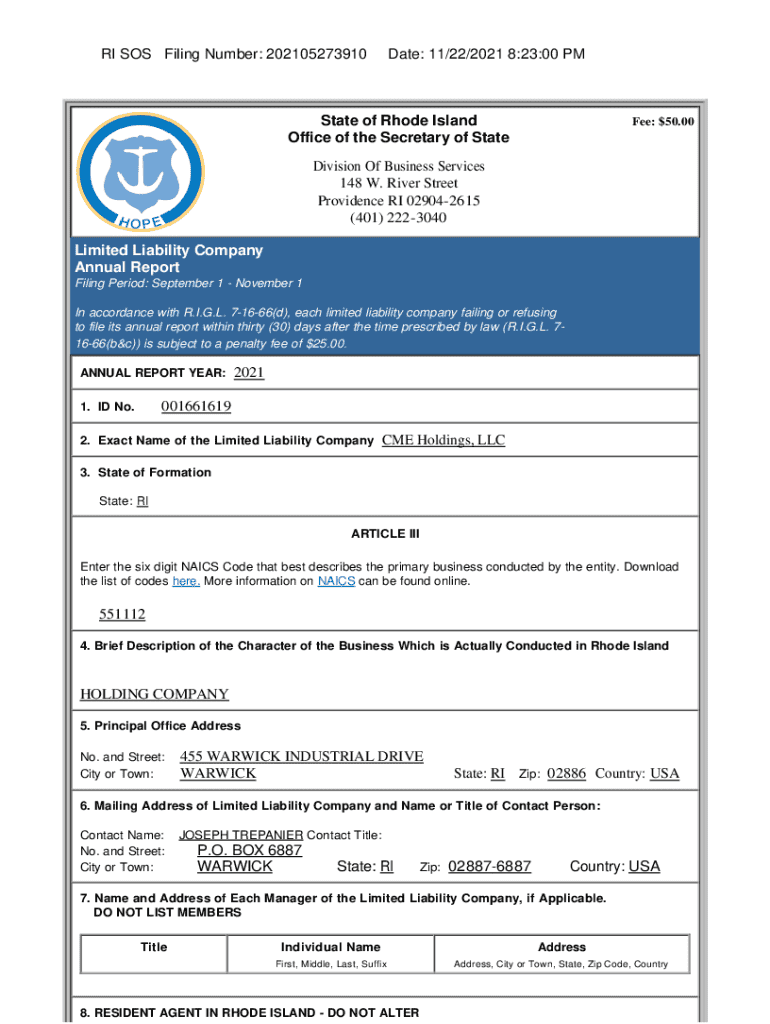

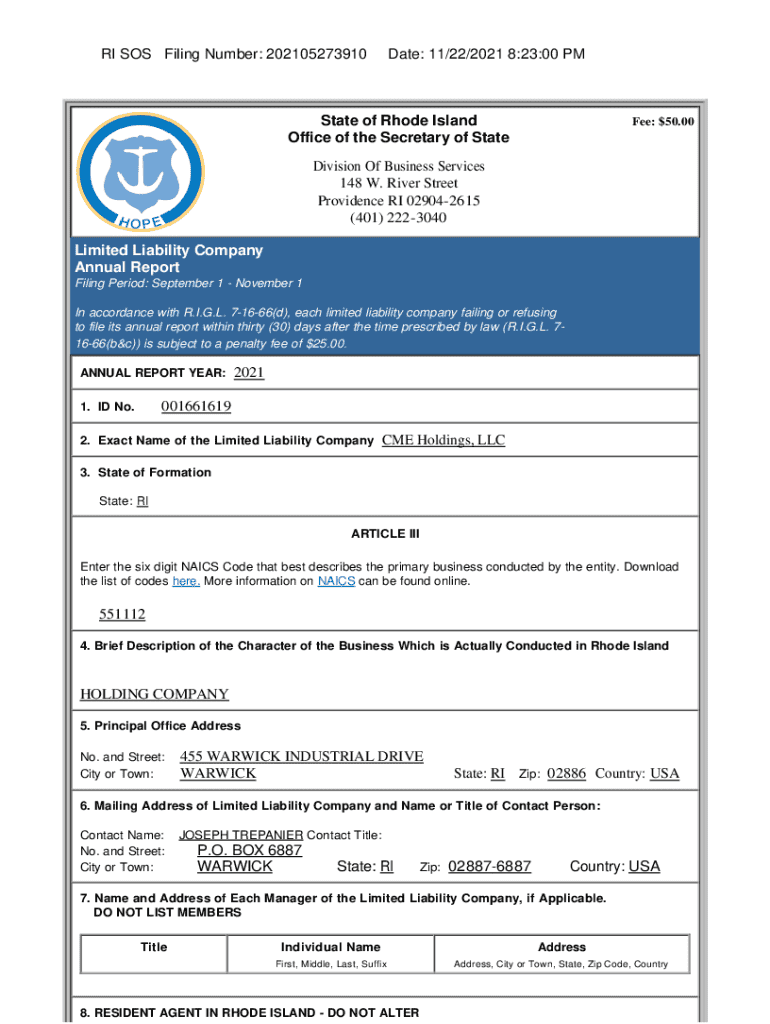

Get the free Ri Limited Liability Company Annual Report

Get, Create, Make and Sign ri limited liability company

Editing ri limited liability company online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ri limited liability company

How to fill out ri limited liability company

Who needs ri limited liability company?

RI Limited Liability Company Form - How-to Guide

Understanding limited liability companies in Rhode Island

Limited liability companies (LLCs) serve a crucial role in the business landscape of Rhode Island. They combine the advantages of both corporations and partnerships, providing a flexible business structure that suits a variety of endeavors. An LLC protects its owners, termed members, from personal liability for the debts and actions of the business, making it an attractive option for individuals and groups alike.

One of the key advantages of forming an LLC is the limited liability protection it offers. This means that, in most cases, members are not personally responsible for the business’s financial obligations. Additionally, LLCs benefit from favorable tax treatment, allowing profits to pass through to members' personal income without facing corporate taxation. Furthermore, LLCs boast a flexible management structure that can be tailored to the members' needs, whether they prefer a member-managed or manager-managed approach.

Despite these advantages, misconceptions about LLCs exist. Some believe they are only for small businesses, or that they require a complicated setup process. However, many business entities across various sizes and industries in Rhode Island leverage LLCs for their operational benefits.

Regulatory framework for LLCs in Rhode Island

The formation of a limited liability company in Rhode Island is governed by the Rhode Island General Laws. These laws outline the foundational requirements and procedures for establishing an LLC. Understanding these regulations is essential for prospective business owners looking to navigate the formation process correctly.

The primary agency involved in the LLC formation process in Rhode Island is the Rhode Island Department of State. This agency oversees the registration and compliance of LLCs. Ensuring adherence to regulatory requirements is critical not just for initial formation but also for ongoing operations, including maintaining good standing.

Preparing to file the RI Limited Liability Company Form

Before filling out the RI Limited Liability Company Form, it’s vital to gather essential information. This includes deciding on a unique business name and physical address. Additionally, you’ll need to designate a registered agent responsible for receiving legal documents on behalf of the LLC. Understanding who will be members and their roles is fundamental in this preparatory stage.

Choosing your LLC name is a pivotal step. Rhode Island has specific guidelines and restrictions to ensure that the name is not misleading or similar to an existing business. It’s advisable to conduct a name availability search through the Rhode Island Secretary of State's website before finalizing your choice.

Another important aspect of forming an LLC is creating an Operating Agreement, which outlines the management structure and financial arrangements among members. While not required by the state law, having an agreement in place can prevent future disputes and clarify expectations.

Step-by-step guide to completing the RI Limited Liability Company Form

Accessing the RI Limited Liability Company Form is straightforward through pdfFiller, a user-friendly platform designed to simplify document creation. Once you have the form, follow this detailed walkthrough of each section to ensure completeness and accuracy.

Business name section

Start with the business name section. Make sure to follow naming conventions suited for Rhode Island. Verify your chosen name’s availability through the state's business name database to avoid conflicts with existing entities.

Registered agent section

Next, in the registered agent section, appoint a registered agent who will handle legal documents. An individual resident or a business entity may serve, but ensure they have a physical street address in Rhode Island.

Principal address section

The principal address section should reflect the legal address of your business. It's essential to differentiate between the legal address and any store or operational addresses.

Management structure section

In the management structure section, indicate whether the LLC will be member-managed or manager-managed. This decision will influence how daily operations are conducted and who has authority in business decisions.

Duration of section

Lastly, specify the duration of the LLC if it’s not intended to be perpetual. If you do not state a specific duration, the state defaults to a perpetual status.

When completing the form, avoid common mistakes such as typos, incorrect information, and missing signatures. Double-check each section to ensure accuracy.

Filing your RI Limited Liability Company Form

Once the RI Limited Liability Company Form is complete, it’s time to submit it. Rhode Island offers two submission options: online filing through the Department of State’s portal or mailing a paper form. Online filing is generally faster, offering immediate confirmation.

Filing fees also apply and typically vary based on the type of business entity. Generally, state fees are reasonable, but consider additional costs such as registered agent fees or expedited processing fees if applicable. Expect a processing time that can vary from a few days to several weeks, depending on the volume of submissions received.

Post-filing, you will receive notifications regarding your submission status, which further aids your business's understanding of its compliance standing.

Post-formation requirements for RI LLCs

After successfully forming your LLC in Rhode Island, several post-formation requirements must be addressed. One of the first steps is obtaining an Employer Identification Number (EIN) from the IRS if your LLC will have employees or if you decide to elect corporate tax treatment.

Additionally, registration with the Rhode Island Division of Taxation ensures compliance with state tax requirements. Your LLC may also be subject to annual reporting, which requires the submission of forms that keep the state updated on your business’s status. Depending on your business activities, you might also need to secure local business licenses and permits to operate legally.

Being proactive in fulfilling these requirements can save you from potential legal troubles down the line, ensuring that your LLC remains in good standing with the state.

Using pdfFiller to manage your documents

Managing documents after forming your LLC is critical, and pdfFiller offers excellent features tailored for ongoing LLC management. With pdfFiller, you can easily edit and sign necessary documents, ensuring that all information is up to date and compliant with state regulations.

Collaborating with team members becomes effortless using pdfFiller’s tools, which likely include permissions for reviewing and signing documents. Additionally, the platform provides cloud storage for organizing your files, enabling easy access from anywhere. This is particularly useful for businesses that may operate remotely or require flexible work arrangements.

By using pdfFiller, business owners can ensure that all essential documents are managed correctly throughout the lifecycle of their LLC, allowing them to focus on growth and strategy.

Frequently asked questions about RI formation

Forming an LLC in Rhode Island often raises many questions among entrepreneurs and business owners. Addressing these frequently asked questions can provide clarity for those interested in establishing an LLC. For instance, many new business owners wonder about the duration of LLC operations, the roles of members versus managers, and ongoing compliance requirements.

Furthermore, individuals may be curious about the potential for converting an LLC to a corporation, or vice versa, as their business needs change over time. Each of these topics carries important implications for how an LLC operates. Detailed resources are available online, linking to specific topics, to provide in-depth information and guidance.

Real-world examples and case studies

Understanding the formation and operational experiences of other businesses can offer invaluable insights. Success stories about businesses that started as LLCs in Rhode Island showcase the adaptability and effectiveness of this structure. Observations from their journeys reveal lessons regarding the importance of strategic planning, compliance, and adaptability in the face of challenges.

For example, a local tech startup may illustrate how an LLC offered the flexibility needed to pivot quickly in the competitive technology landscape while maintaining personal liability protection. Such case studies can inspire potential business owners to explore the LLC option further.

Next steps after forming your

With your RI Limited Liability Company Form filed and your LLC officially formed, the next steps focus on launching and managing your business effectively. Develop a marketing strategy to introduce your business to your target audience, leveraging digital channels and local community engagement. It’s also essential to establish your bookkeeping practices from the outset to keep track of finances.

Additionally, seeking mentorship or networking within local business circles can provide valuable support and information. Resources are available for ongoing LLC management, from educational workshops to online communities dedicated to Rhode Island entrepreneurs. Engaging in these activities will assist you in growing your LLC sustainably over the long term.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ri limited liability company from Google Drive?

How do I make changes in ri limited liability company?

How do I complete ri limited liability company on an Android device?

What is ri limited liability company?

Who is required to file ri limited liability company?

How to fill out ri limited liability company?

What is the purpose of ri limited liability company?

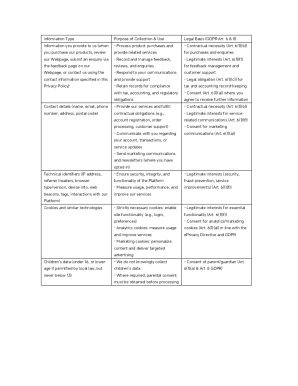

What information must be reported on ri limited liability company?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.