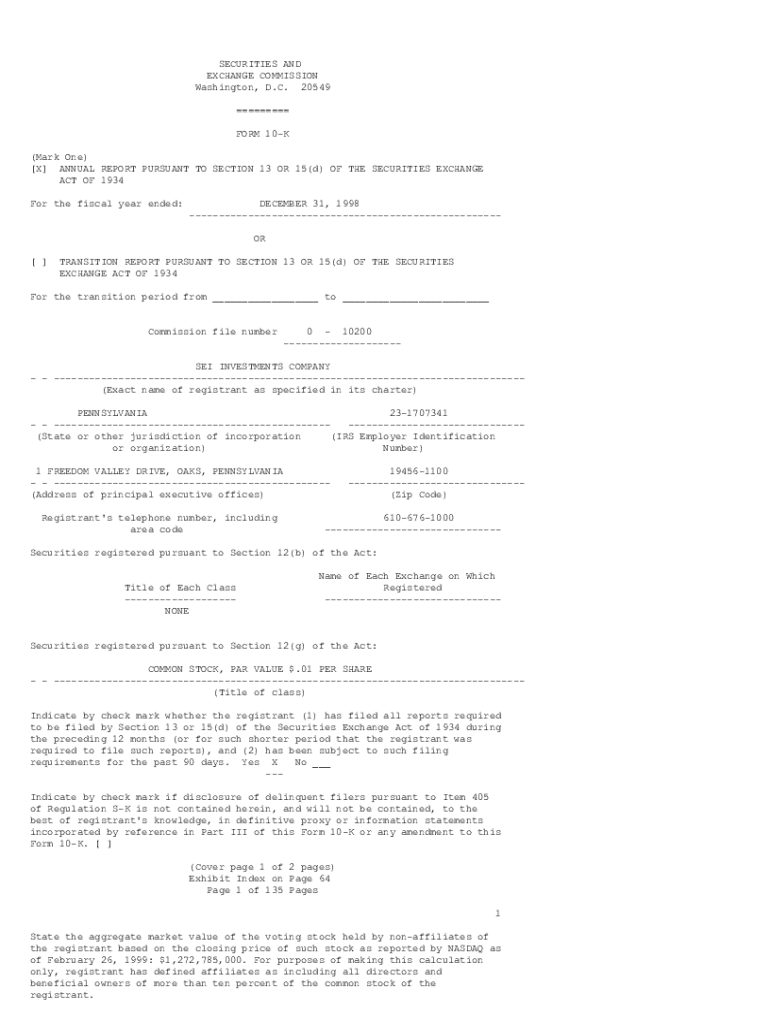

Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Form 10-K: A Comprehensive How-to Guide

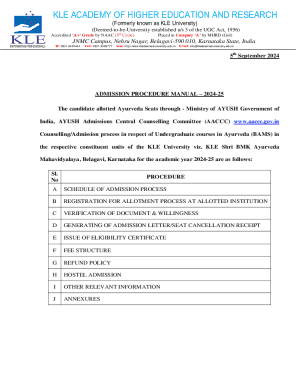

Understanding the Form 10-K

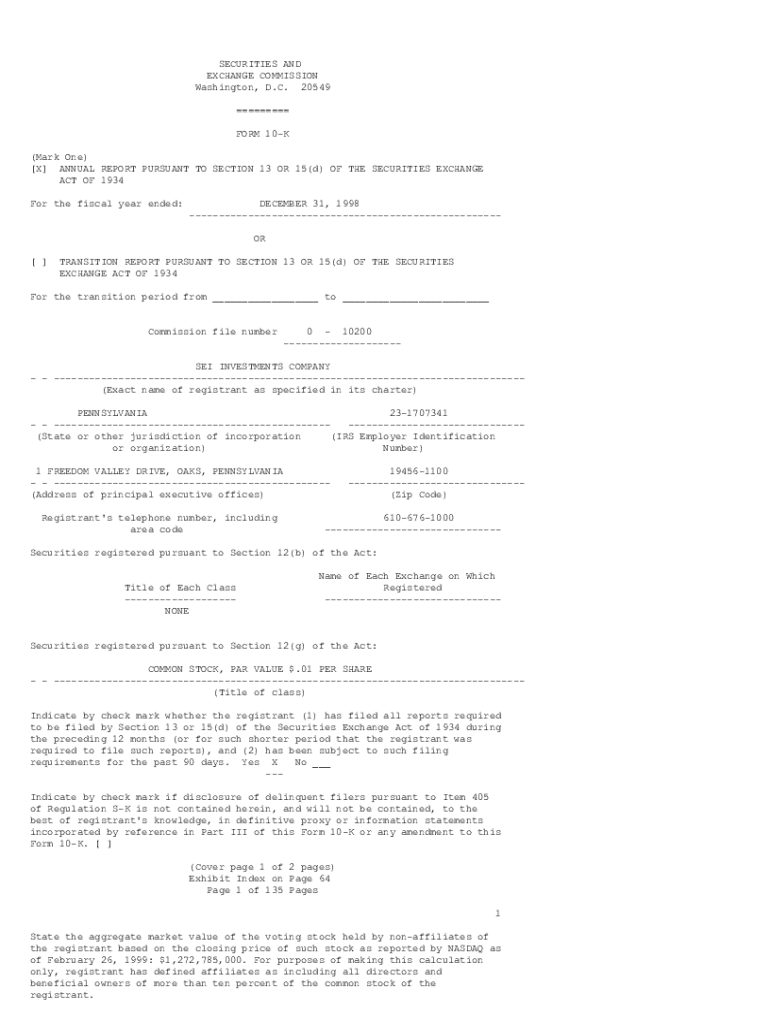

The Form 10-K is a crucial reporting document mandated by the U.S. Securities and Exchange Commission (SEC) that public companies must file annually. This comprehensive report provides a detailed overview of a company's financial performance, operations, and risks. Beyond merely fulfilling regulatory requirements, the Form 10-K serves as a vital resource for investors and stakeholders, offering insights into a company's financial health and strategic direction.

Investors leverage the Form 10-K to analyze potential investments, gauging the performance and stability of companies. This document is not just a collection of numbers; it tells the company's story — its successes, challenges, and plans for the future.

Legal requirements for filing

The SEC mandates that all public companies, except for those with less than $10 million in assets and fewer than 300 shareholders, must file Form 10-K annually. Compliance ensures transparency in financial reporting and maintains investor confidence in the integrity of the capital markets. This regulatory framework emphasizes accurate and timely disclosures, making it imperative for companies to cultivate a sound understanding of these requirements.

Components of a Form 10-K

A Form 10-K is structured into several key sections, each serving a specific purpose. These components not only provide essential information but also help analysts and investors evaluate a company’s financial status comprehensively.

Structure of a 10-K report

The primary sections of a Form 10-K typically include the following:

Detailed breakdown of each section

The business overview section provides insight into the company’s operations, including its mission, products, services, and market presence. It gives investors an essential context for understanding the financial data that follows.

Management's Discussion and Analysis (MD&A) offers a narrative description of the company’s financial performance from the management's perspective. This section highlights significant trends, risks, and opportunities.

Included financial statements encompass the balance sheet, income statement, and cash flow statement. These documents provide a snapshot of the financial health, profitability, and liquidity of the business.

Notes to financial statements add context and details to the financial reports, clarifying accounting policies, methodologies, and any judgments that must be made.

Finally, the risk factors section outlines potentially adverse risks that could impact the company’s performance. Investors should pay close attention to this section, as it highlights specific challenges and uncertainties the company faces.

How to find and access Form 10-Ks

Locating a Form 10-K is relatively simple, thanks to several online resources. The primary source is the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) database, where most public companies file their reports.

Official sources

Navigating the SEC's EDGAR database involves identifying the correct search fields, often by entering the company name or ticker symbol. Users can easily filter results by filing type, making it straightforward to find specific 10-K reports.

Besides the SEC database, other government resources and financial regulatory platforms may also house company filings, providing shoppers of financial information an array of options.

Utilizing third-party platforms

Numerous financial information websites present user-friendly interfaces to access Form 10-K documents. Websites like Yahoo Finance, MarketWatch, and Bloomberg offer summaries and direct access to filings, thus enhancing the user experience further.

10-K filing deadlines

Each public company must adhere to specific deadlines for filing their Form 10-K. The timeline primarily depends on the size of the company, categorized into different groups based on their shareholder count.

Timeline for filing

Typically, companies with a market cap over $700 million must file within 60 days after the end of their fiscal year, while smaller companies have longer deadlines. Failing to file on time can result in financial penalties and can damage a company’s reputation among investors.

Tracking deadlines

Filing companies should adopt proactive measures to track deadlines effectively. Utilizing calendar notifications, project management software, or even regulatory reminders can ensure the timely completion of filings. Staying informed about these deadlines is crucial, as late filings may also attract scrutiny from the SEC.

Key highlights from noteworthy 10-Ks

Examining innovative reporting practices can shed light on how companies adapt to evolving market conditions and regulatory expectations. Forward-thinking organizations often utilize their Form 10-Ks to not only address past performance but also to outline future strategies and goals.

Innovations in reporting

Recent years have seen notable enhancements in the clarity and presentation of Form 10-Ks. Companies are increasingly utilizing interactive graphics, streamlined narratives, and succinct summaries, which aid investors in quickly grasping essential information.

Case studies of notable companies

Examining filings from industry leaders such as Apple or Microsoft reveals how strong reporting practices can enhance investor confidence. Their transparency and comprehensive disclosures set benchmarks for others in the industry, reinforcing the notion that the Form 10-K is not just a formality but a strategic communication tool.

Actionable steps for individuals and teams

Preparing a Form 10-K is a collaborative effort, requiring input from various departments within a company. Gathering the necessary documents early in the process is key.

How to prepare for filing a 10-K

Companies can create a checklist of required documents, including financial statements, risk assessments, and management narratives, ensuring a comprehensive approach. Encouraging collaboration across management divisions can streamline the compilation of this vital report.

Editing and reviewing your 10-K

Once drafted, the importance of thorough editing cannot be understated. Engaging multiple reviewers within the company can provide critical insights and ensure accuracy, as well as highlighting any potential issues ahead of the filing deadline. Utilizing document management tools can also facilitate efficient revisions and communications among team members.

Electronic signature and submission

The submission process for Form 10-K has been greatly streamlined through electronic filing methods. Companies can utilize e-signature options to facilitate quicker approvals.

eSignature options for Form 10-K

Using digital signature platforms can accelerate the verification process. By employing secure electronic signatures, companies can enhance workflow efficiency while ensuring regulatory compliance.

Submitting your 10-K

The online filing process via EDGAR is straightforward. Companies should prepare their documents for submission, follow the requisite steps outlined on the SEC’s website, and carefully monitor for confirmation that the filing has been successfully received.

Managing and archiving 10-K filings

Once a Form 10-K is filed, companies must properly manage and archive their documents. Efficient document management solutions can support the organization of filings for future reference and regulatory checks.

Document management solutions

Cloud-based platforms like pdfFiller offer numerous benefits for managing Form 10-K filings. By utilizing these platforms, companies can maintain accessibility, security, and easy retrieval of necessary documents, ensuring that important information remains organized.

Best practices for document organization

Maintaining a clear system for document organization is essential for large corporations. Implementing robust version control and creating audit trails are also critical to tracking changes and ensuring compliance with regulations.

Interactive tools and resources

Access to interactive tools can greatly benefit companies in preparing and filing their Form 10-K. Platforms that allow real-time collaboration foster a more efficient workflow among team members.

Utilizing pdfFiller’s tools

PdfFiller enriches the document preparation process with features that allow teams to edit, sign, and collaborate on PDFs seamlessly. These capabilities significantly improve the efficiency and accuracy of Form 10-K filings.

Enhancing workflow and collaboration

Incorporating technology into the filing process promotes enhanced teamwork. For instance, tools such as shared access, version-specific editing, and comment threads enable all involved parties to contribute effectively, optimizing the overall report preparation.

Common pitfalls to avoid

Completing a Form 10-K involves navigating many complexities, making it easy for companies to fall into common traps. Awareness of these pitfalls is essential for mitigating risks associated with compliance.

Mistakes in reporting

Errors often arise from lack of clarity or collaboration. Common mistakes include misreporting financial data, failure to disclose pertinent risks, or neglecting section-specific requirements. Developing a rigorous review process can greatly reduce these errors.

Avoiding compliance issues

Key compliance points include timeliness in filing and accuracy of content. Companies must verify that all documents meet SEC standards and maintain open lines of communication with regulatory bodies to address any inquiries or necessary adjustments promptly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-k for eSignature?

Where do I find form 10-k?

How do I complete form 10-k online?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.