Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Comprehensive Guide to SEC Form 4: Details, Filing, and Compliance

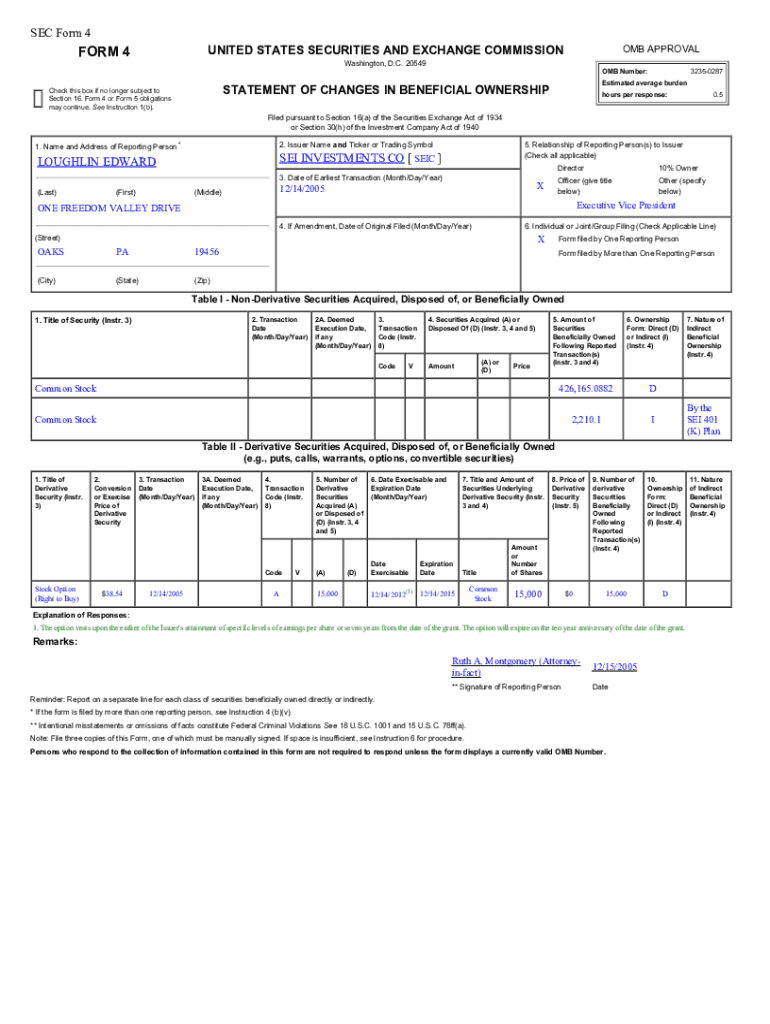

Understanding SEC Form 4

SEC Form 4 is a crucial document mandated by the Securities and Exchange Commission (SEC) for insiders, reporting changes in their ownership of a company's securities. This form provides transparency regarding the trading activities of executives and affiliates within publicly traded companies, enabling investors to make informed decisions based on insider trading information.

The importance of SEC Form 4 in financial compliance cannot be understated. It ensures that all significant transactions by insiders are reported in a timely manner, fostering accountability and maintaining market integrity. Without such requirements, investors might not have access to critical data regarding insider moves that could affect stock prices.

Individuals required to file SEC Form 4 include company officers, directors, and significant shareholders who own more than 10% of a class of the company's equity securities. This makes it essential for those engaged in insider trading or holding substantial stakes in their company.

Key components of SEC Form 4

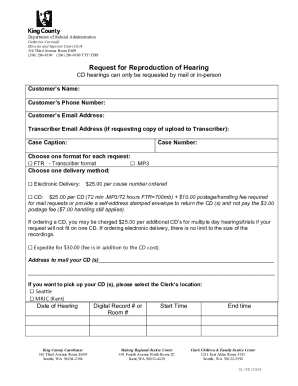

SEC Form 4 consists of several key components, each designed to provide a comprehensive view of insider transactions. First, the identifying information section captures the name, address, and relationship of the insider to the issuer, ensuring clear disclosure of who is reporting their trades.

Next, the transaction details section requires specifics about the executed transactions, including the date, nature of the transaction (purchase, sale, etc.), and the price at which the securities were bought or sold. Additionally, the form mandates an indication of ownership after the transaction, which is critical for tracking ownership changes over time.

An example of a filled SEC Form 4 can include various scenarios like reporting the grant of stock options or detailing a stock sale by an executive, essential for observing trends in insider trades.

When to file SEC Form 4

Filing SEC Form 4 is bound by specific timelines; insiders are required to file this form within two business days following the transaction. This 'prompt' reporting is crucial for maintaining the integrity of the market and providing timely information to investors.

Common circumstances necessitating the filing of Form 4 include the purchase or sale of securities, as well as gifts of securities to family members or charitable organizations. Moreover, transactions in derivatives, such as options or swaps based on the company's shares, also mandate a filing, ensuring comprehensive oversight of insider activities.

How to file SEC Form 4

Filing SEC Form 4 may seem daunting, but following a structured process can simplify the task significantly. Begin by gathering all necessary information, ensuring you have accurate details relating to the transaction and your holdings.

Next, complete the form using an online template, which can streamline the data entry process. After filling out the form, it is crucial to review all the information for accuracy to avoid potential penalties associated with incorrect filings.

Utilizing tools such as pdfFiller can enhance accuracy and compliance during the filing process, making it easier for users to manage their documents as they comply with all SEC regulations.

Common mistakes to avoid when filing

Navigating SEC Form 4 can be tricky, especially when considering the most common mistakes to avoid. One frequently overlooked detail is ensuring all relevant information is completed accurately, which can lead to penalties or scrutiny from the SEC.

Misinterpretation of filing deadlines is another common pitfall; remember that failing to submit the form within two business days can have significant consequences. Moreover, errors in reporting ownership percentages can distill trust among potential investors who rely on accurate insider trading activities.

Tools and resources for SEC Form 4 filers

Modern technology has made the filing of SEC Form 4 more manageable, with tools like pdfFiller playing a pivotal role. Through its interactive fillable templates, pdfFiller empowers users to streamline the SEC Form 4 filing process efficiently.

Additionally, the platform offers electronic signature capabilities and document management features, all within a cloud-based system that suits individuals and teams. By leveraging these resources, filers can ensure compliance while simplifying the entire process.

Tracking and managing your SEC filings

Monitoring your SEC filings post-submission is just as vital as the filing process itself. It's essential to track the status of SEC Form 4 to stay updated on any changes or requirements from the SEC that could affect your compliance status.

For those who may need to amend or correct a filed SEC Form 4, understanding the appropriate procedures for doing so is crucial. Failure to follow the correct process could result in non-compliance, so being proactive in managing your filings is key to maintaining transparent practices.

The role of SEC Form 4 in market transparency

SEC Form 4 plays a pivotal role in promoting market transparency by providing real-time data on insider trading activities. This transparency fosters investor confidence, as shareholders are privy to the trades and movements of key executives within their investments.

Several case studies indicate that timely filings of SEC Form 4 can significantly impact market dynamics. For instance, a rapid filing of significant trades may affect the stock price, as investors interpret the insider movements as indicators of company performance or potential changes.

FAQs about SEC Form 4

Investors and insiders often have common inquiries regarding SEC Form 4, particularly regarding filing timelines. Understanding the differences between Form 4 and other forms such as SEC Form 3 (initial ownership) and SEC Form 5 (annual reporting) is also crucial for effective compliance.

For those requiring legal consultation, numerous resources can provide clarity on SEC compliance. Professional guidance can be invaluable, particularly for executives navigating these regulatory waters for the first time.

Conclusion

In summary, SEC Form 4 is a fundamental facet of insider trading reporting and compliance. By understanding the essential steps for filing this form, from gathering necessary details to ensuring timely submissions, insiders can avoid common pitfalls that could impact market trust.

Leveraging tools like pdfFiller not only simplifies the mechanics of document preparation but empowers users with the ability to manage their filings efficiently, ensuring that they remain compliant with SEC requirements while fostering accountability and transparency in the financial markets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sec form 4 for eSignature?

Can I sign the sec form 4 electronically in Chrome?

How do I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.