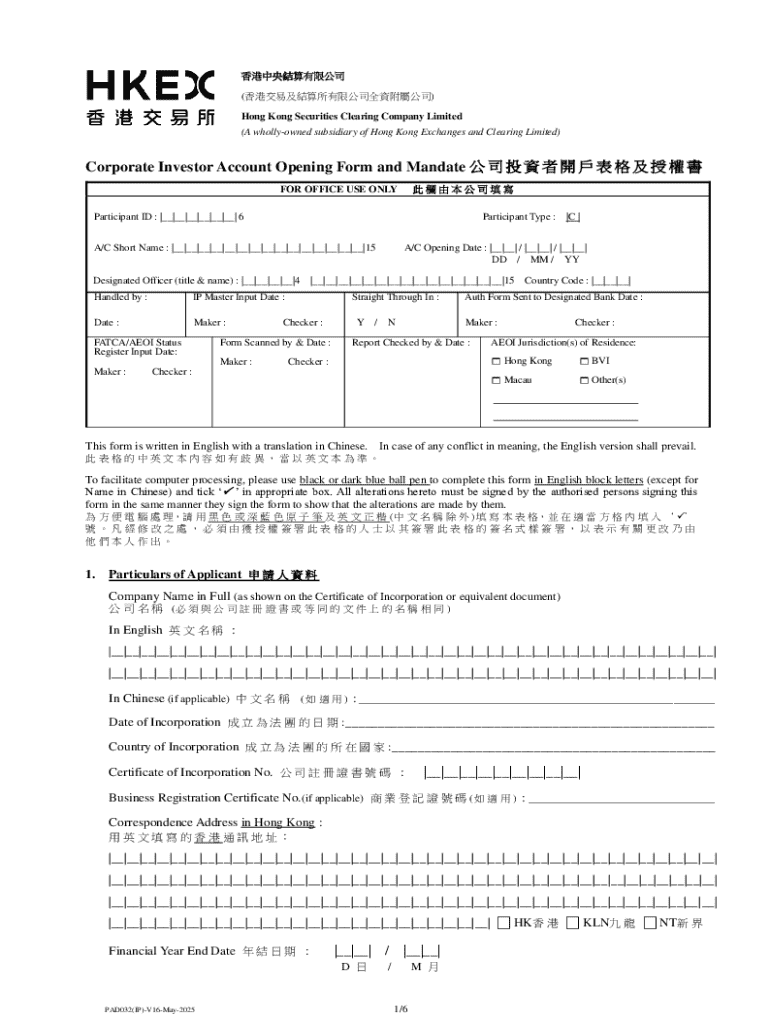

Get the free Corporate Investor Account Opening Form and Mandate

Get, Create, Make and Sign corporate investor account opening

Editing corporate investor account opening online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate investor account opening

How to fill out corporate investor account opening

Who needs corporate investor account opening?

Corporate Investor Account Opening Form: A Comprehensive Guide

Understanding the corporate investor account

A corporate investor account serves as a specialized account established for businesses to manage their investments efficiently. Unlike personal accounts, these accounts are tailored to meet the unique needs of a corporation, allowing for larger transactions, investment management, and compliance with corporate governance.

Having a dedicated corporate investor account is pivotal for businesses looking to grow their capital, engage with potential investors, and manage various asset classes. It provides a structured platform for investment activities, ensuring proper record-keeping and regulatory compliance.

Various types of corporate investor accounts exist, including brokerage accounts, retirement accounts, and mutual fund accounts. Each type brings specific benefits tailored to different investment strategies and financial goals.

Preparing to open your corporate investor account

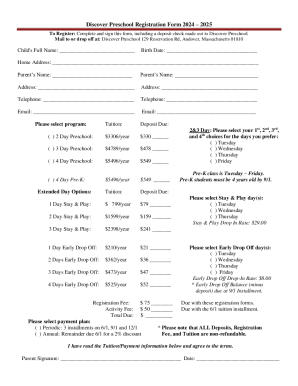

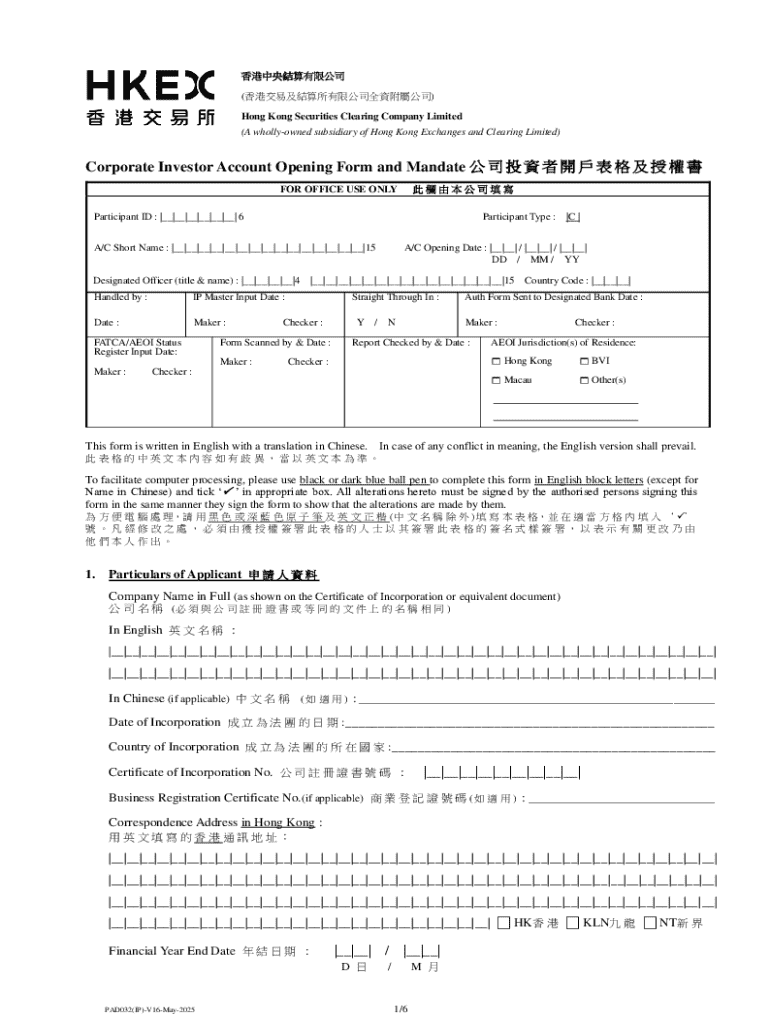

Before diving into the process of opening a corporate investor account, gathering essential documentation is critical. Primary documents typically required include the Articles of Incorporation, which validate your business’s legal status, and a Corporate Resolution that identifies authorized individuals to act on behalf of the corporation.

Additionally, acquiring a Tax Identification Number (EIN) is necessary for tax purposes, and it is essential to clearly identify authorized signatories—individuals who will have the authority to manage the account. Understanding the requirements for verification, including the provision of identity proof and corporate documents, ensures a smooth account setup.

Step-by-step guide to completing the corporate investor account opening form

The corporate investor account opening form may seem daunting, but with a structured approach, it becomes manageable. Start by familiarizing yourself with the specific sections of the form, which typically cover general information, business structure, financial information, and signature requirements.

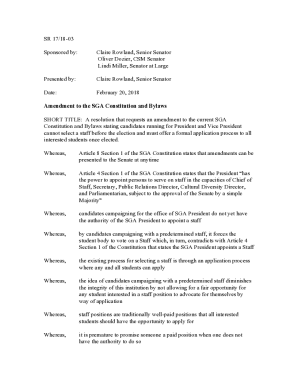

Interactive tools for successful form completion

Utilizing pdfFiller's editing features can drastically simplify the process of completing your corporate investor account opening form. You can fill out the form electronically, leveraging digital tools to ensure accuracy.

Options for saving and submitting the form are ample; you can create multiple versions or collaborate in real time. Teams can use pdfFiller's collaborative editing features to work together on the form, ensuring that all necessary details are thoroughly addressed.

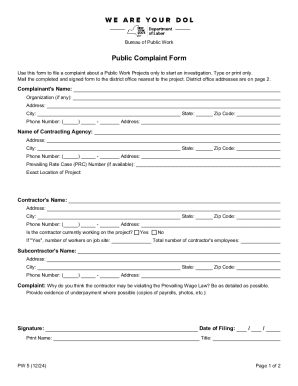

Recommendations for signing and submitting your form

Choosing the right signing method is crucial for the integrity of your submission. With pdfFiller, various eSign options ensure that your signatures are legally binding and compliant with regulations. This digital flexibility not only streamlines the process but enhances security as well.

Pay close attention to compliance with legal requirements during submission. Adhering to set protocols—whether submitting via email or through an online portal—can prevent delays. Additionally, confirm receipt of your form to avoid any future complications.

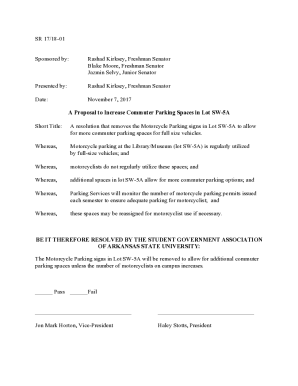

Managing your corporate investor account post-opening

After successfully opening your corporate investor account, the next step involves effective account management. pdfFiller's features facilitate e-signing for any subsequent documents you may require, providing a seamless workflow for your investment needs.

To maintain your account efficiently, practice organizational techniques such as labeling and categorizing documents. Understanding any associated fees and service charges will also help in budgeting for your corporate investments.

Resolving common issues and FAQs

It’s normal to have questions during the corporate investor account opening process. Common queries often revolve around form submission issues, or what steps to take if you need to update corporate information later. Being prepared can help you navigate these challenges.

Additional tools and resources

Access to various forms and templates can enhance your corporate governance and investment strategy. pdfFiller allows easy retrieval of relevant forms and links to investor support services that can better assist account holders.

Through the web service portals available for corporate investors, you can remain informed of market trends and investment opportunities tailored to your unique business needs.

Contact information for further assistance

For any queries regarding the corporate investor account opening process, reaching out to customer support can provide clarity. Options include live chat for immediate assistance, email for detailed queries, or simply calling the investor account service via the hotline.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit corporate investor account opening from Google Drive?

How can I edit corporate investor account opening on a smartphone?

How do I edit corporate investor account opening on an iOS device?

What is corporate investor account opening?

Who is required to file corporate investor account opening?

How to fill out corporate investor account opening?

What is the purpose of corporate investor account opening?

What information must be reported on corporate investor account opening?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.