Get the free Form 4

Get, Create, Make and Sign form 4

Editing form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4

How to fill out form 4

Who needs form 4?

Form 4 Form - A Comprehensive How-to Guide

Understanding the Form 4 form

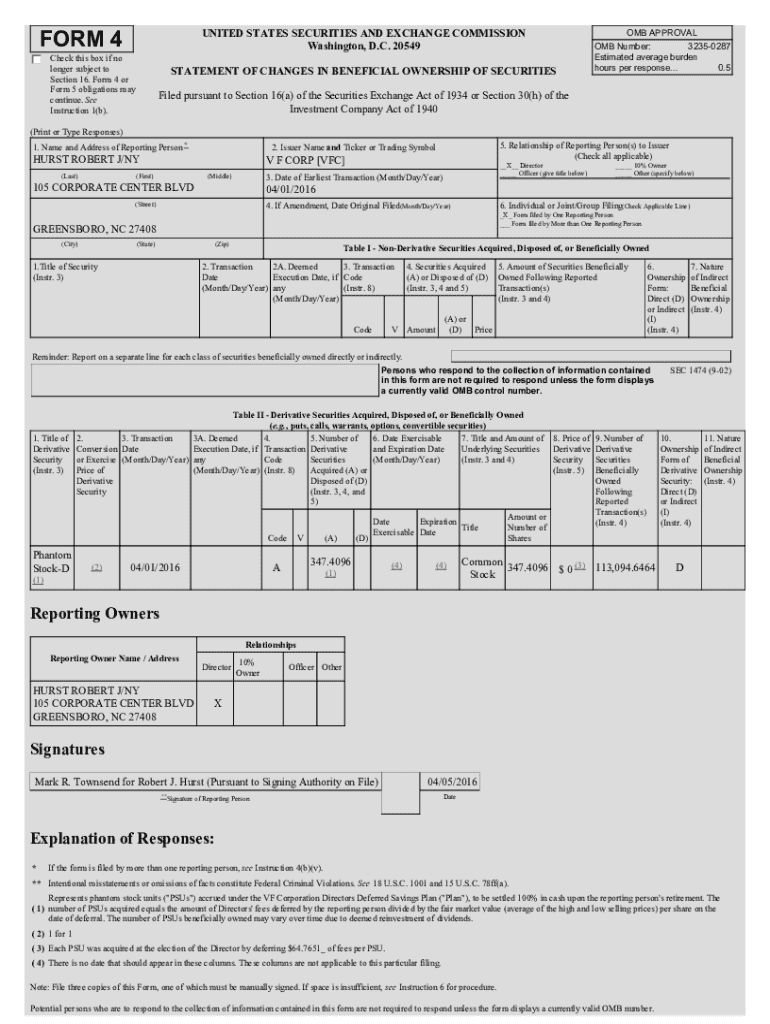

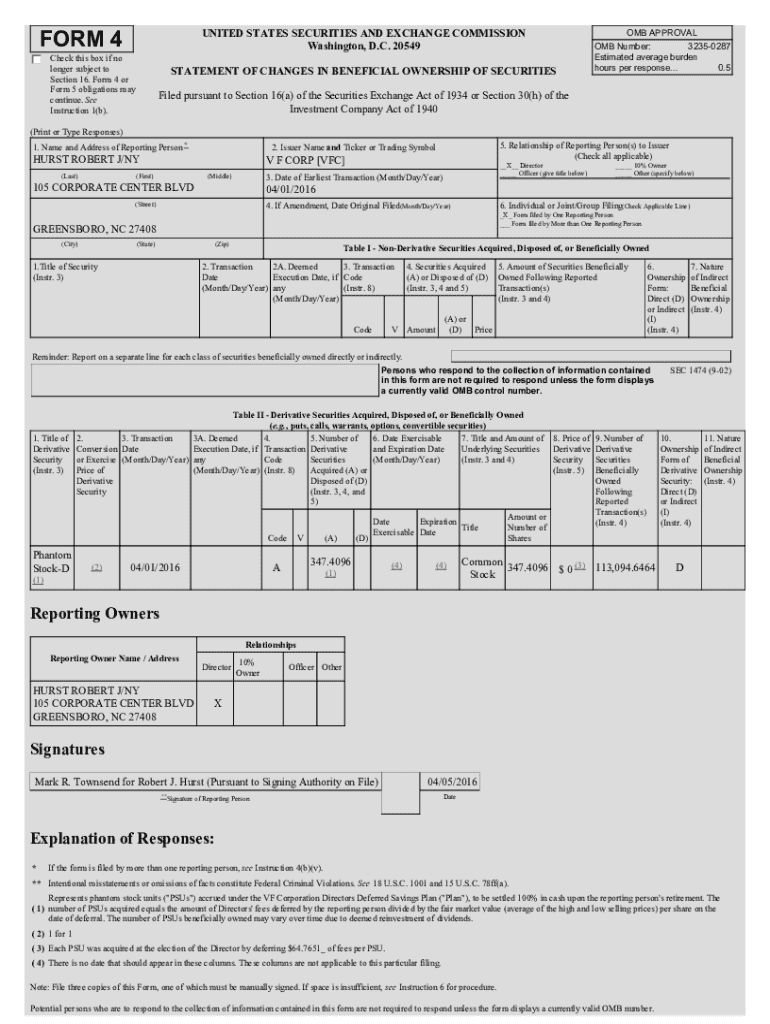

The Form 4 form is a critical document in various regulatory environments, particularly within the context of financial reporting and compliance. It is primarily utilized to report the acquisition and disposition of securities by corporate insiders, including officers, directors, and significant shareholders of public companies. The submission of this form enables transparency, ensuring that investors are informed about changes in ownership that could influence the stock's market perception.

The purpose of the Form 4 form is not only to maintain regulatory oversight but also to protect the integrity of the financial markets. By mandating that insiders disclose their transactions, regulators can deter fraudulent activities and promote fair trading practices. Understanding the nuances of Form 4 is paramount for anyone involved in corporate governance or investment.

Regulatory importance

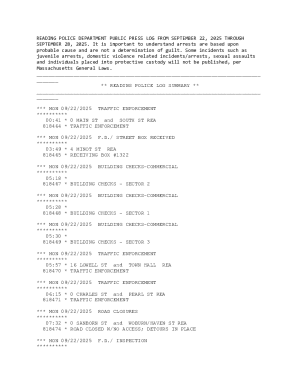

Regulatory bodies, including the United States Securities and Exchange Commission (SEC), oversee the submission of the Form 4. Under the Securities Exchange Act of 1934, insiders are required to file this form within two business days of executing a transaction involving their company's securities. Compliance is crucial; failure to properly submit Form 4 can lead to severe consequences, including fines and reputational damage for both the individual and the company.

Understanding the relevant laws and the implications of non-compliance is essential for insiders. These laws are designed to foster a transparent trading environment, allowing investors to make informed decisions. By following regulatory requirements, individuals and organizations uphold the trust placed in them by shareholders and the investing public at large.

Key components of the Form 4 form

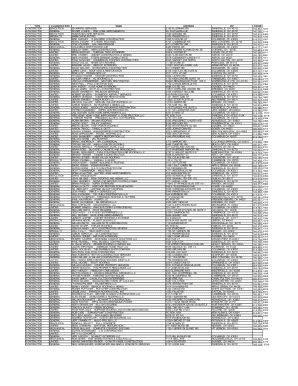

When filling out the Form 4 form, several key components must be included to ensure its acceptance by the regulatory authorities. The document requires information concerning the reporting entities, including the names and addresses of insiders involved in the transactions. Details about the specific dates and types of securities transactions must also be provided, delineating factual and precise data that informs stakeholders of ownership changes.

Furthermore, proper signature verification is crucial, as it validates the authenticity of the information presented. The designated areas for signatures are not mere formalities; they signify that the reporting individual is liable for the correctness of the data presented in the document. This verification acts as a safeguard against fraudulent reporting practices.

Filling out the Form 4 form: step-by-step guide

Before diving into the filling process of the Form 4 form, it is essential to gather all necessary information. Documentation like transaction records, names of involved parties, and precise dates is needed. Organizing this data efficiently will streamline the completion process. Utilize spreadsheets or document management tools to consolidate your data, ensuring accuracy.

When completing the form, start filling each section methodically. Pay meticulous attention to detail as errors can result in compliance violations. Common mistakes include inaccurate transaction dates or failure to sign the document properly. Double-check each entry for accuracy, ensuring that all necessary fields are completed. After completing, consider using platforms like pdfFiller to facilitate smoother editing and signing.

Using pdfFiller for seamless completion

pdfFiller offers an array of tools that elevate the process of filling out the Form 4 form. The platform allows users to import existing forms, edit them directly in the browser, and utilize signature tools to sign digitally. The interactive features provided by pdfFiller simplify the filling process, ensuring users remain compliant with regulatory standards. Users can quickly navigate through the form fields and access terminology and guidelines, making the task less daunting.

The cloud-based nature of pdfFiller means your documents are accessible from anywhere. This flexibility is especially beneficial for teams or individuals involved in multiple transactions, as collaboration can occur in real-time. Ensuring everyone involved has access to the most recent version of the Form 4 can improve accuracy and efficiency.

Managing your completed Form 4 form

Once the Form 4 form has been thoroughly completed and verified, the next step is submission. Guidelines for submitting the completed form vary based on the chosen method. Submissions can usually be done electronically or via physical mail. Electronic submissions are preferred for their efficiency and speed, often processed more quickly by the SEC.

After submission, it is vital to track the status of the form. Monitoring can be done through the SEC’s online portal, where users can check for confirmations or updates regarding their filings. Clear communication with regulatory authorities can help address any issues that arise, ensuring compliance and minimizing potential fines.

Common challenges and solutions

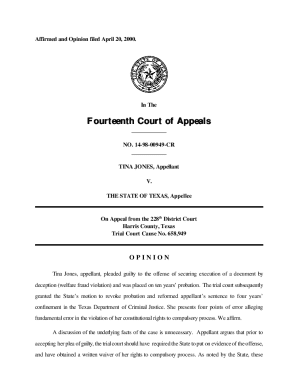

Errors on the Form 4 form can lead to significant compliance issues. Common errors include incorrect transaction details or failing to submit within the designated timeframe. To address mistakes, it is essential to amend submissions promptly, adhering to established procedures set forth by the SEC. This typically involves submitting a new Form 4 with correct information labeled as an amendment.

If users encounter difficulties while filling out the form, they may have common questions such as how to obtain signatures or what to do if transaction times change. Finding onboarding support from authoritative resources, including the SEC’s website, can mitigate these challenges and provide clarity.

Leveraging pdfFiller for enhanced document management

Utilizing pdfFiller for managing your Form 4 documents provides several advantages, including storage solutions and user-friendly management features. As a cloud-based tool, users can access their documents from anywhere, which is highly beneficial in today's increasingly remote work landscape. Moreover, pdfFiller's collaborative features allow for streamlined communication among team members, making it easier to complete and release important documentation.

pdfFiller also offers unique security features, ensuring that sensitive information remains confidential while sharing documents. This is essential in the financial world, where data integrity is paramount. Users can manage permissions effectively, granting access only to individuals who need it, thereby upholding compliance against unauthorized access.

Case studies and examples

Numerous organizations have successfully utilized the Form 4 form for transparency in their financial dealings. For instance, a Fortune 500 company recently completed Form 4 filings for multiple insiders in a streamlined process using pdfFiller, ensuring compliance with government regulations efficiently. The ease of use provided by the platform significantly reduced the time spent on paperwork, allowing the company to focus more on strategic initiatives rather than compliance headaches.

Moreover, testimonials from users indicate that pdfFiller's online tools greatly enhance the filing experience. Users have reported feeling more confident about compliance and have experienced fewer issues with regulatory bodies, thanks to the platform’s systematic guidance and comprehensive approach.

Future trends in document management

As regulatory environments evolve, so too will the requirements surrounding the Form 4 form. Upcoming changes could streamline submission processes further, potentially reducing filing times and enhancing electronic submission protocols. Keeping abreast of these potential modifications will be vital for individuals and organizations who must comply with regulations to avoid penalties.

Moreover, innovations in document management solutions like pdfFiller are on the horizon. Enhancements such as advanced analytics, predictive compliance reporting, and AI-assisted document preparation are likely to transform how users interact with forms like Form 4. As these trends emerge, users of pdfFiller can expect improvements that will further simplify document management and compliance processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 4 directly from Gmail?

How can I modify form 4 without leaving Google Drive?

Can I edit form 4 on an iOS device?

What is form 4?

Who is required to file form 4?

How to fill out form 4?

What is the purpose of form 4?

What information must be reported on form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.