Get the free W-8ben

Get, Create, Make and Sign w-8ben

How to edit w-8ben online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-8ben

How to fill out w-8ben

Who needs w-8ben?

W-8BEN Form: A Comprehensive How-to Guide

Understanding the W-8BEN form

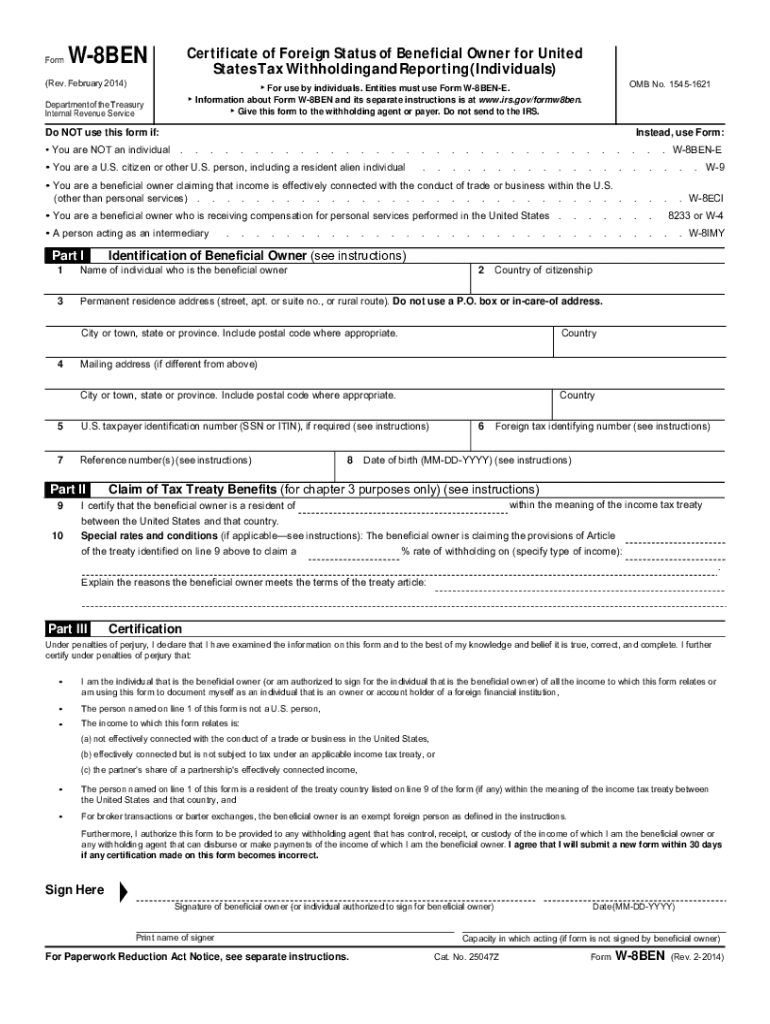

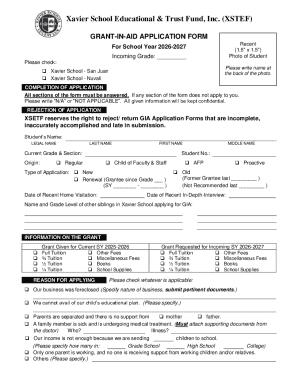

The W-8BEN form is a crucial document used by nonresident aliens (NRAs) to establish their foreign status for U.S. tax withholding purposes. This form is essential when individuals or entities engage in international business with U.S. partnerships, corporations, and other entities and helps them avoid unnecessary tax burdens imposed on foreign entities. By completing the W-8BEN form, nonresident aliens can claim reduced withholding tax rates under applicable tax treaties between their country of residence and the United States.

Understanding the importance of the W-8BEN form is vital for any foreign person receiving income from U.S. sources. Whether it's dividends, interest, or royalties, these payments are subject to U.S. tax unless a tax treaty applies. By accurately submitting the W-8BEN form, taxpayers can ensure compliance with IRS regulations while also maximizing their tax efficiency.

Who needs to use the W-8BEN form?

The W-8BEN form is specifically designed for nonresident aliens and entities seeking to benefit from tax treaty provisions. Individuals and teams eligible to complete this form include:

In summary, anyone categorized as a nonresident alien who engages with U.S. entities or receives income from U.S. sources should consider utilizing the W-8BEN form.

Navigating the W-8BEN form

The W-8BEN form contains several sections, each requiring specific information from the taxpayer. Understanding the structure of the form is key to accurate and efficient completion. The form mainly consists of three parts: identification of the beneficial owner, claim of tax treaty benefits, and certification and signature.

To assist users in navigating the form effectively, pdfFiller offers an interactive tool that guides you through each section of the W-8BEN form. This tool can help pinpoint where to enter taxpayer information while ensuring that you input correct details.

Step-by-step instructions for completing the W-8BEN form

Common mistakes to avoid include neglecting to provide accurate addresses, failing to claim treaty benefits where applicable, and not signing the form correctly. Always double-check your entries before submission to minimize errors.

Submission and processing of the W-8BEN form

Once completed, the W-8BEN form needs submission to the U.S. entities making payments to you. The submission options vary: you can send the form via mail, or, in many cases, submit electronically. Each U.S. entity may have specific protocols for receiving the W-8BEN form, so it’s advisable to reach out to them for submission clarification.

Processing times can vary widely, generally taking anywhere from a few weeks to a couple of months for review and approval, depending on the volume of submissions received by the IRS and the specific U.S. entity handling your form.

Status tracking of your submission

Tracking the status of your submitted W-8BEN form is crucial, especially if you are reliant on timely payments from U.S. sources. Contact the U.S. entity directly for updates and keep a record of the submission date and copy of the form submitted for your own reference.

Keeping your W-8BEN form updated

It’s important to know how often you should resubmit the W-8BEN form. You must update it whenever there are changes in your circumstances, such as a change in your residency status, or if there are changes in the income types you receive from U.S. sources. Usually, the form is valid for three years, but staying proactive about updates is essential to avoid potential issues.

Best practices for document management include scheduling regular reviews of your W-8BEN status and using tools like pdfFiller. Regularly assessing whether your W-8BEN information is current can help mitigate risks associated with tax reporting.

Electronic signatures and the W-8BEN form

With the increasing acceptance of digital processes, electronic signatures are now permissible on the W-8BEN form. This helps streamline the filing process, making it easier for NRAs to manage their documents effectively. The regulatory standards for electronic signatures allow for their use in many official forms, including the W-8BEN.

Using pdfFiller, you can sign your W-8BEN form easily. Here’s how to eSign your document:

Ensuring secure and verified eSignatures is easy with pdfFiller, providing you peace of mind when submitting your form.

Frequently asked questions (FAQs)

Navigating the complexities of tax forms can lead to confusion. Here are some common questions regarding the W-8BEN form.

Additional resources and tools

To further assist you in completing the W-8BEN form, pdfFiller provides a variety of interactive tools. From PDF editing and signing features to collaboration functionalities, you can streamline your document management process effortlessly.

If you're looking for related tax forms, pdfFiller offers quick links to other essential forms, such as the W-8ECI and 1042-S, which can complement your W-8BEN submissions.

Should you require additional assistance, various resources are available for finding professional tax support.

Quick links

Accessing the W-8BEN form and other resources is critical for your international business dealings. Here are quick links to fill and submit the W-8BEN form on pdfFiller, along with additional tools for international tax compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit w-8ben online?

Can I sign the w-8ben electronically in Chrome?

How can I edit w-8ben on a smartphone?

What is w-8ben?

Who is required to file w-8ben?

How to fill out w-8ben?

What is the purpose of w-8ben?

What information must be reported on w-8ben?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.