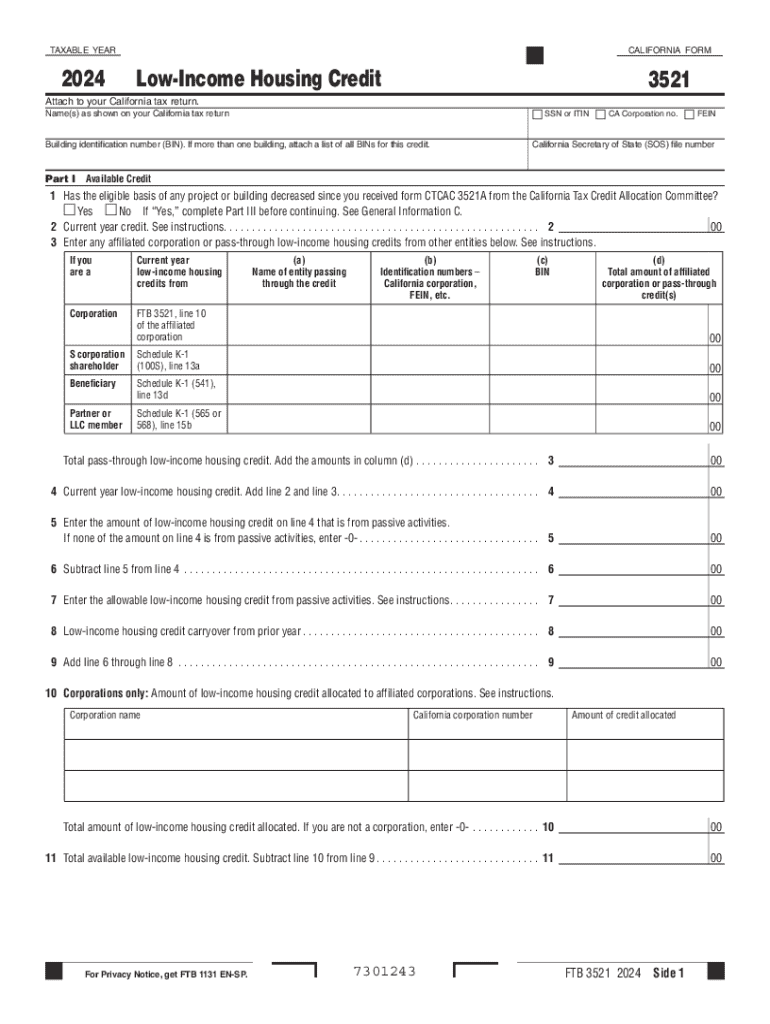

Get the free California Form 3521

Get, Create, Make and Sign california form 3521

How to edit california form 3521 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california form 3521

How to fill out california form 3521

Who needs california form 3521?

A Comprehensive Guide to California Form 3521

Understanding California Form 3521

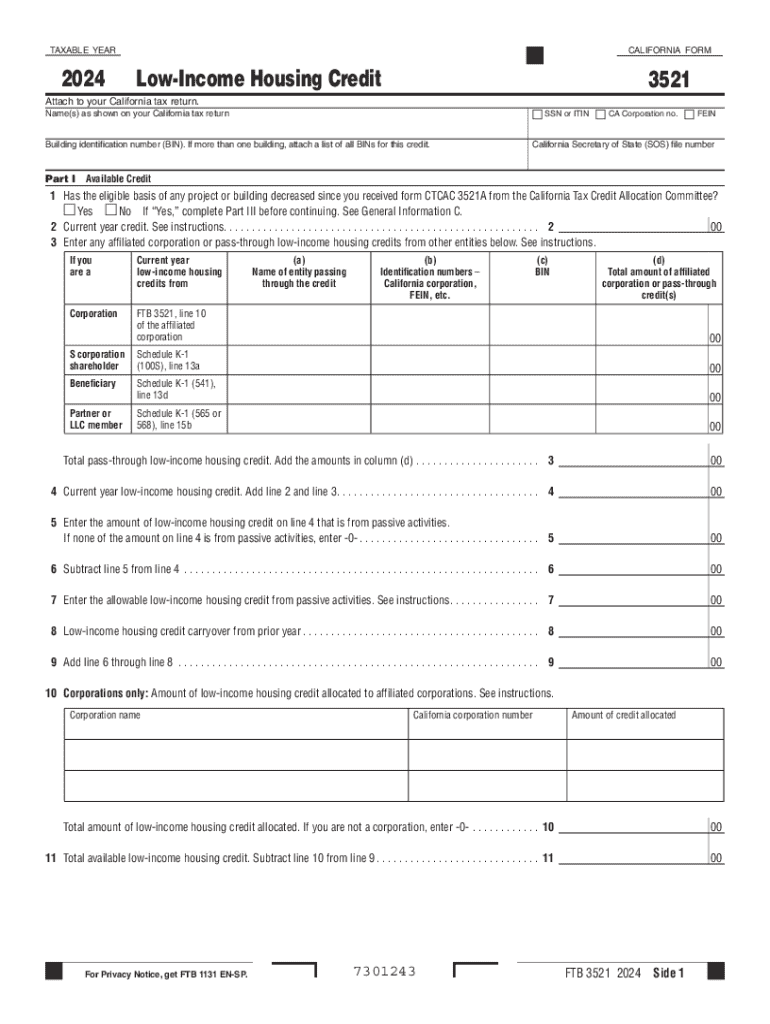

California Form 3521 is a crucial document utilized in the state's tax process, primarily designed to facilitate the state's tax credits request issuance. This form serves to declare eligibility for specific state tax credits, ensuring taxpayers can maximize their tax savings efficiently. Understanding its purpose is essential for both individuals and businesses as it directly impacts their tax liabilities.

The importance of Form 3521 extends to its role in ensuring compliance with California tax regulations. By accurately completing this form, taxpayers help the state maintain fair tax practices and support the allocation of state resources effectively.

Who needs to use Form 3521?

Eligibility for using California Form 3521 is primarily determined by financial circumstances and specific personal or business factors. Individuals and entities taking part in state tax credit programs, such as low-income housing state tax credits, must complete this form to claim the associated benefits. Therefore, it is critical to understand the scenarios that necessitate the completion of Form 3521.

Step-by-step guide to filling out California Form 3521

Filling out California Form 3521 is a structured process that demands careful attention to detail. The first step involves gathering all necessary information, which includes identification documents and financial statements. Individuals must ensure they possess relevant personal information, such as Social Security numbers, as well as financial data pertinent to the specific tax credits being requested.

Different sections of the form require varying types of information. It's crucial to understand what each section demands to ensure accuracy and completeness before submitting.

Detailed instructions for each section of the form

Section 1 focuses on personal information, requiring accurate identification details such as name, address, and Social Security number. Mistakes in this section can lead to delays or rejection of the application.

Section 2 emphasizes income reporting, which is vital as it determines eligibility for state tax credits. Individuals should report all sources of income and verify each with supporting documentation to avoid common pitfalls.

Finally, Section 3 tackles tax credits and deductions. Here, taxpayers identify applicable credits based on their financial situations. It's essential to consult the guidelines to recognize common mistakes, such as misapplying deductions or neglecting to claim available credits.

How to review your completed Form 3521

Before submission, a thorough review of Form 3521 is crucial. Taxpayers should check every section for accuracy, ensuring that all personal data, reported income, and claimed credits are correctly stated. This process helps minimize errors that could lead to further complications with the tax authority.

A comprehensive checklist can be beneficial, allowing you to methodically verify each entry. Double-checking information is a simple yet effective way to safeguard against mistakes that could result in delayed processing or financial penalties.

Alternate submission methods for California Form 3521

California Form 3521 can be submitted online or via mail, catering to different preferences. For those opting to submit online, pdfFiller offers an intuitive platform that streamlines the entire submission process. Users can fill out and eSign the form digitally, significantly saving time and reducing the chance of errors.

For those preferring traditional methods, mailing Form 3521 is also an option. It's important to address the envelope correctly and include appropriate postage to prevent delays. Recommendations for mailing include using certified mail or tracking services to confirm delivery.

Post-submission: What to expect

After submitting Form 3521, tracking its status becomes essential for timely updates. Taxpayers can confirm the submission status through the California tax authority's official website or by contacting their customer service team directly for inquiries.

Should corrections be needed, understanding the process for rectifying errors is crucial. Taxpayers may need to submit supplementary documents or appeal decisions made by the tax authority regarding their application.

Tools and tips for managing California Form 3521

Utilizing interactive tools offered by pdfFiller can significantly enhance the documentation process related to Form 3521. The platform provides features for editing, signing, and securely storing documents in the cloud. This functionality allows users to manage their forms from anywhere, ensuring that all necessary documentation is readily accessible.

Adopting best practices for document management is also advisable. Organizing forms and documents logically, alongside keeping track of key deadlines and submission dates, will lead to smoother interactions with the California tax authority.

Frequently asked questions about California Form 3521

Many taxpayers have common queries related to California Form 3521. For instance, if a mistake occurs on the submitted form, swift acknowledgment and correction are crucial to avoid penalties or lost credits. Additionally, understanding how changes in personal circumstances, such as income fluctuations, can impact filing is beneficial for preparing accurate submissions.

Special considerations and updates

Recent changes to California Form 3521 could significantly impact submission processes for various taxpayer groups. Keeping informed about modifications ensures compliance and maximizes the benefits available through state tax credits.

Moreover, understanding how proposed or enacted tax law changes relate to Form 3521 usage is critical. Taxpayers should remain engaged with updates from the California tax authority to adapt their filing strategies appropriately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete california form 3521 online?

How do I fill out the california form 3521 form on my smartphone?

How do I complete california form 3521 on an iOS device?

What is california form 3521?

Who is required to file california form 3521?

How to fill out california form 3521?

What is the purpose of california form 3521?

What information must be reported on california form 3521?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.