Contribution to Form Donated Form: A Comprehensive Guide

Understanding the contribution to form donated form

A Contribution Form is a critical document used by charitable organizations to record the details of donations made by individuals or groups. This form serves as an acknowledgment of donations and ensures accurate tracking for both the donor and the charity. The importance of these forms cannot be overstated, as they play a vital role in facilitating transparency and trust in philanthropic engagements.

In the realm of charitable giving, the use of Contribution Forms helps organizations keep a formal record of contributions while providing donors with an official acknowledgment for their generosity, often for tax reporting purposes. Different types of Contribution Forms cater to various donation methods, ensuring that every giving experience is documented correctly to benefit both the donor and the organization.

Event Ticket Contribution Forms

Types of contribution forms

Understanding the various types of Contribution Forms is essential for both donors and organizations. Each serves a specific purpose and caters to different needs in the donation process. Here we'll explore the four primary types:

Cash donation forms

Cash donation forms are straightforward documents that record monetary contributions. Key elements required include donor details, donation amount, date of contribution, and sometimes the preferred method of payment. These forms are often used in individual donations, fundraising events, and direct charitable contributions.

In practical terms, a completed cash donation form typically contains the donor’s name, contact information, and the specific amount donated. This form not only acts as a receipt but also aids in tracking donor history for future engagement.

Online donation forms

Effective online donation forms include features such as straightforward navigation, mobile responsiveness, and secure payment processing options. The advantages for both donors and organizations are significant, as they simplify the donation process and can increase the likelihood of contributions due to their convenience.

To create an online donation form, consider the following steps: choose a platform, select template options, customize fields to capture necessary donor information, and implement security measures for payment processing. This ensures sensitive data protection, crucial for fostering donor trust.

Event ticket contribution forms

When organizing events, incorporating a ticket contribution form is essential. This form should be structured to capture various details, including ticket price, donor information, and event specifics. Integration with ticket purchase systems can enhance user experience, allowing real-time updates and confirmations.

A well-designed template allows for easy customization, enabling organizations to tailor the form to match their branding and event details. It ensures a cohesive experience from ticket purchase to contribution acknowledgment.

In-kind donation forms

In-kind contributions, which encompass donated goods or services rather than cash, require specific tracking and acknowledgment. Examples of in-kind contributions may include donated clothing, food items, or professional services like accounting or graphic design.

To ensure compliance and accurate reporting, organizations need to maintain thorough records of in-kind donations. An effective template for in-kind donation forms should include sections for the item description, estimated value, and donor acknowledgment, providing clarity for both parties.

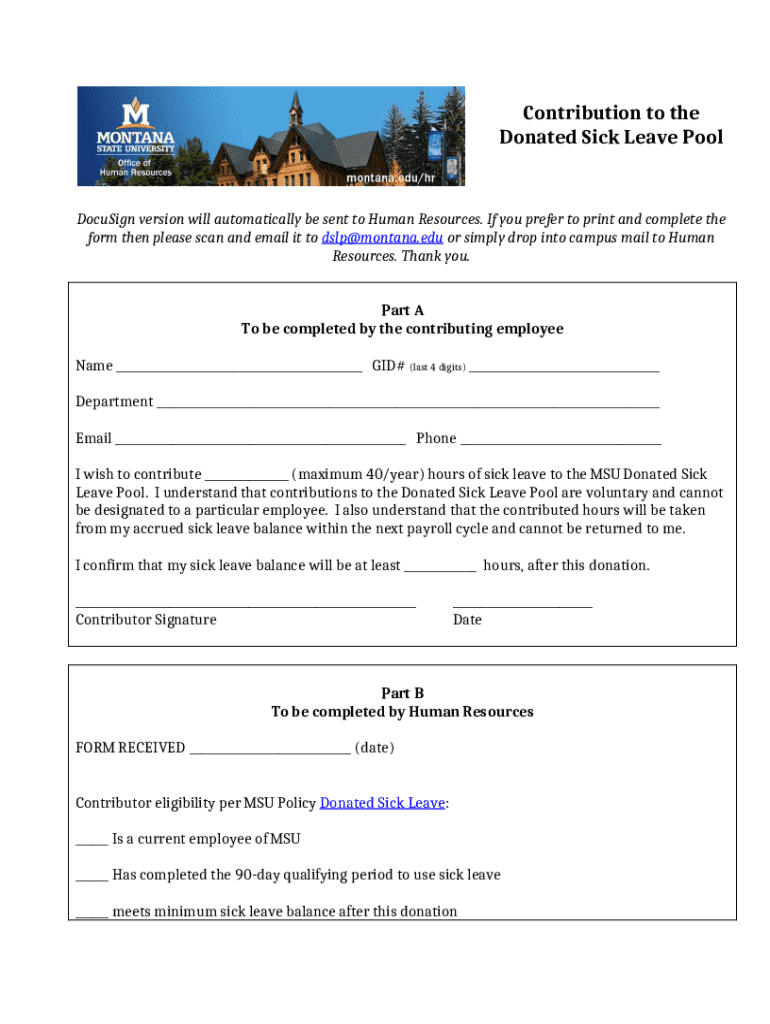

Filling out a contribution to form donated form

Completing a Contribution Form correctly is crucial for ensuring that both your donation is acknowledged properly and you receive appropriate tax documentation. To streamline the process, follow these step-by-step instructions for filling out the form accurately.

Begin by entering your personal details: name, address, phone number, and email.

Specify the type of donation: cash, in-kind, event ticket, etc.

Enter the amount or value of your contribution accurately.

Include any specific instructions regarding the use of your donation if applicable.

Sign the form and date it to validate the contribution.

Common mistakes to avoid while filling out the form include missing required fields, providing inaccurate amount values, and failing to sign or date the document. Ensure you double-check the completed form, as accuracy is key for both your records and the organization's acknowledgment.

To enhance accuracy, utilize tools or templates provided by platforms like pdfFiller, which allow easy editing and completion of forms.

Editing and managing contribution forms

Managing contribution forms across organizations and personal accounts can be daunting without the right tools. Using pdfFiller, you can take full advantage of advanced features that not only allow for editing PDF forms but also enhance collaboration among teams.

Key features in pdfFiller that contribute to user experience include the ability to integrate with cloud storage services, access to extensive templates, and the option to create reusable forms. Users can also enjoy real-time editing capabilities which significantly streamline the collaboration process.

Real-time editing and comments allow teams to discuss and refine details directly on the document.

Sharing options to distribute the forms quickly to stakeholders.

Tracking capabilities to monitor who has completed the forms and when.

Signing contribution forms

The importance of electronically signing Contribution Forms cannot be underestimated. An eSignature provides legal validity and is often accepted by tax authorities as evidence of the donation. When using pdfFiller, the process of eSigning is straightforward, enhancing convenience for users who need a quick solution.

To eSign through pdfFiller, follow this step-by-step guide: First, upload the completed form to pdfFiller. Next, select the 'eSign' feature, choose 'Add Signature,' and draw, type, or upload your signature. Finally, review the signed document and save it securely.

Security measures when eSigning documents should be a priority. Ensure that the document is encrypted and that access is limited to authorized users. A secure platform like pdfFiller includes essential protections to safeguard your data.

Tracking and archiving contribution forms

A well-organized system for managing contribution forms is essential for any organization. Strategies for document management and storage can significantly reduce confusion and streamline access. Use tools like pdfFiller to implement a cloud-based document management system for efficient storage and easy retrieval of important contribution forms.

Best practices for archiving contributed forms include:

Categorizing forms based on donation type or date for easy access.

Maintaining backups in multiple secure locations.

Regularly reviewing archived documents to ensure all records are updated.

Utilizing pdfFiller’s cloud-based platform gives users seamless access to previously submitted forms, assisting both donors and organizations in maintaining clear and accessible records.

Reporting and compliance

Reporting contributions is imperative for both donors and organizations for tax purposes and compliance with legal standards. Accurate documentation is essential to ensure that all donations are recorded and acknowledged correctly.

Required documentation for donors often includes the original Contribution Form and any associated receipts. For organizations, it’s critical to maintain precise records of all donations in a comprehensive manner to ensure reporting requirements are met. Tools like pdfFiller facilitate automated donation receipt generation, which simplifies the process.

Ensure that all forms are stored and easily retrievable for audits or reporting.

Provide donors with automated receipts for their contributions.

Maintain a compliance checklist to ensure all necessary documents are filed.

Empowering donors through transparent submission

Utilizing well-structured contribution forms empowers donors by ensuring a straightforward submission process. Clear, accessible forms build donor trust through transparency, enhancing engagement, and encouraging repeat contributions. A system that provides up-to-date information about how donations are used can effectively strengthen the relationship between donors and organizations.

With pdfFiller, organizations can create interactive forms that inform donors about the impact of their contributions. By offering options for donors to provide feedback or to choose how their contributions will be used, organizations can foster a sense of community and partnership.

Engaging with donors post-submission

Following up with donors after their contribution submission is essential for building lasting relationships. Best practices for post-submission engagement include sending personalized thank-you notes and sharing updates about how their donations have made an impact.

Encouraging recurring contributions can also be effective. Organizations can implement subscription-based giving models or establish monthly donation reminders to keep supporters engaged. Platforms like pdfFiller can help streamline these communications and allow for easy management of donor records.

Additionally, creating content that highlights the positive changes driven by donations can foster a community around charitable giving, encouraging more supporters to join in.

Conclusion

Contribution Forms are crucial in the realm of philanthropy, serving as the backbone of transparent and structured charitable giving. They ensure that donations are tracked, acknowledged, and reported accurately for both donors and organizations.

Using tools like pdfFiller can significantly enhance the experience of managing and submitting contribution forms, allowing users to create, edit, sign, and track documents efficiently and securely. As the philanthropic landscape continues to evolve, these forms will remain essential to ensuring trust and integrity in charitable contributions.