A Comprehensive Guide to the Citi Prepaid Card Application Form

Understanding the Citi prepaid card

The Citi Prepaid Card is a versatile financial tool designed to offer convenience and security for users, providing a prepaid option without the need for a traditional bank account or credit check. It serves as a great alternative for those who want to avoid accumulating debt, allowing individuals to load a predetermined amount of cash onto the card for use. This card is particularly well-suited for various daily transactions, giving users a hassle-free payment option while on the go.

One of the biggest benefits of using a prepaid card is that there is no credit check required, making it accessible for individuals who might have less-than-ideal credit scores or no credit history at all. Additionally, prepaid cards encourage effective budgeting as you can only spend what you load onto the card, helping to manage expenditure efficiently.

Security features are another advantage. Your funds are safeguarded, and if your card is lost or stolen, you can easily report it and freeze your account to prevent unauthorized transactions. Whether you’re using it for travel, online shopping, or as a gift card, the Citi Prepaid Card stands out as a practical financial solution.

Enhanced security against loss and theft

A prepaid card is beneficial in various situations including managing household expenses, giving teenagers a way to spend without a credit card, and traveling where currency conversion is necessary. Its broad utility makes it a popular choice among individuals seeking financial freedom.

Locating the Citi prepaid card application form

Finding the Citi prepaid card application form is a straightforward process, especially with ease-of-use resources facilitated by platforms like pdfFiller. To start, navigate to the pdfFiller homepage and take advantage of their user-friendly interface.

Once you're on the homepage, utilize the search feature efficiently by typing 'Citi prepaid card application form' into the search bar. This will direct you to the specific form you need. After locating the form, you can preview it or download it directly from the site.

Go to the pdfFiller homepage.

Enter 'Citi prepaid card application form' in the search bar.

Select and access the form for completion.

For convenience, here is the direct link to access the Citi prepaid card application form: [insertDirectLinkHere]. This quick access can save time and streamline your application process.

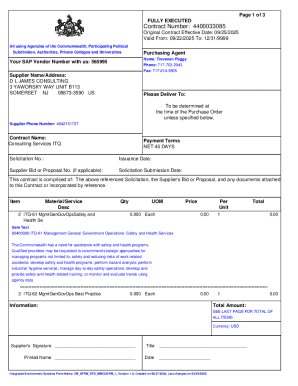

Key information required for the application

To successfully complete the Citi prepaid card application form, you'll need to provide various personal details. This includes your name, address, and contact information. Providing accurate details is essential to ensure seamless communication and processing of your application.

In addition to your personal information, financial information such as your preferred funding source for loading the card will also be necessary. This can include options like direct deposit from your payroll or transfers from a bank account. If you're utilizing the card for online purchases, you may also want to specify other relevant details to facilitate your spending.

Identification requirements are another critical component. You will need to provide acceptable forms of ID to verify your identity, which could include a driver’s license or government-issued ID. Furthermore, ensure you follow the steps for digital verification to prevent any delays in processing your application.

Name, address, and contact info

Acceptable ID forms for verification

Gathering this information beforehand will help streamline the completion of your application and reduce the chances of errors.

Filling out the Citi prepaid card application form

Once you have the application form, it’s time to fill it out carefully. Begin with the personal information section. Here, you’ll need to detail your name, address, and contact information clearly. Make sure there are no typographical errors, as this can lead to processing delays. Take your time to review each field to ensure accuracy.

Next, move on to the funding instructions. Specify how you intend to load funds onto the card. This section is crucial as it informs Citi on how to manage your account and ensures that you’re set up properly for future transactions. For instance, if direct depositing your paycheck is your choice, make sure to provide the necessary bank details.

Double-check personal information for accuracy.

Clearly indicate how you will fund your card.

Review all sections before submitting.

To avoid common mistakes, check that all required fields are filled out correctly. If you use pdfFiller, take advantage of its interactive tools that allow you to edit and troubleshoot potential errors instantly. This step will save you from needing to submit the application multiple times.

Editing and reviewing the application form

Editing your application form after filling it out is essential to ensure precision and compliance with all requirements. pdfFiller offers various features that enable you to edit documents easily, whether you want to add information, correct errors, or update details as necessary. If you find a mistake after submission, it’s possible to make changes; however, it's best to have all details correct before submitting.

Additionally, utilizing collaborative features on pdfFiller can elevate your experience. You can share the document for review with trusted friends, family, or financial advisors who might provide valuable feedback. The built-in comments and feedback mechanisms help ensure clarity in communication as you finalize your application.

Use editing tools to correct mistakes.

Share the application for external review.

Leverage comments for collaborative feedback.

The editing capabilities provided by pdfFiller will ensure your final application is polished and error-free.

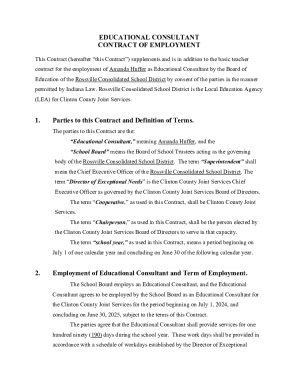

eSigning the application

eSigning your application is a crucial step in the process. This digital signature not only provides your consent to the terms of the card but also secures your identity verification. In the digital age, eSignatures are legally binding and recognized, ensuring your application holds equal weight to traditional signature methods.

Using pdfFiller, the process of eSigning is simple and user-friendly. Begin by creating your unique eSignature using the platform’s tools. Once created, you can easily add the signature to your application form. Ensure that your signature is placed correctly to validate the document.

Confirm the importance of a digital signature.

Use pdfFiller tools to create your eSignature.

Position the signature correctly on the form.

Taking these steps will ensure the legality and security of your eSignature, allowing for a smoother application process.

Submitting your application

After completing the form and applying your eSignature, the next step is to submit your application. pdfFiller provides various options for submitting your completed application, allowing for flexibility based on your preferences. You may choose to submit the application directly online through pdfFiller, which is quick and efficient.

Alternatively, if you prefer a more traditional approach, you can print and mail the application. Whichever method you opt for, be sure to keep a copy for your records. After submission, monitor your application’s status. pdfFiller often includes features to track the progress of your submissions, ensuring you remain informed.

Submit online through pdfFiller for speed.

Print and mail if preferred.

Keep a copy of your submitted application.

Being aware of estimated timelines for application processing will help you manage expectations. Generally, users can expect to hear back from Citi within a few business days.

Managing your Citi prepaid card once approved

Once your Citi prepaid card is approved, managing your card effectively is crucial to maximizing its benefits. pdfFiller provides various account management tools to help you track and manage your Citi prepaid card efficiently. Access your account information via pdfFiller to monitor your spending, set up alerts, and adjust your funding preferences.

Utilizing the card wisely can greatly enhance your budgeting efforts. Setting spending limits is a smart approach that helps control expenditures and prevents overspending. You can also regularly monitor transactions to ensure that your funds are being used appropriately and to catch any unauthorized purchases quickly.

Use pdfFiller tools for account management.

Set spending limits to control budget.

Track transactions regularly for accuracy.

By incorporating these practices, you will ensure you gain the maximum utility from your Citi prepaid card.

Troubleshooting common issues

Throughout the application process, you may encounter certain issues that require troubleshooting. Common questions include what to do if you have problems with the form or if specific fields are unclear. Having access to FAQs on pdfFiller can guide you through these common hurdles efficiently.

If you require direct assistance, Citi's customer support channels are available for inquiries. Reach out via phone or access online support for guidance. pdfFiller also has dedicated support resources that may provide answers to your specific queries regarding the document you are working on.

Consult FAQs for common form issues.

Contact Citi customer support for direct help.

Utilize pdfFiller support resources.

By knowing where to seek help, you can overcome any obstacles and proceed smoothly with your application process.

Additional features of the Citi prepaid card

Beyond the application process, the Citi prepaid card offers a range of features that enhance its appeal. One of the notable benefits is the ability to reload your card easily via various methods such as bank transfers or direct deposit, providing continuous access to your funds without needing to reapply for a new card.

Moreover, users can partake in rewards programs offered by Citi, adding value to card usage. This means that not only can you utilize your funds readily, but you might also earn rewards for everyday spending — something uncommon with other prepaid cards on the market. A comparative review with other prepaid options further substantiates the value of choosing the Citi prepaid card.

Easy reloading options for continuous use.

Access to rewards programs for added benefits.

Competitive edge compared to similar prepaid cards.

With these additional features, the Citi prepaid card stands out in a competitive landscape, making it a favored choice among consumers.