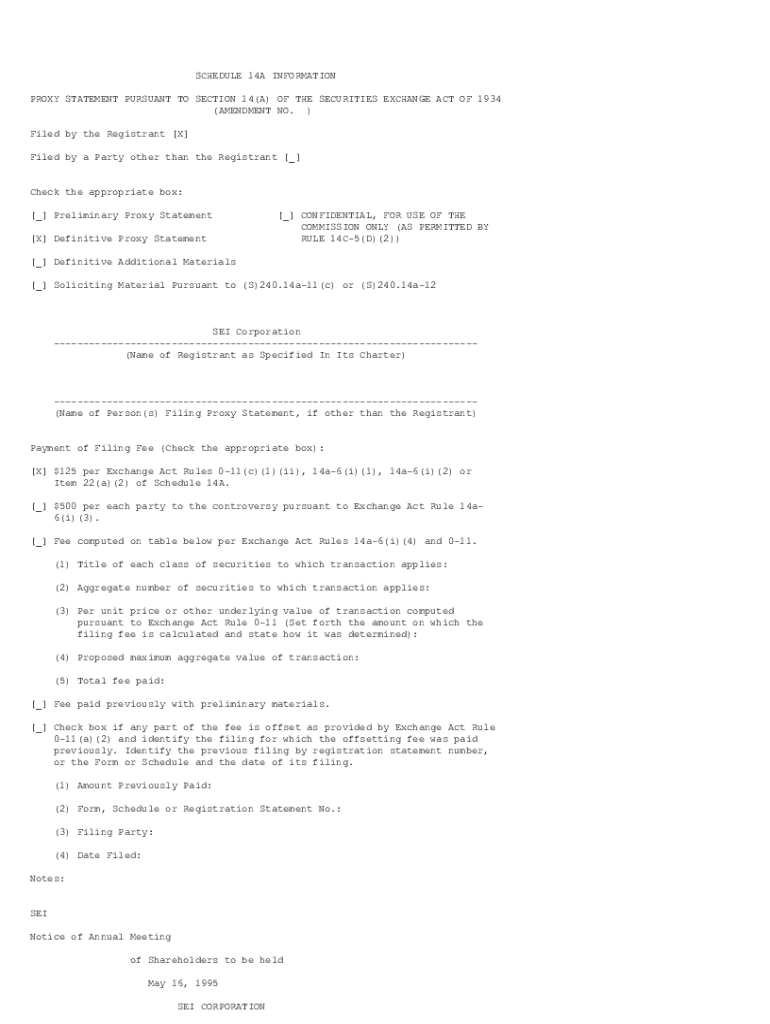

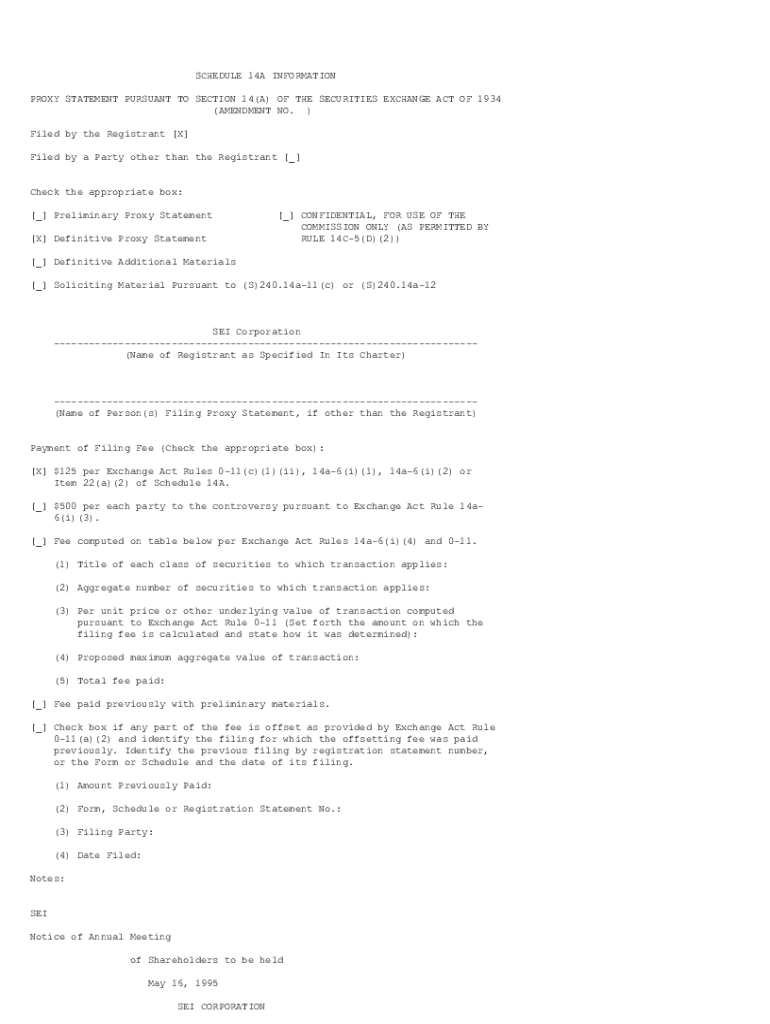

Get the free Schedule 14a Information

Get, Create, Make and Sign schedule 14a information

How to edit schedule 14a information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 14a information

How to fill out schedule 14a information

Who needs schedule 14a information?

Schedule 14A Information Form: A Comprehensive Guide

Understanding Schedule 14A

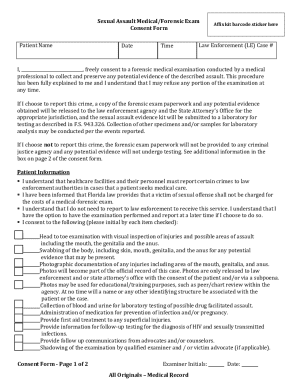

Schedule 14A is a vital regulatory document filed with the Securities and Exchange Commission (SEC) by publicly traded companies. This form serves as a way for companies to disclose crucial information to shareholders regarding upcoming corporate matters. The primary purpose of Schedule 14A is to facilitate transparency and informed decision-making during shareholder meetings. Its significance in corporate governance cannot be overstated, as it lays the groundwork for shareholder democracy and accountability.

Key elements included in the Schedule 14A form consist of proxy statements, which outline the issues shareholders will vote on, such as the election of directors and approval of executive compensation plans. Additionally, this form contains shareholder proposals and detailed financial disclosures, creating a comprehensive view of the company's governance structure and financial health.

Who is required to file Schedule 14A?

Entities obligated to file Schedule 14A primarily include publicly traded companies that are subject to SEC regulations. This requirement often extends to companies that hold shareholder meetings, where votes on significant issues are cast. However, certain exemptions exist, such as for smaller reporting companies relying on Regulation S-K and specific situations where companies are not seeking shareholder votes.

For corporations, compliance with Schedule 14A regulations is critical. Proper filings safeguard the interests of investors and ensure that companies uphold their fiduciary duties. Ensuring timely and accurate disclosures can also help mitigate the risk of legal repercussions and foster trust with shareholders.

Key components of the Schedule 14A form

The Schedule 14A form encompasses several essential sections, each serving a specific purpose in providing information to shareholders. The key components include:

These sections collectively ensure that shareholders receive all pertinent information necessary for voting and understanding the company's strategic direction.

Filing requirements and deadlines

Companies are typically required to file their Schedule 14A forms with the SEC at least 20 days before the meeting date where shareholders will vote. This timeline allows investors adequate time to review the materials before making informed voting decisions. The procedures for submitting the form involve electronic filing through the EDGAR system, making it crucial for corporations to adhere to the specifics outlined by the SEC.

Consequences of late filings or inaccuracies can be severe. Companies may face fines or increased scrutiny from regulators and shareholders. Additionally, failure to provide accurate data may result in trust issues among investors, affecting the overall valuation of the company in the marketplace.

Impact of Schedule 14A on stakeholders

The implications of Schedule 14A filings extend deeply into the relationship between a company and its shareholders. Clear and comprehensive communication through this form can enhance trust and improve investor relations. For shareholders, Schedule 14A serves as a critical tool for understanding corporate governance, executive compensation, and board performance.

Moreover, proactive engagement strategies that incorporate 14A disclosures can give corporations a competitive advantage. Companies that emphasize transparency and open lines of communication with their stakeholders often strengthen their credibility and foster long-lasting relationships.

The review process by the SEC

The SEC reviews Schedule 14A filings to ensure compliance with regulatory requirements. During this process, the SEC may flag common issues such as incomplete sections, misleading statements, or inconsistencies with previous filings. Companies that receive comments from the SEC must address these concerns promptly to maintain compliance.

Amendments and updates to the Schedule 14A can be made if significant changes occur post-filing or if the SEC identifies any issues requiring rectification. It’s essential for corporations to monitor their filings and ensure that all information provided remains accurate and aligned with SEC regulations.

Tools for efficiently managing Schedule 14A filings

Utilizing interactive tools provided by pdfFiller can significantly streamline the process of preparing and filing Schedule 14A forms. These tools include templates designed for compliance and reporting, making it easier for corporations to ensure they meet all regulations effectively.

Key functionalities available on pdfFiller include:

Best practices for preparing a Schedule 14A

Drafting clear and concise disclosures is essential when preparing a Schedule 14A. Companies should focus on clarity, ensuring that shareholders can easily understand each section of the form. Avoiding jargon and using straightforward language can help enhance transparency and facilitate shareholder engagement.

Common pitfalls to avoid include neglecting adequate detail, failing to disclose potential conflicts of interest, or providing incomplete data. Companies should prioritize accuracy as inaccuracies may lead to investor mistrust and regulatory scrutiny. Maintaining a high level of transparency strengthens the relationship between the company and its stakeholders.

Frequently asked questions (FAQs) about Schedule 14A

Understanding the intricacies of Schedule 14A can be daunting for first-time filers. Common questions include inquiries about the filing process, timelines, and specific terminologies.

Engaging with your shareholders post-filing

After filing Schedule 14A, it is crucial for companies to maintain open channels of communication with shareholders. Engaging with them about the contents of the filing can help instill trust and reinforce corporate governance practices.

Utilizing feedback from shareholders not only improves future filings but also demonstrates a commitment to stakeholder engagement. Companies can leverage this input to refine their governance practices and enhance overall shareholder satisfaction.

Related forms and filings

In addition to Schedule 14A, other significant SEC filings exist, such as Form 10-K and Form 8-K. Understanding the differences between these forms is essential for corporate compliance. While Form 10-K presents a comprehensive overview of fiscal results and operations, Form 8-K is used to report significant events that occur between periodic reports.

Schedule 14A serves as a complement to these documents, collectively providing a complete picture of the company’s governance structure and operational strategy. Understanding the interdependencies and relevance of these filings is a key aspect for corporations aiming to navigate the complexities of regulatory compliance.

Start the conversation

For corporations, proactive communication with legal counsel and corporate governance advisors can significantly impact the effectiveness of Schedule 14A filings. Engaging these professionals ensures adherence to all regulatory requirements as well as strategic recommendations for improved stakeholder relations.

Encouraging input from shareholders and maintaining transparency throughout the filing process are essential strategies. Leveraging these interactions can simplify the future filing process and enhance overall corporate governance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the schedule 14a information in Gmail?

How can I edit schedule 14a information on a smartphone?

How do I complete schedule 14a information on an iOS device?

What is schedule 14a information?

Who is required to file schedule 14a information?

How to fill out schedule 14a information?

What is the purpose of schedule 14a information?

What information must be reported on schedule 14a information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.