Get the free Form 18-k/a

Get, Create, Make and Sign form 18-ka

How to edit form 18-ka online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 18-ka

How to fill out form 18-ka

Who needs form 18-ka?

Form 18-KA: An Essential Guide for Effective Document Management

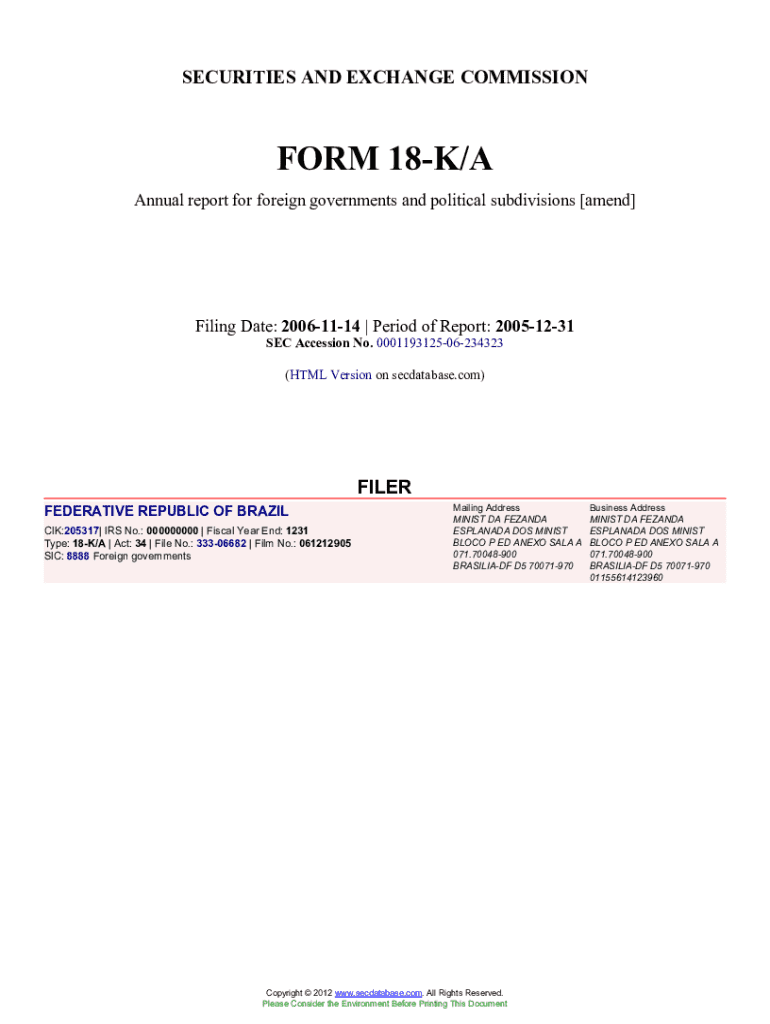

Understanding Form 18-KA

Form 18-KA is a significant document utilized in various legal and financial contexts, often associated with declarations and submissions required by governmental bodies. Its primary purpose is to provide detailed information regarding certain transactions or financial positions to relevant authorities. The form ensures compliance and transparency in dealings, particularly in sectors such as taxation and legal declarations.

The importance of the form cannot be overstated; it serves as a foundational tool for individuals and businesses to formally communicate essential information. Whether you're submitting a tax declaration or fulfilling a legal requirement, Form 18-KA plays a critical role in ensuring that your information is recorded accurately and efficiently.

When is Form 18-KA used?

Form 18-KA is commonly used in situations where individuals or businesses need to disclose their financial status, report transactions, or respond to inquiries from regulatory bodies. Some typical scenarios include tax filings, adjustments to previous submissions, and specific accounting declarations. Understanding when to use this form can help in avoiding legal and financial complications.

Preparing to fill out Form 18-KA

Before diving into filling out Form 18-KA, it's essential to gather all required information. This includes financial records, identification documents, and any specific data relevant to the purpose of the form. Ensure you have the latest information to avoid discrepancies.

Organizing your documents beforehand can streamline the process. Create a checklist of necessary documents, such as income statements, tax returns, and previous forms, to ensure you don’t miss anything crucial.

Understanding eligibility criteria

To effectively utilize Form 18-KA, it is vital to understand the eligibility criteria that may apply. For instance, certain thresholds in income or transactions may dictate if an individual must file this form. Familiarizing yourself with these eligibility requirements can save time and avoid potential errors.

Step-by-step instructions for completing Form 18-KA

Filling out Form 18-KA is a systematic process that can be tackled efficiently by breaking it down into sections. Each part of the form corresponds to specific pieces of information that regulatory bodies require.

Section-by-section breakdown

The first section typically requests personal information such as your name, address, and identification number. Accuracy is paramount here, as any mistakes can lead to processing delays.

The second section usually requires you to provide detailed financial information including income, expenses, and other relevant financial data. Be prepared to explain sources of income and significant expenses.

Attachments may also be necessary; these could include financial statements, proof of identity, and other supporting documents. Ensure that all attachments are clearly labeled and directly related to the information provided in the form.

Interactive tools for form completion

Utilizing interactive tools can enhance the experience of filling out Form 18-KA. Platforms like pdfFiller offer features that simplify document management, such as online editing, templates, and calculators to ensure accuracy in financial reporting.

With pdfFiller, users can access customizable templates that allow for easy input and adjustment of data, ensuring you never miss a critical field while completing the form.

Editing and managing Form 18-KA after completion

Once you've completed Form 18-KA, editing and managing it effectively is essential. Errors can occur, and having the ability to modify your document quickly is a significant advantage. Platforms like pdfFiller provide intuitive editing tools that allow you to correct any mistakes effortlessly.

Furthermore, storing your filled form safely is crucial. Best practices suggest using cloud storage solutions for secure access and easy retrieval. This ensures that your documents are protected and available from any location.

Options for electronic signature

In today's digital age, the capability to sign your form electronically adds significant value. Electronic signatures offered by pdfFiller are legally valid and simplify the submission process, allowing you to finalize documents quickly and efficiently.

Steps include using the electronic signature feature within pdfFiller, making it easy to authenticate your identity without the need for physical copies.

Common mistakes to avoid when filling out Form 18-KA

When dealing with Form 18-KA, specific errors are frequently encountered. Common mistakes include incorrect personal details, miscalculating financial figures, and failing to attach required documents. Each of these oversights can result in significant delays or even rejection of your submission.

Double-checking is essential. Take the time to review your completed form carefully, ensuring all information is accurate and supported by the necessary documentation. Cross-reference your submission with checklists to enhance accuracy.

Navigating post-submission steps

After you submit Form 18-KA, it's crucial to understand what happens next. Processing times can vary depending on the regulatory body, so it's wise to keep track of your submission and any confirmation received.

In the event of a rejection or a request for additional information, respond promptly and accurately. Address any queries from authorities comprehensively to ensure efficiency.

Frequently asked questions about Form 18-KA

Many users have common concerns regarding Form 18-KA. These often include inquiries about where to seek assistance, any associated costs, and how to gather further information. pdfFiller provides comprehensive support and resources to address these queries, ensuring users feel confident in their form preparation.

The cost implications of using Form 18-KA are often dependent on the context. For instance, electronic submissions through platforms like pdfFiller may incur a small fee, but the time saved and reduced likelihood of errors can outweigh these costs.

Other useful forms and variations

Form 18-KA isn't the only documentation needed for various legal or financial processes. Alternatives do exist that serve similar purposes. Understanding these options can provide additional flexibility.

Carefully comparing these forms can help you determine the right choice based on your unique requirements.

Why choose pdfFiller for your document management needs

pdfFiller stands out as a comprehensive solution for managing Form 18-KA. Its unique features cater to a wide array of document needs, including intuitive editing, electronic signing, and cloud storage, making it a valuable tool for individuals and teams.

User testimonials underscore the effectiveness of pdfFiller, with many praising its user-friendly interface and efficient handling of documents, proving invaluable for those seeking an organized approach to form management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 18-ka from Google Drive?

Can I create an eSignature for the form 18-ka in Gmail?

How do I fill out the form 18-ka form on my smartphone?

What is form 18-ka?

Who is required to file form 18-ka?

How to fill out form 18-ka?

What is the purpose of form 18-ka?

What information must be reported on form 18-ka?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.