Get the free Lease Addendum Insurance Requirement

Get, Create, Make and Sign lease addendum insurance requirement

Editing lease addendum insurance requirement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lease addendum insurance requirement

How to fill out lease addendum insurance requirement

Who needs lease addendum insurance requirement?

Understanding the Lease Addendum Insurance Requirement Form

Understanding the lease addendum insurance requirement

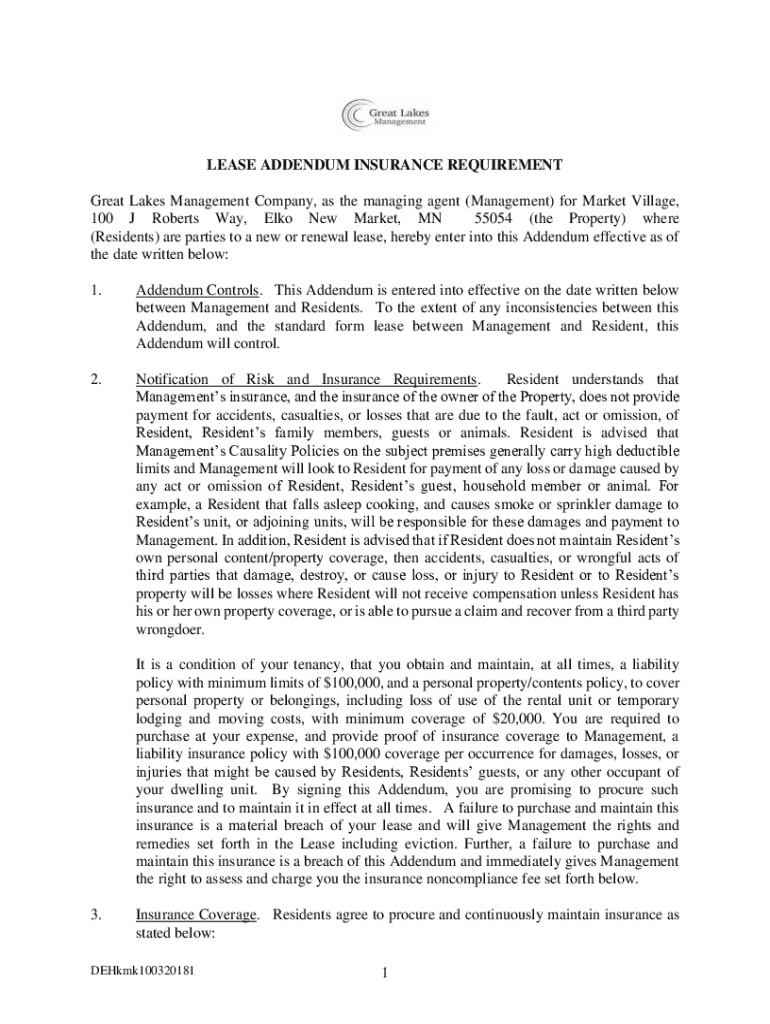

A lease addendum is a supplementary document that modifies or adds specific terms to an existing lease agreement. One primary focus of a lease addendum insurance requirement form is to outline the necessary insurance coverage that tenants must maintain. This requirement serves to protect both landlords and tenants, ensuring that responsibilities around potential damages or liabilities are clearly defined.

Having defined insurance requirements in lease agreements significantly lessens the risk of disputes. Insurance is essential in safeguarding both parties, facilitating a smoother rental experience. Key terms to know include tenant liability insurance, which protects landlords from legal claims due to tenant-caused injuries or damages, and rental insurance, which helps tenants cover property loss or damage.

The role of the insurance requirement in a lease

The insurance requirement in a lease addendum serves a crucial role in safeguarding both landlords and tenants. It establishes a clear plan in case of unexpected incidents, such as property damage, injuries on the property, or liability claims. For landlords, having tenants maintain adequate insurance acts as a buffer against financial losses, while tenants enjoy the peace of mind that comes from being covered, reducing personal financial risk.

Typical scenarios where insurance proves beneficial include incidents like water damage caused by a burst pipe or an injury sustained by a guest in the rental property. By differentiating between tenant liability insurance and rental insurance, both parties can identify which type of coverage is necessary for their unique situations. Tenant liability insurance often shields landlords from lawsuits, while rental insurance is more tailored to protect tenants' personal belongings.

Components of a lease addendum insurance requirement form

A lease addendum insurance requirement form typically includes several crucial sections. These include details about insured parties—specifying the landlord and tenant—as well as various coverage options, such as liability limits and property damage coverage. Coverage types often detail what incidents and damages are included, with varying limits for each type of insurance.

Considerations for specific inclusions based on state laws may also be necessary. For instance, some states have mandatory minimum coverage limits that must be adhered to. It’s vital to customize this form according to local regulations and the unique rental situation to ensure all potential risks are adequately addressed. This attention to detail not only protects everyone involved but also supports the overall legality and enforceability of the lease agreement.

Sample lease addendum insurance requirement form

Here’s a visual example of a completed lease addendum insurance requirement form that highlights the necessary components. Each section plays a distinct role in ensuring clarity and mutual protection. This may include segments for listing the insured parties, specifying the coverage types, and stating the limits of liability.

Breaking down each section’s purpose can help both landlords and tenants understand their responsibilities. For instance, the insured parties section clearly identifies who is covered under the policy, while coverage type lists specific incidents the insurance will cover. When customizing the form for specific rental situations, remember to adjust coverage limits and types to fit the property’s unique circumstances.

Steps to fill out the lease addendum insurance requirement form

Filling out a lease addendum insurance requirement form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, which includes personal details for both the tenant and the landlord, as well as the insurance company details. This initial gathering ensures a smooth process when filling out the form.

Next, follow these step-by-step instructions: 1) Fill in the names and contact information of both landlord and tenant. 2) Specify the insurance provider's name and contact information. 3) Define the types of coverage required, including liability limits. 4) Include necessary signatures. Common mistakes to avoid include ensuring accurate insurance coverage limits aren’t overlooked or forgetting to list all necessary parties involved in the agreement.

Managing and editing your lease addendum

Managing your lease addendum insurance requirement form can be simplified through tools like pdfFiller, which allows for seamless online form management. Uploading and editing PDFs is straightforward, and the e-signature features expedite the approval process. This makes it easy for both landlords and tenants to provide their required signatures without delays.

Storing the form securely is crucial for legal compliance, and pdfFiller offers safe cloud storage options. Its sharing capabilities further enhance collaboration, allowing landlords to send necessary documentation to tenants easily while keeping track of modifications. This streamlining of the process fosters efficiency, ensuring all parties stay informed of the latest terms.

Frequently asked questions about lease addendum insurance requirements

A common question is whether all leases require insurance addendums. While not universally mandatory, many landlords choose to include them to protect their property and mitigate risks. Another frequent query is about the consequences if tenants don’t possess the required insurance. Typically, it may result in lease violations, potential financial liability, or legal action depending on the lease terms.

Landlords might wonder if they can adjust insurance requirements once the lease is signed. While in most cases, adjustments can be made, it’s vital that tenants are notified and agree to any amendments to avoid legal disputes. Open communication is essential throughout this process to ensure all parties remain on the same page.

Comparing tenant liability insurance and rental insurance

Understanding the differences and similarities between tenant liability insurance and rental insurance is critical for landlords and tenants. Tenant liability insurance primarily covers damages or injuries that result from the tenant’s actions, potentially protecting the landlord from lawsuits. In contrast, rental insurance—also known as renters insurance—covers the tenant’s personal belongings in case of theft or damage, offering protective coverage tailored to their items.

Both insurance types are beneficial, but determining which coverage fits a particular situation is essential. For landlords, tenant liability insurance minimizes financial risks while protecting the rental unit’s integrity. For tenants, renters insurance offers crucial coverage for personal items, making it a wise option to consider when entering into any rental agreement.

Popular forms related to lease addendum insurance requirements

Beyond the insurance addendum, several other commonly used documents can synergize with lease agreements. General lease agreements often define the entire rental relationship, while maintenance addendums clarify responsibilities for property upkeep. Pet addendums detail specific regulations regarding pet ownership in rentals.

Understanding how these documents relate to a lease addendum insurance requirement is essential. Each form serves a unique purpose, yet they all aim to establish clear guidelines to prevent misunderstandings. Integration of these forms with pdfFiller can simplify document management, making it easier for both landlords and tenants to keep track of every agreement.

Benefits of using pdfFiller for lease documentation

pdfFiller’s cloud-based platform offers numerous advantages for managing lease documentation. Users can edit PDFs easily, ensuring that all agreements are updated accurately without the hassle of dealing with multiple formats. Collaborative tools also enable landlords and tenants to work together more effectively, facilitating smoother communication and quicker decision-making.

In addition, enhanced management features allow for ongoing lease adjustments without needing to start from scratch with each change. This flexibility is critical in the rental industry, where circumstances can change rapidly. By harnessing pdfFiller's capabilities, users ensure their lease agreements remain compliant and ensure all parties are protected.

Real-world scenarios illustrating the need for insurance addendums

Real-world scenarios underscore the importance of having a lease addendum insurance requirement form in place. For instance, a tenant's negligence leading to a kitchen fire could result in extensive damage to both the property and surrounding units. Having adequate tenant liability insurance protects the landlord from assuming financial burdens, while safeguarding the tenant from the resulting legal disputes.

Case studies from landlords reveal scenarios where having proper insurance was a game-changer. One landlord shared a testimonial about how having an insurance addendum saved him from significant losses following a case of water damage that affected multiple units. Such experiences highlight the necessity of clear insurance requirements and the benefits they provide through protecting all parties involved in a lease.

Final thoughts and next steps

Ensuring compliance and safety through accurate form completion is essential for landlords and tenants alike. As you prepare and fill out the lease addendum insurance requirement form, take the time to understand the essential components, the required coverage, and the implications of omitted sections. This diligence supports not only legal compliance but also promotes a harmonious rental relationship.

Encouragement to utilize pdfFiller for all lease documentation needs ensures that the process remains efficient and manageable. By leveraging this powerful tool, both landlords and tenants set themselves up for success, significantly reducing potential risks and enhancing communication throughout their leasing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the lease addendum insurance requirement in Chrome?

How do I fill out lease addendum insurance requirement using my mobile device?

How do I fill out lease addendum insurance requirement on an Android device?

What is lease addendum insurance requirement?

Who is required to file lease addendum insurance requirement?

How to fill out lease addendum insurance requirement?

What is the purpose of lease addendum insurance requirement?

What information must be reported on lease addendum insurance requirement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.