Get the free Vic Tax Forum

Get, Create, Make and Sign vic tax forum

Editing vic tax forum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vic tax forum

How to fill out vic tax forum

Who needs vic tax forum?

A Comprehensive Guide to the Tax Forum Form

Overview of the Tax Forum Form

The Vic Tax Forum Form serves as a crucial document for taxpayers in Victoria, Australia. It is designed to facilitate communication between taxpayers and the state tax authorities, ensuring compliance with local tax regulations. By collecting comprehensive information about taxpayer's financial situations, this form plays a significant role in the tax filing process.

The importance of the Vic Tax Forum Form lies not only in ensuring that taxpayers meet their legal obligations but also in aiding the administration of fair tax assessments. Submitting this form can prevent miscommunication, minimize the risk of penalties, and streamline the overall taxation process.

Key features

This form is designed with accessibility in mind. Taxpayers can easily fill it out online, making it convenient for individuals and businesses alike. Moreover, the Vic Tax Forum Form's compatibility with local tax laws ensures that all submissions reflect current regulations, further enhancing its efficacy.

Understanding the importance of proper form completion

Completing the Vic Tax Forum Form accurately is of utmost importance. Inaccurate or incomplete submissions can lead to significant consequences, including potential penalties and fines. The Australian Taxation Office has strict guidelines in place, and failing to adhere to them can result in legal troubles.

On the flip side, submitting accurate information brings numerous benefits, such as timely processing of your tax return and faster receipt of any eligible refunds. It also reduces the likelihood of follow-up queries from the tax office, allowing taxpayers to focus on other essential matters.

Step-by-step guide to filling out the Tax Forum Form

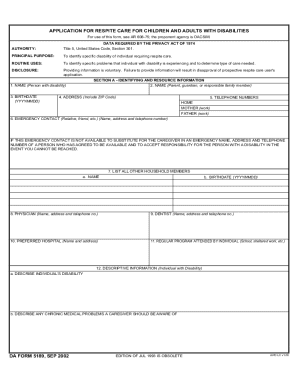

Preparing your documentation

Before diving into the form, it's vital to gather all necessary documents. This includes identification proofs such as your driver's license, passport, or any official identification accepted by the authorities. Additionally, you'll need various income statements, especially if you have multiple income sources.

Organizing your information in advance can save time and prevent stress later. Create a checklist of the documents you need to ensure you don’t miss anything important.

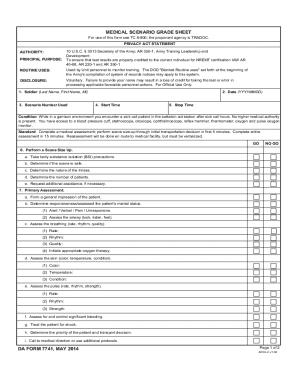

Completing the form

Filling out the Vic Tax Forum Form is a systematic process. Start with the Personal Information section, where accuracy is paramount. Ensure your name, address, and contact details are correct to avoid any potential issues.

Next, accurately report your income. Common income types include salaries, self-employment income, and any investment earnings. Following this, list deductions and credits. Familiarize yourself with common deductions applicable in Victoria, such as work-related expenses, to maximize your eligible claims.

Finally, ensure that all sections are completed before submission. A thorough review of your completed form will help you catch any mistakes or omissions.

Reviewing and editing the form

Reviewing your form is essential to avoid errors that could lead to complications. Create a checklist of common errors, such as incorrect figures or missing information, to assist in this process.

Utilizing pdfFiller's editing tools can simplify this review process, allowing you to collaborate effectively. Features like comments and suggestions facilitate team input, ensuring the document is polished before submission.

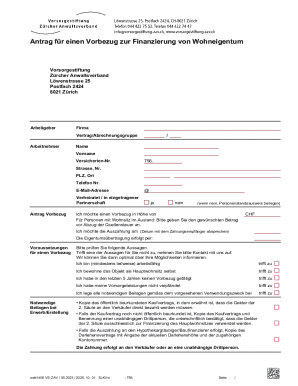

Electronic signing and submission process

The digital age has transformed document submission, and the Vic Tax Forum Form is no exception. Utilizing electronic signing can significantly speed up the process and enhance convenience compared to traditional methods.

With pdfFiller, eSigning is straightforward. Begin by uploading your completed Vic Tax Forum Form to the platform. Once uploaded, navigate to the eSigning function, where you can add your digital signature effortlessly.

After signing, follow the simple submission process through pdfFiller, ensuring that the form is sent to the appropriate state tax authorities promptly.

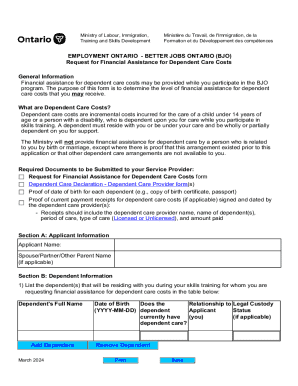

Collaborative features for teams

The Vic Tax Forum Form can be efficiently managed within teams thanks to pdfFiller's robust collaborative features. Team members can collectively edit the form, providing real-time feedback and comments, which promotes a cohesive approach to documentation.

Assigning specific tasks to team members allows for effective progress tracking, ensuring that all responsibilities are clearly delineated. This feature is invaluable during peak tax season when collaboration and organization are paramount to meeting deadlines.

Managing your submitted form

After submitting your Vic Tax Forum Form, it's vital to track its status to ensure it has been received and processed. Tools provided by pdfFiller can assist in monitoring the progress of your submission, helping alleviate any concerns regarding its status.

If there are follow-up steps required post-submission, be proactive. Familiarize yourself with common queries that may arise and know your contact points for assistance should any issues occur.

Additional tools and resources

pdfFiller offers a suite of interactive tools to enhance your tax preparation process. Among these are calculators for deductions and exemptions that can aid in maximizing your tax benefits.

For deeper insights, accessing external resources such as official Victorian government websites and tax forums can provide ongoing guidance on tax regulations. Staying informed about changes in tax law is essential for all taxpayers.

Updates and trends in taxation for Victoria

Taxation is an ever-evolving landscape, and staying updated on changes can significantly impact your submissions. Recent legislative updates affecting the Vic Tax Forum Form may lead to required adjustments in how to report certain income types or claim deductions.

Keep an eye on upcoming taxation events and seminars in Victoria. These gatherings offer opportunities to gain insights from tax professionals and engage in discussions about compliance and best practices. Resources for ongoing learning will ensure you remain compliant with the latest regulations.

Best practices for future tax filings

Efficient record keeping is paramount for smooth future tax filings. Organize your financial documents systematically and maintain digital backups of essential files to streamline your preparation process.

Additionally, setting reminders for tax deadlines can help you avoid last-minute stress. Incorporate tax planning into your financial strategy to ensure every aspect of your tax obligations is considered, allowing you to navigate the complexities of the Vic Tax Forum Form with greater ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my vic tax forum in Gmail?

How do I edit vic tax forum straight from my smartphone?

Can I edit vic tax forum on an iOS device?

What is vic tax forum?

Who is required to file vic tax forum?

How to fill out vic tax forum?

What is the purpose of vic tax forum?

What information must be reported on vic tax forum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.