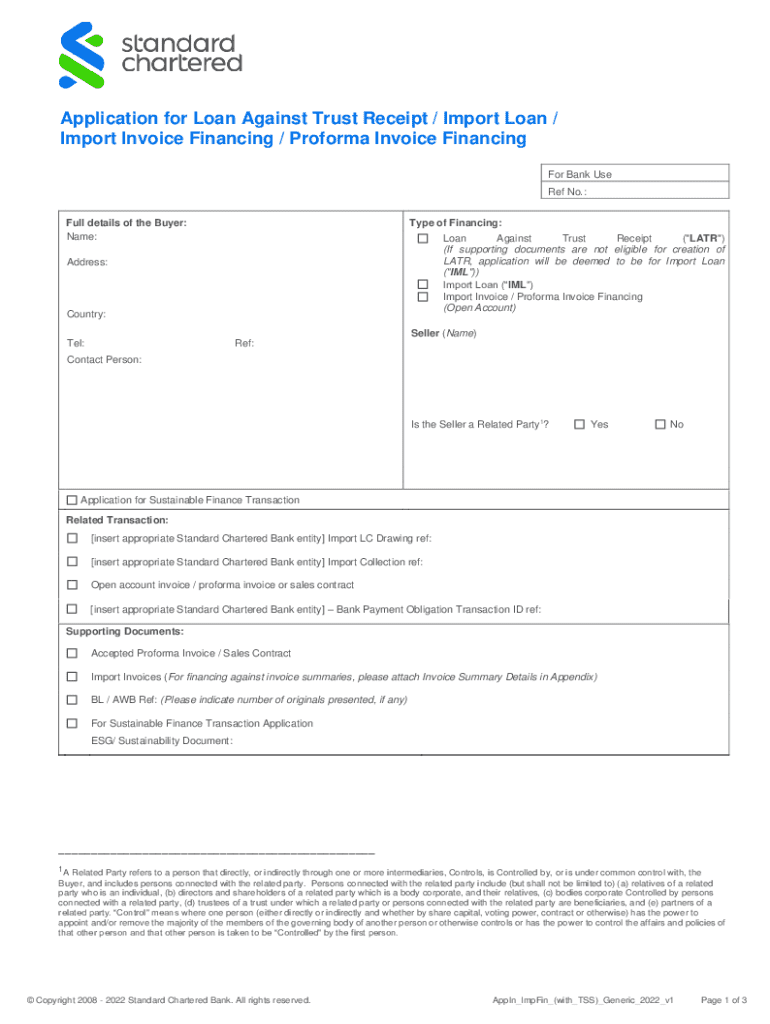

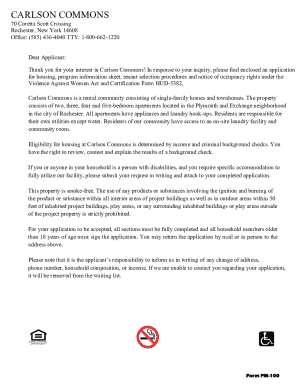

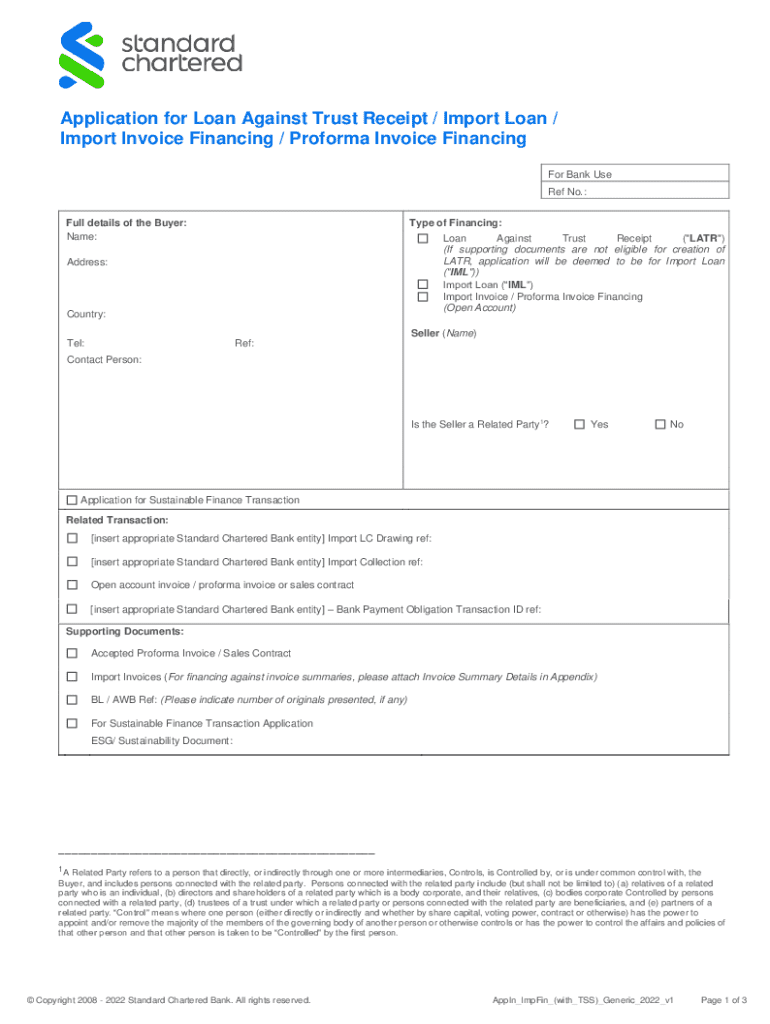

Get the free Application for Loan Against Trust Receipt / Import Loan / Import Invoice Financing ...

Get, Create, Make and Sign application for loan against

Editing application for loan against online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for loan against

How to fill out application for loan against

Who needs application for loan against?

Application for Loan Against Form: A Comprehensive Guide

Understanding the loan application process

A loan against form is a financial instrument that allows individuals to secure funding based on specific assets or forms of collateral. This type of loan is particularly beneficial for those who need quick access to funds without liquidating their assets. The purpose of these loans is to provide liquidity while allowing the borrower to retain ownership of the collateral. Common types of loans that can be secured against forms include personal loans, home equity loans, and auto loans.

You might consider a loan against form in various scenarios, such as emergencies, consolidating debt, or funding significant purchases. The advantage of this loan type includes often lower interest rates due to the collateral backing, making it an attractive option for individuals looking to borrow without incurring hefty fees.

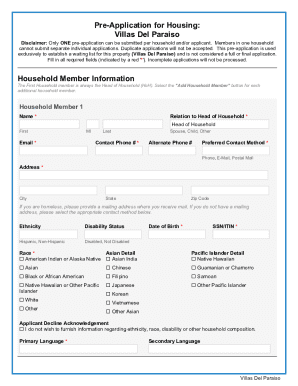

Preparing your application for loan against form

Preparing an application for a loan against form is critical for increasing your chances of approval. Essential documents needed typically include identification proof, such as a government-issued ID, and financial statements that provide details about your income and employment status. If you're offering collateral, prepare documentation that describes the asset in detail and proves ownership.

Collecting personal information with accuracy is vital as lenders rely on the information provided in the application form. Gather necessary personal details such as your social security number, contact information, and residential address efficiently. This not only streamlines your application process but also reduces the chances of errors.

Steps to complete your loan application

Filling out your loan application accurately can influence the approval process. Here’s a step-by-step guide to help you through the form:

Optimize your chances for approval

To secure a loan against form, it helps to understand lender criteria thoroughly. Common requirements include a good credit score, a stable income, and minimal existing debt. Lenders assess these factors to determine your ability to repay the loan. Maintaining a good credit score is essential; even small adjustments, such as paying down debts or lowering credit card balances, can significantly improve your score.

Moreover, being proactive in monitoring your credit health can aid in optimizing your chances for approval. Utilize credit monitoring tools, and familiarize yourself with best practices for maintaining a healthy credit profile to ensure favorable loan conditions.

Utilizing technology to streamline your loan application

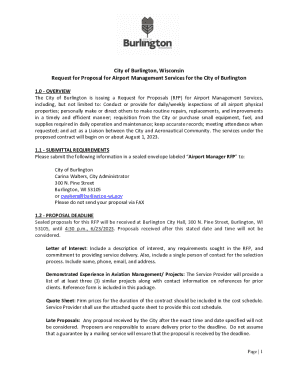

In this modern age, leveraging technology can greatly simplify your loan application process. Consider using digital tools that assist with document collection, ensuring that you have everything in one place prior to submission. Platforms like pdfFiller can significantly enhance your experience during application.

With pdfFiller, you can edit PDFs seamlessly, eSign documents securely, and utilize collaborative features for team efforts. These tools are designed to save you time and hassle, ensuring all your application documents are in proper order.

Post-application steps

After submitting your application, it's crucial to keep track of its status. Many lenders provide an online portal for tracking applications, so be sure to check regularly. Responding promptly to any queries from the lender can also facilitate a smoother process.

Being prepared for the outcome, regardless of whether it's approval or denial, is important. If approved, take the time to thoroughly review loan terms and repayment schedules. In the case of a denial, evaluate the reasons provided and consider steps to improve your application for future endeavors.

Keeping your loan application packet organized

An organized application packet can significantly influence the speed of your approval process. By presenting a well-structured and complete application, lenders may process your request more swiftly. Keeping your documents organized not only helps in maintaining clarity but also reduces stress during the application phase.

To maintain organization, consider using digital tools that enable you to create folders for specific document types. Creating a checklist for the required documents can also ensure that you gather everything needed, leaving no room for errors.

Unique considerations for special situations

Special circumstances, such as being self-employed, may require alternative documentation during your application for a loan against form. This could include tax returns, profit and loss statements, and invoices that demonstrate income stability over time.

Moreover, be aware of external factors that may affect your application. Economic circumstances, such as market fluctuations or events like a pandemic, can influence lending regulations and approval criteria. Staying informed about the changing landscape will empower you to make educated financial decisions.

Final thoughts on securing a loan against form

Looking ahead, if your application is approved, grasp a clear understanding of your loan terms, interest rates, and repayment schedules. Being well-informed about your obligations can prevent future financial strain and ensure successful management of your finances.

Lastly, remember that the benefits of using pdfFiller extend beyond initial applications. For ongoing management of financial and legal documentation, pdfFiller can support you in maintaining well-organized files, ensuring ease of access whenever necessary. Utilizing comprehensive tools will ultimately lead to a more streamlined financial journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in application for loan against?

Can I edit application for loan against on an iOS device?

How do I complete application for loan against on an Android device?

What is application for loan against?

Who is required to file application for loan against?

How to fill out application for loan against?

What is the purpose of application for loan against?

What information must be reported on application for loan against?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.