Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A comprehensive guide to SEC Form 4 filings

Understanding SEC Form 4

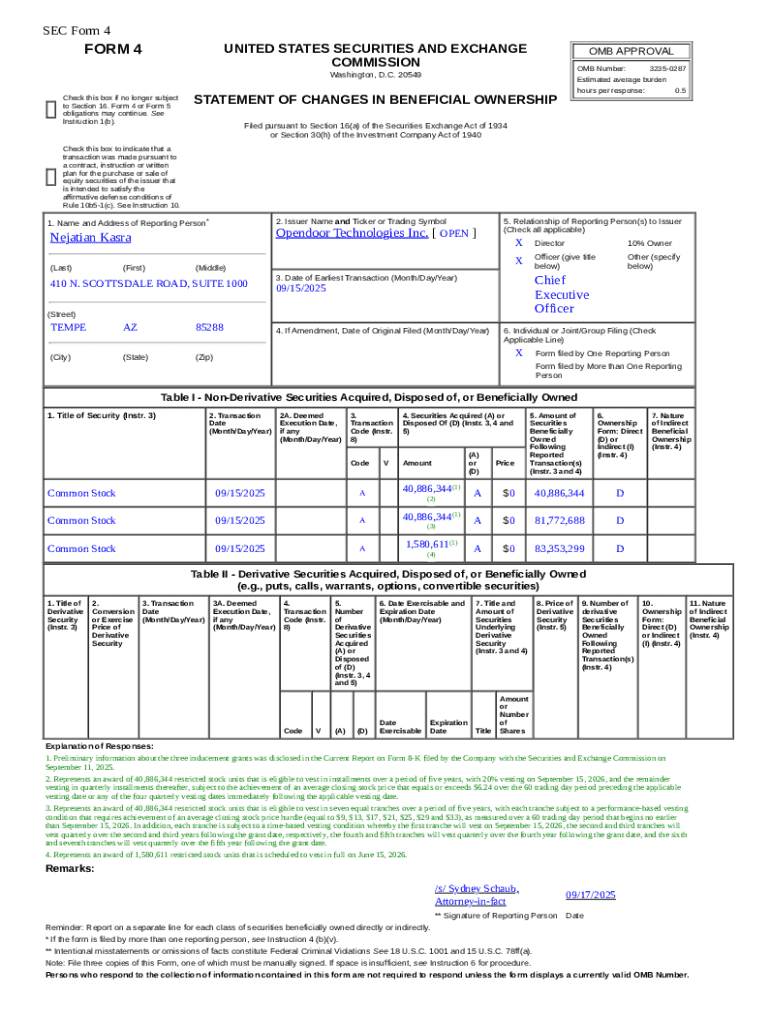

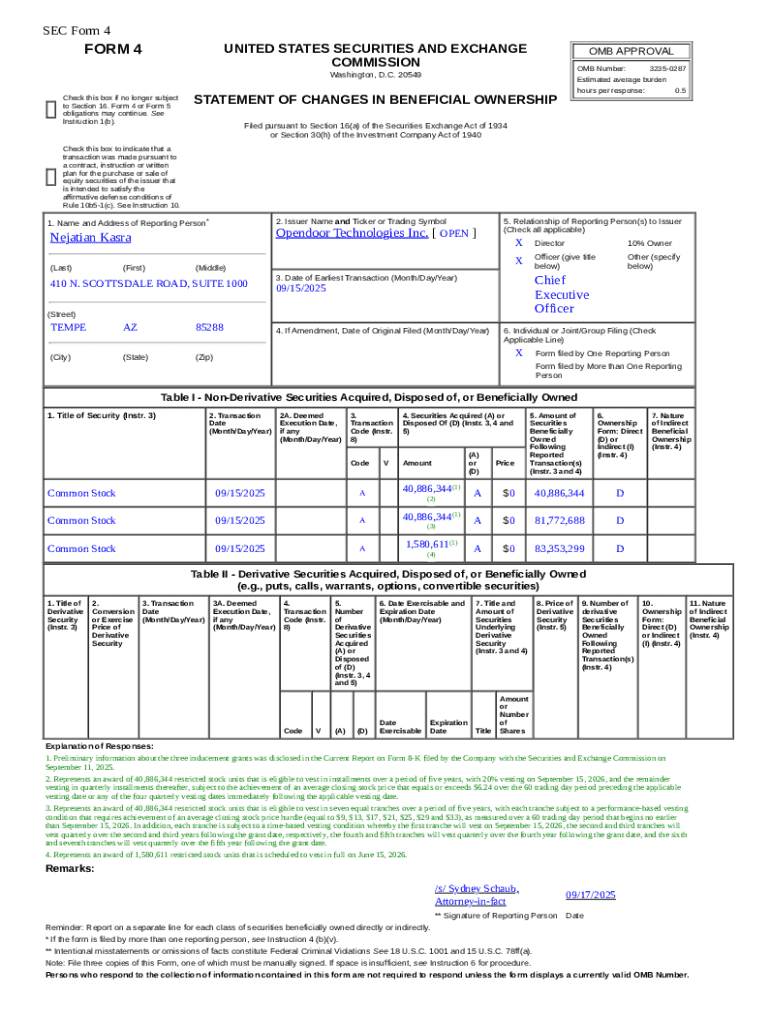

SEC Form 4 is a crucial document required by the U.S. Securities and Exchange Commission (SEC) that is filed by company insiders to report their transactions in the company's securities. Its primary purpose is to provide transparency to the investing public about insider trades, which could indicate the insiders' confidence or concerns about the company's performance. The importance of SEC Form 4 cannot be overstated; it plays a vital role in monitoring insider transactions and protects the integrity of the financial markets.

This form is specifically designed to track the buying and selling behaviors of key decision-makers within a company, such as executives, directors, and major shareholders. By examining these filings, investors and analysts can gauge market sentiment about a company. Understanding this data can influence investment strategies and inform decisions within the context of broader ownership trends.

Who needs to file SEC Form 4?

Filing SEC Form 4 is typically necessary for three categories of individuals associated with a company: corporate officers, directors, and beneficial owners holding more than 10% of a class of the company’s securities. Each of these categories comes with specific reporting obligations to ensure compliance with securities laws.

Officers and directors are required to file this form as soon as possible following any transactions, reflecting their investment activities and aligning with regulations to promote honesty in the market. For beneficial owners, the filing serves a similar purpose, especially since their holdings could influence market movement due to their significant stakes.

Key components of SEC Form 4

SEC Form 4 is structured into several key sections, which include filer information and transaction details. Each part of the form serves to ensure that the information provided is clear and comprehensive, allowing regulators and the public to easily understand the nature and reasons for the insider trading activities.

Common types of transactions reported on SEC Form 4 include the purchase or sale of securities, gifts of shares, and the exercise of stock options. Understanding these transaction types is essential, as they are indicative of insider moves that can influence market perceptions.

The distinction between direct and indirect ownership is important; direct ownership refers to shares owned outright, while indirect ownership could involve shares held in trust or through a partnership. Understanding these figures is crucial for shareholders and institutions analyzing the power dynamics and financial decisions within a company.

How to file SEC Form 4

Filing SEC Form 4 requires a systematic approach to ensure accuracy and compliance. Here is a step-by-step breakdown to help you through the process.

This structured approach will not only ease the filing process but also enable you to maintain compliance efficiently. Always double-check all entries to avoid delays and legal issues arising from inaccurate filings.

Best practices for SEC Form 4 compliance

Compliance with SEC Form 4 can be complicated, but adhering to a set of best practices can streamline the process. First, avoid common mistakes like incorrect names, omitting essential transaction details, and failing to file on time. These errors can lead to hefty fines, reputational damages, or even legal action for insiders. Much like the hedge fund activity market, where every move is scrutinized, the same level of diligence needs to be applied to insider filings.

Timely reporting is paramount; filings must be completed within two business days of an insider transaction. Late filings not only generate penalties but can also erode trust among investors and affect company performance. Establishing a clear internal system for tracking and recording transactions as they occur can mitigate these risks.

Record-keeping is another critical aspect; maintain comprehensive records of all transactions and filings. This includes copies of the submitted SEC Form 4s and any supporting documentation, helping ensure integrity in your dealings and providing a historical account for future reference.

Frequently asked questions about SEC Form 4

SEC Form 4 filings can raise many questions among insiders and investors alike. A common inquiry focuses on filing frequency. Insiders must file whenever they execute a transaction, which makes understanding the mechanics of insider trading crucial for anyone in a decision-making position.

Another frequent question concerns penalties for failing to file. Non-compliance can result in fines that can escalate significantly based on the severity of the oversight. Additionally, insiders often wonder if they can amend an SEC Form 4 after filing; yes, amendments can be made, but they must be filed using the appropriate procedures as specified by the SEC.

Lastly, there are exceptions to the filing requirements, though these are limited. Certain transactions, such as those conducted within established employee benefits plans or when only minimal activity occurs, may not require SEC Form 4 filings.

Why use pdfFiller for SEC Form 4 management?

Managing SEC Form 4 filings can be daunting, but this process can be simplified significantly with pdfFiller. The platform offers seamless document editing and e-signing capabilities, allowing users to complete their SEC Form 4 accurately and efficiently. Its intuitive interface makes it easy for individuals and teams alike to personalize their filings and reduce the chances of errors.

Collaboration features enhance productivity; teams can work on forms together in real time, contributing to a more cohesive filing strategy. With access from anywhere, pdfFiller empowers busy professionals to manage their documentation needs seamlessly, irrespective of location.

Advanced features of pdfFiller for forms management

The advanced features of pdfFiller provide tools that enhance the overall filing process for SEC Form 4. Interactive tools such as templates and auto-fill options can streamline your experience, ensuring you don’t miss important fields while completing your forms. This functionality is particularly beneficial in avoiding the common pitfalls that arise from hurried filings.

Tracking changes and version history allows you to maintain transparency and accuracy in your filings; knowing which revisions have been made can prove invaluable in a regulated environment. Additionally, integration with other document management systems is a standout feature, allowing users to consolidate their data management practices for a more efficient workflow.

Real-life applications of SEC Form 4 filings

The implications of SEC Form 4 filings extend beyond mere compliance; they provide significant insights into market trends and insider sentiments. Case studies of successful filers reveal effective practices in transparency adoption, which can enhance investor trust and company reputation. For example, companies that consistently comply with reporting requirements tend to see stability in their stock prices during turbulent market conditions.

Understanding the data from SEC Form 4 filings can also inform strategic investment decisions. Market analysts study insider trades to gauge potential company performance; when insiders purchase shares, it may indicate their confidence—thus, many investors take these signals seriously when making their trading decisions. However, ethical considerations are paramount; insider information should be approached with caution to avoid violations of securities laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my sec form 4 in Gmail?

Can I edit sec form 4 on an Android device?

How do I complete sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.