation.

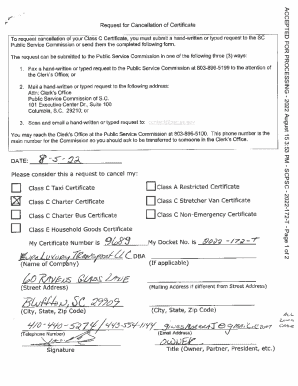

Signing and submitting the continuing disclosure agreement

Once the continuing disclosure agreement is complete, the signing process is crucial. Utilizing electronic signatures is both a convenient and legally valid option that simplifies the process. E-signatures are recognized under the Uniform Electronic Transactions Act (UETA) and can be easily integrated using pdfFiller's features.

To ensure a seamless signing experience, it's important to understand a few best practices for submission. First, ensure compliance with regulatory bodies, which often have specific submission formats and guidelines. Additionally, maintaining accurate records of both the signed document and the submission confirmation is vital for future reference and compliance checks.

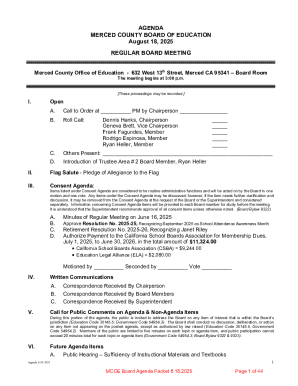

Managing and storing your continuing disclosure agreement

Another critical aspect of the continuing disclosure process is effectively managing and storing your completed agreements. With pdfFiller, users can access their documents in the cloud, providing flexibility and convenience for future reference. This cloud storage option also enhances security, ensuring that sensitive information is protected.

Collaboration features allow team members to work together on documents, streamlining the preparation and revision phases of the disclosure process. Organizing and searching for past disclosures is also simplified through the platform’s intuitive interface, allowing teams to retrieve historical documents effortlessly.

Staying informed: importance of regular updates

Compliance with disclosure requirements is an ongoing responsibility. Monitoring changes to regulations and institutional policies can help ensure that continuing disclosures are compliant. Various tools for compliance management can aid issuers in staying up-to-date, including subscription services to regulatory body announcements and newsletters.

Setting reminders and alerts to review and update disclosure obligations helps in maintaining compliance. Users can utilize digital calendars or project management tools to schedule regular check-ins to ensure that no deadlines are overlooked.

Common challenges and solutions in continuing disclosures

Despite the structured nature of continuing disclosures, issuers often face challenges. Incomplete information can arise from insufficient data collection processes or unclear disclosure obligations. To combat this, maintaining a centralized information repository when drafting the disclosure can mitigate oversight issues.

Additionally, handling changes in regulations requires adaptability. Establishing a compliance team to monitor regulatory changes can be effective. For overcoming technical difficulties while using templates, pdfFiller's customer support offers tailored assistance, ensuring users can navigate the platform effectively.

Expert tips for effective continuing disclosure practices

To enhance the efficacy of your continuing disclosure practices, a focus on accuracy and timeliness is paramount. Regular reviews of your agreements and financial data ensure that all disclosures reflect the current state of your financial health.

Leveraging technology for better compliance is also advisable. Tools like pdfFiller provide not only the capability to edit and manage documents but also facilitate collaboration among team members. Furthermore, consulting legal or financial advisors can provide additional layers of assurance in the compliance process, helping to navigate the complexities of disclosure regulations.

Resources for further learning and support

To foster a thorough understanding of continuing disclosure agreements, access to additional resources is beneficial. pdfFiller’s customer support is equipped to handle inquiries and offer additional guidance on using their platform effectively. Additionally, seeking relevant guidelines from regulatory bodies, such as the SEC or MSRB, can provide comprehensive insight into compliance expectations.

Lastly, exploring community forums may yield valuable user experiences and insights, allowing individuals and teams to learn from others who are navigating similar disclosure processes. Engaging in these discussions can enhance understanding and potentially provide solutions to common challenges faced in continuing disclosures.