Get the free $1,000,000 Cgl Insurance Program and Enrollment Form

Get, Create, Make and Sign 1000000 cgl insurance program

How to edit 1000000 cgl insurance program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1000000 cgl insurance program

How to fill out 1000000 cgl insurance program

Who needs 1000000 cgl insurance program?

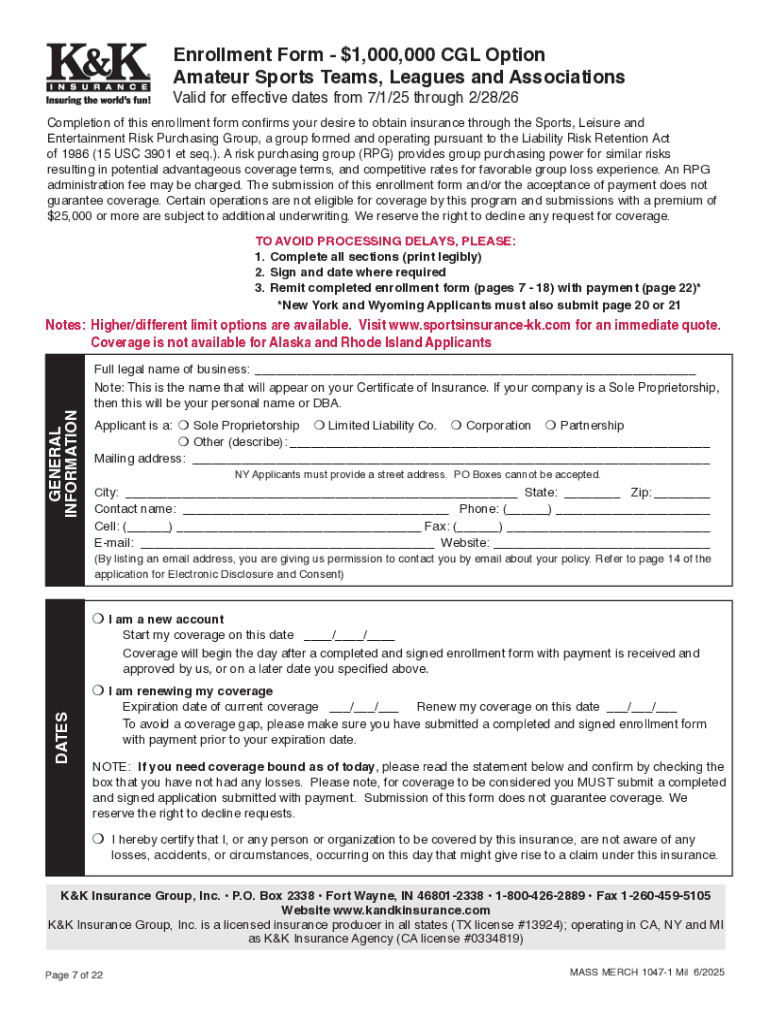

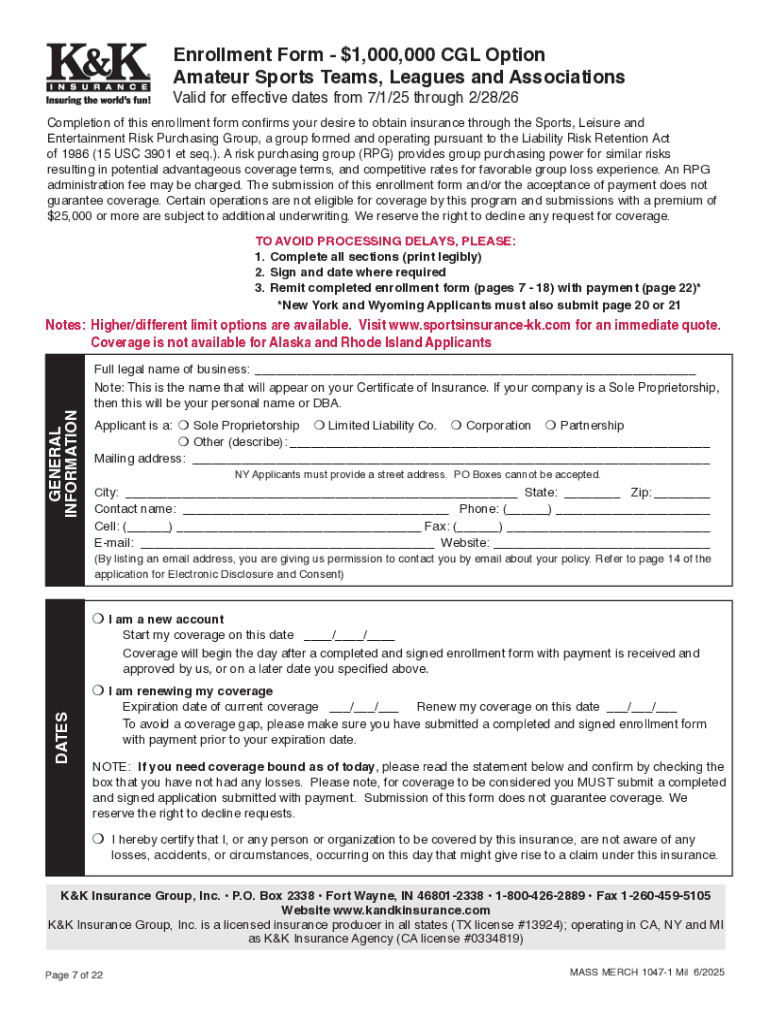

Understanding the 1000000 CGL Insurance Program Form

Understanding CGL insurance: A comprehensive overview

Commercial General Liability (CGL) insurance is a vital component of risk management for businesses. This insurance provides coverage against claims of bodily injury, property damage, and personal injury arising from normal business operations. As companies navigate a litigious environment, having CGL insurance helps protect against financial losses that can arise from legal claims.

The 1000000 CGL insurance program: specifics and benefits

Opting for a 1000000 coverage limit in your CGL insurance provides a significant safety net for businesses. This level of coverage is particularly useful for medium to large enterprises where the risk of claims can escalate quickly due to higher exposure in operations or services offered.

One of the key advantages of higher coverage limits, such as 1000000, is the peace of mind it brings. In case of an unforeseen event, having robust coverage prevents severe financial strain, allowing businesses to focus on operations without the daunting worry of legal costs. Specific scenarios where this coverage is essential include events such as a slip-and-fall accident at your business premises or claims resulting from defective products.

Key features of the 1000000 CGL insurance program form

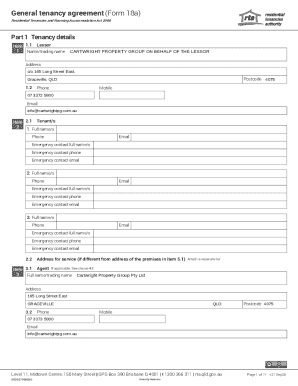

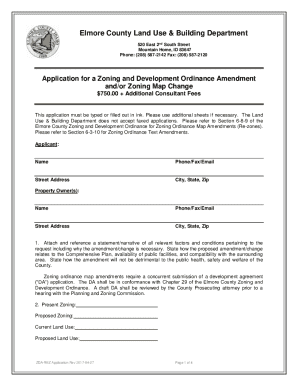

The 1000000 CGL insurance program form consists of several sections that must be completed accurately to ensure coverage. The main sections include applicant information, coverage details, business operations description, and claims history. Each part holds specific importance in assessing the risks involved in covering the business.

Step-by-step guide to filling out the CGL insurance program form

Filling out the CGL insurance program form accurately is crucial for efficient processing. Begin by preparing all necessary documents and information to streamline the experience.

Error-free submission: tips for a smooth process

Submitting the completed CGL insurance form without errors is essential. Common mistakes include missing information and incorrect descriptions, which can delay processing.

To avoid mistakes, double-check all entries against supporting documentation. Utilizing tools like pdfFiller can enhance accuracy by offering features that allow for easy editing, filling, and reviewing of the form.

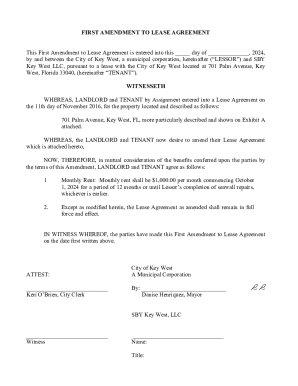

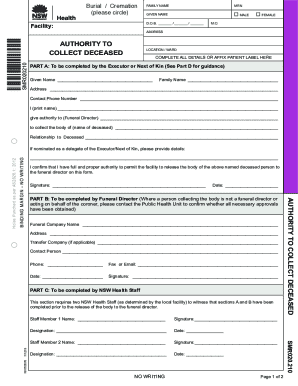

Editing, signing, and finalizing the CGL insurance program form

With pdfFiller, users can take advantage of advanced editing tools that simplify document management. Utilizing these features allows for necessary adjustments prior to submission.

Signing the form can be done securely through eSignature options, ensuring that all parties involved can quickly finalize documents without physical meetings. Team collaboration tools allow for simultaneous reviews and feedback, enhancing the signing process further.

Managing your CGL insurance policy after submission

Once the 1000000 CGL insurance program form is submitted, it is crucial to track the application progress. pdfFiller provides tools that allow you to monitor the status of your application, ensuring transparency.

It's also important to manage your policy effectively. Be proactive in understanding terms for renewal, and make note of any changes in business operations that may impact your coverage needs.

Frequently asked questions (FAQs) about the 1000000 CGL insurance program

Business owners often have questions regarding their coverage limits, such as the implications of choosing a 1000000 limit over lower alternatives. Understanding key definitions and policy details can mitigate misunderstandings before they arise.

Real-life applications: case studies of CGL insurance utilization

Real-life case studies illustrate how businesses have successfully navigated claims thanks to their CGL coverage. For instance, a retail company faced a significant lawsuit due to a slip-and-fall incident, and its 1000000 CGL insurance helped cover legal fees and settlements, preventing financial ruin.

These case studies emphasize not just the protective function of CGL insurance but also highlight the importance of maintaining an updated policy that reflects current risks.

The future of CGL insurance: trends and considerations

As businesses evolve, so do their insurance needs. Trends show a growing awareness among companies about the importance of comprehensive coverage, particularly with emerging risks like cyber liability and environmental exposures.

Technology plays a crucial role in this evolution, with tools that streamline documentation processes and enhance the insurance experience. As companies prepare for changes, staying informed about their insurance coverage and risks becomes paramount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 1000000 cgl insurance program directly from Gmail?

Can I sign the 1000000 cgl insurance program electronically in Chrome?

How can I edit 1000000 cgl insurance program on a smartphone?

What is 1000000 cgl insurance program?

Who is required to file 1000000 cgl insurance program?

How to fill out 1000000 cgl insurance program?

What is the purpose of 1000000 cgl insurance program?

What information must be reported on 1000000 cgl insurance program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.