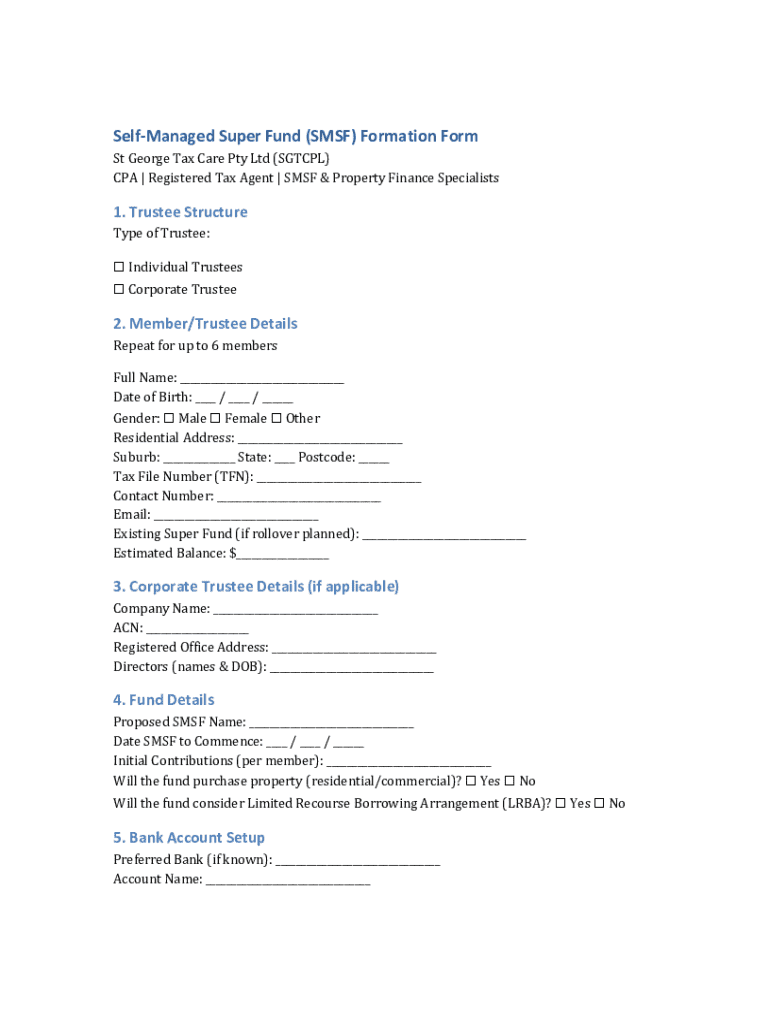

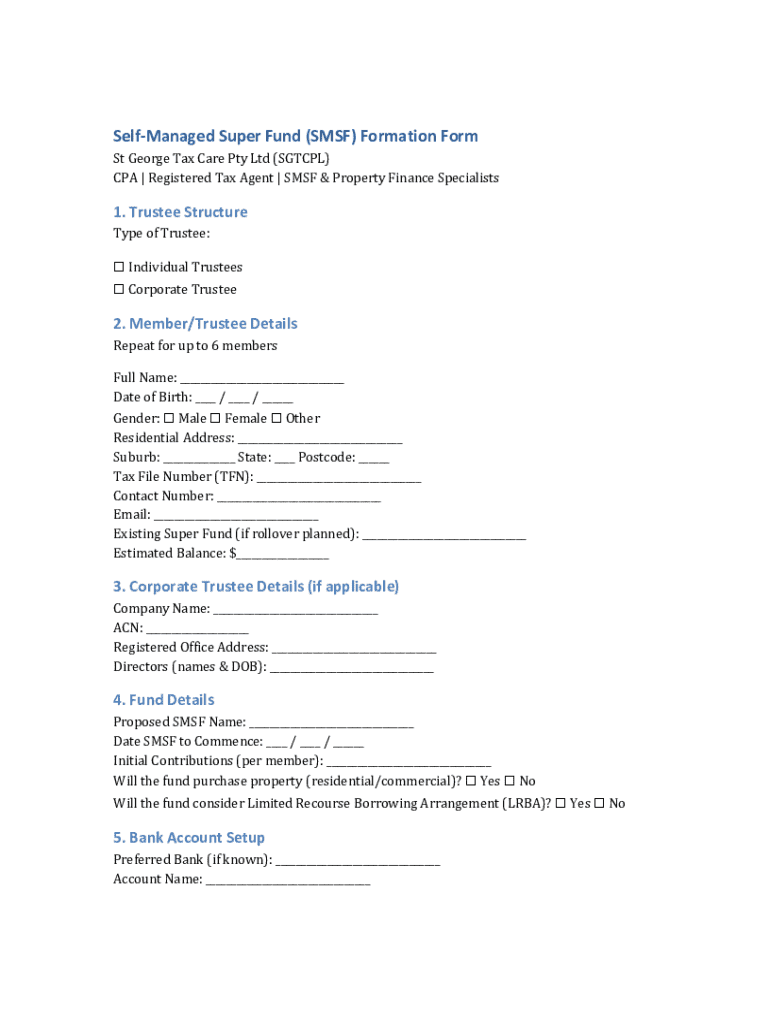

Get the free Self-managed Super Fund (smsf) Formation Form

Get, Create, Make and Sign self-managed super fund smsf

How to edit self-managed super fund smsf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out self-managed super fund smsf

How to fill out self-managed super fund smsf

Who needs self-managed super fund smsf?

Self-Managed Super Fund (SMSF) Form - How-to Guide

Understanding self-managed super funds (SMSFs)

A self-managed super fund (SMSF) is a superannuation fund that individuals manage themselves instead of having it handled by a professional fund manager. An SMSF allows members to take control over their retirement savings and exercise greater flexibility when it comes to investment strategies. This personal involvement ensures that funds can be tailored to suit the unique financial goals and risk appetites of its members.

One of the key features of an SMSF is the control it provides over investment choices. Members are empowered to select from a wide range of investments, including property, shares, and even collectibles, in alignment with their financial objectives. Additionally, SMSFs offer flexibility in asset allocation, enabling investors to modify their strategies according to market changes quickly. Tax benefits can also be significant; SMSFs typically operate at concessional tax rates, leading to substantial savings in the long term.

Typical users of SMSFs include individuals who prefer to manage their superannuation actively, small business owners looking to leverage their funds for business investment, and financial advisors assisting clients in creating tailored superannuation strategies.

Overview of the SMSF form

The SMSF form is a crucial document that facilitates the establishment and ongoing management of a self-managed super fund. This form is significant because it simplifies the compliance and reporting process to ensure that the fund operates within the regulations set by the Australian Tax Office (ATO).

Several types of SMSF forms are necessary throughout the lifecycle of the fund. Establishment forms are needed when setting up the fund, compliance forms update the ATO about any changes, and audit-related documents ensure the fund remains accountable by providing financial transparency and integrity.

Preparing to complete the SMSF form

Before diving into filling out the SMSF form, gather required information and documentation critical for accuracy. This documentation includes personal details of all members, financial records of the fund, and any previous fund documents that might influence the current SMSF structure.

Common pitfalls during this stage can hinder the process. Avoid incomplete information, as this could lead to compliance issues down the line. Misclassification of assets can also unintentionally result in legal obligations and penalties. Therefore, ensure each member's documentation is thoroughly vetted and compliant with current regulations.

Step-by-step instructions for filling out the SMSF form

The process of completing the SMSF form can be broken down into manageable steps. Start with gathering essential information, which includes the member information section and key details of the fund itself. This data lays the groundwork for the compliance and operational assessment by the ATO.

Next, move on to completing the core sections of the form, where you will be required to list assets owned by the fund, as well as a detailed breakdown of income and expenses. Comprehensive data inputs here are critical for maintaining compliance.

It's then essential to review regulatory compliance. Cross-reference your entries with the ATO guidelines to ensure every detail is correctly aligned with reporting obligations. Lastly, finalize and sign the form—consider whether to eSign or use a traditional signing method. Take the time to conduct a final accuracy check before submission to avoid potential misinterpretations later.

Editing and managing your SMSF form with pdfFiller

pdfFiller offers powerful online editing tools specifically designed for handling SMSF forms. You can streamline your workflow using their collaborative features, which allow team input and feedback, ensuring that all aspects of your document meet governance requirements.

To edit your SMSF form using pdfFiller, start by uploading your document to the platform. Utilize the interactive tools to make necessary edits, whether it's changing a numeric value or adjusting text. Save your work regularly, and take advantage of the various exporting options available to share or store your revised form efficiently.

Ensuring compliance and record-keeping

Compliance is at the heart of SMSF management. Understanding and adhering to compliance requirements is critical, including regular reporting and strict deadlines imposed by the ATO. Failure to comply can have financial repercussions, which highlight the importance of staying organized and diligent.

Adopting best practices for record-keeping ensures that you have quick access to financials and reporting data. Embrace digital storage solutions, such as those offered by pdfFiller, for easy access and better organization of documents. Effective categorization and tagging of documents within the system can also streamline retrieval when required.

Troubleshooting common issues with SMSF forms

Even seasoned professionals encounter challenges when dealing with SMSF forms. Common inquiries include concerns about mistakes made on the form and how to amend details after submission. Ideally, mistakes should be rectified as soon as they are spotted by reaching out to the ATO, who can offer guidance on appropriate steps.

For those seeking further assistance, numerous resources provide valuable insights. Engaging financial professionals who specialize in SMSFs can be an excellent way to navigate complexities, while direct consultations with ATO officials are advisable for specific queries.

Leveraging pdfFiller tools for mastering SMSF management

pdfFiller enhances your SMSF management experience by offering interactive tools designed to simplify various forms related to SMSFs. The platform features templates adaptable for diverse scenarios, ensuring that you can manage your documents effectively across all situations.

Moreover, the benefits of a cloud-based platform cannot be overstated. Accessibility from any location adds convenience, particularly for teams that may not be in a single physical location. Enhanced collaboration options enable multiple stakeholders to work on the same documents simultaneously, ensuring that everyone involved remains informed and aligned.

Regulatory changes and their impact on SMSF forms

Regulatory changes can significantly affect the way SMSF forms are completed and submitted. Staying updated regarding recent revisions in SMSF regulations is essential, as it allows fund managers to maintain compliance while optimizing strategies for financial growth.

To adapt your SMSF form in alignment with these changes, regularly consult resources provided by pdfFiller which can provide alerts and detailed insights. Being proactive in understanding amendments can prevent errors in your forms, ultimately safeguarding your compliance status and maximizing your fund's potential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute self-managed super fund smsf online?

Can I edit self-managed super fund smsf on an iOS device?

How do I edit self-managed super fund smsf on an Android device?

What is self-managed super fund smsf?

Who is required to file self-managed super fund smsf?

How to fill out self-managed super fund smsf?

What is the purpose of self-managed super fund smsf?

What information must be reported on self-managed super fund smsf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.