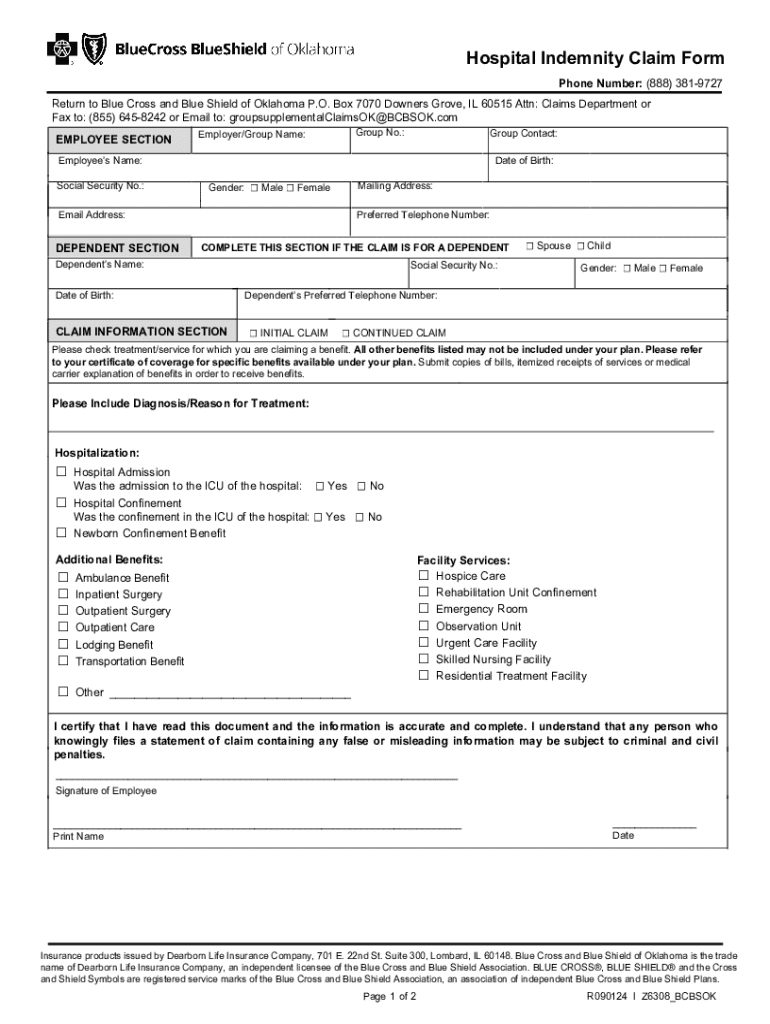

Get the free Hospital Indemnity Claim Form

Get, Create, Make and Sign hospital indemnity claim form

How to edit hospital indemnity claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hospital indemnity claim form

How to fill out hospital indemnity claim form

Who needs hospital indemnity claim form?

Hospital Indemnity Claim Form: A Comprehensive Guide

Understanding hospital indemnity insurance

Hospital indemnity insurance is a supplemental policy designed to provide financial support when you experience a hospital stay or specific medical procedures. Unlike standard health insurance, which covers a portion of your medical expenses, hospital indemnity insurance pays out predetermined benefits directly to you, regardless of other coverage. This safety net helps cover out-of-pocket costs like deductibles, co-payments, or other non-medical expenses that can accumulate during a hospital stay.

The importance of hospital indemnity in health planning cannot be overstated. Medical costs are often unpredictable; an unexpected hospitalization can strain your finances significantly. Hospital indemnity insurance serves as a buffer, ensuring you have quick access to cash when you need it most, allowing you to focus on recovery rather than financial burdens.

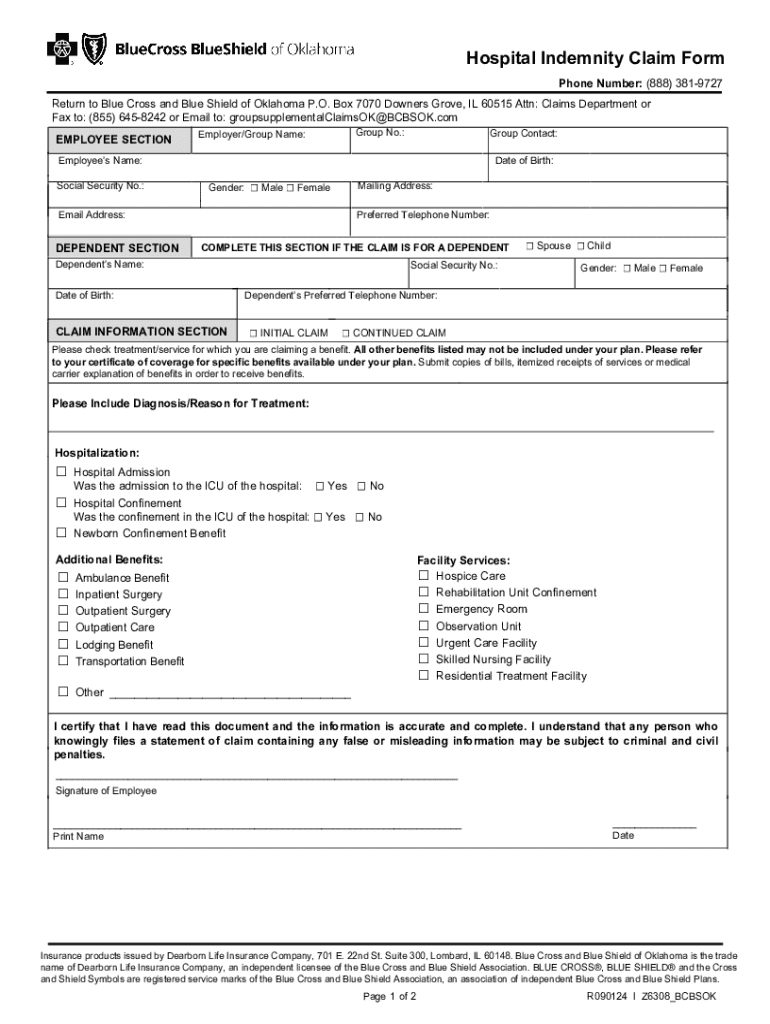

The role of the hospital indemnity claim form

The hospital indemnity claim form is crucial because it initiates the process for receiving your benefits. Filing your claim promptly can be imperative for securing much-needed financial relief. Delays in this process can result in unpaid bills and increased economic stress, particularly if you are already managing an unexpected medical situation.

Common scenarios when filing claims include inpatient hospital stays for surgeries, emergency room visits for acute incidents, and specialized treatments such as chemotherapy. Each of these situations can trigger a different set of benefits under your policy, and understanding which situations qualify for coverage can streamline the claims process considerably.

How to obtain the hospital indemnity claim form

Obtaining the hospital indemnity claim form is straightforward. The most reliable source is your official insurance provider's website. Here, you can find the latest forms tailored to your specific policy. Additionally, resources like pdfFiller provide an efficient platform to download and manage your documents, ensuring you have everything you need at your fingertips.

The claim form may come in different formats. While you're likely to find the typical PDF version on most insurance websites, pdfFiller also offers various accessibility options. Their platform supports easy document editing and electronic signature capabilities, allowing for a smooth claims process.

Step-by-step instructions for filling out the claim form

Before diving into the claim form, prepare by gathering all necessary documents and information. This typically includes your policy number, hospital discharge paperwork, and details surrounding the incident that prompted the claim. Use a checklist to verify that you have everything needed to avoid unnecessary delays.

Filling out the claim form involves several critical sections. Start with your personal information, ensuring accuracy—this includes your name, address, and insurance policy number. Then, detail the specifics of your claim such as dates of admission, types of services received, and the length of your stay. Confirm that all services rendered align with your policy to avoid complications.

To avoid common mistakes, double-check that all information is correct. Errors in dates or policy numbers can lead to unnecessary claim denials. Take your time filling out the form to ensure accuracy. Once satisfied, ensure you’ve signed where required.

Submitting your hospital indemnity claim

Submission of your hospital indemnity claim can be done through multiple methods. One of the most convenient is to file online via pdfFiller’s cloud-based platform, which also allows you to track the status of your claim. Alternatively, you can mail your completed form to your insurance provider; however, ensure you include proper postage and consider sending it via certified mail for tracking purposes.

Once you submit your claim, it’s essential to confirm receipt with your insurance provider. Usually, a claims representative will reach out to confirm they have received your information, allowing you to understand the next steps in terms of timelines and potential follow-ups.

Managing your claim status

Understanding the claims review process is critical to managing your expectations. Typical claim processing times can vary, often taking anywhere from a few days to several weeks, contingent upon the complexity of your claim and the completeness of the documentation provided.

Several factors can delay your claim, including missing documentation or policy exclusions. Thus, when you follow up with your insurance provider, it's wise to ask for specific details about your case, such as potential issues noted during the review process.

Addressing claim denials or delays

Claim denials can occur for a variety of reasons. Common issues include insufficient documentation, lack of coverage for a specific service, or errors in the claim form itself. Understanding why a claim has been denied is the first step in the appeals process.

If your claim is denied, you can appeal. Start by gathering all relevant documents and carefully read your insurance policy to identify the grounds for your denial. Following a structured appeals process, which may vary by insurance provider, is crucial. Strengthening your appeal often involves providing additional evidence or clarification about your situation.

Utilizing pdfFiller’s tools for claim management

pdfFiller offers a range of features designed to streamline document management, making it easier to navigate the intricacies of the hospital indemnity claim form process. With easy editing tools, you can fill out and adjust your claim forms quickly, ensuring accuracy before submission.

Additionally, pdfFiller enhances collaboration through its eSigning capabilities, allowing you to expedite the approval process for necessary documents. You can organize your health documents using pdfFiller’s platform, creating folders for different claims, making retrieval effortless and efficient.

Additional resources and support

When navigating health insurance claims, connecting with your insurance provider's customer service is vital. They can assist you with any questions regarding your claim, provide clarification on your policy's terms, or help resolve any issues you encounter. Seek out their contact methods for prompt assistance.

Understanding your rights as a policyholder is just as critical. Familiarizing yourself with your policy's terms and conditions ensures you are aware of the coverage limits and procedures in place. By arming yourself with knowledge, you empower yourself to advocate for your needs effectively.

Expert insights on hospital indemnity insurance

Engaging with industry professionals can provide valuable insights into best practices for managing your hospital indemnity claims. Experts often suggest understanding your policy deeply before a claim arises, which can prevent confusion during stressful times and ensure a smoother process.

Staying informed about trends in hospital indemnity insurance can also offer foresight into potential coverage changes. As healthcare policies evolve, staying connected with insurance experts can provide benefits and tips for optimizing your insurance use in an ever-changing landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the hospital indemnity claim form in Chrome?

Can I create an electronic signature for signing my hospital indemnity claim form in Gmail?

How do I fill out hospital indemnity claim form using my mobile device?

What is hospital indemnity claim form?

Who is required to file hospital indemnity claim form?

How to fill out hospital indemnity claim form?

What is the purpose of hospital indemnity claim form?

What information must be reported on hospital indemnity claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.