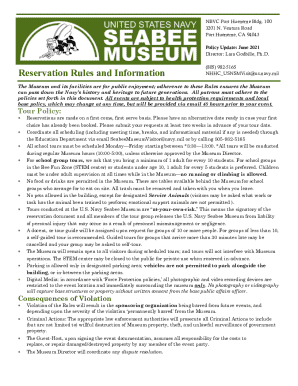

Get the free Money and Finding Financial Support

Get, Create, Make and Sign money and finding financial

How to edit money and finding financial online

Uncompromising security for your PDF editing and eSignature needs

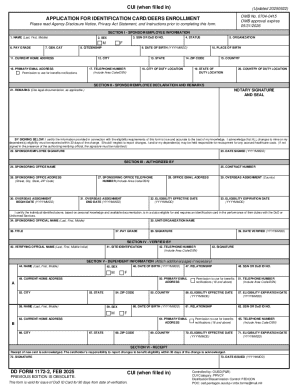

How to fill out money and finding financial

How to fill out money and finding financial

Who needs money and finding financial?

Money and Finding Financial Form: A How-to Guide

Understanding financial forms: The key to effective money management

Financial forms are structured documents that record, categorize, and analyze monetary transactions. The importance of financial forms cannot be overstated, as they facilitate effective budget planning, expenditure tracking, and overall financial management. Consider financial forms as the backbone of an organized financial life, enabling individuals to make informed decisions based on their economic circumstances.

Several types of financial forms are essential for anyone looking to streamline their money management process. Here are some key ones:

Setting financial goals: The foundation for your financial success

Establishing clear financial goals is crucial for successful money management. Goals provide direction and motivation, acting as the cornerstone for your financial planning. When your objectives are defined, it becomes easier to allocate resources effectively and measure your progress.

A proven method to set effective financial goals is the SMART Goals Framework, which advocates for goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. For example:

Utilizing an interactive Financial Goals Worksheet can further aid in this process by allowing you to visually plot your goals, making adjustments as needed and keeping you accountable.

Establishing and following a budget: Your roadmap to financial stability

Creating a personalized budget serves as your roadmap towards achieving financial stability. The first step is to calculate your income accurately, which includes your salary and any additional income streams. Next, listing your monthly expenses is paramount; this involves both fixed costs (like rent and insurance) and variable costs (like groceries and entertainment).

Another essential step is categorizing your expenditures into wants versus needs. This distinction helps you prioritize essential expenses over discretionary spending. Setting spending limits within each category enables you to adhere to your budget effectively.

To manage your budget effectively, tools such as budgeting templates on pdfFiller can simplify the process. Tracking your spending is equally vital; consider implementing monthly reviews of your budget to ensure you remain on track.

Building an emergency fund: Your financial safety net

An emergency fund acts as a financial safety net, providing you with peace of mind during unforeseen circumstances, such as a job loss or sudden medical bill. It’s essential to prioritize building this fund to avoid falling into debt when emergencies arise.

The general guideline is to save at least three to six months’ worth of living expenses in your emergency fund. However, the amount can vary based on individual circumstances. A good starting point is to assess your monthly outgoings and multiply that by three.

Helpful resources and calculators can assist you in visualizing your savings goals and organizing your pathway towards financial security.

Managing debt: Strategies for financial freedom

Understanding the complexities around debt is vital for achieving financial freedom. Different types of debt include credit card debt, student loans, personal loans, and mortgages, each having unique implications and management strategies.

Effective strategies such as the Snowball and Avalanche methods can help manage and eliminate debt. The Snowball method focuses on paying off the smallest debts first to build momentum, while the Avalanche method targets the highest interest rates first to minimize overall interest paid.

Using debt management forms can assist in organizing your debts. These forms can help you track your outstanding amounts and payment schedules, providing clarity and control over your financial obligations.

Reviewing insurance policies: Protecting your financial future

Insurance serves as a form of financial protection, which can safeguard you against catastrophic events. Evaluating your insurance policies regularly ensures that they meet your evolving needs.

There are various types of insurance to consider, such as health insurance, which covers medical expenses; disability insurance, which provides income replacement in case of incapacitation; and life insurance, which secures your dependents' financial future.

Evaluating your current policies regularly helps identify gaps in coverage. Tools for comparing insurance options are readily available, enabling side-by-side analysis of benefits and costs for informed decisions.

Planning for taxes: A crucial aspect of financial health

Tax planning is an integral part of your overall financial strategy. It involves understanding and applying tax regulations to optimize your financial situation and minimize liabilities.

Being aware of common tax deductions and credits can significantly reduce your taxable income. For instance, deductions for business expenses, educational expenses, and mortgage interest. Organizing your tax documents throughout the year facilitates a smoother filing process.

Digital tools help streamline tax form preparation, ensuring you’re capturing all applicable information efficiently.

Saving for retirement: Secure your financial future

Saving for retirement is essential for achieving financial independence and peace of mind in your later years. There are various retirement savings accounts available, such as 401(k), IRA, and Roth IRA, each with unique tax benefits and limitations.

The commonly suggested savings rate for retirement is to aim for at least 15% of your pre-tax income, though your target may vary based on individual retirement goals and lifestyle expectations.

Creating a retirement savings plan is imperative for building your future. Tools like a Retirement Savings Calculator can help assess how much you should save to meet your retirement goals.

Diversifying your savings: Maximizing your financial potential

Diversification is crucial for mitigating risk and enhancing financial growth. By spreading your investments across various asset classes—such as stocks, bonds, real estate, and mutual funds—you can protect your portfolio from significant losses.

Understanding different types of savings and investment options is key to making informed decisions. Engaging with an investment portfolio assessment tool can provide insights into your current investment mix.

By using tools to assess your investment portfolio, you gain a comprehensive understanding of where to reposition assets to enhance financial potential.

Creating an estate plan: Ensuring your wishes are honorably handled

Estate planning is crucial in ensuring that your assets are distributed according to your wishes upon your passing. It encompasses various financial considerations, including identifying heirs and managing debts.

Key documents are integral components of an estate plan, including a Will, which outlines asset distribution; a Trust, which can avoid probate; and a Power of Attorney, which designates someone to manage your affairs if you cannot. Understanding these documents can significantly impact how your assets are handled after your death.

To initiate estate planning, utilizing estate planning forms can streamline your process, and accessing legal assistance ensures that your documents are drafted correctly and in compliance with the law.

Interactive features and tools

Innovative tools available on pdfFiller can facilitate the management of your financial forms. The platform allows users to seamlessly edit, sign, and collaborate on documents in just a few clicks. This cloud-based platform significantly simplifies the document creation process, whether it's for budgets, estates, or tax filings.

Step-by-step instructions on editing and signing financial forms streamline the process further. Collaboration features allow teams to manage document workflows, ensuring an efficient process from creation to approval.

Summary of how to utilize financial forms effectively

Navigating the financial landscape can seem daunting, yet with structured financial forms, you can tackle all aspects of money management effectively. Understanding and applying the concepts from budgeting to estate planning enables you to clearly outline your financial journey.

With pdfFiller as your resource, creating, editing, and managing financial documents becomes an efficient and intuitive process. Ensure that you allocate time to review your financial forms regularly, adjusting as necessary to maintain a healthy financial outlook.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit money and finding financial online?

How do I fill out money and finding financial using my mobile device?

How do I fill out money and finding financial on an Android device?

What is money and finding financial?

Who is required to file money and finding financial?

How to fill out money and finding financial?

What is the purpose of money and finding financial?

What information must be reported on money and finding financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.