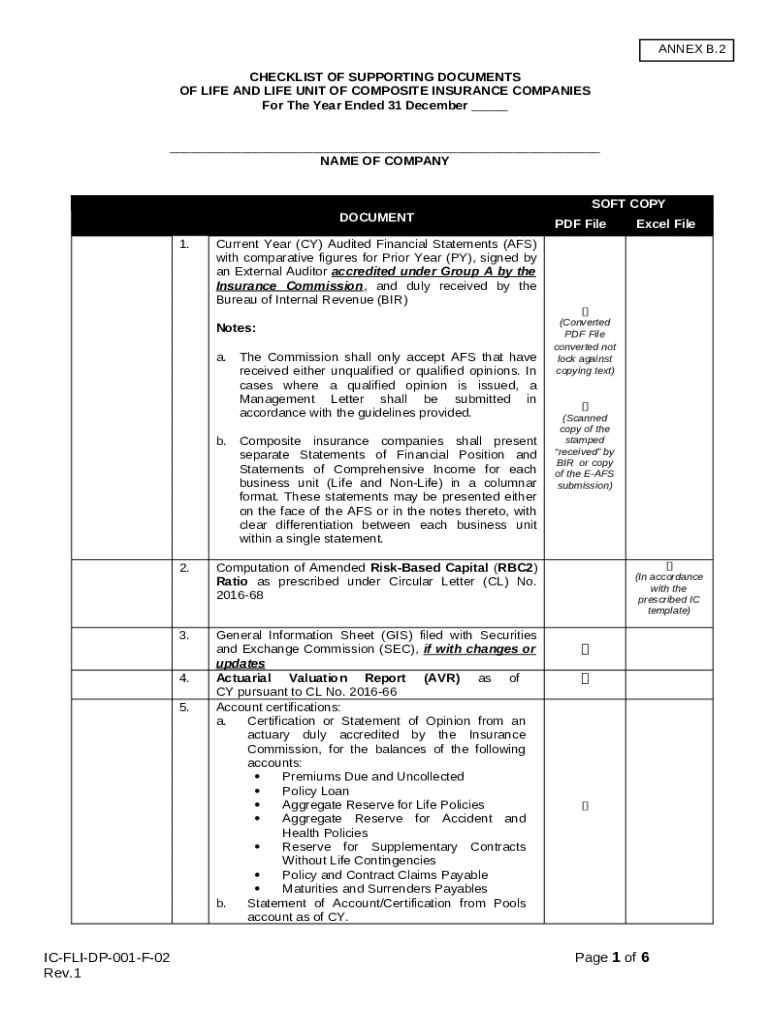

Annex B2 Checklist for Life Insurance Companies Template Form

Understanding the Annex B2 checklist

Life insurance companies operate within a complex regulatory framework that necessitates the adoption of various compliance measures. One such measure is the Annex B2 checklist, a vital tool designed to standardize and streamline the documentation and verification processes involved in life insurance underwriting.

The primary purpose of the Annex B2 checklist is to enhance compliance and risk management. By utilizing this checklist, life insurance companies ensure that they collect the necessary information while adhering to regulatory standards. This thorough documentation serves as a protective measure against potential liabilities, ultimately fostering client trust and transparency in the insurance process.

Ensures compliance with regulatory requirements

Improves risk assessment and management

Facilitates accurate and thorough documentation

Key components of the Annex B2 checklist

The Annex B2 checklist comprises several key components that facilitate its effectiveness in life insurance operations. Understanding these components is crucial for insurance agents, compliance officers, and management teams.

The essential items in the checklist typically include documentation requirements, data verification checks, and risk assessment criteria. Each of these elements plays a pivotal role in ensuring that all aspects of the life insurance policy are addressed. For instance, documentation requirements may mandate specific forms of identity verification and financial disclosures. Data verification checks ensure that the information provided is accurate and aligned with the underwriting requirements. Lastly, risk assessment criteria enable insurers to evaluate the potential risks associated with insuring a client.

Documentation requirements, including identity verification

Data verification checks to ensure accuracy

Risk assessment criteria to evaluate insurance risk

Preparing to use the Annex B2 checklist

Before utilizing the Annex B2 checklist, it is essential to identify who will be using it. The target audience includes life insurance agents, compliance officers, and management teams. Each group has a unique role in the insurance process, and understanding these roles can enhance the effectiveness of the checklist.

To ensure smooth usage of the checklist, consider these practical tips. First, organize all relevant documentation before starting. Having all information at hand allows for faster completion and reduces the chances of mistakes. Secondly, collaboration among team members is crucial—encouraging input from all stakeholders can yield better results. Lastly, establish clear deadlines for each checklist item, aimed at keeping the process timely and efficient.

Organize relevant documentation prior to use

Encourage team collaboration for efficient completion

Set clear deadlines for each checklist item

Step-by-step guide to filling out the Annex B2 checklist template

Accessing the Annex B2 checklist template is straightforward, especially through platforms like pdfFiller. Users can retrieve the template online or download it for offline use. For online access, simply log in to pdfFiller, navigate to the template library, and search for the Annex B2 checklist. Offline downloads offer convenience, allowing users to fill in the checklist at their leisure.

When filling out the checklist, comprehensive guidelines must be followed. Each section of the template comes with detailed instructions. Utilizing interactive tools provided by pdfFiller makes the data entry process more user-friendly. Accuracy in filling out each item is paramount, as even minor discrepancies can lead to significant compliance issues down the line.

Access the template online or download for offline use

Follow comprehensive guidelines for each section of the template

Utilize interactive tools for easier filling and editing

Editing and customizing the checklist

Once the checklist is filled out, users might want to edit and customize it further. pdfFiller's editing tools offer various options for tailoring the checklist according to specific company requirements. Adjusting the template to include company branding or particular forms of documentation enhances personalization and can improve the checklist’s relevance to specific processes.

Customization is not limited to branding—the checklist can also be modified to incorporate additional fields relevant to your company’s needs. By adding specific requirements, organizations can enhance compliance efforts and ensure that all essential information is captured during the insurance application process.

Utilize editing tools to tailor the checklist

Incorporate company-specific requirements

Add customizing branding options in the form

Managing the completed Annex B2 checklist

After completing the Annex B2 checklist, it's crucial to manage the signing and approval process effectively. pdfFiller enables users to obtain necessary signatures through its eSign tool, streamlining the approval workflow. Understanding when and where signatures are required is essential, as it impacts overall compliance and document legitimacy.

Tracking the approval process among team members ensures that all reviews are completed efficiently. Utilizing pdfFiller’s tracking features allows users to monitor the status of each checklist item, identifying potential bottlenecks and implementing solutions proactively.

Obtain necessary signatures using pdfFiller eSign tools

Understand when signatures are required and their significance

Track approval progress within teams

Storing and organizing submitted checklists

An essential aspect of document management involves storing and organizing completed checklists. Best practices recommend using a cloud platform like pdfFiller for effective organization of submitted documents. By implementing a consistent naming convention or folder structure, retrieving specific checklists becomes effortless, contributing to operational efficiency.

Additionally, utilizing compliance tracking features within pdfFiller assists in maintaining industry standards. Consistent reviews of stored checklists help ensure ongoing compliance with regulatory requirements, reducing the risk of errors due to outdated information.

Implement easy retrieval strategies for submitted checklists

Utilize compliance tracking features within pdfFiller

Conduct regular reviews to ensure ongoing compliance

Common challenges and how to overcome them

Even with comprehensive checklists, organizations often face common pitfalls when utilizing the Annex B2 checklist. Frequent issues include incomplete documentation, which may lead to errors in insurance applications and compliance troubles. Additionally, miscommunication among team members can result in mismatched information and increased processing time.

To enhance the effectiveness of the checklist utilization, implementing specific strategies is key. Regular training sessions for staff ensure that everyone understands the checklist's importance and the proper way to complete it. Frequent reviews and audits of checklist usage can also help identify areas for improvement and foster a culture of compliance across the organization.

Identify common pitfalls, such as incomplete documentation

Implement regular training updates for staff

Conduct frequent reviews and audits of checklist usage

Enhancing collaboration with the Annex B2 checklist

Collaboration is further enhanced using the sharing features of pdfFiller, enabling teams to work together on the Annex B2 checklist effectively. Setting appropriate permissions and access settings allows for smooth teamwork while ensuring that sensitive information remains secure. By sharing the checklist, team members can contribute in real-time, answering questions and providing feedback on entries.

Encouraging feedback mechanisms related to the checklist’s efficacy can lead to continued improvements. Setting up a formal review system for team members to express their thoughts can refine the checklist over time, making it even more effective and tailored to organizational needs.

Utilize pdfFiller’s sharing features for collaborative work

Set permissions for team access to maintain document integrity

Establish a feedback mechanism to enhance checklist efficacy

Real-world applications of the Annex B2 checklist

Life insurance companies have increasingly adopted the Annex B2 checklist to improve their compliance processes. Case studies show how businesses have successfully implemented the checklist, resulting in enhanced operational efficiencies and fewer compliance issues. Companies that meticulously follow the checklist often find improved turnaround times in policy approvals, ultimately leading to higher customer satisfaction rates.

Current industry trends also impact the relevance of the Annex B2 checklist. As regulations evolve, life insurance companies must adapt their processes accordingly. For example, recent regulatory changes may have introduced new documentation requirements. Understanding these shifts helps maintain the checklist's utility and effectiveness.

Examples of successful implementations by life insurance companies

Outcomes achieved through diligent checklist utilization

Current trends affecting the application of the checklist

Leveraging pdfFiller for optimal document management

A cloud-based document management solution like pdfFiller significantly enhances the checklist process. By allowing anywhere access, users can fill out, sign, and manage their documents from any device, making life easier for busy teams. Real-time collaboration capabilities ensure that all team members can work together on the checklist seamlessly.

Beyond enhancing the Annex B2 checklist process, pdfFiller offers additional features worth exploring. Access to a template library allows users to find similar documents with ease, and integration with other software solutions commonly used in the insurance sector makes pdfFiller a versatile tool for any organization aiming to streamline its documentation processes.

Real-Time collaboration capabilities for team members

Access to a versatile template library

Seamless integration with other tools in the insurance sector