Get the free Certificate of Refund Under Sgst and Cgst Act

Get, Create, Make and Sign certificate of refund under

How to edit certificate of refund under online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of refund under

How to fill out certificate of refund under

Who needs certificate of refund under?

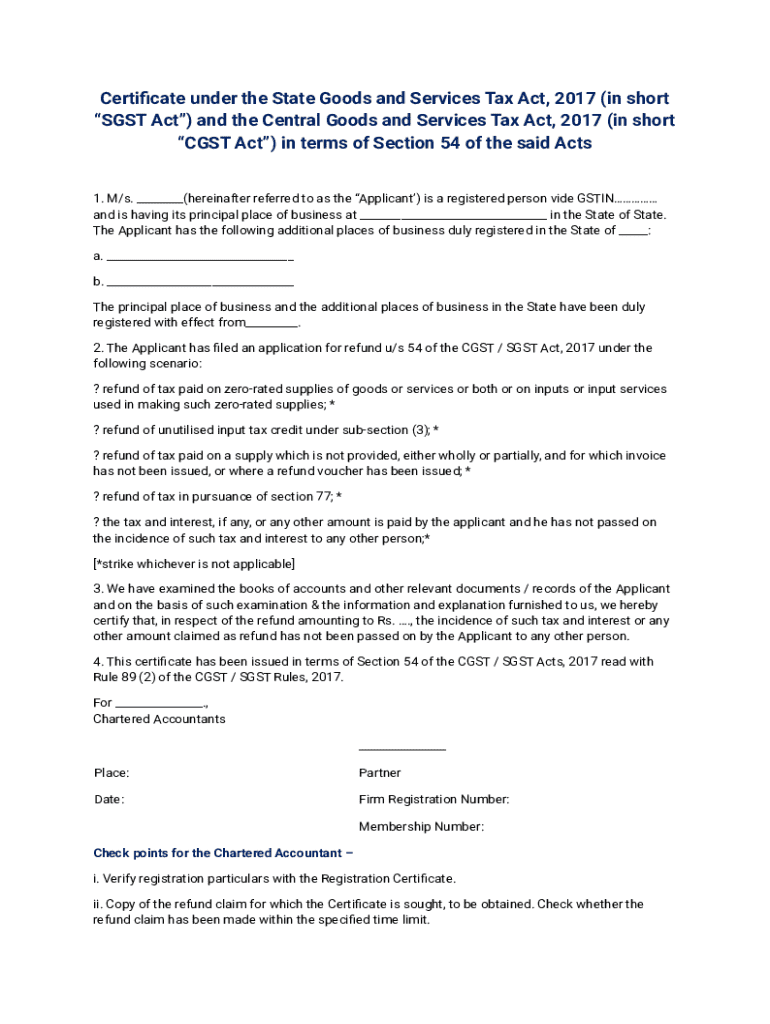

Understanding the Certificate of Refund Under Form

Understanding the Certificate of Refund

A Certificate of Refund is an official document issued to confirm the amount reimbursed to an individual or business. It serves as proof that a refund has taken place, documenting the transaction for both the issuer and the receiver. This certificate is crucial for individuals and organizations alike due to its role in record-keeping, tax reporting, and customer satisfaction.

The importance of a Certificate of Refund cannot be understated. For individuals, it often signifies tax refunds or cash rebates, providing clarity and proof of financial transactions. Businesses rely on these certificates to maintain financial integrity, ensuring accurate accounting practices and customer trusts. Without this documentation, individuals and organizations may struggle to validate their financial records.

Who issues the certificate?

Various authorities can issue a Certificate of Refund. Common issuers include governmental agencies, financial institutions, and corporations, each handling refunds pertinent to their operations. For instance, tax authorities may issue certificates for income tax returns, while corporations might provide them for product returns or service cancellations.

Types of refunds covered under this certificate can range widely, including tax refunds, service cancellations, overpayment reimbursements, and more. Understanding which authority issues these certificates is essential for ensuring that the document adheres to applicable regulations and requirements.

Key components of a certificate of refund

A well-structured Certificate of Refund comprises several essential components that ensure its validity and recognition. The certificate title clearly indicates its purpose, typically labeled as 'Certificate of Refund'. Following this, identification of the refundee must be accurately documented, usually including the name and contact information of the individual or business receiving the refund.

Issuer details must also be included, providing clarity on who is responsible for the refund. The amount of refund must be clearly stated in numerical and written form, alongside the date of issuance. Each of these elements is crucial for creating a comprehensive document.

Accurate information is paramount; discrepancies can lead to reduced trustworthiness of the document. Misrepresentations in the refund amount or mislabeling the issuer can complicate future claims or audits, emphasizing the need for diligence during preparation.

Preparing to fill out the certificate

Proper preparation is essential for completing a Certificate of Refund accurately. Key documentation must be gathered beforehand, including the required personal identification, such as a government-issued ID, and any related financial documents that substantiate the refund request. This preparation not only simplifies the process but also ensures compliance with tax regulations and refund policies.

Common mistakes arise when individuals rush through the form. Incomplete forms can lead to processing delays, while missing signatures or dates can invalidate the document. Furthermore, errors in the recorded amounts can not only complicate the refund process but also lead to wastage of time and resources. Paying attention to details while completing the certificate can significantly streamline the process.

Step-by-step instructions for completing the certificate of refund

To efficiently complete a Certificate of Refund, a section-by-section guide is invaluable. Begin by filling out personal information accurately, including the full name and address of the refundee. Next, detail the issuing authority—this is vital for tracing the origin of the refund. The amount of the refund should be spelled out in both digits and words to prevent misunderstandings.

In different scenarios, the requirements may vary. For instance, an individual claiming a tax refund may require different additional information than a business seeking reimbursement for overpayment. Special cases, such as those involving tax refunds, generally necessitate the inclusion of tax identification numbers or previous tax filings.

Editing and signatures

Editing a Certificate of Refund to ensure clarity has never been easier with tools such as pdfFiller. Users can upload their completed form and make real-time edits to any section that requires revision. The platform provides features such as annotations and notes, allowing one to highlight specific information needing further attention or clarification.

eSigning is another essential aspect of finalizing the document. Legal compliance is crucial when it comes to signatures, and understanding e-signature laws ensures that your signature holds validity in legal contexts. Make sure to comply with regulations that govern electronic signatures in your jurisdiction to prevent any issues.

Submitting the certificate of refund

Once you have completed and signed your Certificate of Refund, the next step is submission. Depending on the issuing authority's requirements, certificates can often be submitted in two ways: direct submission or through online portals. Each method can differ in processing times, with online submissions typically being quicker due to reduced paperwork.

Tracking the status of your refund post-submission can save you time and anxiety. Many issuing authorities provide online tracking tools, allowing you to follow up on your submission or check processing timelines. Regularly monitoring your refund status can ensure you are informed about any issues that might arise.

Troubleshooting common issues

When issues arise, it's essential to know how to troubleshoot effectively. One of the most frequently asked questions concerns the denial of certificates. If your certificate is denied, the first step is to review the reason provided and ensure that errors are corrected promptly. Developing a clear understanding of why a certificate might be rejected can help prevent similar pitfalls in the future.

If you've submitted a certificate and later discover errors, act quickly to correct them. Contact the issuing authority to understand the procedure for making amendments and follow their guidelines carefully. For added support, seek out customer service or help desks associated with the issuing agency.

Additional tips for managing your refund documents

Managing your refund documents efficiently can save time and ensure accountability. Keeping documents organized is crucial; create a clear filing system for both digital and physical records. This allows you to easily retrieve information when needed, especially during tax season or financial audits. A disciplined approach to document management reduces the risk of misplaced information that could lead to potential financial discrepancies.

Utilizing tools like pdfFiller enhances your document management capabilities. With features designed to track and manage multiple forms seamlessly, you can adjust workflows or collaborate with team members for better results. By harnessing the power of the right tools, you can streamline processes and ensure that you maintain an organized and efficient approach to document management.

Conclusion

Understanding the Certificate of Refund under form is pivotal for both individuals and businesses seeking refund documentation. From knowing who issues the forms and what key components are necessary to managing your documents effectively, each aspect plays a vital role in ensuring a smooth refund process. Relying on tools like pdfFiller can significantly enhance the experience by allowing users to edit, collaborate, and manage their certificates efficiently.

The organization and accuracy of your refund documents can streamline financial interactions. By leveraging the functionalities of pdfFiller's platform, you can ensure that you not only manage your Certificate of Refund optimally but also enhance your overall workflow. Embrace efficient document management today for a stress-free refund experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in certificate of refund under without leaving Chrome?

Can I create an eSignature for the certificate of refund under in Gmail?

How do I complete certificate of refund under on an iOS device?

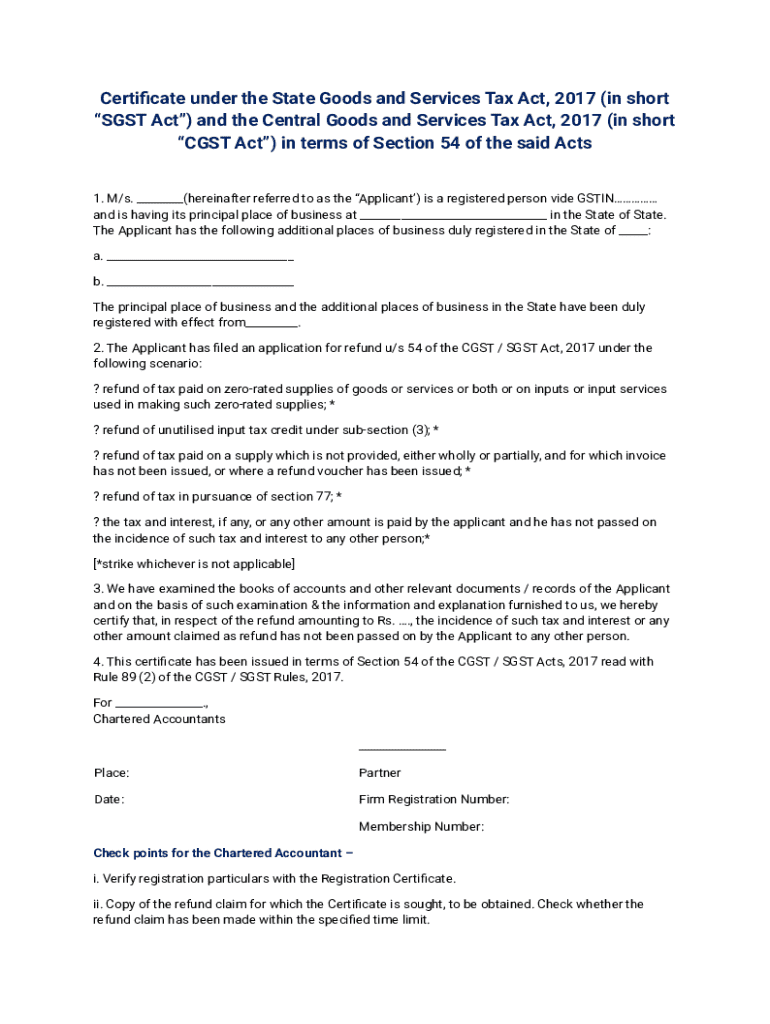

What is certificate of refund under?

Who is required to file certificate of refund under?

How to fill out certificate of refund under?

What is the purpose of certificate of refund under?

What information must be reported on certificate of refund under?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.