Budget paycheck guide for form

Understanding the importance of a budget

Budgeting is the cornerstone of financial health. It provides clarity on where your money is going and how effectively you're managing your income. Successful budgeting can reduce stress, enabling you to handle unexpected expenses and achieve your financial goals. A structured budget can help you prioritize spending, save for important purchases, and avoid unnecessary debt.

When you understand your paycheck and its allocation, it becomes easier to forecast your financial position. A budget allows you to track paychecks and ensures that every dollar serves a purpose. With effective budgeting, you can enhance your saving habits and build a security net for future needs or emergencies.

Navigating budget paycheck forms

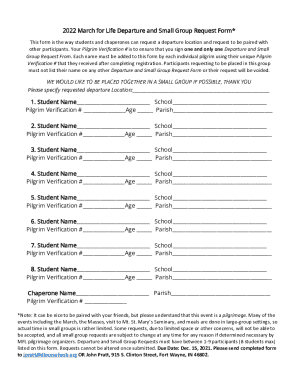

Choosing the right budget paycheck form from platforms like pdfFiller can streamline your financial planning process. Various forms cater to different budgeting needs, each designed to help track income and expenses more effectively. For instance, the Monthly Cash Flow Plan allows users to visualize how their money flows in and out over each month.

On the other hand, the Allocated Spending Plan helps users assign specific amounts of their income to various categories, emphasizing discipline in spending. Understanding these differences is crucial when making a choice that aligns with your financial habits and goals.

Step-by-step guide to using the budget paycheck form

To get started, follow this structured approach for filling out a budget paycheck form effectively. The first step involves gathering all necessary information about your financial status.

Identify all your income sources, including your salary, bonuses, and any side gigs. Next, document your fixed expenses such as rent and utilities, alongside variable expenses like groceries and entertainment. Having this data ready simplifies the process of filling out the budget form.

Once you have gathered your information, access the desired budget paycheck form on pdfFiller. The intuitive interface allows you to easily find and select the template you need, ensuring a seamless experience thanks to functionalities like auto-fill and easy navigation.

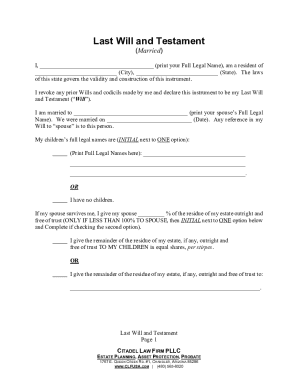

Filling out the budget paycheck form

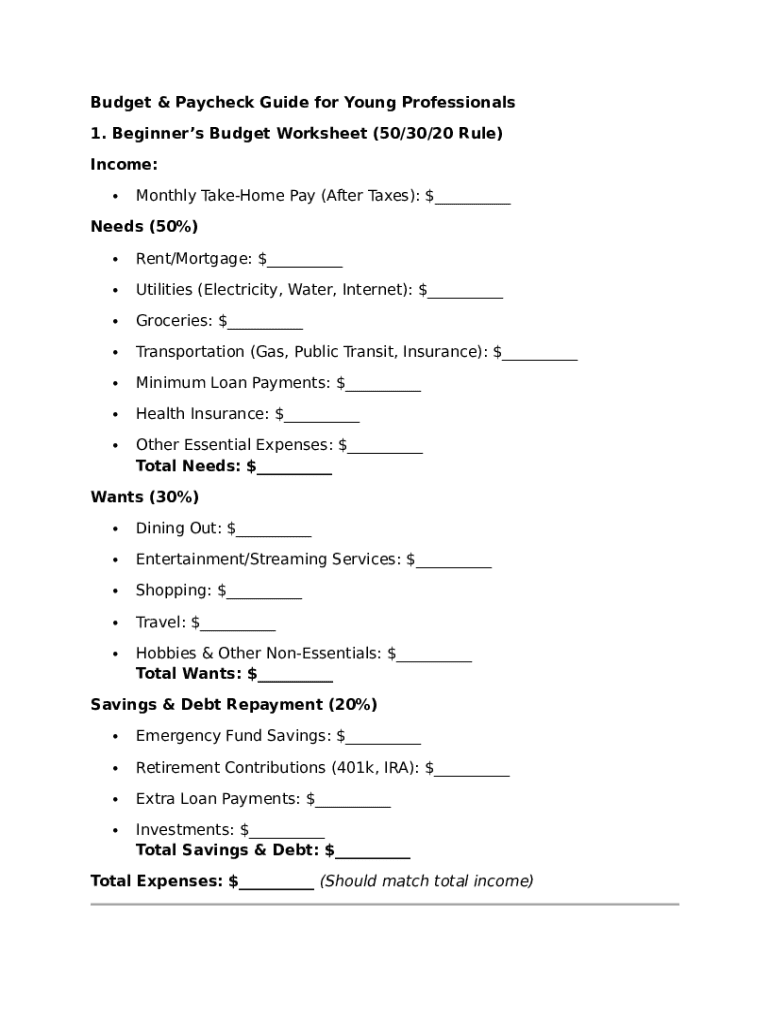

Completing each section of the form is key to effective budgeting. Start with the income section, ensuring you include all sources of income. Record your net pay first, followed by any additional income streams, ensuring accuracy. This establishes a complete financial picture.

Next, move on to the expense section. Here, differentiate between essential and discretionary spending. Essentials include rent and bills, while discretionary spending might consist of dining out or entertainment. This distinction aids in pinpointing areas where you can cut back or reallocate funds. Additionally, utilizing tools to estimate irregular income can be immensely helpful, especially for freelancers or gig workers.

Best practices for budgeting with payroll in mind

Establishing realistic financial goals is vital when budgeting with your paychecks. Review past pay periods to identify patterns in your income and expenses, and use these insights to set achievable targets. Allocate specific percentages of your income towards saving, spending, and investing. A common guideline is the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings or debt repayment.

Incorporating plans for monthly cash flow and managing lump sum payments, such as tax refunds or bonuses, can enhance your budgeting strategy. Ensure these extra funds are directed strategically, perhaps towards paying off debt or bolstering your savings account, reinforcing a proactive financial approach.

Collaborating in teams for effective budgeting

For teams, utilizing the Budget Paycheck Form on pdfFiller can foster collaboration and accountability in financial planning. By sharing access to a single budget document, teams can engage in collaborative financial decisions, ensuring everyone's input is considered. This practice not only strengthens team morale but also promotes transparency.

To enhance collective budgeting efforts, consider scheduling regular financial meetings to review progress, adjust plans, and discuss any unforeseen expenses or changes in income. This collaborative approach helps in aligning team goals and fosters a sense of mutual responsibility towards financial health.

Editing and managing your budget form in pdfFiller

As your financial situation changes, so should your budget. Regularly updating your budget paycheck form on pdfFiller is crucial for staying on track. The platform’s editing tools allow users to make necessary adjustments, whether due to a change in income or unexpected expenses.

Best practices for managing your documents include labeling and organizing them within pdfFiller. Use folders to keep related documents together and take advantage of pdfFiller's document retrieval features to access your budget forms whenever necessary. This systematic approach minimizes confusion and enhances the efficiency of your budgeting process.

Common pitfalls to avoid when budgeting

Aspiring to improve your budgeting skills involves learning from common pitfalls. One significant mistake is neglecting contingency funds for unexpected expenses. A good rule is to set aside around 10% of your income for emergencies, which serves as a financial cushion when life throws surprises your way.

Moreover, analyzing past budgeting mistakes and recognizing patterns can reveal insights into your financial behavior. Utilizing this data to refine your methodology will help circumvent similar challenges in the future, placing you in a more favorable position financially.

Interactive tools to enhance your budgeting experience

pdfFiller offers several interactive tools that can elevate your budgeting experience. Features like real-time calculations make adjusting estimates quick and efficient, allowing you to see the immediate impact of any changes to your budget. Such tools can boost your confidence in financial planning by simplifying complex calculations.

Integration options with other financial tools and apps enhance the user experience further. By syncing budget data across multiple platforms, you can consolidate financial management processes and obtain a holistic view of your finances. This leverages automation, saving you time and ensuring accuracy in your budgeting efforts.

Tracking your progress: analyzing and adjusting your budget

Conducting a monthly review of your budget in conjunction with your paychecks is essential for progress. Allocate time each month to analyze spending patterns, reassess priorities, and adjust your budget as necessary. This reflective practice allows you to tweak your budget based on past performance, reinforcing your monetary discipline.

Utilizing reports and summaries available in pdfFiller can enhance your review process. These insights provide a clearer picture of overall financial health, helping pinpoint areas for improvement. This adaptive approach ensures your budgeting strategy evolves along with your financial situation, setting you up for long-term success.