Understanding the Virginia Last Will and Form

Understanding the Virginia Last Will and Testament

A last will and testament in Virginia is a legal document that outlines how a person's assets and affairs should be managed after their death. Its primary purpose is to ensure that the wishes of the deceased, known as the testator, are executed as intended. Without a will, the distribution of assets falls under the state's intestacy laws, which may not reflect the individual's preferences.

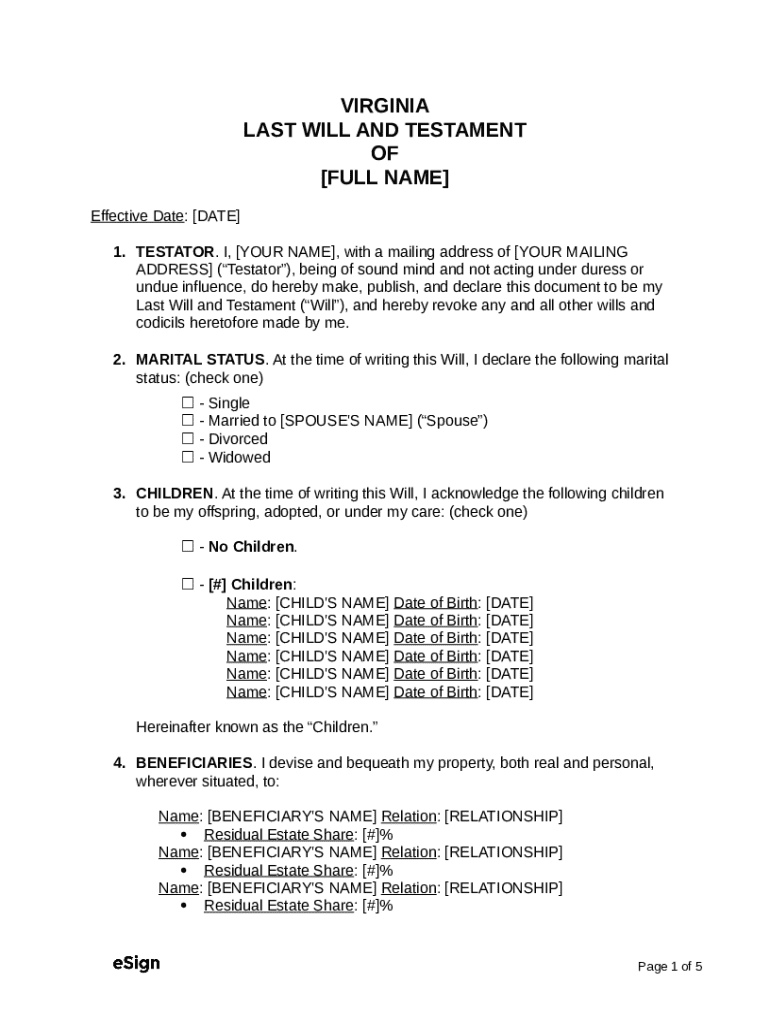

Key components of a valid last will in Virginia include the identification of beneficiaries, an inventory of assets, appointment of an executor, and signature of the testator, among others. It is essential to include explicit details about the distribution process to avoid confusion and conflicts among heirs.

Having a will in place is crucial; it provides clarity and minimizes disputes, ensuring that personal property and financial assets are allocated according to the individual's wishes. Moreover, it saves surviving family members from additional stress during an emotionally challenging time.

Overview of Virginia laws governing wills

Virginia law mandates specific requirements for a will to be considered valid. According to Virginia Code § 64.2-403, a will must be in writing, signed by the testator, and witnessed by at least two individuals who are present at the same time. The witnesses must affirm that they witnessed the testator signing the will or that the testator acknowledged the will in their presence.

Different types of wills recognized by Virginia law include handwritten wills (holographic wills), witnessed wills, and oral wills. It's a common misconception that any handwritten note can function as a valid will; it must still meet the specific criteria set forth by Virginia law.

Steps to create a last will in Virginia

Creating a last will involves several steps, which are critical to ensure your wishes are honored after your passing.

Begin by taking stock of your property, including personal assets, real estate, and financial accounts. Once you have an inventory, decide how you want these assets to be distributed among your chosen beneficiaries.

An executor is responsible for carrying out the terms of your will, managing your estate, and ensuring legal compliance. Choose someone trustworthy, organized, and willing to take on this responsibility.

You can draft your will using templates or software such as the tools available on pdfFiller, or you may opt to work with a lawyer for tailored legal advice. Ensure all essential elements are included, like executor details and asset distribution.

Virginia law requires your will to be signed in the presence of at least two witnesses who must also sign the document. Proper witnessing is critical to uphold the will's validity; consider having it notarized for added legal weight.

Utilizing pdfFiller for your Virginia will

pdfFiller offers an intuitive platform to create and customize your last will, making the process straightforward for individuals and teams alike. Utilizing interactive tools available on the platform allows you to complete your Virginia will efficiently and accurately.

One of the main benefits of pdfFiller is its cloud-based document management system, which enables secure storage and easy access to your legal documents from any location. This is particularly valuable for those who may need to make changes or review their documents while away from home.

Moreover, the editing features of pdfFiller allow users to collaborate on their wills, making it easy to gather input from family members or legal advisors. You can securely share the document, ensuring that sensitive information is protected while still allowing necessary access to relevant parties.

Managing your will over time

Creating a last will is not a one-time task; regular updates are essential to reflect changes in your life circumstances. Major life events such as marriage, divorce, the birth of children, or the acquisition of significant assets all necessitate a review and potential revision of your will.

Safekeeping and accessibility of your will should also be a priority. Options for storing your will include physical safes and digital platforms like pdfFiller, which offer encrypted storage solutions. This ensures that your will is both secure and easily retrievable in the event of your passing.

The probate process in Virginia

Probate refers to the legal process by which a deceased person's will is validated and executed. In Virginia, this involves several steps, including filing the will with the local circuit court, managing outstanding debts and tax obligations, and distributing assets according to the will. The entire process can be intricate and may lead to disputes if the will is ambiguous or improperly executed.

A well-prepared will simplifies the probate process significantly, delineating clear instructions that guide the executor and heirs through the distribution of assets and settlement of debts. Additionally, a comprehensive will reduces the likelihood of challenges or objections from beneficiaries.

Frequently asked questions (FAQs) about Virginia wills

Many individuals have common questions regarding the creation of a last will and testament in Virginia. Some frequently asked queries include: How do I ensure my will is valid? What happens if I die without a will? How can I contest a will if I believe it does not reflect the deceased's wishes?

A valid will must meet the legal requirements set forth by Virginia law, including being in written form, signed by the testator, and witnessed appropriately.

In the absence of a will, Virginia's intestacy laws dictate how assets are distributed, often resulting in outcomes that may not align with your preferences.

To contest a will, one typically must demonstrate that the testator lacked capacity at the time of signing or that the will was made under undue influence.

Additional considerations for Virginia wills

When formulating a last will, it's essential to consider the unique dynamics of one's family structure. Non-traditional families may face complexities not addressed in conventional wills. Understanding how to address the distribution of digital assets, such as social media accounts and online banking information, is also increasingly important in today's digital age.

Additionally, trusts may be a beneficial component of estate planning in Virginia. Establishing a trust can provide management of assets, protect beneficiaries, and potentially mitigate taxes. It’s wise to discuss these options with a qualified estate planning attorney to ensure all facets are appropriately covered.

Assessing your understanding: feedback and insights

How well do you understand the process of creating a valid will? Reflect on questions such as, 'Have I considered all my assets?' or 'Is my executor someone I can trust and who understands my wishes?'. These reflections can guide you in evaluating your preparedness in drafting your will.

If uncertainties persist about the legal nuances or requirements for your will in Virginia, seeking professional legal advice may offer peace of mind. Engaging with qualified professionals can provide clarity on complex issues surrounding wills and estates.

Email delivery

Using pdfFiller, once your last will is completed, you can engage with the email delivery option to ensure secure access to your document. This feature allows you to send your will directly to relevant parties or individuals who may need copies, while maintaining confidentiality through encrypted communication.

The importance of secure delivery and access cannot be overstated; ensuring your will is where it needs to be helps facilitate the distribution process later while alleviating strain on your loved ones.