Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: Your Complete Guide to Filing and Managing Financial Reports

Understanding Form 10-Q

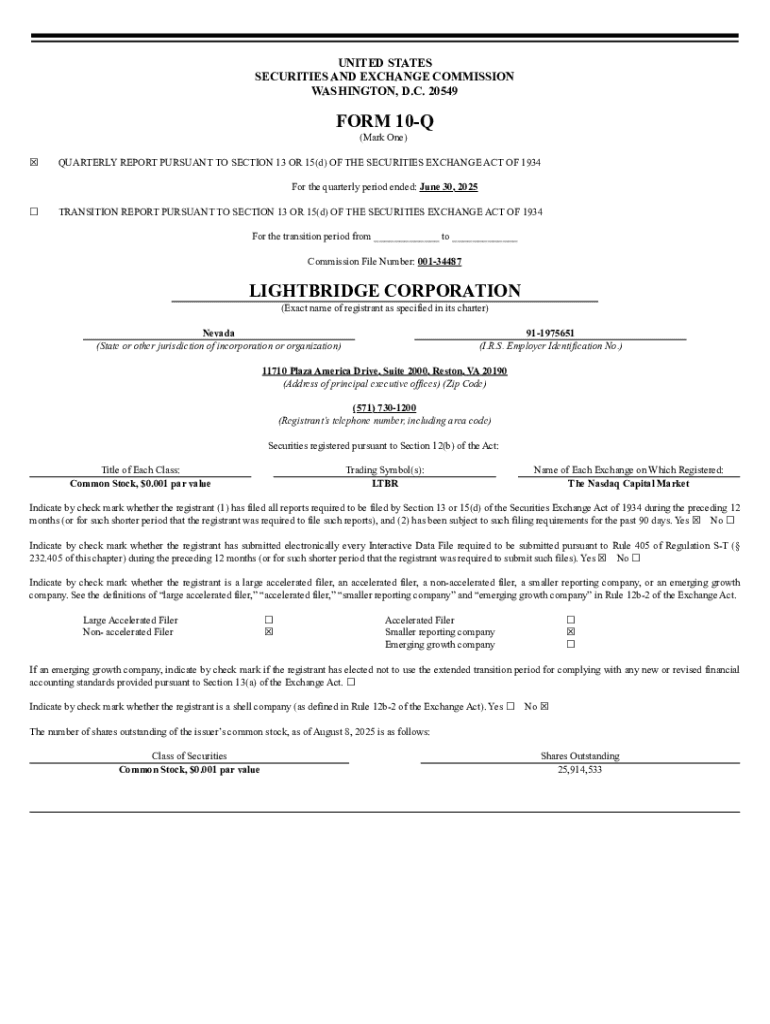

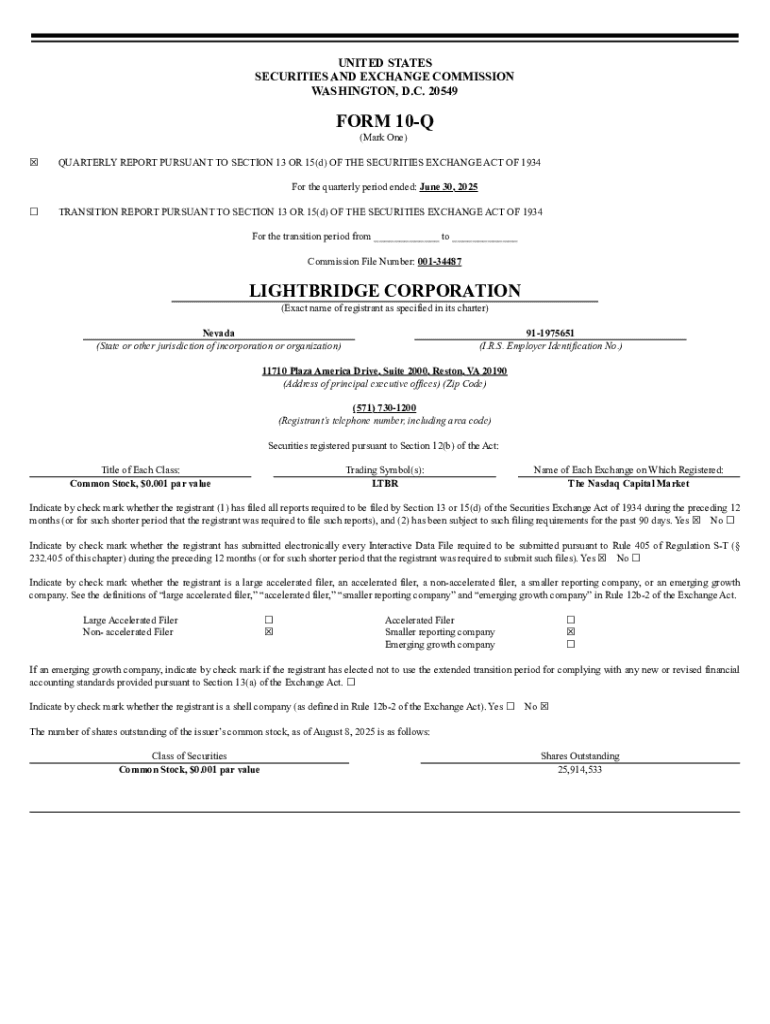

Form 10-Q is a comprehensive report that publicly traded companies in the United States must file with the Securities and Exchange Commission (SEC) on a quarterly basis. This form aims to provide investors with a consistent update on the company's financial performance and operational changes during the quarter. As businesses are required to file Form 10-Q within 40 or 45 days after the end of a fiscal quarter, depending on their classification, it plays a vital role in maintaining transparency in financial reporting.

The importance of the Form 10-Q extends beyond mere compliance; it also serves as a valuable tool for investors and analysts looking to assess a company's performance over time. By examining the data presented in the Form 10-Q, stakeholders can identify emerging trends and make informed decisions about investments. Failure to file a Form 10-Q on time may lead to regulatory penalties or reputational damage, making it imperative for companies to prioritize this task.

Components of Form 10-Q

Form 10-Q is structured into several key sections, each providing essential information about the company's financial health. The primary components include:

Each of these components is crucial for stakeholders seeking a comprehensive understanding of a company's performance and risk landscape. A thorough review of these sections can help investors make informed decisions.

Navigating the filing process

Obtaining a Form 10-Q is straightforward, with documents accessible through various sources. The SEC's EDGAR database is a primary resource for free online access to Form 10-Q filings. Investors and analysts can search the database by entering a company's name or ticker symbol, allowing for efficient retrieval of necessary documents.

Additionally, many financial news websites and investment platforms provide tools to monitor and track filings, enhancing accessibility. This ease of access empowers users to stay updated on companies they are interested in.

The filing deadlines differ based on the type of filer: large accelerated filers have 40 days, accelerated filers must file within 40 days, and non-accelerated filers have 45 days to submit their 10-Qs after the end of the fiscal quarter. Understanding these deadlines is crucial for ensuring timely compliance.

Tackling common filing challenges

Failing to meet filing deadlines can have significant consequences for companies, including penalties from regulatory bodies and negative perceptions from investors. Companies should prioritize effective planning and organization to avoid these pitfalls.

Common issues leading to late filings include miscommunication between departments, lack of necessary data, or insufficient preparation time. Implementing regular review meetings and maintaining an organized data collection process can mitigate these challenges.

Accurate data collection is vital for compliance with reporting requirements. Companies should establish best practices, such as leveraging dedicated software to gather and organize financial data efficiently, ensuring all necessary information is readily available when preparing the Form 10-Q.

Utilizing interactive tools for form management

Managing the Form 10-Q effectively involves utilizing digital tools that allow for seamless editing and collaboration. pdfFiller provides an array of features tailored for professionals handling essential financial documents. Its user-friendly interface makes it easy for team members to collaborate on form completion in real time.

With pdfFiller, users can edit PDF documents effortlessly, adding comments, and suggestions directly on the form. The ability to eSign and securely share documents via the cloud streamlines the entire filing process, helping teams stay organized and efficient.

Detailed guidance for filling out Form 10-Q

Completing the Form 10-Q requires attention to detail and adherence to specific guidelines. Here’s a step-by-step approach to help ensure accuracy and compliance:

By following these structured steps, organizations can enhance the clarity and transparency of their Form 10-Q filings, thereby improving stakeholder trust.

Key insights from recent Form 10-Q filings

Regularly analyzing recent Form 10-Q filings from well-known companies can yield significant insights into market trends and economic health. For instance, comparing financial data across different quarters and years provides critical information about a company's adaptability and competitiveness.

Investors often look for patterns in revenue growth or expense management as indicators of a company’s operational efficiency. Notable filings, especially from industry leaders, can set benchmarks or form expectations regarding future performance across the sector.

FAQs on Form 10-Q

Individuals frequently have questions regarding the nuances of Form 10-Q. Here are some common inquiries addressed:

Additional considerations

As regulatory environments evolve, companies must stay abreast of compliance and reporting requirements related to Form 10-Q. Emerging trends from the SEC may indicate shifts in disclosure requirements, making it crucial to remain informed.

Utilizing tools and training to track regulatory changes can help companies adapt swiftly and ensure ongoing compliance. This proactive approach also positions companies favorably in the eyes of investors.

Leveraging pdfFiller's tools for enhanced document management

pdfFiller plays a vital role in simplifying the Form 10-Q filing process. With features tailored specifically for professionals managing financial forms, users can enjoy a streamlined experience from drafting to submission.

Customer testimonials highlight significant efficiency improvements and reduced errors when using pdfFiller for financial documentation. By harnessing this solution, companies can elevate their reporting processes and enhance overall compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 10-q online?

Can I create an eSignature for the form 10-q in Gmail?

How can I fill out form 10-q on an iOS device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.