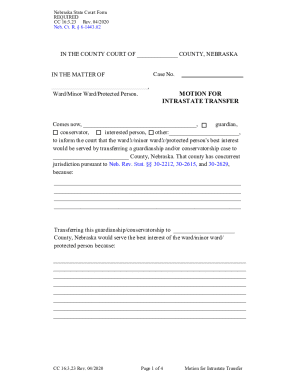

Get the free 511-w

Get, Create, Make and Sign 511-w

How to edit 511-w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 511-w

How to fill out 511-w

Who needs 511-w?

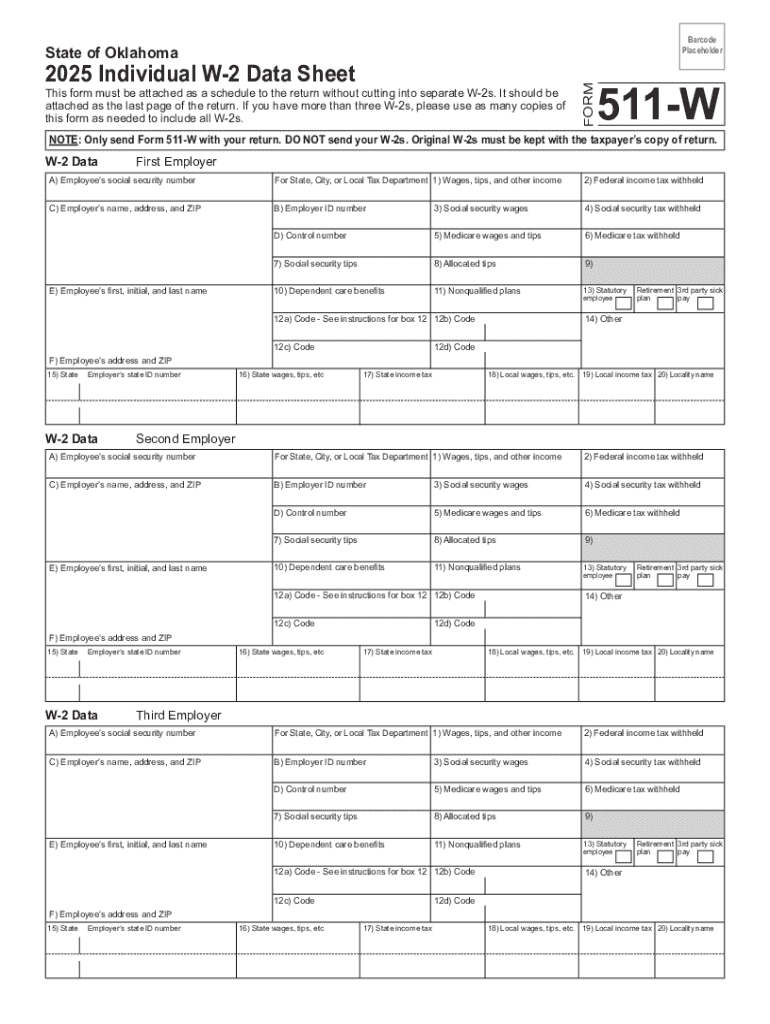

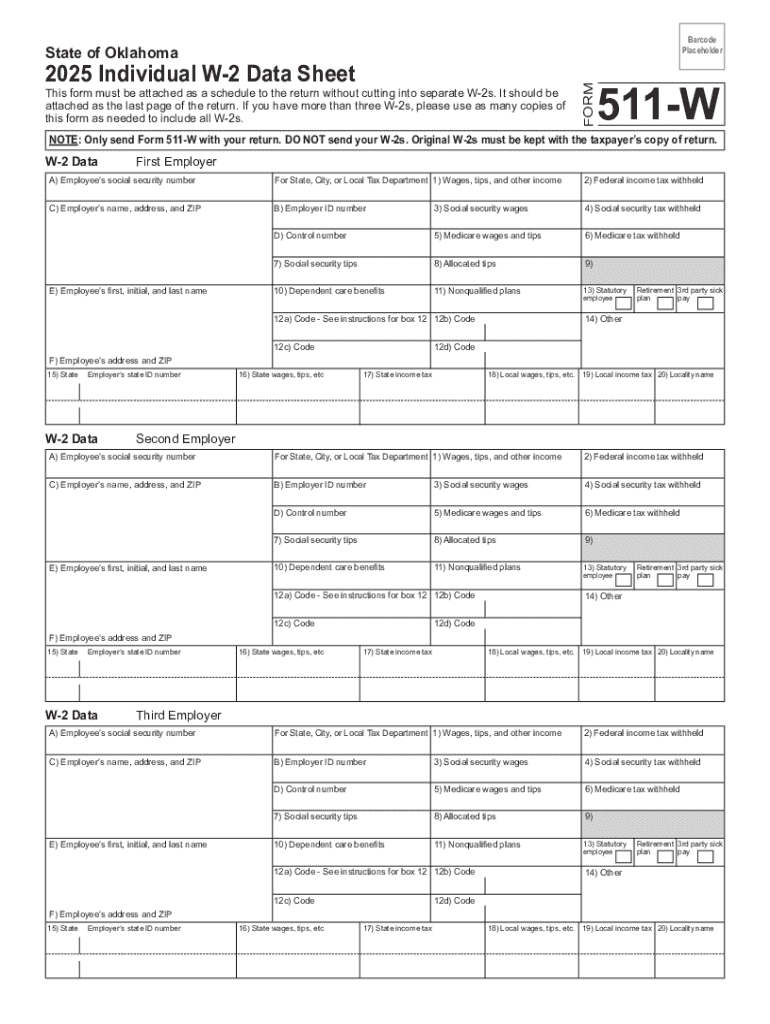

511-W Form: A Comprehensive Guide

Understanding the 511-W Form

The 511-W form is a critical document used for tax and income reporting, particularly impacting self-employed individuals and businesses. This form serves to report any estimated tax payments owed and provides a structured approach to managing one's tax obligations. Properly understanding the 511-W form can significantly affect your financial health by ensuring accurate tax reporting and avoiding penalties.

In many cases, individuals who work as freelancers, contractors, or are self-employed will find themselves needing this form to report their income accurately. The 511-W form is not only essential for keeping your tax records in check but also plays a crucial role in determining your future tax liabilities.

Who needs to file the 511-W Form?

Filing the 511-W form is necessary for a diverse range of taxpayers, particularly those who do not receive a regular paycheck with tax withholding. This includes:

Each of these groups relies on the 511-W form to provide an accurate depiction of their expected income, which is vital for calculating estimated taxes owed throughout the year. Understanding who needs this form is the first step toward successful income management.

Key features of the 511-W Form

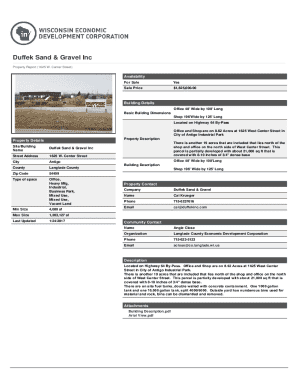

The 511-W form is made up of several essential components that taxpayers must be aware of when filling it out. These components typically include sections for personal information, income reported, deductions, and any applicable credits. Each section connects to different aspects of your financial landscape, making it crucial to provide accurate information.

Vital sections of the form include:

When completing the 511-W form, common mistakes should be avoided. Errors such as incorrect personal information, misreported income amounts, or overlooking potential deductions can lead to discrepancies that may result in penalties or increased tax bills.

Step-by-step instructions for filling out the 511-W Form

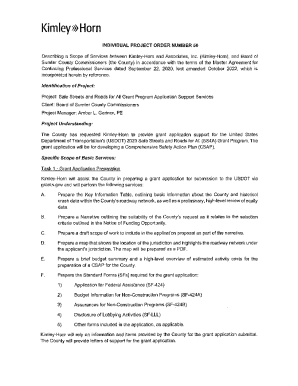

Before diving into the 511-W form, it's essential to prepare adequately. Gather all relevant documents, such as income statements, previous tax returns, and records of any deductions you might claim. This preparation helps streamline the filling process and ensures you have accurate information at hand.

When starting the form, here’s a detailed guide for filling out each section:

Keep an eye on the details during this process, and utilize resources like pdfFiller to help with digital editing and form submission.

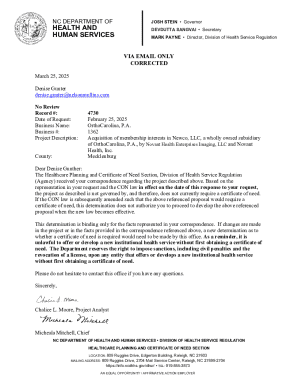

Editing and managing your 511-W Form

Editing your 511-W form has never been easier, thanks to online tools like pdfFiller. You can easily make modifications to your form with their interactive tools, enabling you to correct any errors or update your details quickly.

To effectively manage different versions of your 511-W form, consider the following tips:

By following these practices, you can ensure that you have control over the documentation process and can easily access the information you need.

Signing and submitting the 511-W Form

Once your 511-W form is complete, the next step is to sign it. pdfFiller offers an easy way to eSign your form, ensuring you meet legal requirements while saving time. Using their platform, you can quickly apply your signature electronically, which is legally valid in most jurisdictions.

When it comes to submission, there are several options available. Here are the common methods of submitting the 511-W form:

Be mindful of important deadlines to ensure your submission is timely and accurate, as missing these deadlines could result in penalties or issues with your tax obligations.

Frequently asked questions about the 511-W Form

Mistakes can happen when completing the 511-W form. If you realize you made an error after submission, follow these steps to rectify the mistake. First, assess the nature of the error—if it's a minor mistake, simply keep a note of it for your records. For significant errors, such as incorrect income reporting, it's crucial to file an amendment.

In many cases, individuals wonder about their options post-submission. You can amend your 511-W form by:

For additional help, it’s advisable to consult tax professionals or reach out to local tax assistance offices that can guide you through the intricacies of the form.

Interactive tools available on pdfFiller

pdfFiller offers an array of interactive tools tailored for filling out the 511-W form effectively. Users can access pre-filled templates, which can save time when entering repetitive information. Furthermore, these templates can be modified to suit specific needs, ensuring accuracy and completeness.

Additionally, pdfFiller's tools include calculators and estimators that can aid in determining your expected tax liabilities, giving you real-time insights into your financial responsibilities.

Using these features eliminates guesswork and provides clarity on how tax obligations can affect your overall financial picture.

Additional considerations

It’s crucial to consider variations in state-specific regulations regarding the 511-W form. Different states may have unique requirements or additional forms to complete. Always check with your state’s tax authority to ensure compliance with local laws.

Moreover, understanding the future implications of filing the 511-W form can be beneficial. Proper filing today can influence your tax obligations in subsequent years, aiding in better tax planning and financial management. Ensuring accuracy and timely filing lays a foundation for a favorable financial future.

Conclusion

Utilizing pdfFiller for your 511-W form and other documents streamlines your document management journey. From filling and editing to signing and submitting, pdfFiller empowers you to manage your documentation efficiently. With its comprehensive suite of features, you can enhance your document processing experience and stay on top of your financial responsibilities. Make the most out of pdfFiller to facilitate your journey towards streamlined document management and financial clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 511-w directly from Gmail?

How do I complete 511-w on an iOS device?

How do I fill out 511-w on an Android device?

What is 511-w?

Who is required to file 511-w?

How to fill out 511-w?

What is the purpose of 511-w?

What information must be reported on 511-w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.