Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

How to Fill Out Form 8-K: A Comprehensive Guide

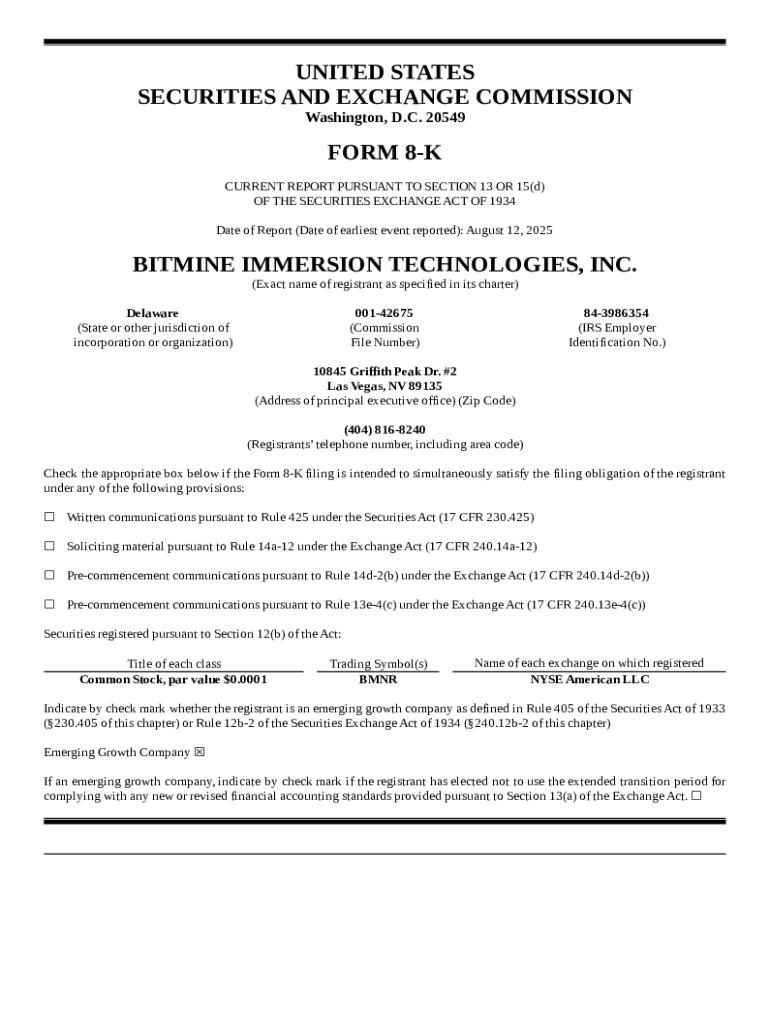

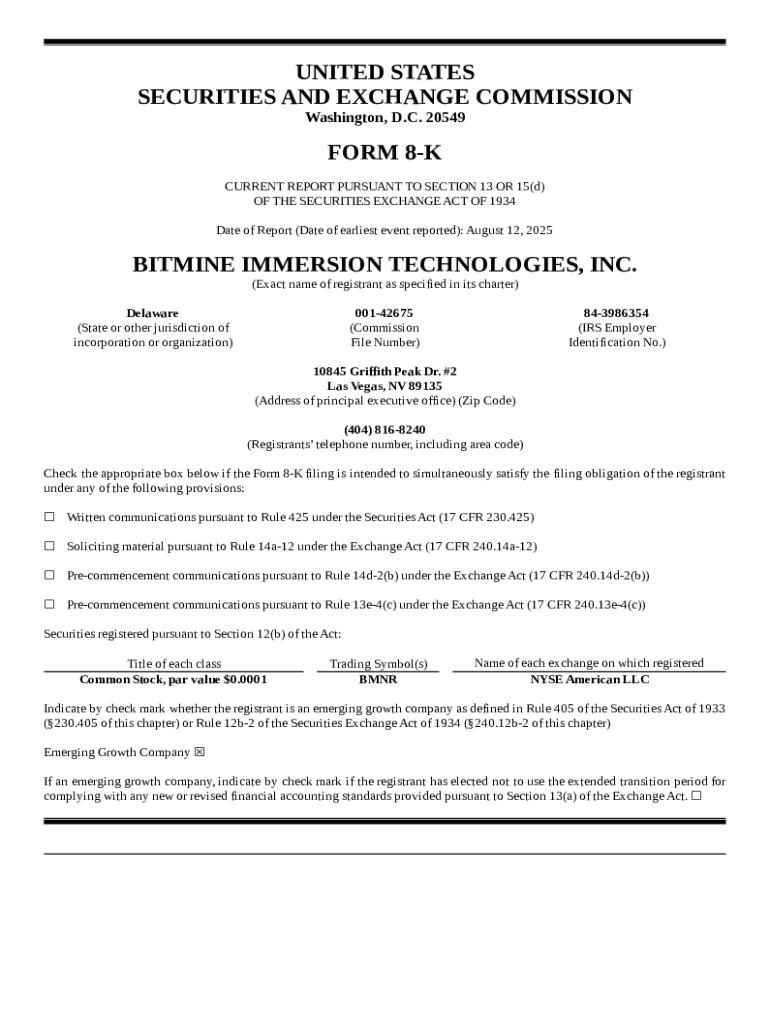

Understanding Form 8-K

Form 8-K is a crucial document for public companies, serving as a means for timely disclosure of significant corporate events. It is mandated by the U.S. Securities and Exchange Commission (SEC) to ensure that all material information affecting a company's stock price is accessible to investors.

The importance of Form 8-K lies in its role in promoting transparency. By requiring companies to divulge major developments, this form helps maintain a level playing field for all investors, as it ensures that everyone has equal access to potentially market-impacting information.

When is Form 8-K required?

Form 8-K must be filed in a variety of circumstances, primarily those that might have a significant impact on a company's stock value. Triggers for filing include major corporate events such as mergers, acquisitions, the departure of key executives, or financial disclosures indicating significant financial distress.

Additionally, any changes in auditors or amendments to financial agreements can require a Form 8-K. Understanding these triggers is vital for compliance, as failing to report these events can lead to severe penalties from the SEC.

Timeliness is crucial when filing a Form 8-K, as it underscores a company's commitment to transparency. Typically, filings must be made within four business days from the event.

Benefits of filing Form 8-K

Filing Form 8-K provides several key benefits. It enhances investor communication by ensuring that stakeholders are informed about essential events. By disclosing material changes promptly, companies build trust with their investors, potentially boosting their stock value.

Moreover, adhering to SEC regulations by timely filing helps mitigate risks of enforcement actions or penalties, thus maintaining the company's reputation.

Step-by-step guide to filling out Form 8-K

Filling out Form 8-K requires careful preparation and attention to detail. Here’s a structured approach to ensure accurate completion.

Start by gathering all necessary documents and information related to the event. Identifying the applicable Item number is critical, as this directly influences the required disclosures.

Prior to submission, it’s essential to review your filing meticulously. Proofreading can help avert mistakes that may lead to regulatory scrutiny.

Submitting your Form 8-K

Form 8-K submissions can be made electronically through the SEC's EDGAR system. Utilizing eXtensible Business Reporting Language (XBRL) enhances the accuracy and efficiency of electronic filings.

For those who need to submit physical copies, traditional methods are available, though they are less common. Always seek confirmation of your filing to ensure it has been successfully submitted. In case of errors, errata procedures are in place to correct mistakes.

Common mistakes to avoid when filing Form 8-K

Avoiding pitfalls in the filing process is crucial for maintaining compliance. One common mistake is submitting incomplete disclosures. Full transparency is essential to evade regulatory scrutiny from the SEC.

In addition, missing deadlines is a frequent oversight that can lead to severe penalties. Lastly, incorrectly choosing item numbers can result in inaccurate or incomplete filings, undermining the integrity of the disclosure.

Frequently asked questions about Form 8-K

Understanding who is required to file Form 8-K is essential for compliance. All publicly traded companies are mandated to file when significant events occur.

Failure to file can result in penalties, including potential legal actions and reputational damage. Amendments to filed forms can be made under certain circumstances, allowing companies to correct or clarify disclosures.

Staying updated on Form 8-K regulations

The landscape of SEC compliance requirements evolves over time, and staying informed is crucial for accurate filing. Regularly reviewing SEC updates and guidance ensures that your company adheres to best practices for disclosures.

Several industry publications and online resources provide valuable insights regarding trends and changes related to Form 8-K filings. Engaging with these resources can enhance your understanding and ability to comply with evolving regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 8-k online?

Can I sign the form 8-k electronically in Chrome?

Can I edit form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.