Get the free Kansas Commercial Lease Agreement

Get, Create, Make and Sign kansas commercial lease agreement

Editing kansas commercial lease agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kansas commercial lease agreement

How to fill out kansas commercial lease agreement

Who needs kansas commercial lease agreement?

A comprehensive guide to the Kansas commercial lease agreement form

Understanding the Kansas commercial lease agreement

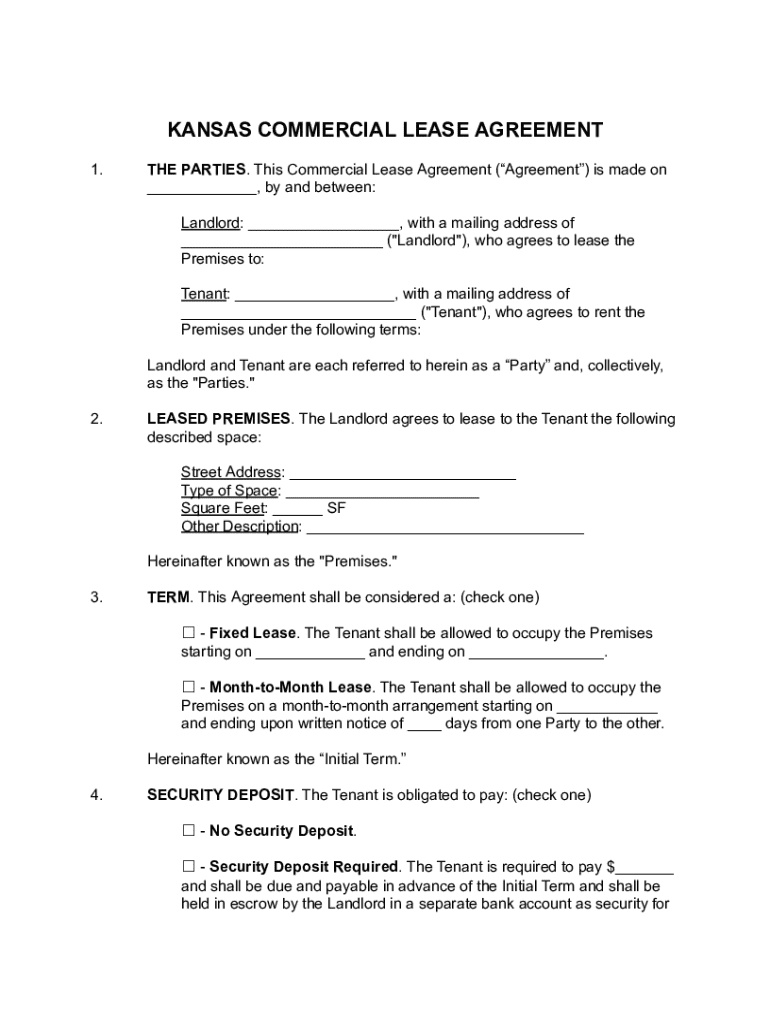

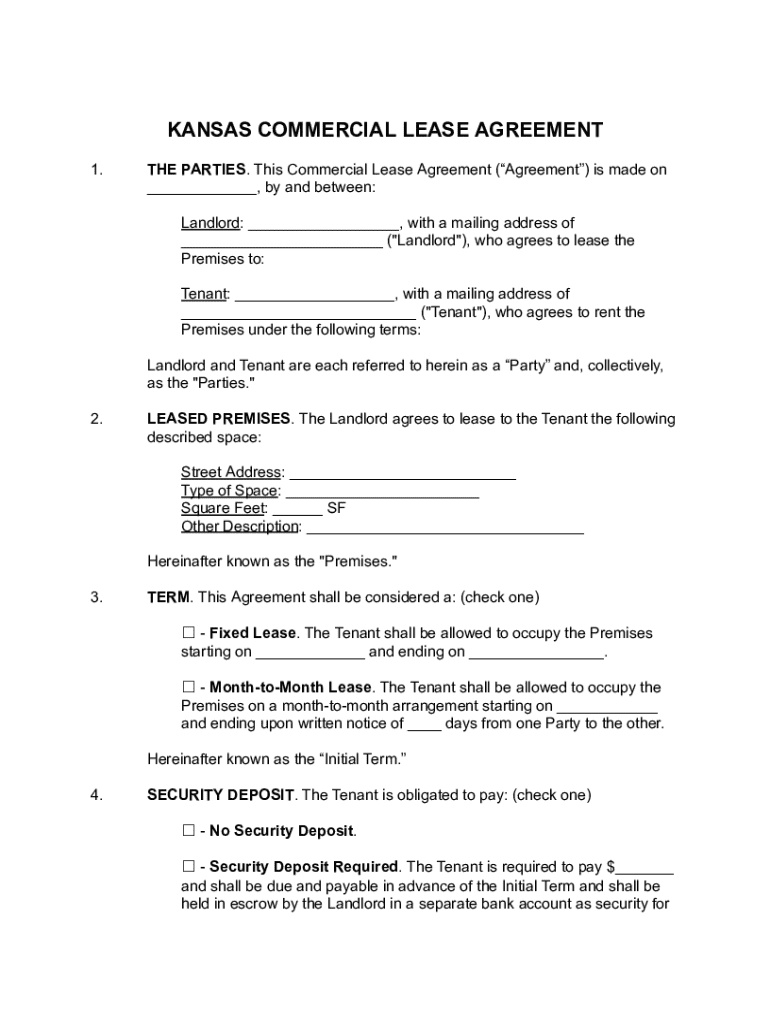

A Kansas commercial lease agreement is a legal document that outlines the terms under which a landlord allows a tenant to use a commercial property. This form is essential for both business owners and property owners, as it delineates all critical aspects of the rental relationship. By providing a comprehensive framework, it ensures that both parties have a clear understanding of their rights and obligations. Notably, commercial leases differ significantly from residential leases due to the nature of the property and the intended use. While residential agreements focus on living conditions, commercial leases cater specifically to business use, including offices, retail spaces, and other commercial entities.

The importance of these agreements cannot be overstated. For businesses, they protect their investment and operational space, guaranteeing that their lease terms align with their financial and business goals. For landlords, these agreements provide legal protection, ensuring that tenant behavior, payments, and property maintenance issues are clearly defined and enforceable. This vital legal framework not only sets expectations but also strengthens partnerships, minimizing potential conflicts.

Essential components of a Kansas commercial lease agreement

Every Kansas commercial lease agreement should include several critical components to ensure clarity and fairness. Start by identifying the lease parties, explicitly stating the legal names of the landlord and tenant. Similarly, providing a detailed property description, including the complete address and any specifications that set the premises apart, is crucial for preventing misunderstandings. The lease term should outline the duration of the lease, specifying the start and end dates, which allows both parties to plan accordingly.

Next, the rental payments section must convey the amount due, the schedule for payments, and acceptable payment methods. This information is vital for managing cash flow. Additionally, a security deposit clause should be part of the agreement; it defines the deposit amount, conditions for return after the lease ends, and any applicable Kansas laws influencing security deposits. Lastly, the use of premises clause outlines permitted business activities and restrictions, protecting landlords from unauthorized usage that might harm their property.

Critical lease clauses to include

Beyond the essential components, several critical clauses should be included in a Kansas commercial lease agreement to address various operational and legal aspects. Maintenance and repairs are vital responsibilities that must be clearly allocated between the landlord and tenant to avoid disputes. The insurance requirements clause should specify types of insurance needed by the tenant, such as general liability or property insurance, along with coverage liabilities to protect both parties in case of accidents or damages.

Another crucial clause is indemnity and liability, which helps limit exposure to claims from third parties and outlines waivers by both parties regarding certain risks. Moreover, termination and renewal options should be well defined, detailing procedures for ending the lease, as well as any renewal terms that might be applicable. These clauses allow both landlords and tenants to navigate the lifecycle of the lease actively and responsibly.

Navigating Kansas laws relating to commercial leases

Understanding Kansas laws governing commercial leases is critical to ensuring compliance and protecting one’s interests. The state has specific regulations and statutes that govern various aspects of commercial leasing, including disclosure requirements and tenant rights. Familiarity with statutory notice periods is essential; for instance, certain notifications related to lease termination must adhere to state-mandated timelines, which vary based on the lease type.

Moreover, Kansas law includes implied covenants in commercial leases that protect both landlords and tenants. This legal concept mandates that each party act in good faith and deal fairly with one another throughout the lease term. Keeping abreast of changes in laws or statutes affecting leases can significantly impact rental agreements, as it empowers property owners and business owners to adapt their agreements proactively.

Steps to create a Kansas commercial lease agreement

Creating a Kansas commercial lease agreement requires careful planning and execution. Begin by gathering all necessary information, including property details, tenant information, and financial terms that will govern the rental relationship. Once equipped with this data, consider selecting or using a comprehensive template for your agreement. Utilizing a robust template ensures consistency, compliance with Kansas laws, and thorough detail needed in lease drafting.

Next, customize your lease agreement to address the unique needs of your situation. Tailoring clauses and provisions allows for a more personalized contract that can potentially prevent disputes down the line. Following customization, conduct a thorough review to ensure clarity and legal compliance, potentially leveraging tools like pdfFiller for enhanced editing. Finally, finalize the document, executing it with all necessary parties using eSignatures, which not only provides efficiency but also maintains security in the digital age.

Common questions about Kansas commercial leases

When entering a Kansas commercial lease, several common questions arise that both landlords and tenants should consider. For instance, what happens if a tenant breaches the lease? Understanding the remedies available under state law, including potential eviction or monetary damages, is essential for property owners. Additionally, how disputes can be resolved is pivotal. Many leases include clauses stipulating methods such as mediation or arbitration, which can save both parties time and money.

Furthermore, it’s crucial to ask whether there are specific regulations for different types of commercial properties. Real estate laws often vary, influencing lease terms based on the property type, such as offices or retail locations. Lastly, knowing how to modify an existing lease agreement can prevent pitfalls. Amendments should typically be made in writing, with both parties documenting their agreement to changes to ensure clarity moving forward.

Related templates and tools

In addition to the Kansas commercial lease agreement form, numerous related templates and tools can streamline the leasing process for business owners and landlords. Various lease templates exist tailored to specific types of commercial properties, including specialized agreements for industrial spaces or retail locations. Comparing these different types is essential for ensuring that the selected template meets all legal and operational needs.

Additionally, interactive worksheets for lease calculations can provide insights into the financial aspects of rental arrangements, enabling landlords and tenants to assess rental costs relative to income effectively. With resources like these, document management becomes more efficient, empowering both parties to navigate leasing agreements successfully.

Making the most out of your lease agreement

To maximize the effectiveness of your Kansas commercial lease agreement, prioritize effective communication between both parties. Open discussions can help clarify expectations and address any potential issues before they escalate. Furthermore, regular reviews of the lease terms are vital to adapt to changing circumstances, such as shifts in market conditions or business strategies. Amendments may be necessary, and keeping a flexible approach to the lease agreement can be beneficial.

Additionally, staying updated on legal changes affecting leases is crucial for both landlords and tenants. Regularly reviewing state laws and regulations will help ensure ongoing compliance and protect both parties' rights and interests throughout the lease term. By remaining proactive and engaged, businesses can make the most out of their commercial leasing agreements.

Experience pdfFiller for your commercial leasing needs

pdfFiller stands out as an exceptional platform for managing your Kansas commercial lease agreement form and other important documents. With its user-friendly interface, you can easily edit PDFs and customize any leasing agreement to your specific needs. The ability to eSign documents provides an additional level of efficiency and security, allowing transactions to proceed smoothly without the need for physical meetings.

Incorporating real-time collaboration features allows both landlords and tenants to work together seamlessly on lease agreements. This capability ensures all parties stay informed and engaged throughout the process, creating a transparent leasing experience. Moreover, the cloud-based document accessibility means you can manage your lease documentation from anywhere, providing flexibility and convenience for busy landlords and business owners alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send kansas commercial lease agreement to be eSigned by others?

How do I complete kansas commercial lease agreement on an iOS device?

How do I complete kansas commercial lease agreement on an Android device?

What is kansas commercial lease agreement?

Who is required to file kansas commercial lease agreement?

How to fill out kansas commercial lease agreement?

What is the purpose of kansas commercial lease agreement?

What information must be reported on kansas commercial lease agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.