State of Colorado Small Form: A Comprehensive Guide

Overview of small forms in Colorado

Small forms in Colorado are concise documents used for various administrative and legal purposes, simplifying transactions and communications for both individuals and organizations. These forms range from tax-related paperwork to business registrations and personal legal documents, providing a standardized approach across different sectors.

The importance of small forms cannot be understated. For individuals, they are essential for identity verification, tax compliance, and healthcare decisions. Organizations, on the other hand, rely on these forms for legal compliance, business registrations, and inter-entity communications. They also contribute to the efficient functioning of the administrative processes in local and state agencies.

In Colorado, small forms are ubiquitous, utilized in educational institutions, healthcare systems, and various business sectors. Common uses include tax filings, business entity registrations, and personal legal documents like power of attorney. Understanding their nuances can save time and prevent errors in critical processes.

Types of small forms available in Colorado

Identification Forms: Required for proving identity during various civic activities, including voting and accessing state services.

Tax-related Forms: Essential for complying with state tax regulations, with forms like the Colorado Individual Income Tax Form being commonly used.

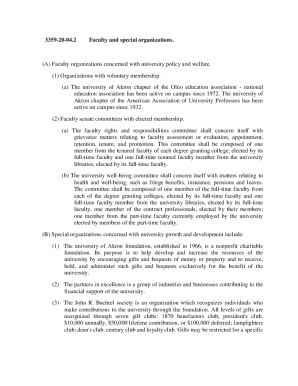

Licensing and Registration Forms: Necessary for operational compliance for businesses and individuals seeking professional certifications.

Incorporation Documents: Required for establishing a legal entity in Colorado, including Articles of Incorporation.

Contracts and Agreements: Fundamental for ensuring legal protection in business partnerships and employee relations.

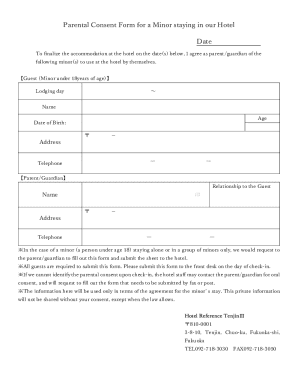

Power of Attorney: Allows one individual to make legal decisions on behalf of another.

Medical Directives: Documents outlining healthcare preferences and medical decisions in case of incapacitation.

How to access and download Colorado small forms

Locating small forms in Colorado can be done through various state websites, including the Department of Revenue and county clerk websites. Typically, you can find these forms organized by category, making navigation straightforward. It's advisable to familiarize yourself with the layout of the specific site as this can save time during your search.

Another reliable option for accessing forms is pdfFiller. This platform allows you to download Colorado small forms directly and edit or fill them out from any device, ensuring you can manage your paperwork effectively whether you’re at home or on the go.

When downloading forms, make sure to pay attention to the file formats available. While most forms will be in PDF format, ensuring compatibility with your editing tools is essential. Additionally, keeping track of the latest versions of these forms can help prevent any unnecessary complications due to outdated documentation.

Step-by-step guide to filling out small forms

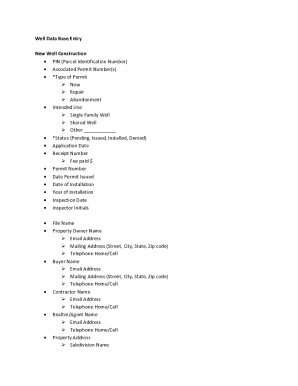

Before you begin filling out a small form, it's crucial to gather all the necessary information. This can include personal details, identification numbers, and specific data related to your application. Understanding the requirements of the form helps to minimize errors that could delay processing.

When completing the form, be sure to adhere to the provided instructions carefully. Overlooking details, such as signatures or dates, can lead to processing issues. A common mistake is omitting required information, so double-check your entries.

Utilizing a tool like pdfFiller can facilitate the editing process. With its user-friendly interface, you can easily incorporate digital signatures, making the submission process smoother. Ensuring that all fields are correctly filled before submission will save you from potential delays.

Submitting your small form in Colorado

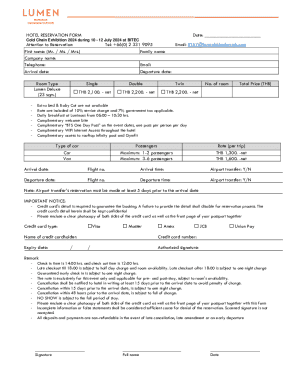

Once your small form is ready, you have a few options for submission in Colorado. Numerous small forms can be submitted online through state agency websites, which often feature dedicated portals for form processing. This method is not only quick but also allows for tracking your submission status after completion.

Alternatively, traditional mail can be used to send your forms, especially if online submission isn't feasible. When mailing forms, it’s crucial to verify that they are sent to the correct address and to keep copies for your records. Tracking your submission status is essential, particularly for time-sensitive forms. Familiarize yourself with important deadlines to avoid complications.

Managing your small forms with pdfFiller

pdfFiller provides an extensive suite of document management tools that are particularly helpful for handling small forms. By organizing your documents in the cloud, you can easily access, edit, and share them from any device. This cloud-based approach removes the hassle of keeping physical copies and allows for more efficient workflows.

The collaborative features of pdfFiller allow for teamwork on form completion. You can share forms with team members for feedback, assign roles, and track changes, ensuring everyone stays aligned on the project. Security is another key aspect, as pdfFiller incorporates data protection measures compliant with Colorado's laws, ensuring safety for your personal information.

Frequently asked questions about Colorado small forms

What is the processing time for submissions? Typically, processing times vary based on the type of form submitted, ranging from immediate online confirmations to several weeks for certain paper forms.

How can I correct an error after submission? Depending on the form and agency, you might be able to submit a correction form, or you may need to contact customer service for guidance.

Are there fees for certain small forms? Yes, some forms, especially those related to business registrations, may incur processing fees; always verify with the specific agency.

Advantages of using pdfFiller for managing Colorado small forms

pdfFiller offers unlimited access to a broad range of templates, which can be particularly useful for those frequently dealing with Colorado small forms. Whether you need a power of attorney document or tax forms, pdfFiller has you covered, allowing you to start with a reliable template.

Seamless eSigning features ensure that your documents are ready without unnecessary delays. Additionally, collaborative tools help facilitate teamwork, allowing multiple users to engage with the form content. Automation features help to streamline repetitive tasks, saving time and reducing the burden of paperwork.

Real-life use cases and testimonials

Many individuals in Colorado have benefited from using small forms to enhance efficiency in their personal and professional lives. For instance, individuals have reported that utilizing pdfFiller for tax forms reduced their processing time significantly, allowing for quicker refunds.

Businesses in Colorado have shared success stories where using proper forms led to renewed contracts and smoother compliance with state regulations. The ease of use and comprehensive features offered by pdfFiller have transformed how companies handle their documentation, demonstrating the platform's value.

The future of small forms in Colorado

As technology evolves, the future of small forms in Colorado is likely to shift toward increased digitalization. Trends indicate a growing preference towards mobile-friendly forms that can be accessed and completed on various devices, reinforcing the need for platforms like pdfFiller that accommodate these changes.

The incorporation of artificial intelligence and automation in form management is expected to further streamline the process, reducing errors and enhancing user experience. This evolution will support individuals and organizations in maintaining compliance while maximizing efficiency in their administrative tasks.