Get the free Evidence of Coverage

Get, Create, Make and Sign evidence of coverage

Editing evidence of coverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out evidence of coverage

How to fill out evidence of coverage

Who needs evidence of coverage?

Understanding the Evidence of Coverage Form: A Comprehensive Guide

What is an Evidence of Coverage Form?

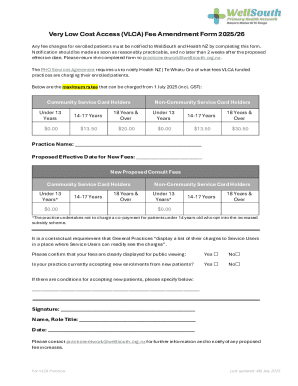

The Evidence of Coverage (EOC) form is a crucial document provided by health insurance plans, outlining the specifics of the health coverage they offer. Its primary purpose is to serve as a clear reference point for enrollees regarding what their health plan covers, thereby promoting transparency and informed decision-making. It details the benefits, coverage limitations, and in-network provider listings critical for managing healthcare needs.

The EOC is often mandated by state and federal regulations, thus ensuring compliance with the law. Each EOC can vary based on the plan type, such as Medicare, private insurance, or Medicaid, which is why understanding its key components is vital for every policyholder.

When and why should you obtain your Evidence of Coverage form?

Obtaining your EOC should be a priority during significant enrollment periods. Generally, you receive your EOC shortly after you enroll in a health plan or after any substantial change in your coverage, like during the Medicare Open Enrollment period. Understanding when to expect your EOC is essential for consistently managing your health care services.

It's important to keep your EOC updated, as changes in benefits or health care landscape could affect your plan. Regularly reviewing your coverage ensures that you are aware of essential details, including what your plan requires in terms of cost-sharing and out-of-pocket maximums, which can help mitigate unexpected health care expenses.

Who issues the Evidence of Coverage form?

The EOC is primarily issued by health insurance companies, government programs, and other entities offering health coverage. Typically, private insurers and Medicare plans are responsible for delivering this document twice a year or upon enrollment in a new plan. Enrollees should expect a professional layout that aligns with the standards set by regulatory bodies.

Understanding the differences in EOCs between public and private plans is crucial. Government plans, such as Medicare, provide more standardized formats to ensure compliance and help beneficiaries better navigate through their options, while private plans can vary widely.

Understanding the contents of your Evidence of Coverage form

Your EOC contains several vital sections that outline the essentials of your coverage. A detailed breakdown includes a summary of benefits, coverage details, and a list of limitations and exclusions. Each component plays a role in helping you understand what services are covered and what you will need to pay out of pocket.

Navigating this document can be straightforward if you know what to look for. Pay close attention to the summary of benefits as it provides the clearest insight into your health plan, while the coverage details explain the specifics of services covered under your plan. Limitations and exclusions sections are equally important, as they inform you about what is not covered, potentially preventing unexpected costs.

What should you do if you receive an EOC notice?

Receiving an EOC notice should prompt immediate action. First, consider verifying if the document received pertains to your current health plan, especially if you have other family members who may also be enrolled in different plans. If it is yours, take time to thoroughly read the document, checking for anything that looks unclear.

Should any questions arise while analyzing the information, don’t hesitate to reach out directly to your health insurance provider. Their representatives are trained to assist with clarifications and can explain any complex terms or conditions. Approaching your EOC with an inquisitive mindset allows you to know your rights and responsibilities clearly, optimizing your health care experience.

Interactive tools for managing your Evidence of Coverage form

Managing your Evidence of Coverage form can be streamlined with digital tools like pdfFiller. This platform allows users to interact with their EOCs effectively by enabling them to edit documents, fill out forms, and sign them electronically. Accessing and managing your EOC across any device, anywhere is a significant advantage for busy individuals or teams.

For those unfamiliar with pdfFiller, it provides a user-friendly interface and efficient features for handling health documents. A detailed step-by-step guide to using these editing capabilities can enhance your experience, allowing you to customize your EOC as needed. Furthermore, keeping your health-related documents secure in cloud storage means they are always accessible and safe from loss.

Download a sample Evidence of Coverage form

Reviewing a sample Evidence of Coverage form can help demystify what to expect from your own document. It will give you a better perspective on how the information is structured and categorized. When examining a sample, focus on the areas that detail coverage limits, essential benefits, and emergency procedures to ensure they align with your health needs.

You can easily download sample EOC forms from trusted sources such as pdfFiller. Altering a sample EOC is also advantageous; it gives you a chance to practice filling out the various sections correctly before officially managing your own document.

Common questions and FAQs about the Evidence of Coverage form

Many policyholders have questions regarding their Evidence of Coverage forms, particularly concerning receipt and understanding. If you don’t receive your EOC notice by the expected time, it’s essential to reach out to your insurance provider promptly. They can forward necessary documents and clarify any potential issues.

In terms of review frequency, consider looking over your EOC at least annually, especially during enrollment periods or significant life changes. Understanding the terminology used in these documents is also crucial; familiarize yourself with common terms to decode your coverage efficiently.

Glossary of terms related to Evidence of Coverage forms

When navigating the realm of health insurance, understanding the language used in your Evidence of Coverage form is vital. A glossary of common terms such as co-payment, deductible, network provider, and out-of-pocket maximum can significantly improve your grasp of the content. Knowing these terms will enable greater confidence when discussing your plan with healthcare providers.

Consider referring back to this glossary whenever new terms arise in documentation or discussions, promoting a better understanding of your health plan and facilitating better communication with healthcare providers.

Additional insights on managing your health plan documents

Efficient document management can significantly enhance your experience with healthcare services. Organizing your Evidence of Coverage along with other health-related documents ensures you have all the necessary information at hand for appointments and discussions with healthcare providers. This practice reduces stress and can lead to better outcomes.

Consider utilizing pdfFiller not only for your EOC but also for keeping related documents in one accessible place. Using cloud storage to organize your healthcare documents allows for easy updates and retrieval, ensuring that you’re always prepared, especially during important enrollment periods.

Utilizing pdfFiller for seamless document management

pdfFiller is designed to facilitate seamless interaction with your health documents, including the Evidence of Coverage form. The platform offers features that make editing, signing, and sharing documents a breeze, providing users with a simple way to ensure all health documentation is accurate and up-to-date.

Compared to other document management solutions, pdfFiller stands out for its user-friendly interface and robust features tailored specifically for health documents. Existing users often share testimonials highlighting the ease of use and efficiency, making it a preferred choice for anyone managing health-related documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my evidence of coverage in Gmail?

How can I edit evidence of coverage from Google Drive?

Can I create an eSignature for the evidence of coverage in Gmail?

What is evidence of coverage?

Who is required to file evidence of coverage?

How to fill out evidence of coverage?

What is the purpose of evidence of coverage?

What information must be reported on evidence of coverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.