Get the free Standard Form 1199a

Get, Create, Make and Sign standard form 1199a

Editing standard form 1199a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out standard form 1199a

How to fill out standard form 1199a

Who needs standard form 1199a?

A Comprehensive Guide to Standard Form 1199A: Everything You Need to Know

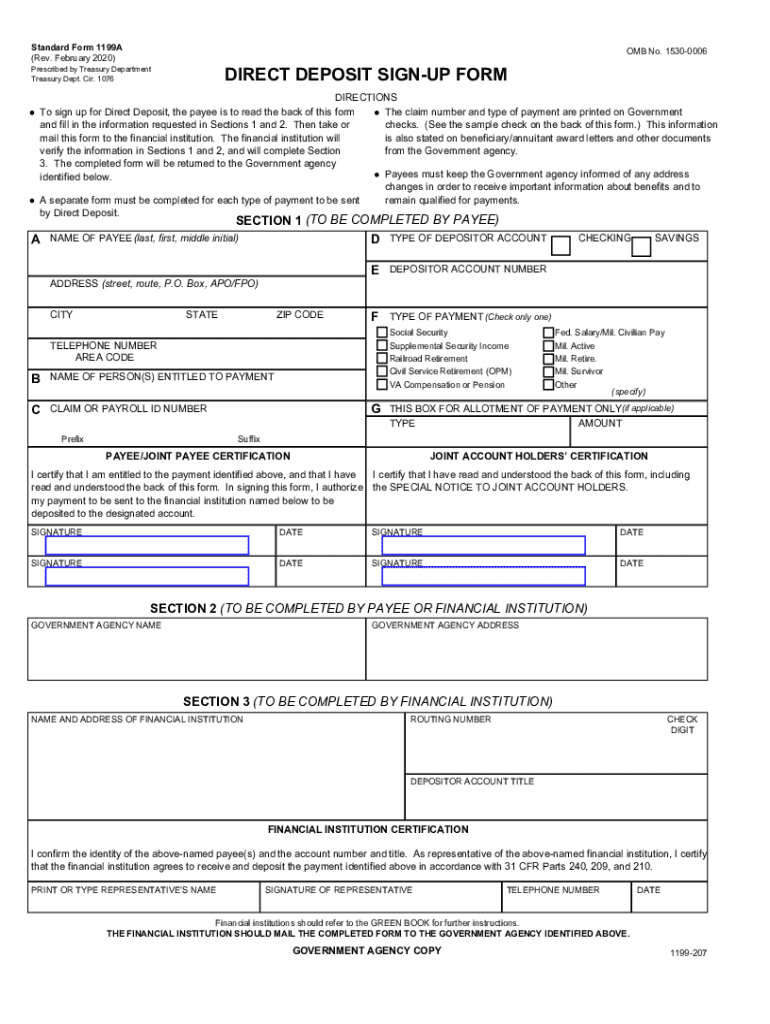

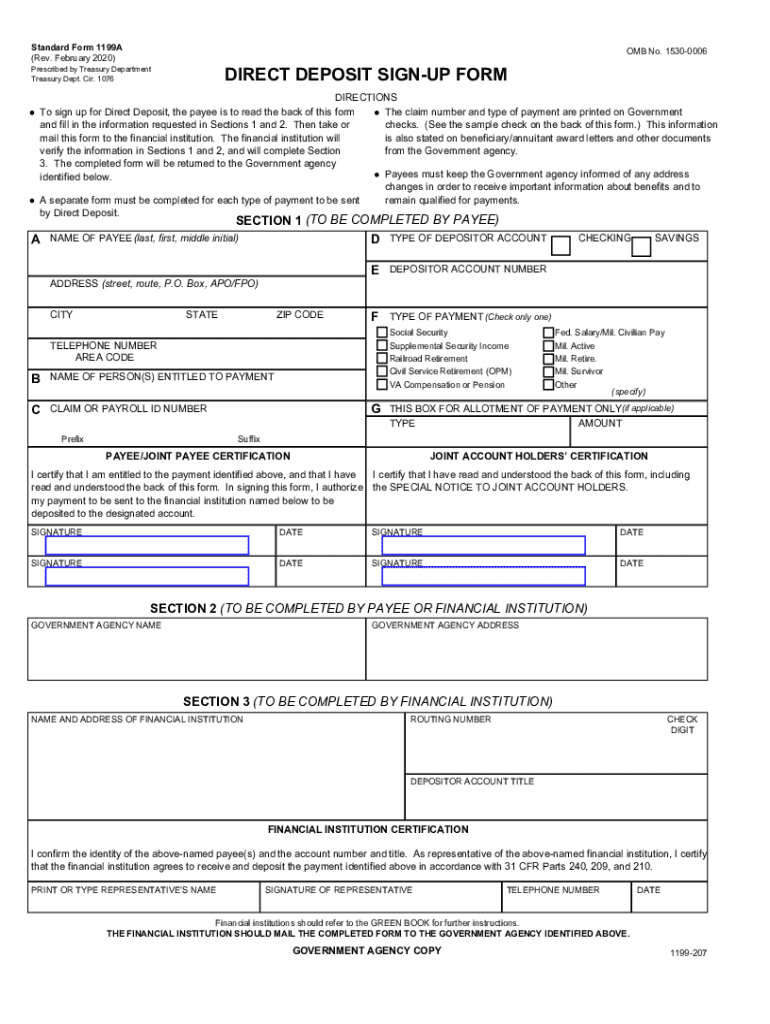

Understanding the standard form 1199A

The Standard Form 1199A is a government-issued document that plays a crucial role in facilitating direct deposit for federal benefits. This form allows recipients to authorize the Department of the Treasury to deposit their payments directly into their bank accounts, streamlining the disbursement process and ensuring timely access to funds.

The importance of the 1199A form cannot be overstated; it eliminates delays associated with paper checks, reduces the risk of lost or stolen payments, and offers a convenient way for individuals to manage their finances. Essentially, it provides a hassle-free solution for receiving government benefits, including Social Security, veterans' benefits, and federal pensions.

Individuals who need to complete the 1199A form typically include those receiving federal benefits for the first time, those who wish to change their banking information, or those managing multiple accounts. By filling out this form correctly, recipients ensure that their funds are deposited accurately and promptly.

Structure of the standard form 1199A

The layout of the Standard Form 1199A consists of several distinct sections, each designed to collect essential information needed for direct deposit enrollment. Understanding these sections is vital for successful completion of the form.

Each of these sections contains required fields that must be filled in accurately. For instance, alongside typical personal details such as your name and address, you also need to provide your Social Security number and bank account details to complete the form.

Step-by-step guide to filling out the standard form 1199A

Filling out the Standard Form 1199A doesn’t have to be daunting. Here's a detailed step-by-step guide to help you complete it accurately.

These steps are critical for ensuring your form is processed without delays. Each piece of information you provide contributes to the verification of your identity and your ability to receive payments seamlessly.

Common mistakes to avoid when completing the 1199A form

While filling out the Standard Form 1199A may seem straightforward, several common mistakes can result in processing delays or denied requests. Here are crucial points to keep in mind.

Being vigilant about these common pitfalls can save time and prevent frustration. Always double-check your entries before submitting the form.

Tips for submitting the standard form 1199A

Once the Standard Form 1199A is completed, the next step involves submission. Knowing where and how to send the form can greatly affect the speed of processing your request.

Adhering to these guidelines can enhance the likelihood of your form being processed promptly, facilitating a faster transition to receiving benefits.

Troubleshooting issues with standard form 1199A

After submission, you may encounter issues regarding the status of your enrollment for direct deposit. Knowing how to troubleshoot can alleviate anxiety and resolve complications.

Taking proactive steps in troubleshooting can minimize disruption in payment processes and foster a smoother experience.

Managing your payments via direct deposit

Direct deposit offers numerous benefits, from convenience to enhanced security for your funds. Understanding how to manage these payments effectively is essential for financial stability.

Being informed about these aspects allows individuals to take full advantage of the direct deposit system while maintaining financial security.

Exploring pdfFiller’s tools for working with standard form 1199A

pdfFiller offers a range of features designed to make completing and managing the Standard Form 1199A effortless. The platform provides a cloud-based solution that is both user-friendly and efficient.

These features empower users to manage their documents reliably and efficiently, contributing to a seamless experience with the Standard Form 1199A.

Resources for further assistance with the standard form 1199A

When navigating the complexities of the Standard Form 1199A, having access to reliable resources is invaluable. These resources can guide your completion and submission process.

Utilizing these resources effectively can greatly simplify the process of managing your government payments through direct deposit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the standard form 1199a in Chrome?

Can I edit standard form 1199a on an iOS device?

How do I complete standard form 1199a on an iOS device?

What is standard form 1199a?

Who is required to file standard form 1199a?

How to fill out standard form 1199a?

What is the purpose of standard form 1199a?

What information must be reported on standard form 1199a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.