Understanding Russia Withholding Tax and Form Requirements

Understanding withholding tax in Russia

Withholding tax is a critical component of the tax regime in Russia, serving as a means for the government to collect taxes at the source of income. This tax is deducted from payments made to both domestic and foreign entities and typically applies to specific types of income such as dividends, royalties, and interest. For international businesses, understanding withholding tax is essential since it directly affects the profitability of cross-border transactions.

The Russian tax system is characterized by its complexity and numerous regulations. This complexity differentiates it from other jurisdictions, where tax structures might be more streamlined. Within this framework, withholding tax plays a fundamental role in ensuring tax compliance and revenue generation for the state, thereby impacting multinational enterprises significantly.

Types of payments subject to withholding tax

Several categories of income incur withholding tax obligations in Russia. The most notable include interest payments, dividend distributions, and royalties from the use of intellectual property. Additionally, transactions involving the sale of property and certain other incomes are also subject to withholding tax requirements.

For example, when a foreign company receives dividends from a Russian entity, it must adhere to local withholding tax regulations, which can significantly cut into the expected revenue. Furthermore, royalties paid for the use of patents or trademarks often attract different withholding tax rates depending on specific circumstances or agreements.

Interest payments: Typically subject to standard withholding tax rates.

Dividends: Often face higher withholding tax, varying by ownership stakes.

Royalties: Subject to varying tax rates based on usage rights.

Sale of property: Depending on asset nature and transactions.

Foreign companies and withholding tax: An increased burden

Foreign entities operating in Russia often face an increased financial burden due to withholding taxes. Unlike domestic companies, which may benefit from more straightforward tax conditions, international businesses must navigate a tangled web of tax regulations, making their accounting processes more complicated and costly. Withholding taxes can reduce net income drastically for foreign firms engaging with Russian counterparties.

This discrepancy can lead to significant tax liabilities for international businesses, affecting their overall investment decisions and financial strategies in the Russian market. Often, foreign companies must also account for any associated transfer pricing regulations that may impact income allocations, further complicating their tax compliance efforts.

The role of tax treaties

Tax treaties play a vital role in mitigating the impact of withholding taxes on foreign entities. Russia has entered into numerous treaties designed to avoid double taxation and reduce withholding tax rates on specific income types. Understanding the nuances of these treaties is crucial for businesses looking to optimize their tax obligations.

Typically, these treaties can significantly lower the withholding tax rates for dividends, interest, and royalties, allowing businesses to retain more income. However, to benefit from such reductions, companies must comply with specific procedures, including providing the necessary documentation to the Russian tax authorities.

Review relevant tax treaties before proceeding with transactions.

File the proper requests for treaty benefits in advance.

Prepare documentation such as the certificate of residency to substantiate claims.

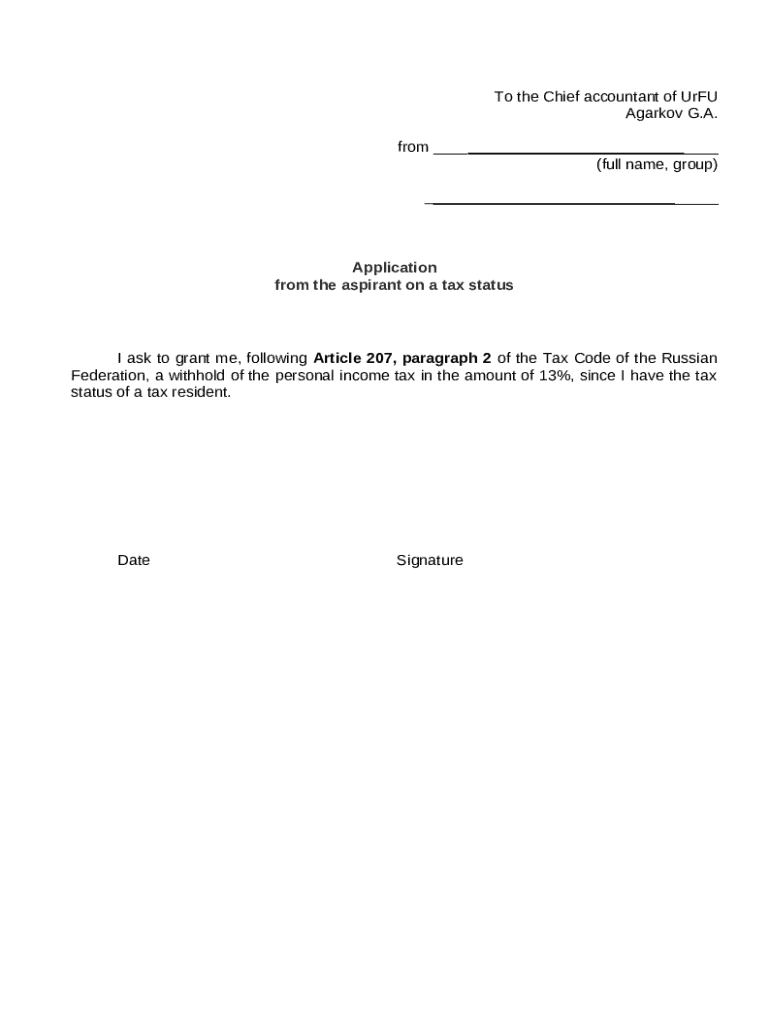

Necessary paperwork and compliance

Complying with withholding tax regulations requires meticulous attention to detail regarding paperwork and documentation. Foreign entities must be aware of the specific forms that are required when reporting and remitting withholding taxes. This includes forms that detail the amounts subject to withholding and the rates applied.

Filing these forms accurately and on time is imperative. Not adhering to deadlines can result in penalties or increased tax liabilities. Utilizing tools like pdfFiller can streamline this process, ensuring that forms are correctly filled, signed, and submitted while also keeping original documents organized and easily accessible.

Form 050310: Required for reporting payments subject to withholding tax.

Certificate of residency: Necessary for tax treaty benefit claims.

Documentation evidencing the nature of payments and agreements.

The process: Steps to submit withholding tax forms

Successfully navigating the withholding tax submission process involves several systematic steps. First, companies must prepare the relevant forms accurately, ensuring that every detail aligns with the actual payments made. Employing best practices in documentation will mitigate errors and potential issues.

Once the forms are prepared, they need to be submitted to the appropriate Russian tax authority. Follow-up is also crucial; businesses should confirm receipt of their submission and verify acceptance. Keeping meticulous records of submissions allows for quick resolutions in case discrepancies arise.

Gather all necessary documentation before filling out the forms.

Double-check figures and information to ensure accuracy.

Submit forms electronically to streamline processing.

Monitor your submission status following submission.

Common challenges and how to overcome them

Foreign companies often face common challenges when dealing with withholding taxes, such as misunderstanding local tax regulations and making documentation errors. These issues can lead to unexpected financial liabilities that can affect overall business strategies.

To mitigate these challenges, seeking professional guidance can be invaluable. Tax consultants familiar with the Russian landscape can provide insights into the complexities of compliance and offer practical solutions tailored to specific business needs, enhancing overall tax efficiency.

Engage tax experts to clarify complex regulations.

Utilize technology for accurate document management.

Continuous education on changes in withholding tax laws.

Advantages of using pdfFiller for withholding tax documentation

pdfFiller serves as an exceptional resource for managing withholding tax documentation. Through its cloud-based platform, users can create, edit, and store relevant documents efficiently, ensuring compliance without the chaos of physical files. Real-time collaboration features and eSigning capabilities help streamline the entire process.

The ability to access documents from anywhere enables teams to remain productive and responsive to filing deadlines, which is essential in today’s fast-paced business environment. This flexibility transforms the often daunting task of tax compliance into a manageable and straightforward process.

Our expertise in tax documentation

At pdfFiller, we understand the intricacies of tax documentation and compliance as they relate to international clients. We offer services tailored to aid businesses in managing their withholding tax obligations efficiently. Our solutions help users create accurate forms in line with local requirements, reducing the potential for costly errors.

Feedback from our clients speaks volumes about the usability and effectiveness of our platform. Businesses have found success in navigating the complexities of taxation by leveraging our document management features, which alleviate administrative burdens and foster focus on core business activities.

Additional considerations for international tax compliance

For businesses operating globally, staying updated on tax regulations is vital. The Russian tax landscape can shift, highlighting the need for companies to regularly review changes in laws to remain compliant. Cultivating a proactive approach will safeguard against unexpected liabilities and ensure continued operational effectiveness.

Future trends in taxation suggest potential shifts in withholding tax rates and compliance requirements, driven by broader economic conditions and international agreements. Awareness of these trends will help businesses adapt strategies accordingly, enabling them to remain competitive in the evolving landscape.