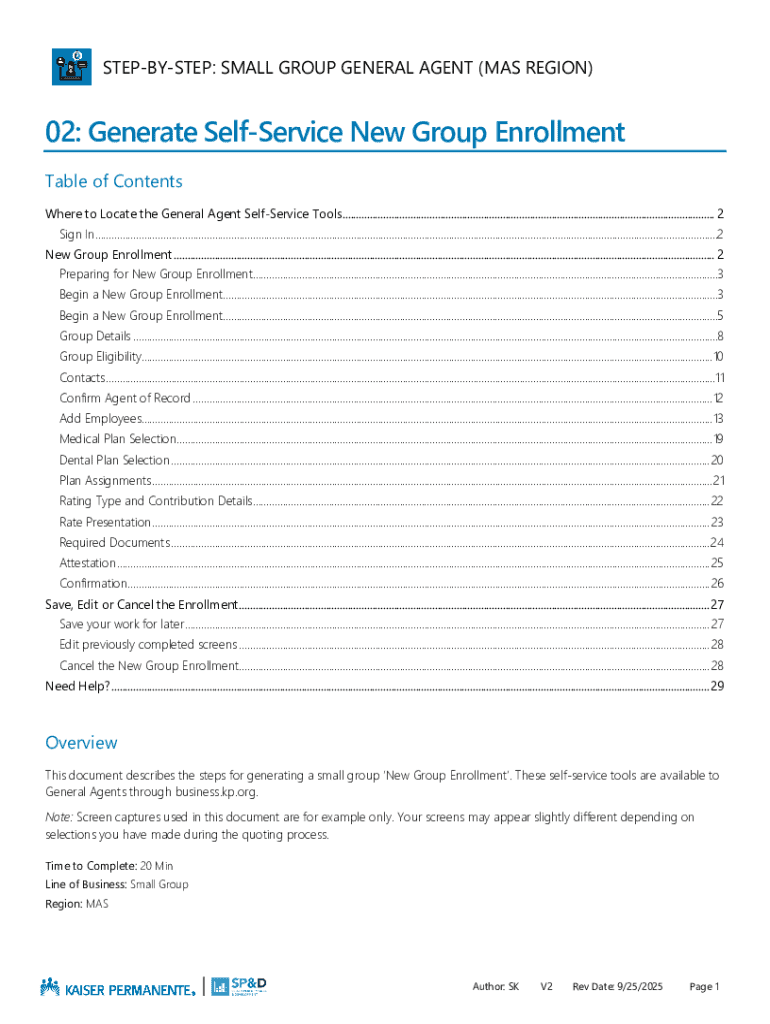

Get the free Small Group General Agent (mas Region)

Get, Create, Make and Sign small group general agent

Editing small group general agent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out small group general agent

How to fill out small group general agent

Who needs small group general agent?

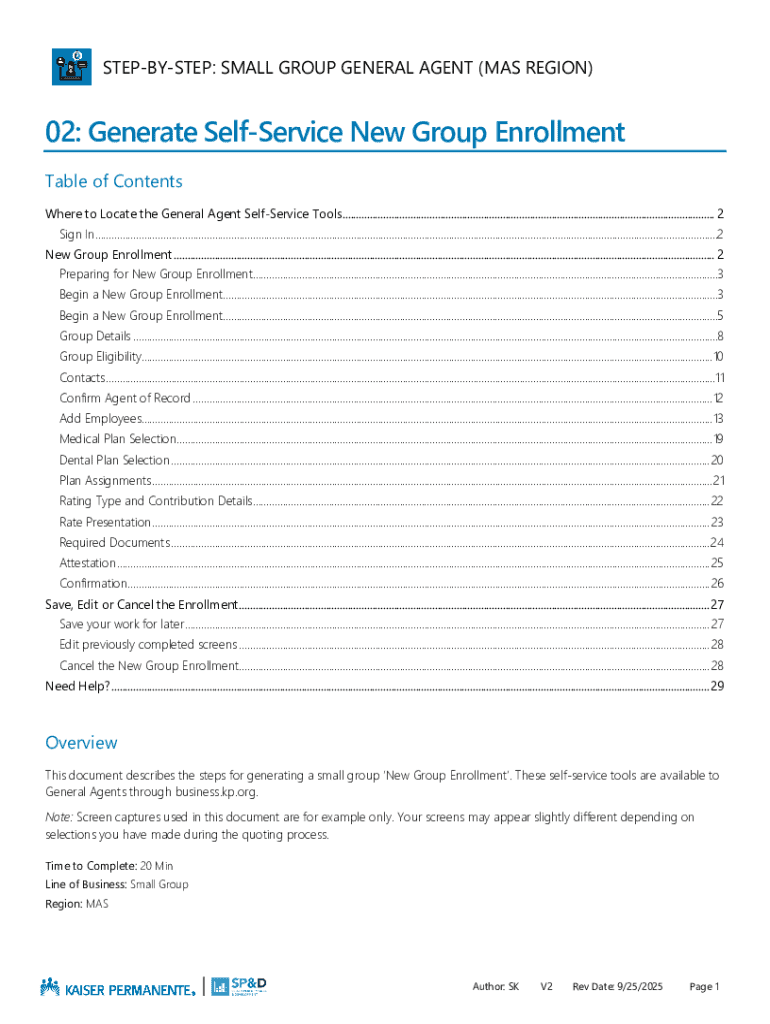

A comprehensive guide to the small group general agent form

Understanding the small group general agent form

The small group general agent form serves as a crucial document for agents and small businesses seeking group insurance coverage. This form provides a structured way to collect essential information about a group, its members, and the desired insurance coverage. The completion of this form is not merely a bureaucratic step but a fundamental part of facilitating access to affordable and comprehensive insurance options for small groups.

Its importance lies in creating a clear record that ensures compliance with insurance regulations while also aiding in the determination of coverage types, eligibility, and costs. The small group general agent form is foundational for making informed decisions about insurance policies and ensuring every member of the group is adequately covered.

Who needs this form?

Agents, small businesses, and group members are the primary users of the small group general agent form. Insurance agents utilize the form to assist businesses in navigating the complexities of securing group insurance, ensuring that all necessary information is collected and processed correctly.

Small businesses looking to provide health benefits to their employees are the main beneficiaries of this form. It is typically used during specific contexts such as enrollment periods when new coverage options are available or during policy changes when current coverage needs to be updated or altered.

Key components of the small group general agent form

The small group general agent form consists of several key components that must be filled out accurately for it to be valid and effective. Each section plays a vital role in ensuring that the insurance provider has all the necessary information.

Demographic information

The demographic section requires details such as the group's name, contact information, and group size. This information helps insurers assess the group’s risk profile and coverage needs.

Coverage options

The form allows groups to indicate the types of insurance coverage they seek. This could vary from health benefits to dental or vision coverage. Additionally, cost estimations are often provided based on group size and selected options, offering transparency and helping groups make budget-conscious decisions.

Signature requirements

The signature section defines who must sign the form—usually an authorized representative of the group and sometimes involved members. Additionally, it may specify other documentation needed, such as proof of eligibility or previous insurance records.

Step-by-step guide to completing the small group general agent form

Completing the small group general agent form involves a systematic approach to ensure all information is accurate and comprehensive. Here’s a step-by-step guide.

Editing and managing your form with pdfFiller

pdfFiller offers a comprehensive solution for accessing and managing the small group general agent form. This platform makes it easy for users to find the right template and make necessary modifications.

Accessing the small group general agent form with pdfFiller

To begin, users can quickly locate the small group general agent form template using the search feature. This means spending less time on document management and more time on the needs of the business.

Editing features

The editing features of pdfFiller allow users to modify fields effortlessly. Whether adding more information or updating existing entries, the platform's capabilities support collaboration among team members. You can even allow stakeholders to review or suggest changes in real-time, enhancing the document's accuracy.

Signing the form electronically

Beyond editing, pdfFiller also allows for electronic signatures. The process is straightforward: once all necessary fields are filled, users can apply their eSignature using the platform’s secure interface. Considering the legal acceptance of e-signatures across many jurisdictions, this feature streamlines the finalization of documents.

Troubleshooting common issues

Even with the best intentions, issues may arise when submitting the small group general agent form. Here are some common obstacles and how to overcome them.

Form not sending or submitting

If you encounter difficulties with submission, check for common problems like incomplete fields, internet connectivity issues, or problems with the document format. Ensure all sections are thereby filled correctly, as a misstep there may prevent submission.

Issues with signatures

Signature discrepancies can delay the approval process; if signatures don’t match those on file or are unsigned, it could lead to rejection of the form. Always confirm that the right people sign and validate these signatures.

Amendments and corrections post-submission

After submission, any necessary corrections can usually be made by contacting the insurance provider. Each company has its protocols for amendments, so know your provider’s preferred channels for handling these changes.

Frequently asked questions (FAQs)

Navigating the small group general agent form can raise many questions. Below are some frequently asked queries that can help clarify common uncertainties.

Advantages of using pdfFiller for your small group general agent form

Utilizing pdfFiller for the small group general agent form brings numerous benefits that enhance document handling and submission efficiency. The platform offers a one-stop solution for every document-related need.

Comprehensive document management

pdfFiller provides tools for document creation, editing, and signing, all in one place. This streamlines workflows, allowing teams to focus more on their core missions rather than managing paperwork.

Access from anywhere

Being cloud-based, pdfFiller allows team members to access forms from any location. This flexibility is crucial for businesses with remote teams or those that require on-the-go access.

Enhanced collaboration

The platform’s collaboration features ensure that teams can work together in real-time. Users can share documents with colleagues, gather input, and finalize forms much more effectively.

Best practices for future applications

Keeping meticulous records of your previous submissions is essential for any future insurance applications. This includes saving copies of the completed small group general agent form and any correspondence related to your group insurance application.

Staying updated on policy changes is another crucial best practice. As insurance policies evolve, having current information can make a significant difference in the coverage available to your group. Consider subscribing to industry newsletters or using platforms like pdfFiller that often update users regarding industry trends and requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit small group general agent online?

How do I fill out small group general agent using my mobile device?

Can I edit small group general agent on an Android device?

What is a small group general agent?

Who is required to file small group general agent?

How to fill out small group general agent?

What is the purpose of small group general agent?

What information must be reported on small group general agent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.