Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A Comprehensive How-to Guide

Understanding form 10-q

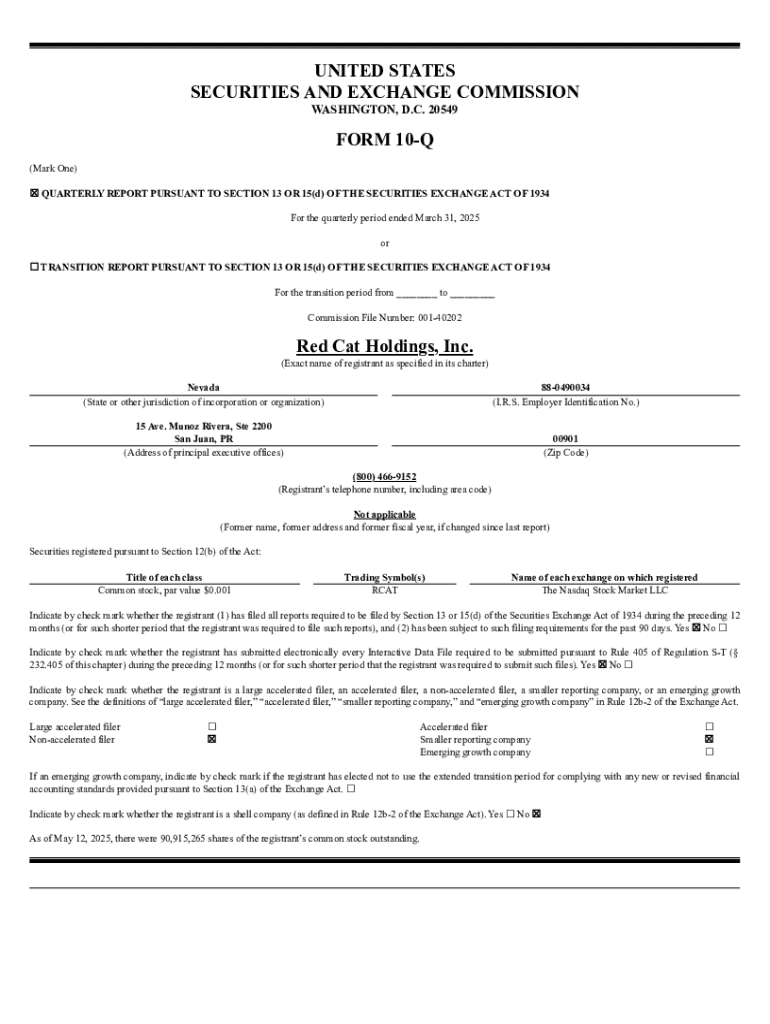

Form 10-Q is a quarterly report mandated by the U.S. Securities and Exchange Commission (SEC) that provides a comprehensive overview of a public company's financial performance. Unlike the annual Form 10-K, the 10-Q offers a timely, in-depth analysis of a company's operations without the extensive detail required for the annual filing.

The primary purpose of the form is to enhance transparency and inform investors about the company's financial position, performance, and changes in its operational outlook. For public companies, timely compliance with the requirements of the Form 10-Q is crucial not only for maintaining investor confidence but also for meeting regulatory standards.

Comparatively, while Form 10-K provides a broader annual overview including detailed management discussions, audited financial statements, and risks, the Form 10-Q focuses on a more immediate snapshot of financial performance with unaudited data, thus creating a clearer view of ongoing operational changes and financial health.

Structure of a form 10-q

A Form 10-Q typically consists of several key sections that provide crucial insights into the company's financial dynamics. The main sections include the financial statements, management's discussion and analysis (MD&A), legal proceedings, and controls and procedures. Each of these sections serves to provide a different aspect of the company's financial landscape.

Each item within these sections plays a vital role in understanding not only the financial health of a company but also the efficiency of its operations. Investors particularly focus on the MD&A as it outlines future outlooks and management strategies, which can heavily influence investment decisions.

Filing requirements and deadlines

The SEC regulations stipulate that public companies must file Form 10-Q within 45 days after the close of each fiscal quarter. This timeline ensures that investors receive timely updates on company performance. For companies with fiscal years aligning with the calendar year, their quarterly filings must be submitted for the first three quarters of the year, while the fourth quarter's information is incorporated into the annual Form 10-K.

Failure to submit a Form 10-Q by the designated deadlines can lead to significant consequences, including penalties from the SEC, loss of investor confidence, or even delisting from stock exchanges. Therefore, it’s crucial for companies to maintain rigorous compliance systems to ensure all reporting deadlines are met.

How to prepare and file a form 10-q

Preparing Form 10-Q can seem daunting, but breaking it down into manageable steps simplifies the process significantly. The first step involves gathering all financial data from various departments such as accounting, finance, and legal, ensuring accuracy and completeness.

Next, drafting the Management's Discussion and Analysis (MD&A) is essential. This section should reflect the management's insights on financial statements and market position, thus providing a storyline that links data with the company's strategic goals. It is crucial to articulate any significant changes in operations, prospective risks, or market conditions that might influence the company's financial future.

Utilizing tools such as pdfFiller can streamline the preparation process. The platform’s features allow teams to collaborate effectively, ensuring that all necessary documents are in order. The eSigning capabilities also ensure compliance by providing a verifiable method of securing approvals on required documents.

Common mistakes to avoid when filing form 10-q

When preparing a Form 10-Q, there are several common pitfalls that companies should avoid. One major mistake is submitting incomplete financial statements. Accurate and fully populated financial statements are essential for providing a true picture of the company's financial health and can protect against regulatory scrutiny.

Moreover, missing required disclosures is another prevalent issue that can lead to compliance violations. All risk factors and relevant contingencies must be disclosed in the 10-Q; failure to do so can invoke serious regulatory penalties. Additionally, a lack of coordination between different departments involved in the filing process can result in inconsistencies and inaccuracies.

Accessing and reviewing form 10-q filings

Investors and analysts can access Form 10-Q filings easily through various platforms. The SEC’s EDGAR database is a primary resource for obtaining these filings. Additionally, many public companies provide links to their quarterly reports directly on investor relations (IR) pages on their websites, making it convenient for stakeholders to stay informed.

Analyzing the data within Form 10-Q reports is vital for making informed investment decisions. Key financial metrics to consider include revenue growth, operating income, net earnings, and cash flow. While positive indicators are essential, it's equally critical to keep an eye out for red flags such as declining revenues, increased liabilities, or adverse legal proceedings, as these might signal underlying issues within the company.

Interactive tools for managing form 10-q

Modern digital tools can significantly simplify the management of Form 10-Q filings. pdfFiller offers a host of interactive features designed to assist with the creation and filing process. Their templates for the Form 10-Q are customizable, allowing users to input their specific company details while maintaining regulatory compliance.

Version control and document management features enable teams to stay organized as they prepare their filings. Additionally, the cloud-based access ensures that stakeholders can collaborate in real-time, irrespective of their locations. These capabilities lead to better communication and accuracy, ultimately resulting in a more efficient filing process.

Navigating potential issues with form 10-q

While preparing Form 10-Q, companies may encounter various compliance challenges. Common issues include discrepancies in financial reporting and failure to adapt to changing regulations that govern reporting requirements. Companies must ensure they have robust internal controls in place to manage compliance effectively.

In instances where a company faces inquiries from the SEC, immediate action and clarity of communication are essential. It is advisable to have legal counsel ready for guidance in such situations to navigate potential audits or compliance checks. Resources such as regulatory guidelines and professional consultations can provide invaluable support in ensuring adherence to SEC requirements.

Future of form 10-q filings

The landscape of financial reporting is evolving, with a notable shift towards more integrated and technology-driven solutions in documenting and filing forms like the Form 10-Q. Emerging trends indicate increased reliance on data analytics and Artificial Intelligence (AI) to streamline reporting processes. This transformation aims to enhance efficiencies and reduce errors in financial filings, enabling companies to focus more on strategic decision-making.

Additionally, regulatory changes may transform how disclosures are crafted and presented, leading to more straightforward, accessible reporting that meets the needs of investors and stakeholders alike. Companies must remain adaptable and embrace these technological advancements to maintain a competitive edge in the current financial environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 10-q?

Can I create an electronic signature for the form 10-q in Chrome?

How do I edit form 10-q on an iOS device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.