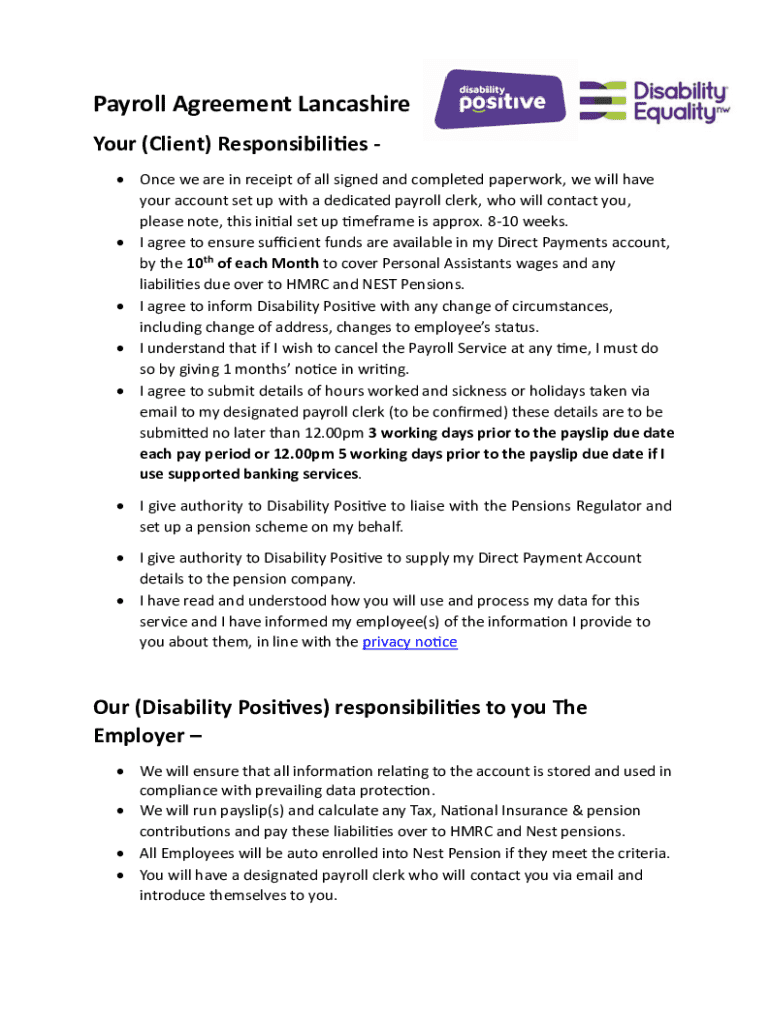

Get the free Payroll Agreement Lancashire

Get, Create, Make and Sign payroll agreement lancashire

How to edit payroll agreement lancashire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll agreement lancashire

How to fill out payroll agreement lancashire

Who needs payroll agreement lancashire?

Comprehensive Guide to the Payroll Agreement Lancashire Form

Understanding the payroll agreement in Lancashire

A payroll agreement in Lancashire serves as a critical document that outlines the terms and conditions relevant to the remuneration process between an employer and an employee. It is not just a formal requirement; it encapsulates the mutual understanding that exists before payment is made. A well-structured payroll agreement lays the groundwork for clear communication regarding what employees can expect in terms of salary, benefits, and deductions.

Compliance with local regulations is paramount. The payroll agreement must align with national and regional labor laws, as well as industry standards, ensuring that both employers and employees are protected. This is particularly significant in the North West of England, where regional governing bodies, such as district councils, often implement supplemental rules.

A properly managed payroll agreement yields numerous benefits. It not only enhances the operational efficiency of a company's payroll service but also fosters trust between the management and employees, knowing that their pay is handled transparently and accurately. For organizations like academy trusts and schools, it also establishes a foundation for maintaining quality standards within their payroll and recruitment services.

Key components of the payroll agreement Lancashire form

To ensure a thorough understanding and execution of the payroll agreement, several key components must be included. Essential information is divided into specific categories that encapsulate all necessary details pertaining to both employer and employee.

Step-by-step guide to completing the payroll agreement Lancashire form

Completing the payroll agreement form in Lancashire can seem daunting, but by breaking it down into manageable steps, it becomes a straightforward task. The process begins with gathering all necessary documentation.

Editing and modifying the payroll agreement

Amendments to the payroll agreement are sometimes necessary to accommodate changes in employment status or pay conditions. Recognizing when and how to make these amendments is essential for maintaining an up-to-date record.

eSigning the payroll agreement

In today's digital age, eSigning has become a critical part of form management. The payroll agreement is no exception, and utilizing electronic signatures speeds up the approval process considerably.

To eSign the payroll agreement, start by inviting the necessary parties to review and sign the document. This can usually be done through the pdfFiller platform where you can easily add signatories. Additionally, eSignatures are legally valid in the UK, providing a secure way to complete contracts without physical paperwork.

The benefits of eSigning not only include faster turnaround times but also reduced physical storage and enhanced security measures compared to traditional paper methods.

Submitting the payroll agreement Lancashire form

Once the payroll agreement has been completed and signed, the next crucial step is submission. Understanding the methods available for submission is essential to maintain compliance.

Ongoing management of the payroll agreement

Managing the payroll agreement doesn't end once it is submitted. Continuous oversight is vital for adapting to changes within the organization and ensuring compliance with evolving regulations.

Common FAQs about the payroll agreement Lancashire form

Understanding the payroll agreement is crucial, and many individuals may have questions regarding its intricacies. Common inquiries often revolve around the purpose of deductions, changes to agreements, and how to resolve discrepancies.

Training and support for filling out the payroll agreement

For both employers and employees, training on how to properly fill out and manage the payroll agreement is invaluable. Educational resources ensure that everyone understands their rights and responsibilities related to payroll.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send payroll agreement lancashire to be eSigned by others?

Can I edit payroll agreement lancashire on an Android device?

How do I complete payroll agreement lancashire on an Android device?

What is payroll agreement lancashire?

Who is required to file payroll agreement lancashire?

How to fill out payroll agreement lancashire?

What is the purpose of payroll agreement lancashire?

What information must be reported on payroll agreement lancashire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.