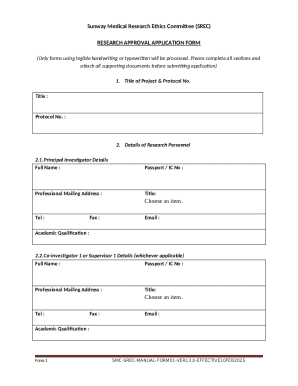

Get the free Final Notice

Get, Create, Make and Sign final notice

Editing final notice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out final notice

How to fill out final notice

Who needs final notice?

Understanding Final Notice Forms and How to Use pdfFiller Effectively

Understanding final notice forms

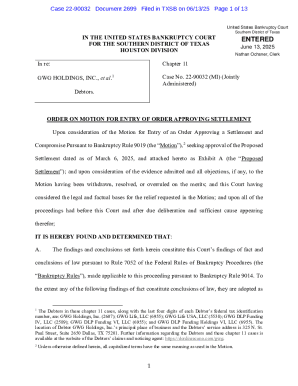

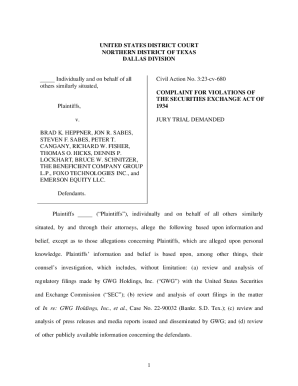

A final notice form serves as a critical communication tool for creditors dealing with overdue payments. This document marks the last attempt by a creditor to collect a debt before pursuing more formal action, such as legal proceedings or involving a collection agency. The significance of a final notice is profound, as it aims to convey urgency while maintaining professionalism. The sender must clearly articulate the issue at hand, ensuring the debtor comprehends the consequences of continued non-payment.

These forms are instrumental in setting clear expectations for both parties, providing the debtor with an opportunity to resolve the payment issue without escalating to potential litigation. A well-crafted final notice can help preserve relationships while emphasizing the importance of honoring financial commitments.

Key components of a final notice form

Every final notice form should include several essential elements to be effective. These components not only inform the debtor about the overdue payment but also clarify what steps need to be taken next.

Benefits of using pdfFiller for final notice forms

Using pdfFiller to create final notice forms offers significant advantages that streamline the otherwise cumbersome process of document creation. One of the standout features of pdfFiller is its intuitive interface that allows users to quickly generate professionally formatted final notice documents tailored to their needs.

Moreover, pdfFiller's cloud-based platform ensures that users can access their forms from anywhere, anytime, whether in the office or on the go. This remote access is particularly advantageous for teams handling multiple debtors, allowing synchronized efforts to manage outstanding payments effectively.

Collaborative features

Another essential benefit of pdfFiller is its collaboration tools. Teams can seamlessly work together on final notice forms, sharing comments, and edits in real-time. This collaborative approach not only enhances productivity but also ensures that the final notice content is accurate and reflective of any necessary stakeholder input.

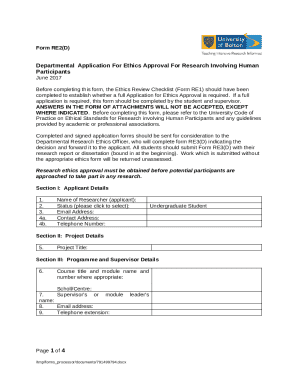

Step-by-step guide to filling out a final notice form

To effectively complete a final notice form using pdfFiller, start by gathering all necessary information related to the debt in question. This involves compiling not only creditor and debtor details but also the exact amount due and any specific conditions tied to payment.

Once you have the information at hand, navigate to pdfFiller, where you can select from customizable templates or create a form from scratch. pdfFiller's editing tools allow you to input text directly, adjust formatting, and even add checkboxes or dropdown menus for interactive elements.

Adding additional sections or notes

Practicality in communication is vital, especially in a final notice. Utilize pdfFiller’s features to add personalized messages or legal disclaimers, ensuring that the notice not only conveys urgency but also provides clear instructions on how to reconcile the debt. Customize these sections to suit the specific situation, reinforcing the necessity of addressing the issue promptly.

Managing final notice forms with pdfFiller

After generating a final notice using pdfFiller, managing the document effectively is crucial. One significant feature is the eSignature integration, which allows creditors to obtain necessary signatures electronically, expediting the process and eliminating delays associated with physical document exchange.

Furthermore, organizing and accessing past final notice forms is straightforward on the pdfFiller platform. The system automatically saves and indexes all documents, making it easy to retrieve previous notices for reference or follow-up. Being able to track responses and payments directly through pdfFiller provides a clear picture of outstanding debts and facilitates timely follow-up actions.

Common mistakes to avoid when sending a final notice

Crafting a final notice demands precision. One common error to avoid is including inaccurate information, which can undermine the document's credibility and lead to misunderstandings. Double-check all debtor details, amounts due, and due dates before dispatching the notice to ensure clarity and correctness.

Another crucial aspect is the clarity of language. Avoid legal jargon that might confuse the recipient. Instead, articulate the message clearly, outlining the consequences of non-payment in straightforward terms. Additionally, it’s vital to remain aware of the legal requirements governing final notices in your jurisdiction to avoid any pitfalls that might arise from non-compliance.

Frequently asked questions about final notice forms

When dealing with final notice forms, several questions often arise. One common inquiry is what action a creditor can take if the recipient ignores the final notice. Typically, the next steps may involve escalating the matter to a debt collection agency or filing a claim in civil court.

Another frequently asked question pertains to the customization of final notice forms. pdfFiller enables users to tailor their final notices extensively, allowing for variables to be adjusted according to individual circumstances. After a final notice is sent, creditors often wonder about best practices for following up. Regular communication is essential, whether through additional notices or direct contact, ensuring that the debtor is aware of their obligations.

Real-world examples of effective final notice usage

Businesses frequently share experiences where well-structured final notice forms yielded successful outcomes. Consider a small business that used a final notice form as a last resort to address unpaid invoices. By clearly outlining the debt, the due date, and potential legal actions, they prompted several clients to complete their payments promptly and avoid further escalation.

Analysis of their approach reveals not only the importance of clarity in communication but also the ethical responsibilities involved. Maintaining professionalism throughout the debt collection process is essential to preserving client relationships, even during disputes. Ethical considerations can guide creditors in adopting a compassionate approach while ensuring that contractual obligations are met.

Related topics and further reading

It's essential to consider broader themes surrounding the issuance of final notice forms. For instance, managing client relationships during payment delays requires a balance between asserting one's rights as a creditor and understanding the debtor's challenges. Effective communication strategies can alleviate tension and foster goodwill, especially in prolonged cases of deferred payments.

Additionally, businesses often analyze the financial impact of delayed payments. Such insights can help formulate strategies to mitigate risks associated with late payments, including adjusting credit terms, implementing early payment discounts, or employing advanced invoicing practices. These practical lessons can help organizations avoid reliance on final notice forms as a regular tool and instead promote a cash-flow-positive culture.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit final notice online?

How do I make edits in final notice without leaving Chrome?

Can I create an eSignature for the final notice in Gmail?

What is final notice?

Who is required to file final notice?

How to fill out final notice?

What is the purpose of final notice?

What information must be reported on final notice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.